CORPORATE INSIGHTS | 2020/21

THE OBSTACLE COURSE

Sri Lanka’s corporate houses display resilience against the backdrop of a global pandemic and economic challenges disrupting business

While the global operating environment has been challenging since the onset of the COVID-19 pandemic towards the end of 2019, recovery has progressed quicker than expected in some regions. This has been true for Sri Lanka to some extent although it faces myriad economic challenges.

As the Central Bank of Sri Lanka (CBSL) publication titled ‘Recent Economic Developments: Highlights of 2021 and Prospects for 2022’ notes, Sri Lanka’s economy “rebounded strongly from the COVID-19 pandemic induced contraction in 2020.”

As the Central Bank of Sri Lanka (CBSL) publication titled ‘Recent Economic Developments: Highlights of 2021 and Prospects for 2022’ notes, Sri Lanka’s economy “rebounded strongly from the COVID-19 pandemic induced contraction in 2020.”

The report reveals that the national economy expanded by eight percent in the first half of 2021 as a result of a broad-based recovery across all major sectors.

“This recovery was underpinned by the extraordinary policy stimuli provided by the government and the Central Bank across a wide spectrum of businesses and individuals, phasing out of the selective mobility restrictions in tandem with the nationwide vaccination programme and normalising global activity,” CBSL explains.

The government continued its fiscal stimulus measures to maintain a low tax regime in addition to offering other means of support while the moratoriums offered to businesses and individuals in 2020 were extended to smooth the “effects of cash flow disruptions faced by stakeholders amidst multiple waves of the pandemic.”

Moreover, the Central Bank says that as a result of its monetary policy and accommodative stance maintained throughout 2020 and the first eight months of 2021, “market interest rates declined to historically low levels, thereby facilitating credit to businesses and individuals, and supplementing investment needed to revive the economy.”

In August 2021, CBSL implemented monetary tightening measures by raising policy interest rates and the Statutory Reserve Ratio (SRR) to “preempt the build up of excessive inflationary pressures over the medium term while also addressing imbalances in the external sector.”

Meanwhile, merchandise exports improved to pre-pandemic levels while expenditure on imports also rose. The Central Bank notes that this reflects a normalisation of activity as well as escalating prices across key commodities in the global market.

However, the regulator says it was compelled to impose mandatory conversion requirements on export proceeds, and provide exchange rate guidance and liquidity support, in response to limited foreign exchange inflows and speculative activity putting pressure on the domestic foreign exchange market.

Due to the impact of the pandemic on tourism, the service sector’s performance remained somewhat subdued. But with global travel resuming and vaccination campaigns gathering pace across countries, the tourism industry is expected to bounce back.

According to the CBSL, workers’ remittances moderated in recent months despite remaining resilient early during the pandemic. This is attributed to the resumption of cross border travel, departures for foreign employment and the search for exchange gains outside the banking system.

Given the challenges posed by limited foreign inflows and dwindling reserves, the government and Central Bank are looking to promote foreign exchange earnings in the form of merchandise and service exports, and remittances, through coordinated efforts.

“The external current account balance is expected to improve over the medium term, supported by these efforts,” CBSL maintains.

Apart from this, foreign direct investments (FDI) in large-scale projects and the monetisation of non-strategic assets among other measures are expected to generate non-debt creating foreign inflows to facilitate foreign debt servicing.

Moreover, the government’s efforts to create an export-oriented production economy along with diversifying economic activities are expected to sustain the economy’s growth momentum over the medium term while boosting its resilience.

On the fiscal front, CBSL explains that “the expansion of the government budget deficit amidst the pandemic is expected to be curtailed along with the normalisation of activity and planned expenditure rationalisation measures by the government over the medium term.”

Meanwhile, headline inflation exceeded the Central Bank’s target range of between four and six percent due to high food prices, the upward revision of certain prices, and the relaxation of price controls on selected imports and commodities in line with global prices.

While inflation is expected to remain higher than the targeted range in the near term, the monetary authority says it’s committed to maintaining it within these bounds over the medium term “under the flexible inflation targeting framework with appropriate preemptive measures as and when required while ensuring the support needed for the economy to reach its potential growth trajectory.”

While inflation is expected to remain higher than the targeted range in the near term, the monetary authority says it’s committed to maintaining it within these bounds over the medium term “under the flexible inflation targeting framework with appropriate preemptive measures as and when required while ensuring the support needed for the economy to reach its potential growth trajectory.”

In its outlook for the future, CBSL says that “economic growth is expected to rebound and steadily progress above five percent in the medium term, thereby ensuring the shared benefits of growth…”

However, it stresses that structural reforms that promote growth will be important for Sri Lanka to “overcome heightened vulnerabilities witnessed amidst the pandemic.”

Furthermore, the Central Bank states: “The envisaged post-pandemic economic recovery, and achievement of a high and sustainable growth path while maintaining macroeconomic and financial system stability, depend largely on the ability of the economy to adapt fast to the new normal.”

Given the extreme uncertainties on the healthcare and economic fronts, the leading listed entities in the island will have to continue to run the obstacle course – as they’ve done in recent years.

To this end, the latest edition of the LMD 100 highlights the performance of the 10 leading listed corporates, which together comprise the illustrious Leaderboard.

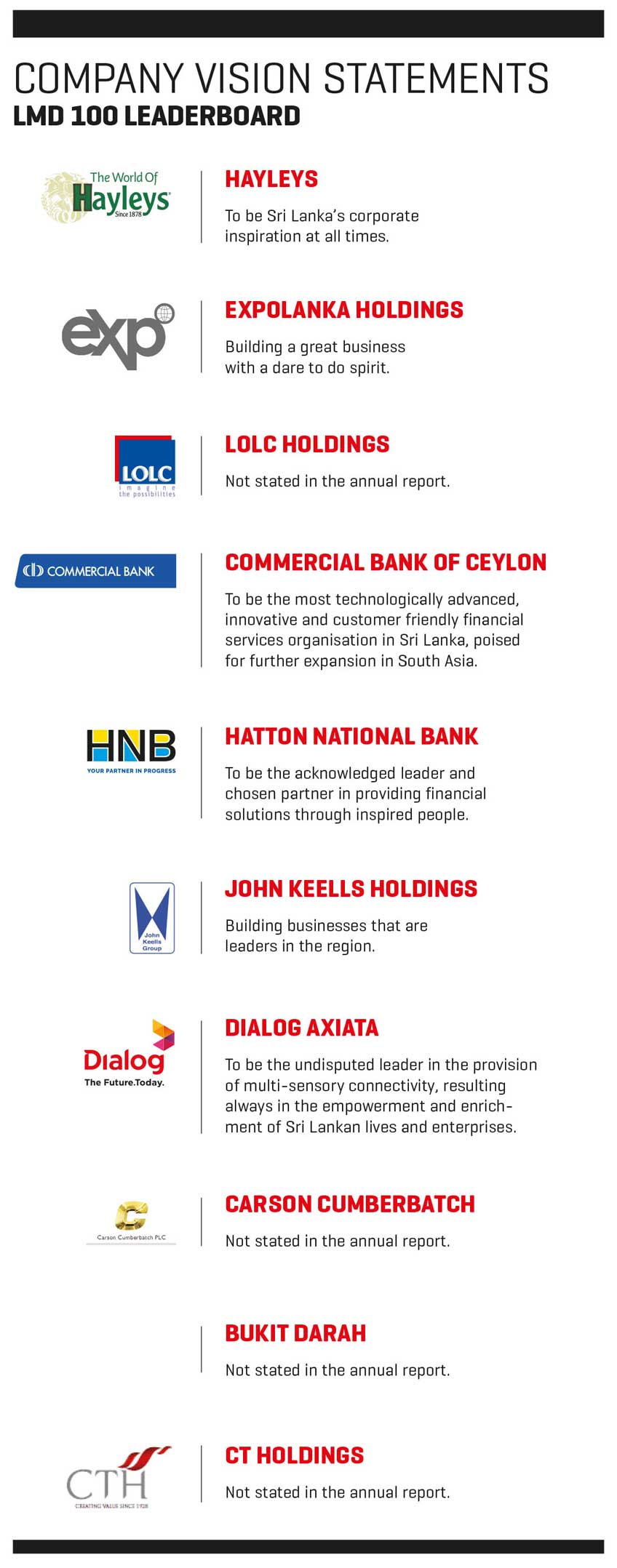

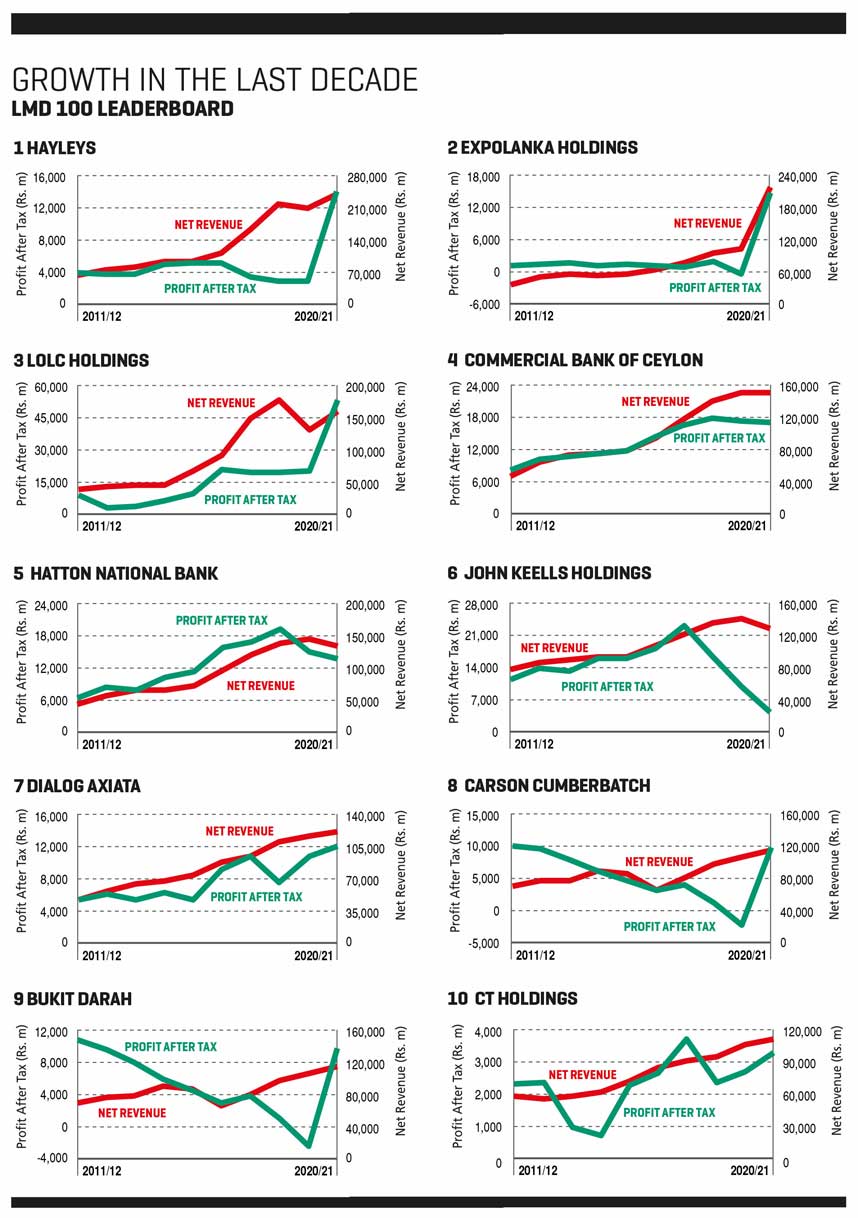

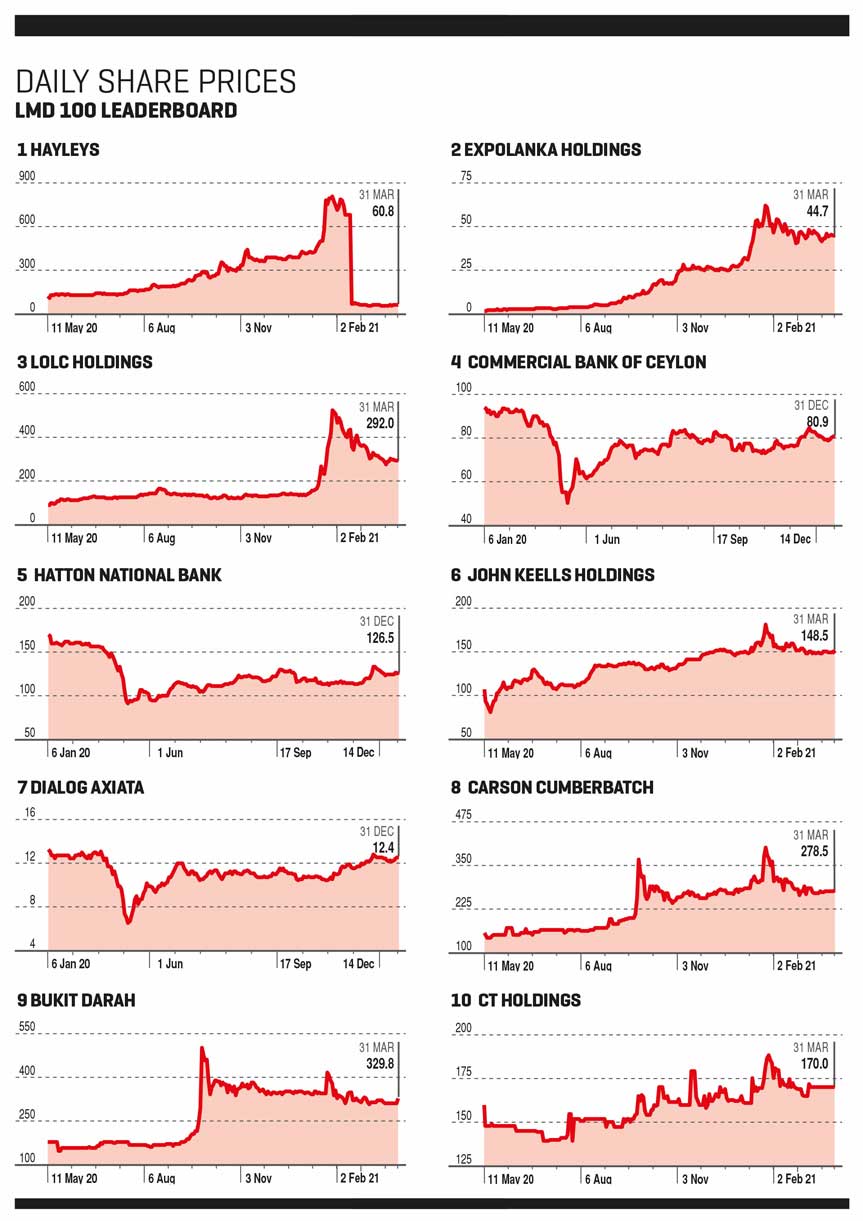

Hayleys retains its place at the top of the rankings in the LMD 100 owing to its consolidated revenue of Rs. 241 billion for the year ended 31 March 2021, which reflects a top line growth of 15 percent year on year.

Additionally, the leading conglomerate’s profit after tax (PAT) expanded by a whopping 385 percent from the prior year to 14 billion rupees in the year under review.

In a communiqué issued to coincide with the release of the group’s 2020/21 annual report, Hayleys noted that its performance was underpinned by the substantial growth of its export-oriented businesses, ongoing focus on resource optimisation and cost management through the Haysmart programme, and the group’s strategic agility in navigating the numerous complexities brought about by the pandemic.

The hand protection, purification products, textiles, agriculture, construction materials, transportation, and consumer and retail sectors were among the businesses that contributed to this growth while leisure activities continued to generate losses.

And with foreign currency earnings amounting to more than US$ 600 million, Hayleys is positioned among the largest value added exporters listed on the Colombo Stock Exchange (CSE).

The group derives a little over half of its revenue from the domestic market while the balance comes from exports.

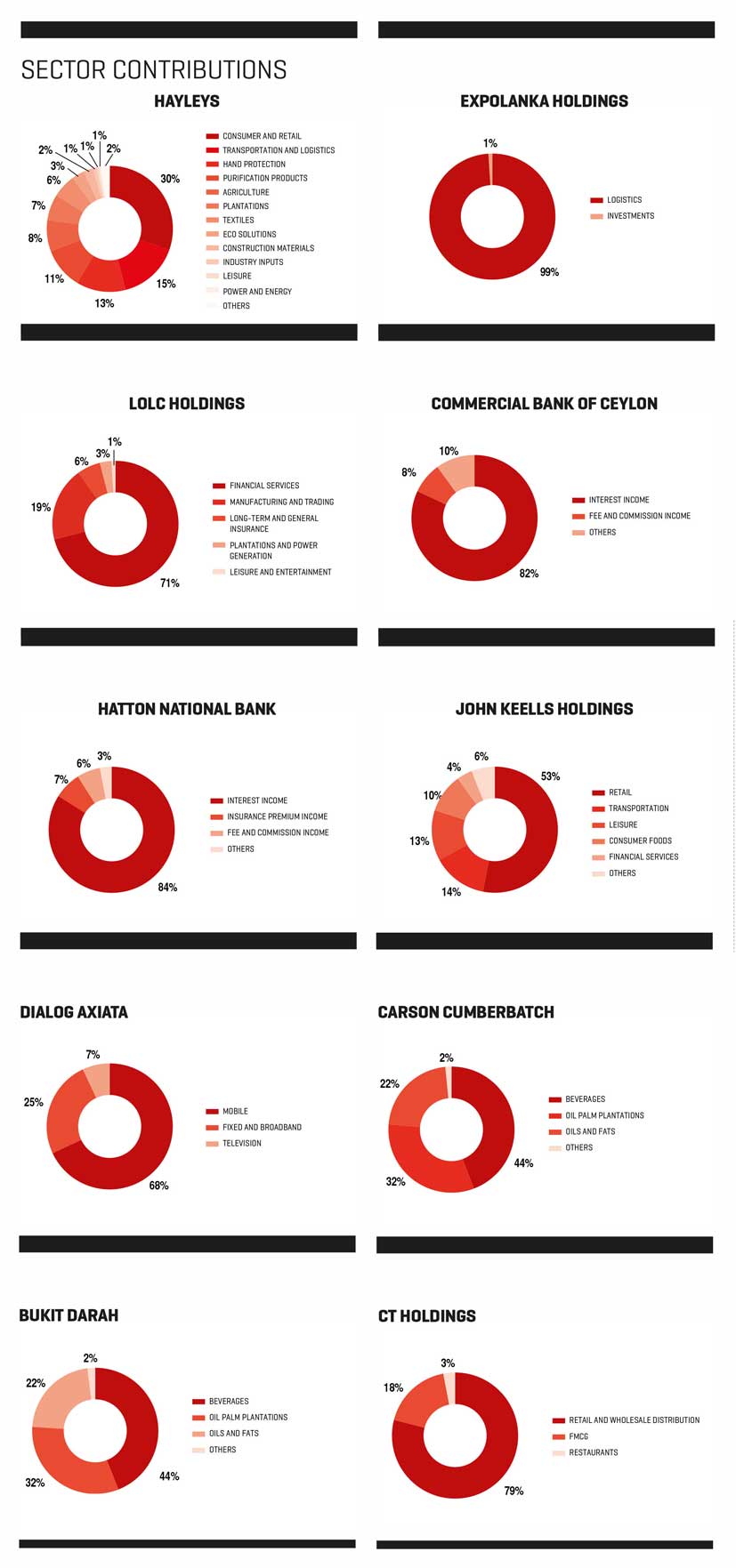

In the 2020/21 financial year, the group’s consumer and retail sector was the largest contributor to its performance, accounting for 30 percent of consolidated revenue with consumer durables player Singer (Sri Lanka) enjoying an after-tax profit of Rs. 2.7 billion.

Hayleys’ transportation and logistics operations accounted for 15 percent of turnover in the period under review while 13 percent of the group’s top line reflects the contribution of hand protection and 11 percent by purification products.

In the group’s 2020/21 annual report, Chairman and Chief Executive Mohan Pandithage reveals that “Hayleys set a new bar for performance, recording the highest profit of 14 billion rupees in its 143 year history.”

Attributing this to the execution of detailed plans to build resilience, he remarks that “every sector undertook a detailed analysis of the potential to increase revenue and identified potential savings to offset the salaries bill, and that became the map for the uncharted territory that was 2020/21.”

He cites the group’s strengths as its diversity (in terms of operations and geographical location) as well as Hayleys’ governance structure.

“Embracing technology was part of the solutions and the shift to digital will increase productivity, enabling Sri Lanka to compete more effectively,” he asserts, noting: “Weaker economic indicators give cause for concern but we all need to work together to turn the tide and rise above.”

And he stresses that “forecasts by the IMF are positive, particularly for advanced economies and this provides the Hayleys Group with further opportunities for growth in the year ahead. Government policy will play a key role in driving sustainable economic growth and we will continue to monitor developments in this regard as we need to carefully consider their impacts on strategy.”

A 112 percent uptick in revenue – to nearly Rs. 219 billion – means that Expolanka Holdings climbed 10 spots to take second place in the 2020/21 LMD 100. Moreover, the conglomerate’s 3,497 percent increase in post-tax profit (to 14.9 billion rupees) represents the largest rise in this edition of the LMD 100.

Expolanka’s interests comprise global logistics, travel and leisure, and investments – with a majority of its revenue being derived from international operations.

Logistics accounted for the lion’s share (99%) of the group’s revenue in the period under review, which Executive Director and Group CEO Hanif Yusoof says is the result of a consistent and continuous strategy to grow EFL (its logistics business) since 2017.

“Having made a quantum leap to expand beyond our roots as a subcontinent-based freight operator, our rapid global expansion over the past three years has propelled EFL to the forefront of the global logistics arena,” he explains. In his assessment of the prevailing business landscape, Expolanka’s Executive Chairman Hitoshi Kanahori states: “The pandemic situation has created a new normal operating environment where it has become increasingly difficult to predict when trading and operations across the world will return to pre-pandemic levels.”

“Nonetheless, having weathered the initial shock and lived in this pandemic environment for over a year, the world as a whole is now more informed and certainly better equipped to deal with what lies ahead,” he adds, expressing hope that tangible improvements will be observed where economic recovery is concerned.

LOLC Holdings (LOLC) rises two spots to third place on the back of a 23 percent year on year increase in revenue (to in excess of Rs. 160 billion) in the latest LMD 100 rankings.

In addition to this, the conglomerate’s post-tax profit of 53 billion rupees reflects an increase of nearly 170 percentage points compared to the prior year and is the highest in this year’s edition.

During the period under review, financial services accounted for most (71%) of the group’s revenue. This sector includes three local financial services institutions – viz. LOLC Finance (LOFC), Commercial Leasing & Finance (CLC) and LOLC Development Finance (LODF).

In the group’s 2020/21 annual report, Deputy Chairman Ishara Nanayakkara asserts: “Achieving this feat amidst a financial year disrupted by a global pandemic makes this achievement a matter of pride for the entire country.”

“The impact of the COVID-19 pandemic was severely felt by all the markets. Lockdowns and mobility restrictions hampered economic activities; and despite the varying monetary stimuli offered by governments, the year overall proved highly constraining for most sectors,” he observes.

And the year under review also involved the divestiture of PRASAC Microfinance Institution in Cambodia to KB Kookmin Bank as the group looks to expand its financial services business in new overseas markets across the African continent and Central Asia.

As for LOLC’s other major operating segments, manufacturing and trading account for 19 percent of the group’s consolidated revenue in 2020/21, along with long-term and general insurance (6%), plantations and power generation (3%), and leisure and entertainment (1%).

According to LOLC’s Group Managing Director and CEO Kapila Jayawardena, the highly diversified conglomerate is “looking outwards to expanding its footprint more stridently in key target markets during the 2021/22 year, building on its core competencies.”

“The main focus will be on widening its financial services base outside Sri Lanka whilst building an international portfolio in terms of the other sectors that we operate in,” he concludes.

Having recorded nearly Rs. 152 billion (up 1% compared to 2019) in income for the year ended 31 December 2020, Commercial Bank of Ceylon (ComBank) secures fourth place in the latest LMD 100. This means that ComBank slips two notches from its ranking in the prior year. Meanwhile, the bank’s bottom line of 17 billion rupees in 2020 reflects a year on year decline of two percent.

ComBank’s main business segments comprise personal banking, corporate banking and treasury, as well as international operations in Bangladesh, the Maldives, Italy and Myanmar.

In the calendar year under review, ComBank generated 82 percent of its revenue by way of interest income while fees and commissions accounted for eight percent.

Commenting on ComBank’s financial results in 2020, former Chairman Dharma Dheerasinghe and present Chairman Justice K. Sripavan state that “under extremely challenging conditions that negatively impacted the business environment locally and globally, the bank performed appreciably well in key areas of its business activities.”

Despite the challenging conditions, they point to ComBank ending the year “on a strong footing with substantial deposits growth, better liquidity and higher provision cover compared to most peers.”

Acknowledging that the pandemic has also presented opportunities for reinvention, the duo asserts that “it is patently clear that we are living through a digital revolution where conventional business models and ecosystems are in rapid transformation, and new entrants to the financial landscape have heightened competition and risk.”

Managing Director and Chief Executive Officer Sivakrishnarajah Renganathan maintains that the group PAT – which recorded a marginal decline – is “remarkable” given the concessions mandated by the regulator and the bank’s voluntary rebate scheme, as well as ComBank making its single highest impairment provision during the year.

“We view our efforts in supporting customers as an investment in relationship capital – one that will hold the bank in good stead in the future,” he says.

As part of the bank’s efforts to embrace digitalisation during the year, it integrated online and mobile banking channels on an omni-channel platform with the launch of ComBank Digital to position it as a market leader in the digital space.

Renganathan elaborates on this initiative: “The pandemic has revealed more than ever that end-to-end digital processes are needed wherein the whole chain of events that occur in a transaction or service increasingly become digitalised and integrated.”

“To that end, the bank has adopted a digital strategy for 2025 that prioritises redesigning conventional banking processes as digital processes, integrating with other ecosystems, upgrading internal systems to be prepared to capitalise on changes in the regulatory environment, and developing talent and building partnerships,” he asserts.

Another leading representative of the banking sector, Hatton National Bank (HNB) is placed at No. 5 in the 2020/21 edition of Sri Lanka’s leading listed entities. Its consolidated income declined by eight percent on an annual basis to slightly under Rs. 135 billion for the year ended 31 December 2020.

HNB’s post-tax profits also fell by nine percent to13.6 billion rupees for the calendar year.

The bank’s former Chairman Dinesh Weerakkody says that “2020 has been a year unlike any other in recent memory as the COVID-19 pandemic transformed the socioeconomic landscape dramatically, elevating uncertainty and risks at every level, both locally and globally.”

He points to challenges impacting the economy prior to the onset of the pandemic – viz. the Easter Sunday attacks in April 2019 – and maintains that COVID-19 aggravated the country’s economic woes while also “paving the way for a disruptive transformation that vaulted us to a new era of exciting possibilities.”

Weerakkody stresses that as a leading bank, HNB has “a crucial role to play in the task of restoring and supporting the livelihoods of our communities.”

Commenting on the future of the banking sector, he notes: “Technology and information assets will be the game changer… Harnessing their power to create e-commerce solutions that enable faster, smarter decisions, and customised solutions will create collaborative networks that will transform supply chains and how we transact.”

Unlike ever before, banks “need to offer innovative customer friendly financial solutions leveraging on deep-rooted expertise, agile operational models and digital capabilities,” Weerakkody remarks.

Interest income accounted for around 84 percent of HNB’s top line in 2020 while insurance premiums, and fees and commissions, registered seven and six percent respectively.

“HNB prepared itself for a tough year in 2020 and this gave us a head start as the pandemic created extreme volatility across multiple risk factors.,” HNB’s Managing Director and CEO Jonathan Alles explains.

He goes on to note that “market risk factors remained volatile throughout the year as interest rates declined and the rupee came under pressure. HNB is presently the best capitalised among our peers due to sustained prudent capital management, providing a strong foundation for growth.”

And in terms of the future outlook, Alles notes: “We expect the local and global economy to recover… and our plans are focussed on strengthening business sustainability… We will look to drive sustainable business growth through deeper relationships, customer acquisition and relevant innovation around new business.”

“Customer experience will be a key focus and process improvements, digitalisation, automation and robotic process automation are on the radar,” he states, adding that technology is also an area of focus: “Technology enablement is also expected to provide deeper insights through data analytics while planned upgrades of core and enabling systems… are expected to create considerable enhancements to the bank’s overall customer value proposition.”

John Keells Holdings (JKH) drops to sixth place (from No. 4 in 2019/20) in the latest LMD 100 rankings. The highly diversified group’s top line declined by nine percent year on year to marginally less than 128 billion while its PAT shrank by 59 percent to four billion rupees in 2020/21 – from Rs. 9.7 billion in the preceding year.

The group’s main sources of revenue include its transportation, financial services, consumer foods, retail, leisure and property segments.

With regard to the conglomerate’s retail business, which accounts for more than half (53%) of revenue, Chairman Krishan Balendra remarks: “With the gradual easing of measures and opening of outlets, the business witnessed a sharp quarter on quarter recovery momentum in sales with the fourth quarter same store sales recovering to pre-COVID levels – although the March 2020 comparative is distorted due to the closure of outlets towards the end of the month.”

“Significant growth was witnessed in online sales due to the isolation measures which were in place intermittently during the year. Considering that shopping patterns of customers have changed where the frequency and purchase patterns have resulted in a consolidation of baskets, the statistics on footfall and basket values are distorted in the short term,” he reveals.

In the transportation segment, profitability was impacted by the group’s ports and shipping business – i.e. the South Asia Gateway Terminals (SAGT) and to some extent, the bunkering business Lanka Marine Services.

Balendra elaborates on this: “In line with the trend of overall volumes in the Port of Colombo, throughput at SAGT was impacted by COVID-19, recording a 12 percent decrease in the year under review although this impact was primarily during the first quarter of 2020/21 when the pandemic escalated in Sri Lanka and the region.”

When it comes to the leisure sector – which accounts for four percent of revenue for financial year 2020/21 – he notes that “the performance of the resorts started to demonstrate an encouraging uptick with the revival of domestic tourism and the opening of the airports in Sri Lanka and the Maldives.”

He asserts the group’s confidence in operations returning to normal, “given the aggressive ramp up of the COVID-19 vaccination programme in the country,” and maintains that its properties are geared to capitalise on pent-up demand for leisure travel from various markets.

As for the group’s landmark Cinnamon Life development, Balendra reveals that with the project nearing completion, the revenue and profit recognition from the sale of residential and office units would begin from the first quarter of 2021/22.

Dialog Axiata remains unmoved in the 2020/21 rankings to occupy seventh place in the latest list of Sri Lanka’s leading listed entities. The telecommunications company’s revenue amounted to over Rs. 120 billion in 2020 (up 3% year on year) while also witnessing a 12 percent hike in PAT, which stood at 12 billion rupees for the period under review.

In the year ended 31 December 2020, Dialog’s mobile, fixed and broadband, and television business segments contributed 68 percent, 25 percent and seven percent respectively to the group’s consolidated turnover, while boasting a subscriber base of 16.2 million Sri Lankans.

Chairman David Nai Pek Lau discloses: “Our earlier work on digitisation in the previous few years has helped to cushion our revenue which was hit hard by reduced roaming and virtually no income from tourists.”

He asserts that “though the pandemic has certainly challenged all facets of our business, it has also affirmed that we are on the right track in transforming Sri Lanka into a digital nation.”

The telecom giant has continued its investment programme to provide robust connectivity while promoting digital transformation and the use of data analytics across the island. To this end, Dialog is engaged in 5G innovation, having established a trial network in collaboration with the Telecommunications Regulatory Commission of Sri Lanka (TRCSL) to pilot pre-commercial 5G services.

Meanwhile, Group Chief Executive Supun Weerasinghe reveals that Dialog provided more than Rs. 7 billion in consumer concessions to ensure customers remain connected during lockdowns.

Additionally, the group supported the healthcare and education sectors through investments, and by facilitating access. He affirms: “As we move further into this new normal, we will continue to invest in critical resources – and develop solutions that have a positive societal impact and empower Sri Lanka’s transformation into a digital nation.”

Looking to the future, Weerasinghe insists that “while the pandemic has affected all facets of our business, it has also strengthened our status as a national strategic partner with the ongoing shift to remote working and learning, driving demand for network infrastructure.”

As such, he points out that Dialog’s success will depend on building its network resilience, and meeting customers’ diverse needs and expectations, while driving positive perceptions: “Amid uncertainties, we remain committed to advancing the country’s digital infrastructure to bridge the digital divide in society.”

Advancing two spaces to the No. 8 slot in the 2020/21 LMD 100 is Carson Cumberbatch. The diversified group posted a PAT of Rs. 9.7 billion for the financial year under review compared to the loss of 2.5 billion rupees recorded in 2019/20. Moreover, its revenue for the period grew by eight percent year on year to almost Rs. 115 billion.

A large share (44%) of the group’s revenue is derived from the beverages segment, which is followed by oil palm plantations (32%), and oils and fats (22%).

In the group’s annual report, Carson Cumberbatch’s Chairman Deshabandu Tilak De Zoysa notes that its local and international verticals “were equally grappled with the challenges posed by the pandemic. However, the impact on some sectors outweighed others due to the disproportionate toll on Sri Lanka’s tourism sector, downturn in the Sri Lankan economy and reduced local consumption activity.”

Following the imposition of lockdowns and closure of the country’s airports, the “profit potential of the consumer oriented beverage and leisure sectors of the group were substantially crippled particularly during the initial months of the year under review,” he explains.

However, he points out that the easing of restrictions enabled the group to embark on a gradual recovery. De Zoysa elaborates: “Despite the pandemic related hardships, the beverage sector was able to cushion its local shocks to a certain extent through the expansion of its exports segment during the year, which presently spans over 25 countries.”

As for the oil palm plantations segment, it was impacted by volatility across global crude palm oil (CPO) prices during the period under review, as well as factors including weather related supply constraints on soya bean oil, improved demand following the first wave of lockdowns, the impact of La Niña weather patterns on plantation operations and the recovery of crude oil prices.

In spite of this, the group’s oil palm plantations sector achieved its highest crop output by producing 1.3 million tonnes of fresh fruit bunches during the period under review while 318,500 tonnes of CPO were sold in the first half of the year, according to De Zoysa.

Commenting on the future, he stresses that new COVID-19 strains continue to pose risks to people and threaten to cause disruptions. “Over the past year, we have recognised the power of preparedness as never before in navigating the uncertainties and unexpected challenges arising from extremely volatile business environments,” he reasons.

An eight percent year on year increment in revenue to 114.8 billion rupees enables Bukit Darah to advance by two notches – to ninth place – in the LMD 100 for financial year 2020/21. Meanwhile, its bottom line expanded by 480 percent year on year to register Rs. 9.7 billion rupees for the period under review.

The diversified entity has interests in beverages, oil palm plantations, and oils and fats.

Chairman Hari Selvanathan points out that the year under review was a “period of unprecedented challenges to the world at large, as well as for Sri Lanka, Indonesia and Malaysia” where the group operates.

“During the year, our business sectors that directly interact with customers such as beverages, oils and fats, and leisure were negatively impacted due to lack of demand, as well as restrictions on access,” he laments.

However, the group continued its capital expenditure initiatives with Selvanathan noting the beverage sector – which accounts for 44 percent of its revenue – migrated its IT systems to the cloud in keeping with its strategic plans while carrying out several vital supply chain investments and completing capacity enhancements in line with long-term infrastructure development plans to meet future demand.

As for the oil palm plantations sector (32% of revenue), it completed three commissioned milling projects on schedule to ensure all its locations had sufficient capacity and increased margins.

Sharing his outlook for the future, Selvanathan says: “As the world becomes more accustomed to the pandemic, the financial easing enacted by governments will be reversed and across countries, interest rates are expected to increase during the coming year, impacting funding costs as well as creating inflationary pressure.”

Sharing his outlook for the future, Selvanathan says: “As the world becomes more accustomed to the pandemic, the financial easing enacted by governments will be reversed and across countries, interest rates are expected to increase during the coming year, impacting funding costs as well as creating inflationary pressure.”

“The group will continue to focus on improving its financial performance whilst progressing on actions related to the environmental, social, and governance (ESG) fronts – especially for its oil palm plantations sector. The brewery will focus on increasing its geographical coverage and balancing its export markets, as well as developing flexibility in production to cater to niche demand for smaller batch volumes,” he reveals.

Rounding off the top 10 of the LMD 100 for 2020/21, CT Holdings’ revenue (nearly Rs. 113 billion – up 5% year on year) was derived from the retail and wholesale distribution, fast-moving consumer goods (FMCG) and restaurants business segments.

As for retail and wholesale distribution (which accounts for 79% of its consolidated revenue), the sector operates supermarkets under the names of Cargills Food Hall, Cargills Food City and Cargills Food City Express, as well as Millers.

In the group’s financial year 2020/21 annual report, Chairman Louis Page describes the financial year as “perhaps the most challenging period faced by our group, as well as the wider business community both in Sri Lanka and overseas.”

The retail and wholesale distribution business continued to expand, launching 43 new stores to boost the group’s outlet count to more than 450.

Discussing the FMCG sector’s performance – which contributes 18 percent to revenue – he says: “The robust growth achieved by this sector during the current and previous years has placed it as a significant contributor to the bottom line profitability of the group.”

Moreover, he asserts that these operations have positioned the group as a major player in the country’s manufacturing industry.

The group’s dairy sector is thought to have the widest portfolio of products in the country, and is credited with spearheading national efforts to increase milk production, dairy farm development, and change customer preferences from powdered to locally produced fresh milk and similar products.

In terms of restaurants, CT Holdings holds the franchises for the KFC and TGI Fridays chains. “The restaurant sector was predictably impacted by the reluctance of customers to eat out in the current situation,” Page notes in his assessment of the segment.

While the pandemic persisted throughout financial year 2020/21 and made for a difficult operating environment, revenue among the LMD 100 has improved by six percent while PAT increased by a noteworthy 45 percent compared to 2019/20.

However, 2021/22 is set to be another tough year as the various economic challenges facing the country contribute to the already demanding business landscape.