The Central Bank of Sri Lanka notes that the country’s official reserve assets rose by 2.3 percent in January, reaching US$ 4,491 million from US$ 4,392 million in December.

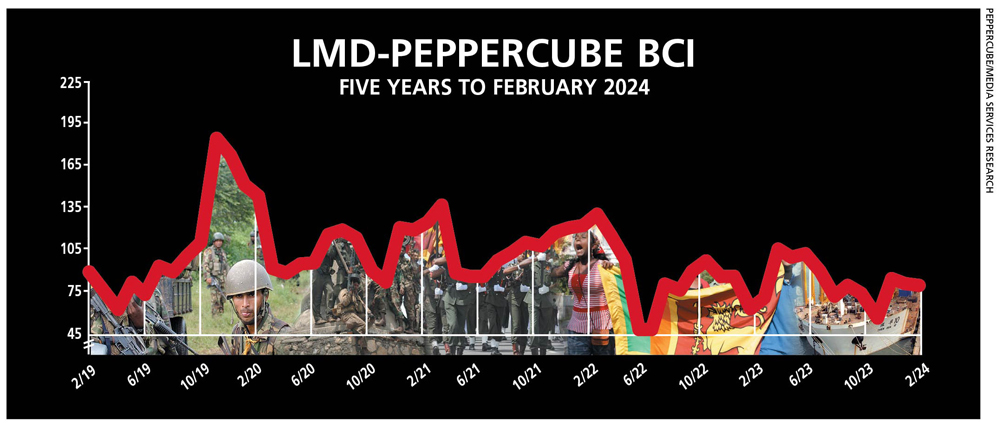

LACKLUSTRE BUSINESS CONFIDENCE

The gauge of corporate sentiment remains steady albeit way short of its all-time average

This appreciation came on the back of a US$ 1.4 billion swap facility from the People’s Bank of China.

Simultaneously, the monetary regulator opted to ease restrictions imposed on standing facilities available to Licensed Commercial Banks (LCBs) through Open Market Operations (OMOs).

The Central Bank says that various measures resulted in positive outcomes – including the reactivation of the domestic money market and reduction of excessive competition for deposit mobilisation among financial institutions.

In another positive development, the IMF’s Managing Director Kristalina Georgieva expressed confidence in the global economy’s ability to navigate a soft landing.

THE INDEX Despite the positive indicators however, the LMD-PEPPERCUBE Business Confidence Index (BCI) continues to be lacklustre… but steady: it has remained in the 81-85 range for three successive months.

In February, the index registered a one basis point dip to 81, which is a massive 42 notches shy of its all-time average (123) although compared to 12 months ago (63), the barometer has in fact gained 18 points.

PepperCube Consultants attributes the dip in the index to the impact of the value added tax (VAT) hike. But it notes that there is a degree of buoyancy regarding the investment climate and expectations about maintaining sales volumes have remained relatively unchanged over the past four weeks – this despite the marginal drop in optimism regarding the economy over the next 12 months.

SENSITIVITIES Businesses are currently battling numerous challenges including inflation and high taxes although on the monetary front, the cabinet spokesman recently said the government expects the Sri Lankan Rupee to strengthen against the US Dollar, dropping to as low as Rs. 280.

“During the foreign exchange crisis and shortage of fuel, we saw the dollar being sold for over Rs. 400. However, now it has dropped to Rs. 314. It is expected to drop further – at least to Rs. 280,” he asserted.

PROJECTIONS As we said in this column last month, “the BCI is unlikely to gain any substantial ground at least until there’s clarity on the timing and conduct of one more election this year.”

On this score, the President’s Media Division (PMD) stated in a recent text alert that “the presidential election will be held within the mandated period and according to the current timeline, general elections will be held next year – and financial provisions will be provided for in the 2025 budget.”

It adds: “The Election Commission is responsible for conducting the elections, and the government will be communicating with the commission as and when required.”

So we are back in ‘wait and see’ mode! And if there is one or more poll in the next 12 months, where the index will head is also left to be seen, given the prospect of political turmoil ahead of elections.

– LMD

This content is available for subscribers only.