BUSINESS SENTIMENT

CONFIDENCE SHORES UP AT YEAR END

The barometer of business confidence regains lost ground but uncertainties loom large

Despite a notable 51 percent increase in state tax revenue during the first nine months of 2023 compared to the previous year, the IMF’s target remains unmet. Finance Ministry officials anticipate that the higher rate of value added tax (VAT) to 18 percent (from 15%) and reducing exemptions on 97 out of 138 previously exempted goods will help meet the desired goal.

Meanwhile, the good news is that the second tranche of the IMF’s US$ 2.9 billion Extended Fund Facility (EFF) of approximately 337 million dollars was released following executive board approval on 12 December.

Whats’ more, the Asian Development Bank (ADB) recently approved a US$ 200 million concessional loan to help Sri Lanka’s economic stabilisation endeavours.

In addition, the country’s external debt restructuring efforts gained ground at the end of November when an agreement in principle was reached with the Official Creditor Committee in regard to the treatment of debt (i.e. longer-term maturity coupled with lower interest rates) valued at a whopping 5.9 billion dollars.

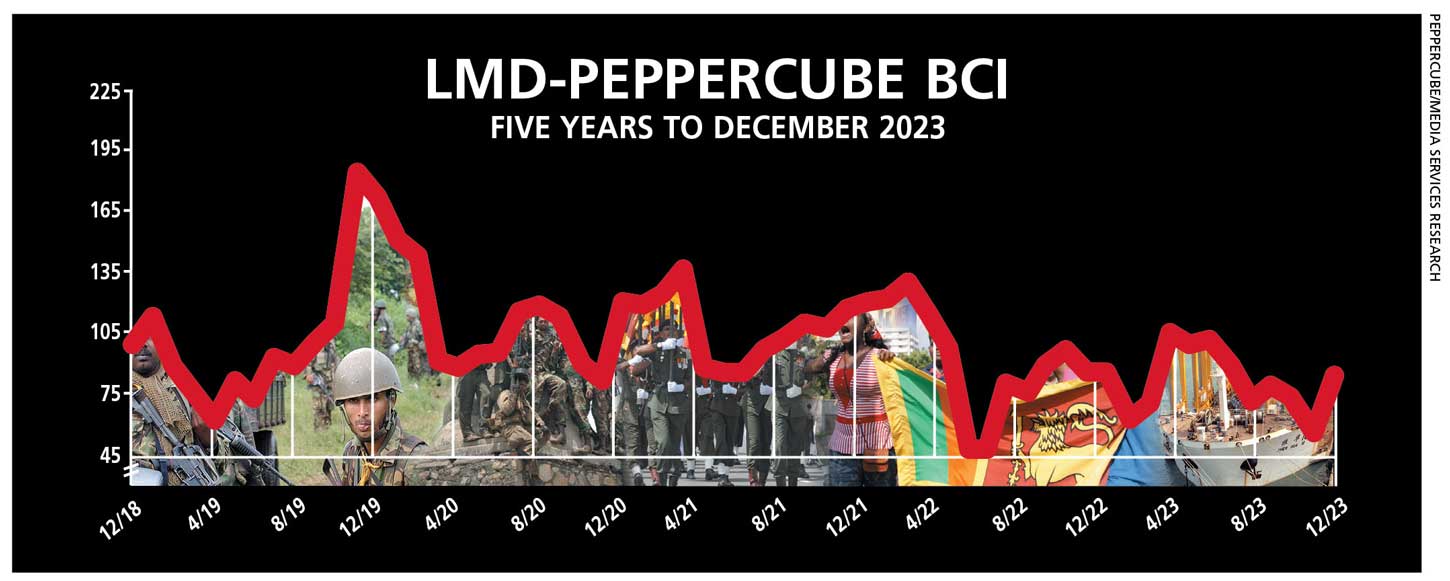

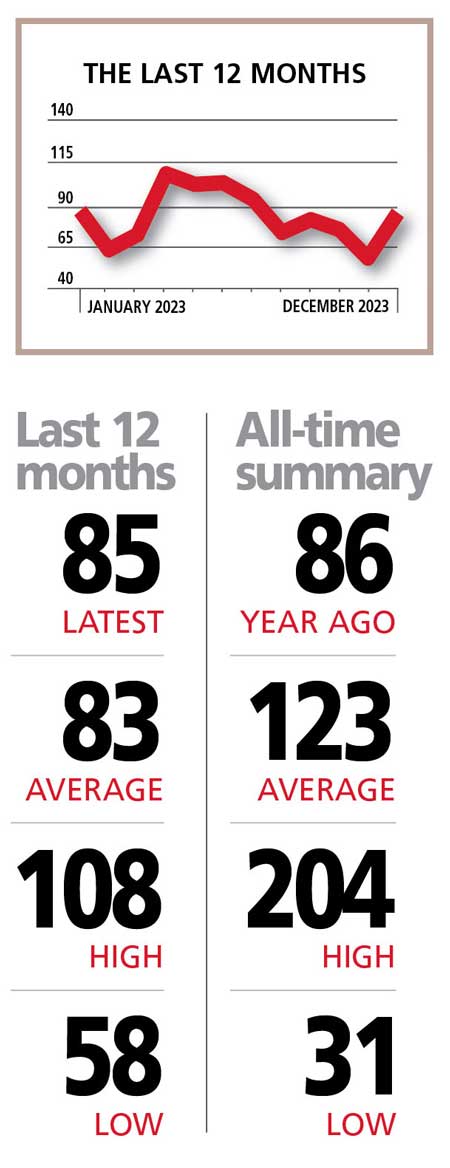

THE INDEX In the meantime, the LMD-PEPPERCUBE Business Confidence Index (BCI) spiked by 27 basis points in December to register 85 compared to the previous month’s 58.

While the biz barometer has shown a degree of volatility in its trajectory in recent months, the sudden upswing suggests a narrative of uncertainty: the index, which fluctuated between 73 and 81 from August to October, plummeted to 58 in November (a 15 month low), possibly influenced by the prospect of new taxes being levied in Budget 2024.

PepperCube Consultants says that “the budget proved to be less disruptive than initially anticipated, which has resulted in an improvement in the index. This stems from a sense of optimism about the economy, investment climate and maintaining business volumes.”

The rebound in the BCI means that the barometer is by and large on a par with its 12 month average (83) as well as where it stood a year ago (86) – although it continues to languish at a notable 38 points below the all-time average of 123.

SENSITIVITIES An election year being ahead of us instils a sense of unease among the business community as uncertainty looms about the prospect of political instability, economic disruptions and even unrest – a reminiscent concern from experiences in 2022.

And the protracted challenge of the high cost of living and doing business adds a layer of trepidation to the outlook. The external outlook too is riddled with uncertainties arising from wars in Ukraine and Gaza in particular.

PROJECTIONS Amid the pros and cons of doing business, predicting the short-term trajectory of the BCI is a thankless task in the light of multiple sensitivities that confront the nation.

And as PepperCube notes, “inflation and taxes continue to challenge the nation and the business community, alongside political interference.”

What we can say with some degree of certainty is that year 2024 is destined for a rollercoaster ride!