BUSINESS SENTIMENT

BIZ CONFIDENCE IN A TAILSPIN

Business sentiment plummets to a seven month low amid a stream of shattering news

“As soon as adequate assurances are obtained and the remaining requirements are met – including by the Sri Lankan authorities – the Extended Fund Facility (EFF) can be presented to the IMF’s Executive Board for approval, which would unlock much needed financing,” a spokesman for the so-called ‘lender of last resort’ stated recently.

Hot on the heels of this statement, President Ranil Wickremesinghe assured parliament that “we have received positive responses from all parties [to the debt restructuring process] – we’re now working towards unifying the approaches of other countries and that of China.”

For all intents and purposes, these two statements may hold the key to reviving our battered economy – and with it, a turnaround from where business and investor confidence stand today.

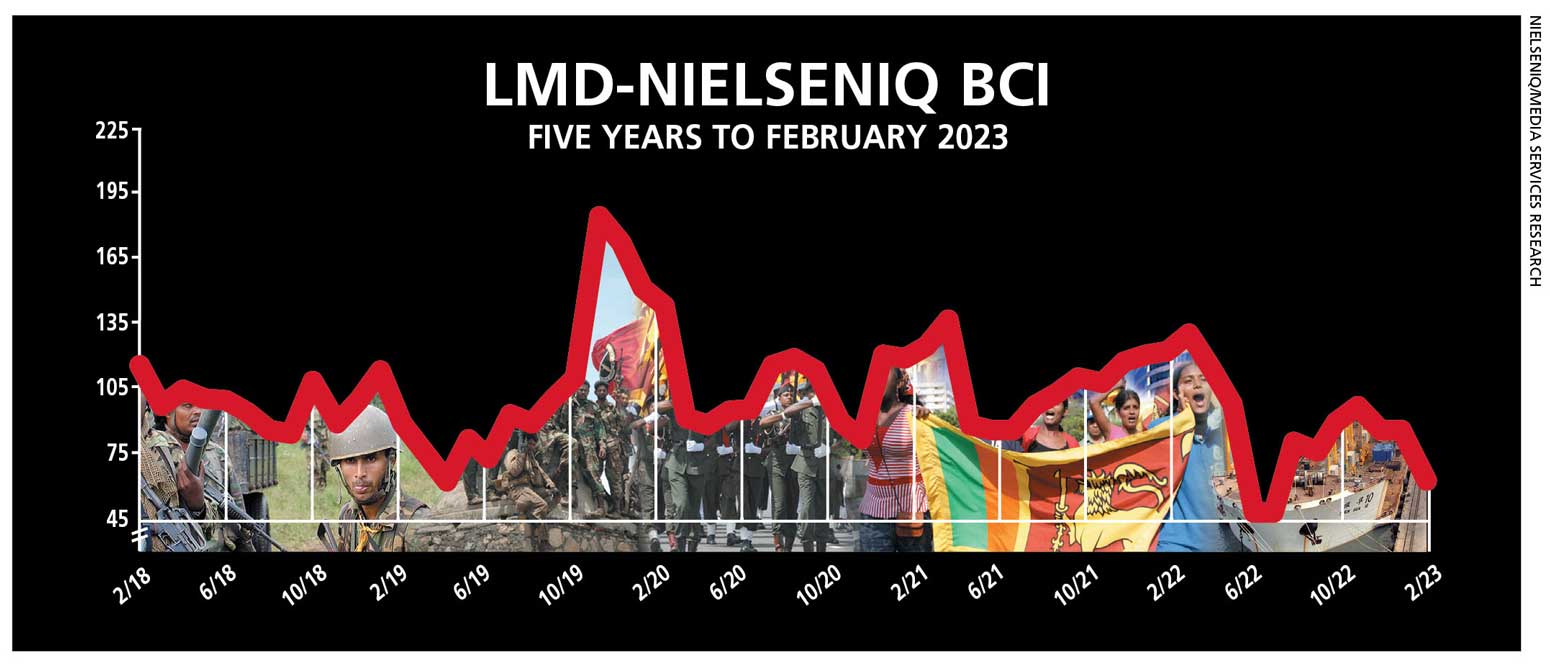

THE INDEX Not since the height of the economic crisis – when Sri Lankans stood in long queues for days to refill their fuel tanks and gas cylinders, in April, May and June last year – has the nation’s only barometer of business confidence fallen to such depths of despair.

In the three aforementioned months, the LMD-NielsenIQ Business Confidence Index (BCI) shed 16, 17 and 50 basis points respectively to crash land at 49 on the sentiment scale.

Despite clawing its way back up to a range of between 76 and 98 since then, the unique index nosedived by 23 points to register 63 in February.

The BCI is now a disconcerting 27 notches shy of its 12 month average (90) and a whopping 69 points less than the 132 recorded in March last year. A year ago, the business sentiment barograph stood at 124 points.

NielsenIQ’s Director – Consumer Insights Therica Miyanadeniya notes: “More than inflation, which used to be the bigger concern, the high tax regime is now the chief concern for business with 55 percent of corporate leaders saying so in our latest monthly survey.”

SENSITIVITIES The uncertainly that surrounds the local government polls is perhaps at the top of the list of sensitivities as far as the outlook is concerned.

In addition, the announcement of yet another massive hike in the electricity tariff could also add to the pressure there now is on business sentiment, as corporates and the people alike grapple with the cost of doing business and living – sky high inflation and interest rates are to blame for this.

PROJECTIONS As we have stated in recent months, the index will fluctuate as business sentiment ebbs and flows between victories and defeats – be it at the polls or any good news that emanates from ongoing debt restructuring talks.

Should the likes of China come to the party, the IMF’s first tranche from the US$ 2.9 billion EFF will follow – and should this eventuate sooner rather than later, a spike in confidence among prospective lenders and investors may follow.

So while there is hope of seeing a little light at the end of the tunnel, the barricades continue to cast doubts over what lies beyond such a horizon – for example, the unprecedented brain drain, power outages and fuel quotas, and no end in sight for any relief from the monetary burdens that have led to rapidly shrinking disposable incomes.

– LMD