BUSINESS SENTIMENT

CONFIDENCE TAKES AN ABOUT TURN

Business sentiment trends down amid a growing sense of uncertainty in corporate circles

With the emergence of a new cluster of COVID-19 cases in early October, the Ministry of Health sought to gazette new regulations under the Quarantine and Prevention of Diseases Ordinance in a bid to stop the virus in its tracks. This involved penalties for those found in contravention of the rules.

Not surprisingly, this has meant a virtual return to a period of lockdown for the public and for all but those services deemed to be essential, much to the dismay of corporate establishments across the land.

So it follows that the latest LMD-Nielsen Business Confidence Index (BCI) survey too would reflect a dip in sentiment in the light of prevailing conditions.

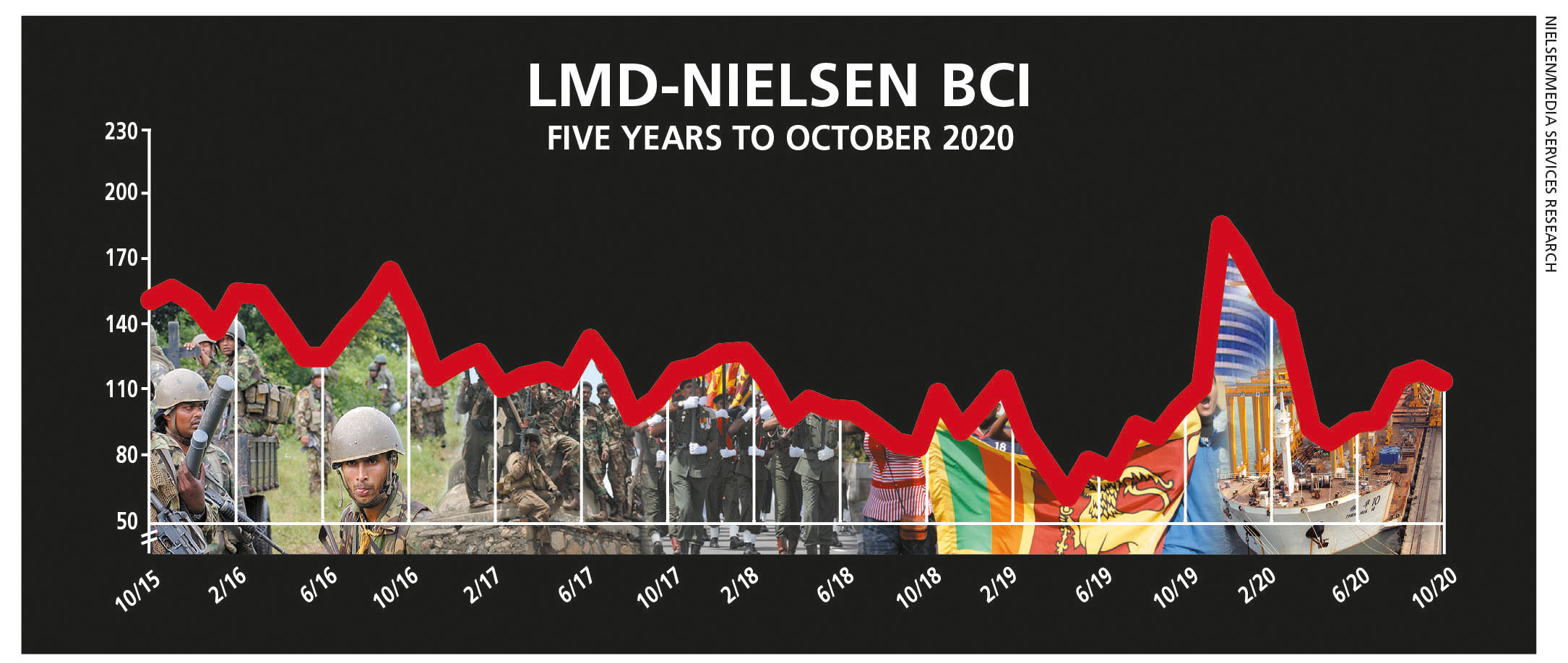

THE INDEX The BCI, which had been making progress following the end of the islandwide curfew, has trended down once again given the prevailing state of the nation – the BCI for October stands at 115, which is five basis points lower than the index value in the previous month.

Nielsen’s Director – Consumer Insights Therica Miyanadeniya observes: “Alas, with the coming of a ‘second wave’ of COVID-19 in Sri Lanka where numbers have been escalating by the day and isolated cases connected to the Minuwangoda cluster are emerging all over, fear has begun to grip the country once again. Although there is no official lockdown of the nation as a whole, a number of businesses and private corporates are in a state of self-imposed lockdown.”

“Among the more informed and learned, working from home (WFH), minimising travel, adhering to physical distancing and wearing masks at all times have once again taken precedence. With schools and universities shutting down, as well as a ban on social gatherings, the state is once more plunged into a state of crisis,” she adds.

SENSITIVITIES The impact of the coronavirus continues to be the most pressing issue for businesses in Sri Lanka today with a majority of corporate executives expressing this fear. In addition, inflation, high taxes and interest rates are cited as concerns although garnering much lower prominence among respondents than COVID-19.

Meanwhile, apprehension over the spread of the coronavirus has also escalated among businesspeople vis-à-vis the major issues warranting urgent national attention with the economy also being mentioned in this regard.

PROJECTIONS Whereas last month’s analysis of the BCI prompted muted optimism over the future direction of the index, the latest news on the COVID-19 front has come as a rude shock to business and the people alike.

To this end, Miyanadeniya comments that “with government resources being stretched as part of efforts to curtail a second wave of infections, and business as well as the public opting for a self-imposed lockdown, the BCI is expected to fall further in the coming months.”

What’s more, with Budget 2021 scheduled for presentation later this month, the prospects of a turnaround in the index appear somewhat bleak at this juncture. It is likely therefore, that the BCI will remain below its 12 month and all-time averages of 125 and 127 respectively.