BUSINESS SENTIMENT

CONFIDENCE NUDGES UP BY A WHISKER

Business sentiment continues to crawl up despite the uncertainties that prevail

Sri Lanka’s GDP is forecast to contract by 5.5 percent this year, according to a recent update to the Asian Development Bank’s (ADB) Outlook 2020 report, with the regional lender noting that “while the impact of the lockdown due to COVID-19 on economic activity during the second quarter of the year will be significant, a faster recovery than earlier anticipated in the second half of the year is expected.”

“The forecast for GDP growth in 2021 is maintained to accommodate a low base this year and with the expectation of higher growth in the major advanced economies as they return to normal,” ADB adds.

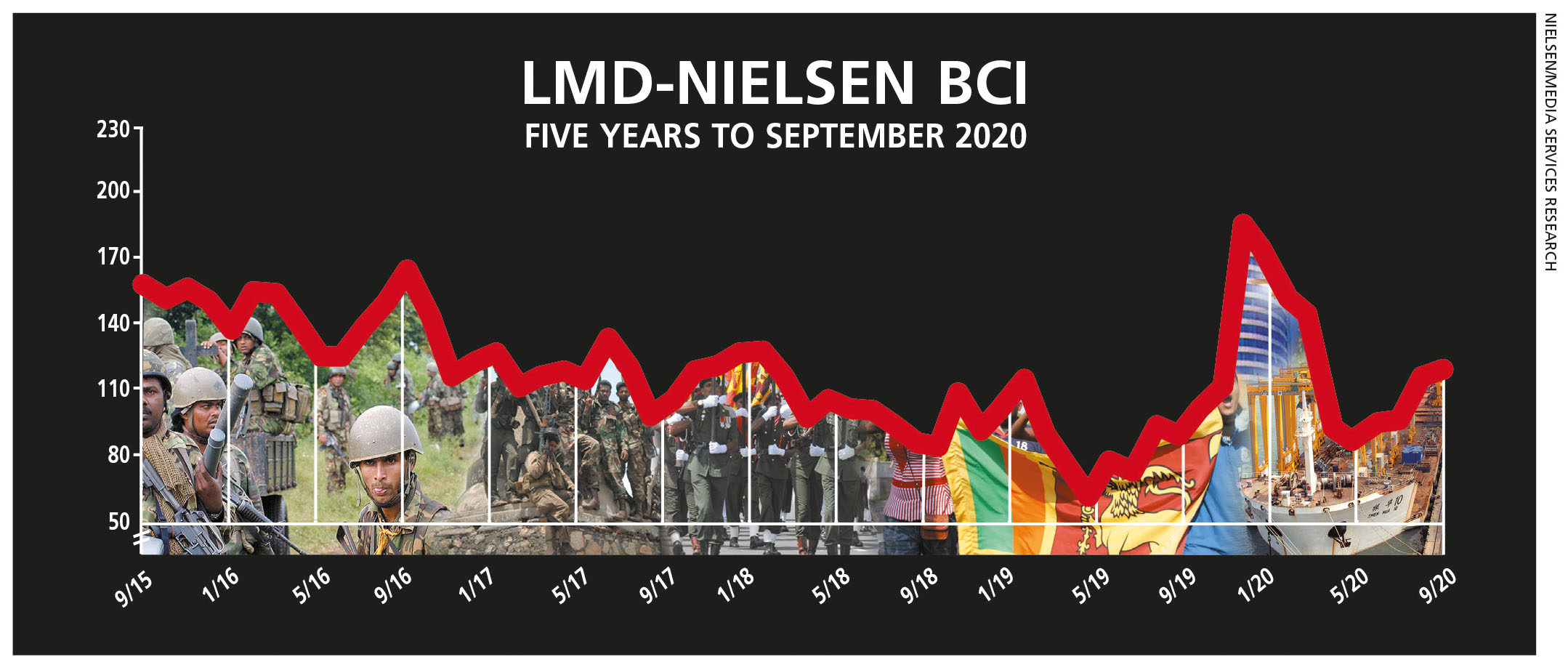

Meanwhile, the latest LMD-Nielsen Business Confidence Index (BCI) survey also paints a slightly more positive picture as reflected by the uptick in corporate sentiment in September.

THE INDEX Although the immediate future may seem uncertain, sentiment among businesspeople appears to be improving gradually – the BCI has nudged up by three basis points from the previous month to reach 120 in September.

Nielsen’s Director – Consumer Insights Therica Miyanadeniya comments: “The COVID-19 situation seems to be abating, the general election has come and gone, and life is slowly returning to some sort of normalcy. However, businesses as well as the people continue to grapple with the aftereffects of the pandemic.”

According to Miyanadeniya, “many businesses have had to cut down on their workforce as well as reduce wages to survive. This of course, has a ripple effect on the people as their wages have been constricted or they’re now out of work; and with many establishments freezing employment, this has a dire effect on the public.”

“Coupled with this is the effect on the tourism industry and associated supply chains, as well as the numerous SMEs, which have been hit hard by the pandemic,” she adds.

SENSITIVITIES The impact of COVID-19 remains the most pressing issue for business in Sri Lanka, followed by the likes of inflation, taxes, interest rates, workforce standards and import restrictions.

Meanwhile when it comes to the main national concern, it is the coronavirus that takes pride of place with the economy also being highlighted by survey respondents – along with the adverse effect on daily wage earners and the state of the education system.

PROJECTIONS Going by the latest survey results, which register a slight uptick in business sentiment, corporate executives appear to have a positive view on such issues as the new regime’s handling of matters of the constitution, the cabinet and other key portfolio announcements.

Miyanadeniya also points out that “the path towards recovery seems to be a painful journey although businesspeople appear to be hopeful that the government will implement strategies to uplift the country’s strained economy. If this is the case, the BCI will continue to rise slowly.”

On top of this, there’s the prospect of a belt-tightening budget ahead – and as far as confidence is concerned, the slight improvement in corporate mindsets could well be offset by anxiety over how far the government will go to balance its books.