BUSINESS SENTIMENT

Plans to develop the Hambantota Port – with the state-owned China Merchants Port paying an estimated US$ 1.1 billion for a 70 percent stake in the facility – understandably made the headlines in late July. The project, which takes the form of a public-private partnership, is to be developed as a ‘major industrial and service port,’ according to reports citing China Merchants Port.

BIZ CONFIDENCE TAKES A NOSEDIVE

Dim prospects on the economic front put corporates on the back foot

A recent statement issued by the Ceylon Chamber of Commerce while recognising the Hambantota Port development project as “an important step towards the goal of positioning Sri Lanka as a full-service maritime hub nation,” urges the government “to ensure that the principle of collective responsibility is respected so as to inspire confidence in the final decision taken.”

The chamber continues: “Sri Lanka needs to enhance its reputation as a business destination that has a credible and predictable investment regime. This imperative is challenged when seemingly conflicting sentiments are expressed by responsible government sources.”

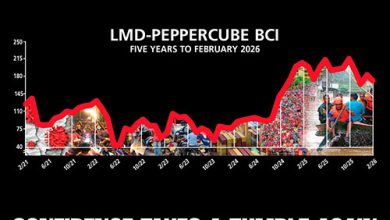

Amidst such goings-on, the business community has evidently taken a step back as reflected in the double-digit drop in the latest LMD-Nielsen Business Confidence Index (BCI).

THE INDEX Following an exuberant jump in July, the index falls back to the low 120s – at 121 in August, the BCI slumped by 13 points from the prior month. However, with the exception of July, this is the highest level witnessed since February.

On the other hand, the barometer of biz confidence is now eight basis points below its average for the last 12 months (129) and nine notches below the all-time average (130).

Nielsen’s Managing Director Sharang Pant opines: “The upward trend over the past five months comes on the back of easing inflation and interest rates, and the granting of GSP+, but has probably been stunted by the controversy around the transparency of the government’s bond sale in the last few weeks.”

“This is substantiated by the fact that while inflation and interest rates are lesser worries for businesses and consumers, political instability and corruption are perceived as larger issues,” he explains.

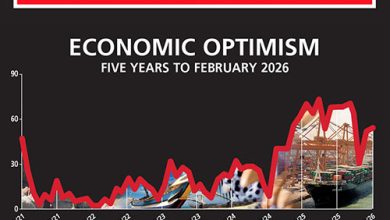

THE ECONOMY Contrary to the upward trend of the past three to four months, expectations on the economy have taken a beating in the latest survey results.

Only one-in-five (21%) respondents feel that the economy in general ‘will improve’ in the coming 12 months – this number stood at 28 percent in July. Over a third of those surveyed state that the economy will ‘stay the same’ but the majority (43%) view is that conditions ‘will get worse.’

According to one businessperson, “currently, the economy is very static” while another adds: “With the economy in its current state, we cannot expect our business to grow.”

BIZ PROSPECTS Sentiment regarding business prospects has more or less remained stable for the short term as well as the longer run.

About two-thirds of corporate executives feel that business will remain the same or improve in the next three months. Meanwhile, almost half the survey sample say business will improve over the coming 12 months.

INVESTMENT Members of the biz community also feel that the investment climate will suffer on account of issues related to transparency, as well as protests and strikes that affect the country’s image.

This view is confirmed by a respondent who notes: “The current situation is not very favourable to investors. There are no solid initiatives carried out by the government to promote investment and the lack of transparency in the investment climate is causing many to think twice before investing.”

A mere 17 percent (compared to 29% in July) of those polled view the investment outlook in a positive light. Conversely, the majority (51%) state that investment conditions are ‘poor’ or worse and the rest deem the funding climate only to be ‘fair.’

WORKFORCE Eight-in-10 (versus 74% in the prior month) businesspeople say they plan to maintain their workforce in the coming six months. Meanwhile, the share of those looking to expand their pool of workers has dropped from 23 percent in July to 15 percent in August.

SENSITIVITIES Although the cost of doing business remains a concern, corporates also feel that exports will pick up in the next few months, thereby aiding growth. To this end, a poll respondent observes: “We expect a positive shift in our business activities in the coming months as a result of the government’s push to promote the export sector.”

Interest rates and the rupee value are also concerns for corporate folk. For instance, a respondent points out that “interest rates keep increasing, the rupee is still not performing well and corruption in the government is still taking place.”

And another asserts: “The value of the rupee continues to depreciate and we face a very unfavourable situation when engaging in foreign trade.”

PROJECTIONS Despite early indications of a recovery in business confidence in July, the “many obvious concerns at the ground level” that we alluded to last month seem to have taken their toll on corporate mindsets.

Whether the recent resignation of a cabinet bigwig and political heavyweight amid allegations of wrongdoing will lead to perceptions of transparency taking centre stage will be closely watched when next month’s BCI survey results are collated.

Also on the watch list will be whether the spate of protests and strike action by various civil and public groups will subside.

It follows that while Nielsen’s September survey of businesspeople is likely to be an eye-opener on many counts, it is unlikely that a major shift in the BCI’s fortunes (or indeed, misfortunes) will eventuate in the near term. Such is the state of the nation at this juncture.

As the nation’s leading business chamber has noted, Sri Lanka needs to enhance its reputation as a business destination – first.

– LMD