BUSINESS SENTIMENT

DRAB OUTLOOK FOR BIZ CONFIDENCE

Despite a slight jump in sentiment the clouds of despair have far from cleared

In a recent assessment of the Sri Lankan economy as part of its South Asia Economic Focus Spring 2017 report, the World Bank (WB) noted that “recent policy reforms including monetary tightening and revenue-led fiscal consolidation have improved the outlook.” WB also stressed that “it is critical to expedite structural reforms to promote competitiveness and governance, and continue on fiscal consolidation in order to ensure sustained growth and development.”

The global lending institution also highlighted the need to “improve the external liquidity position and prepare for active liability management” as the immediate challenge, with a slowdown in growth and delays in key reforms in what is a challenging political environment being the chief risks to the economy.

A likewise cautiously optimistic tone is apparent among the nation’s corporates as well, going by the outcome of the latest LMD-Nielsen Business Confidence Index (BCI).

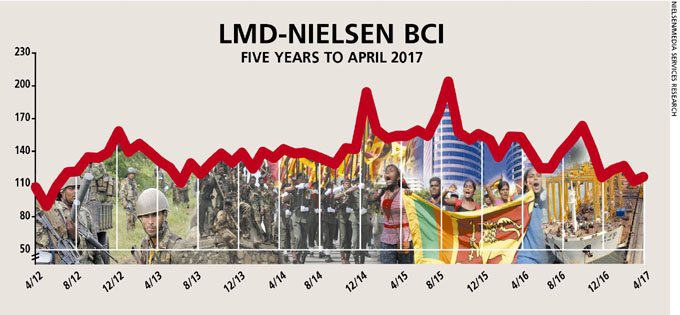

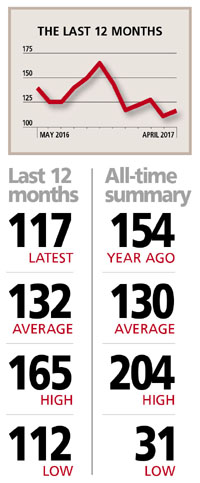

THE INDEX The BCI moved up by five basis points to 117 in April (compared to 112 in March) amid continuing concerns over inflation and taxes, but with businesses appearing to have factored-in the perennial bugbears in both their short and long-term plans. However, the index remains lower than both its 12-month (132) and all-time (130) averages, and way short of the 154 score of a year back.

THE INDEX The BCI moved up by five basis points to 117 in April (compared to 112 in March) amid continuing concerns over inflation and taxes, but with businesses appearing to have factored-in the perennial bugbears in both their short and long-term plans. However, the index remains lower than both its 12-month (132) and all-time (130) averages, and way short of the 154 score of a year back.

Ironically, the sentiment gauge is back where it was in the immediate aftermath of the 2017 budget presentation at the end of last year: in post-budget December, it shed a whopping 27 points to register 117. Reflecting on the latest survey results, Nielsen’s Managing Director Sharang Pant observes that respondents’ marginally more positive sentiment on the economy “could be an early indicator of growing trust in government policies among the business community and how they are readjusting their plans accordingly.”

In addition, he points out: “With positive outcomes expected for GSP+ and other key trade treaties, confidence in the investment climate is improving marginally.”

Pant recommends that “with the country still reeling from drought conditions, this is a critical time for businesses and consumers to withstand the difficult conditions, and take a long-term perspective on the economy, business climate and consumption growth.”

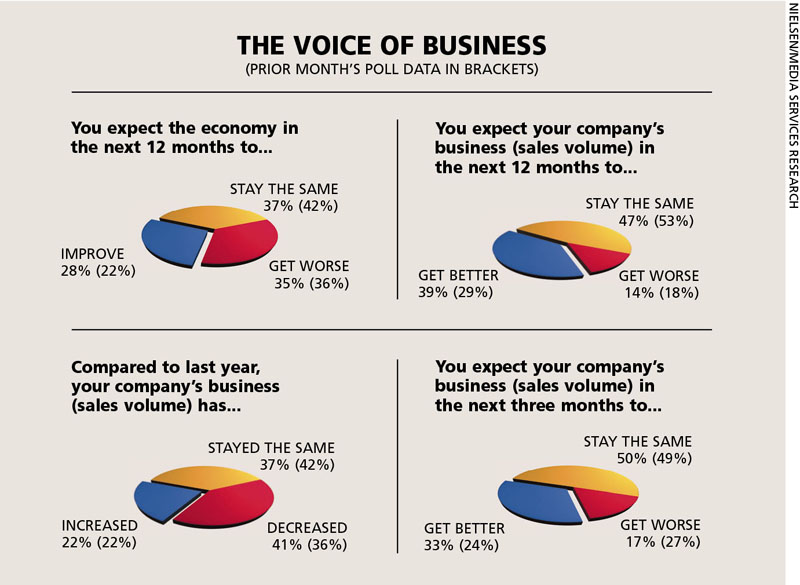

THE ECONOMY While more than a third of the sample population (about the same as in March) continue to feel that the economy will be worse off in the coming 12 months, positivity has increased marginally with 28 percent (versus 22% in the prior month) of respondents saying the economic climate ‘will improve.’

To this end, one corporate executive expects “the current economic situation to get better… So at the moment, everything is looking positive.” However, another survey respondent maintains that “political instability is affecting the economy as a whole.”

BIZ PROSPECTS Nearly four-in-10 corporates spoken to by Nielsen (up from 29% in March) expect business to ‘get better’ in the next 12 months although the majority (47%) believe that sales volumes will ‘stay the same as now.’

Furthermore, a third of those surveyed are of the view that the next quarter would display positive growth trends vis-à-vis business prospects.

INVESTMENT Sentiment regarding the investment climate has improved marginally with 17 percent of respondents deeming it to be positive compared to only 10 percent in the previous month. Nevertheless, the majority (48%) of businesspeople continue to view prevailing investment conditions in a negative light.

“Nobody seems to want to invest in either the stock market or the economy due to high uncertainty in the bourse and the instability of the government,” laments a member of the biz community.

Since then however, the market has gained ground on the back of foreign-investor activity.

WORKFORCE There’s been a slight uptick in corporate expectations of expanding the workforce with a fifth (up from 12% in the prior month) stating they would recruit more personnel in the coming six months.

As for the rest, as few as four percent of those polled plan to reduce their staff numbers while a notable majority (76%) are looking to maintain staffing at present levels.

SENSITIVITIES Businesspeople continue to single out the likes of government policy implementation, interest rates and taxes as being critical factors affecting their business outlook.

As a corporate executive explains, “due to all the government regulations regarding policies, taxes and import duties, there hasn’t been a favourable change in our business activities.”

And another businessperson states: “With increasing interest rates and high taxes, customers’ purchasing power has fallen significantly. This has had a huge impact on our sales volumes.”

A survey respondent also remarks that “when it comes to policy implementation by the government, there is a major contradiction between what it says and what it does.”

PROJECTIONS The crippling reversal of the BCI’s fortunes last month to a 44-month low left us pondering the future direction of the unique index and there was little to suggest that a turnaround of any magnitude was around the corner.

A month later, nothing has changed – except that perhaps due to an ever-so-slight sense of optimism going into the festive season, businesspeople delivered a mildly positive verdict in the first week of April.

With the powers that be facing increasingly damning setbacks – such as the tragic collapse of a garbage dump that was left to reach for the skies – in the weeks that followed however, it is unlikely that we will witness any buoyancy in business sentiment in the near term.

– LMD