BUSINESS SENTIMENT

INDEX PLUMMETS TO A 41-MONTH LOW

The unique index free-falls to new depths against a backdrop of heightened uncertainty

Budget 2017 may have been passed with a two-thirds majority in parliament in December, but the verdict in the corridors of business is seemingly a veritable thumbs down – and that’s putting it mildly.

The budget proposals aim to reduce the fiscal deficit to 4.6 percent of GDP from the prior year’s 5.4 percent, and contain long-term reforms to boost government revenues. But according to the World Bank, while Sri Lanka has taken positive steps in terms of reform, much needs to be done to enable the private sector to grow and provide equal opportunities for all.

Its Doing Business 2017 report also notes that process and policy simplification is required to boost business and entrepreneurship.

Moreover, the downtrend in business sentiment since October coincides with Sri Lanka’s lower Ease of Doing Business ranking.

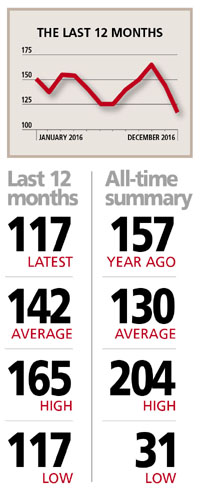

THE INDEX The LMD-Nielsen Business Confidence Index (BCI) slumped to 117 in December compared to 144 in November and is at its lowest level since July 2013.

Nielsen’s Managing Director Sharang Pant observes: “The survey results this month [December] are a reflection of a possible reaction to the Value Added Tax (VAT) rate increase starting 1 November 2016 and the budget proposals.”

He also points out that the slide in the index “is very similar to what we saw in June 2016, after the announcement of the VAT increase in May.”

“Business leaders were expecting a streamlining of Sri Lanka’s tax system and administration in the new budget. But they are now faced with more taxes and new tax rules. This is creating confusion in the supply chain system and intermediaries are wary of the impact of tax changes on their businesses as well, as clearly called out by the FMCG sector.”

“Business leaders feel the VAT hike will put a lid on the otherwise healthy consumption trend of the last few months. The increase in taxes on telecom services is seen as a step backwards, which impacts the digital vision,” he adds.

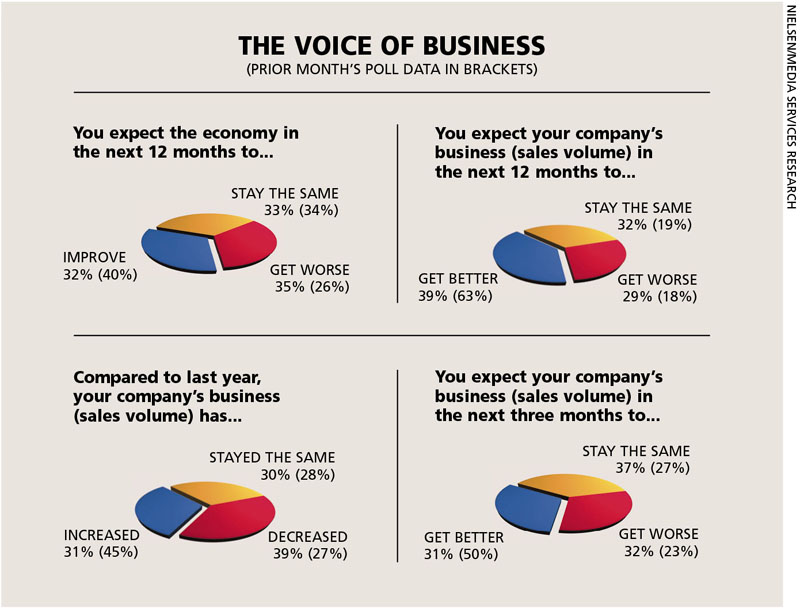

THE ECONOMY Survey results indicate that 35 percent of respondents expect the economy to deteriorate in the coming 12 months – this stood at a far less negative 26 percent in November.

And the third of the sample population that maintain that economic conditions will improve contrasts starkly with the four out of 10 who said so a month ago.

One optimistic respondent however, asserts that “with the economy performing well, our business also seems to be on the rise … The government is pushing to regain GSP+, which will aid many businesses and strengthen the economy,” while another says: “There seem to be many opportunities coming up, especially in the construction industry. This is a good sign for the economy.”

BIZ PROSPECTS Meanwhile, 29 percent of respondents are of the view that their business (sales volumes) ‘will get worse’ in 2017. Worse still, the response is even more negative for the nearer term – i.e. the next three months – with around a third expecting a deteriorating trend.

“With raw material prices increasing and loan interest rates on the rise, it has become challenging for us to maintain a profitable business,” reveals a corporate executive who spoke to the pollsters.

INVESTMENT Sentiment on the investment climate has gradually moved from ‘fair’ to ‘poor’ over the last couple of months with constant amendments to policy and taxes cited as reasons for the lack of faith in Sri Lanka’s outlook.

According to the latest BCI survey, four-in-10 businesspeople view Sri Lanka’s investment prospects in a negative light and a third deem them to be ‘fair’ while 28 percent have more positive perceptions.

An interviewee highlights the widely held view that “foreign direct investments seem to be on the decline, and the expected influence from foreign companies on infrastructure and other similar projects is not seen. This is not a positive sign for the government…”

“The government seems to want to always change its strategies; so how can it expect to encourage businesses to invest?” asks another member of the business community.

WORKFORCE When asked about what their company plans are vis-à-vis the workforce in the next six months, the majority (59% versus 68% in the prior month) of those polled say they will maintain existing staff numbers.

At the same time, 27 percent disclose plans to increase their workforce, while 12 percent (up from 4% in November) expect a drop in their employee count and a further two percent remain uncertain about their staffing plans.

PROJECTIONS We said last month that the December survey would be an eye-opener as it will all but convey a verdict on the budget proposals by businesspeople.

Furthermore, we noted: “We expect the index to fall yet again in the light of the burdens that have befallen businesses – unless corporates take a long-term view that fiscal consolidation was a dire need in the interest of the nation and that it is fair to expect them to take the hit.”

The latest index outcome therefore, is a damning verdict on the state of business in the island and one hopes that the downtrend has bottomed out – even though there’s been nothing of significance to whet the corporate appetite at the dawn of the new year.

Doom and gloom it would seem have permeated the landscape of business once again.

– LMD