BUDGET 2022

REBUILDING CONFIDENCE

Shiran Fernando sheds light on areas of concern ahead of the forthcoming Budget 2022 proposals

The end of a calendar year brings with it the announcement of the proposals for the national budget for the next fiscal year. The 2022 Budget will be keenly looked at given the present state of the economy. It will also signal the policy direction under the new finance minister. Rebuilding confidence in the market and stabilising the economy will be high priorities.

FISCAL POSITION Sri Lanka was able to meet the repayment of the US$ 1 billion International Sovereign Bond (ISB) on 27 July. However, this did not inspire confidence in forex and bond markets, and the pressure on the currency continued into August and early September with a notable weakening of the spot and quoted bank rates.

FISCAL POSITION Sri Lanka was able to meet the repayment of the US$ 1 billion International Sovereign Bond (ISB) on 27 July. However, this did not inspire confidence in forex and bond markets, and the pressure on the currency continued into August and early September with a notable weakening of the spot and quoted bank rates.

Despite the repayment, S&P Global Ratings downgraded Sri Lanka’s rating outlook to ‘negative,’ citing challenging external refinancing prospects in the next 12 months.

The repayment of the ISB came from dollar reserves, which subsequently fell to a low of 2.8 billion dollars.

Since then however, Sri Lanka has been able to bolster its reserves back to above US$ 4 billion thanks to inflows from the IMF (an increase in the global reserve allocation meant a boost of 787 million dollars), US$ 200 million from Bangladesh Bank and 200 million dollars from the China Development Bank.

MONETARY POLICY On the monetary policy side, the Central Bank of Sri Lanka (CBSL) hiked policy rates in August by 0.5 percent for both the policy deposit and lending rates while increasing the reserves ratio of banks.

Sri Lanka was the first in Asia to tighten its policy rates since the pandemic took root early last year. Other central banks such as those in Hungary, Norway, Brazil, Russia and Mexico had previously raised their interest rates.

This shift in policy is important as it would ease pressure on the economy – in particular to tame inflation, stabilise credit growth, and reduce the arbitrage between US Dollar and Sri Lankan Rupee deposit rates. With regard to the latter, with its policy tightening, CBSL mandated a ceiling rate of five percent on all foreign currency deposits with effect from 24 August.

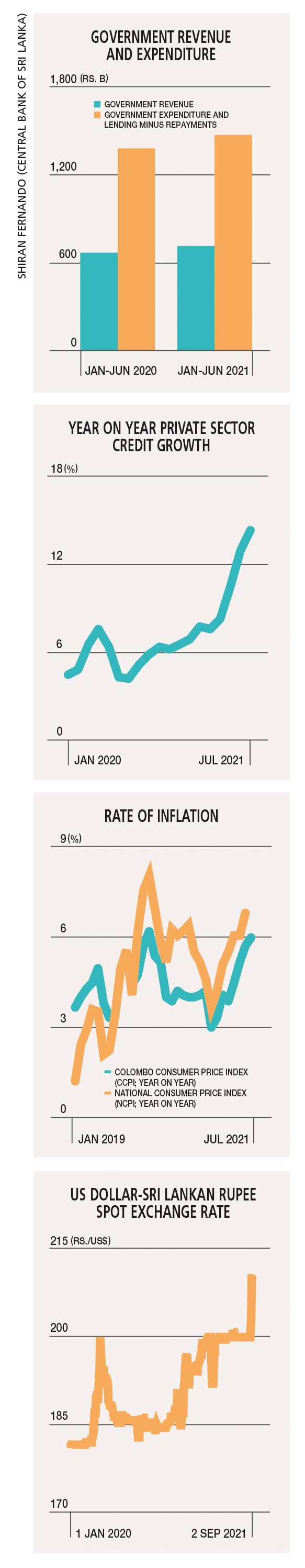

INFLATION INDICES As for inflation, the Colombo Consumer Price Index (CCPI) recorded a year on year growth rate of six percent in August – the highest since February 2020.

Inflation has been driven by a combination of factors – namely, an increase in food prices domestically and internationally, while recent revisions in the prices of fuel and essential drugs have resulted in the non-food component of the index rising. Low base effects have also played a part.

The National Consumer Price Index (NCPI) – which has a higher weightage of food in its basket of items – rose to 6.8 percent in July.

CREDIT GROWTH The low interest rate environment has stimulated credit growth to the private sector. In July, credit grew by 14.3 percent year on year compared to only 4.2 percent in the corresponding period of last year.

In absolute terms, credit growth in the first seven months of this year has been far higher than in the entirety of 2020 and 2019.

Credit to public corporations (i.e. state owned entities) has also increased with the low interest rate environment.

ECONOMIC RECOVERY While CBSL’s monetary policy has supported the country’s economic recovery, the next phase will be determined by how well the fiscal policy aspect is navigated.

The hike in policy rates could mitigate inflationary pressures and stabilise credit growth while enabling support for the currency. However, support in terms of improving the country’s tax revenue position, curbing expenditure and maintaining a single digit budget deficit will be vital to changing the narrative.

In the first half of 2021, the country has witnessed a 7.5 percent increase in government revenue collected while expenditure has expanded by 6.7 percent. The budget must spell out key revenue proposals that will boost revenue without burdening the consumer while curbing expenditure.

EXTERNAL SUPPORT At the time of going to print, IMF support has not been sought in terms of engaging it for a reform programme.

Such a programme is expected by most rating agencies and international investors as a pathway to stabilise the economy. If Sri Lanka pursues this option, it would be the 17th such programme since the country became a member of the IMF.

At present, policies related to interest rate adjustments and exchange rate flexibility are being implemented. Typically, we have seen more revenue-based fiscal consolidation programmes while the focus has been on reforming state owned enterprises.

Sri Lanka can pursue some of these reforms on its own but there will be more credibility if such initiatives are undertaken as part of an IMF programme.

Alternatives to the IMF and in maintaining medium-term debt sustainability would include witnessing a rapid increase in exports, the resumption of tourism, higher foreign direct investments (FDI) and the sale of non-strategic assets.