BRAND BUILDING

MARKETING-FINANCE NEXUS

Sohan Jayasena wants the gap between marketing and finance to be bridged

The disconnect between marketing and finance, which are the two primary verticals of an organisation, has been of concern for a long time. However, prudent business leaders have now identified its adverse effects on their organisations in the long term.

Finance executives are often sceptical about spending on brand building, citing challenges in quantifying perceived benefits and justifying returns on investment.

Similarly, marketing executives struggle to align soft marketing metrics such as share of voice, positive sentiment, consideration, loyalty, top of the mind placement and so on with financial planning, which often results in contentions between the two units.

Both verticals possess distinct psychologies and operational perspectives; and while their paths differ, they converge at the bottom line. It’s pragmatic to acknowledge that they may never fully comprehend each other but a compromise should be reached by appreciating each other’s unique contributions through a shifted vision.

Marketing and finance aren’t encouraged to give up their foundations and fundamental thinking.

In fact, their different perspectives add richness to an organisation. The key is to foster a holistic understanding of how each vertical uniquely contributes value to the business. This will help shift the focus toward unified business growth.

It’s necessary to gain a deeper understanding of how a brand can be one of the most valuable assets of a business by driving goodwill and long-term growth.

COMPREHENSION An inability to comprehend the benefits of brand building on the bottom line means that the effort is often considered a cost rather than an investment.

This is seen with marketing often being the first on the list of candidates during efficiency restructuring – and it’s an imprudent approach.

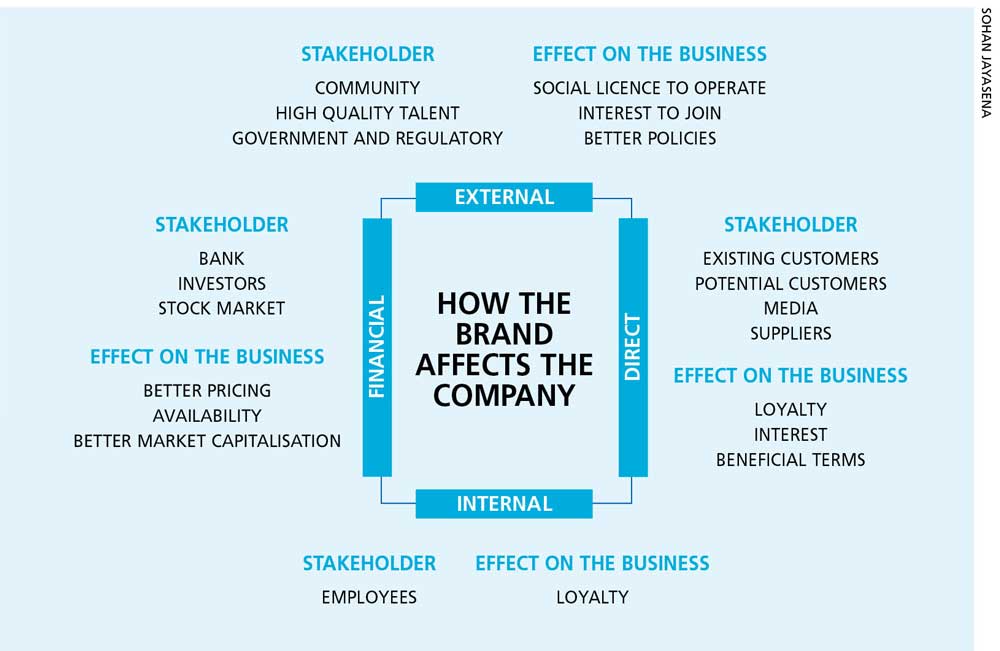

IMPACT This is about assuming that a brand only impacts customers. In reality, a brand’s influence extends to a majority of stakeholders, and plays a vital role in attracting top talent and investors.

As the former CEO of Quaker Oats John Stuart once said, “if this business was split up, I would give you the land, bricks and mortar; and I would take the brands and trademarks – and I would fare better than you.”

PERFORMANCE Shortsighted evaluation results in having a myopic view on business performance, such as the pressure on brand investments to deliver instant performance. This approach predominantly addresses the immediate quarterly performance, which turns into a vicious cycle that establishes an unhealthy culture.

RISK AVERSION While finance executives rightly see themselves as risk managers, an excessively risk averse approach can adversely impact a business. This is evident in the scepticism towards brand investment, which is driven by a preference for hard evidence.

However, brand building is a science that works with consumer psychologies and complex behaviour, and delivers greater results over an extended period of time.

PERCEPTIONS Finance executives focus on left brain factors such as investment efficiency, visible logic, analytics and the prioritisation of time.

In contrast, marketing executives place an emphasis on right brain factors such as customer psychology, brand loyalty, purchase intent, buyer journey, lifetime value and so on, which lead to tangible results over time.

A brand’s outreach goes beyond a logo or graphic – it’s the real estate that a business owns in the customer’s heart.

In fact, a brand is an instrument of differentiation and testament of quality; it encompasses facets such as associated feelings, experiences, product design, fragrances and even sound, which enable consumers to make speedy and justified purchase decisions.

Furthermore, a brand is often the most valuable asset of a business, averaging more than 20 percent of a company’s value.

Brand value creation is successful only when all stakeholders contribute to it; and as such, marketing and finance are both crucial for organisational success.

BRAND VALUE Leading consultancies facilitate brand valuation, which fosters collaboration between chief financial officers and chief marketing officers.

BUSINESS VALUE It’s important to discover how branding adds tangible business value. Benefits include increased revenue through customer loyalty and lower costs via better terms from key suppliers.

CONTRIBUTION Attention must be paid to both tangible and intangible assets. Leading businesses often derive market value from intangibles such as the brand, a loyal customer base and partnerships. The value of intangible assets is seen when market value exceeds the book value of a business on the back of a strong brand.

VOCABULARY A holistic view of each vertical’s contribution to an organisation’s success is crucial. Finance executives should articulate marketing and recognise the role of the brand while marketers converse about finance for organisational growth.

A brand’s outreach goes beyond a logo or graphic