BEVERAGE SECTOR

FORWARD THINKING

DON’T WASTE A ‘GOOD CRISIS’

Maud Meijboom-van Wel looks ahead to a recovery of the alcobev sector

Compiled by Yamini Sequeira

“Never waste a good crisis because every crisis brings new opportunities,” says Maud Meijboom-van Wel. In the case of Sri Lanka, she believes the rapid adoption of technology platforms and digitalisation induced by the pandemic is a positive outcome that should be consolidated further.

During her career, she has worked in 26 markets of which 22 have been in the Asia-Pacific region. And barely six months into her assignment in Sri Lanka, she’s all praise for the country and its people, and the unenviable balancing act of adopting stringent health policies while keeping the economy open.

During her career, she has worked in 26 markets of which 22 have been in the Asia-Pacific region. And barely six months into her assignment in Sri Lanka, she’s all praise for the country and its people, and the unenviable balancing act of adopting stringent health policies while keeping the economy open.

Commenting on the state of the economy, she asserts: “I believe some of the measures taken – e.g. incentives to investors in tourism, logistics and industries impacted by the pandemic; tax breaks; and low interest loans are all imperative.”

“Another aspect that’s noticeable is the focus on curtailing imports to bridge the trade deficit and move towards a more export oriented economy,” she adds.

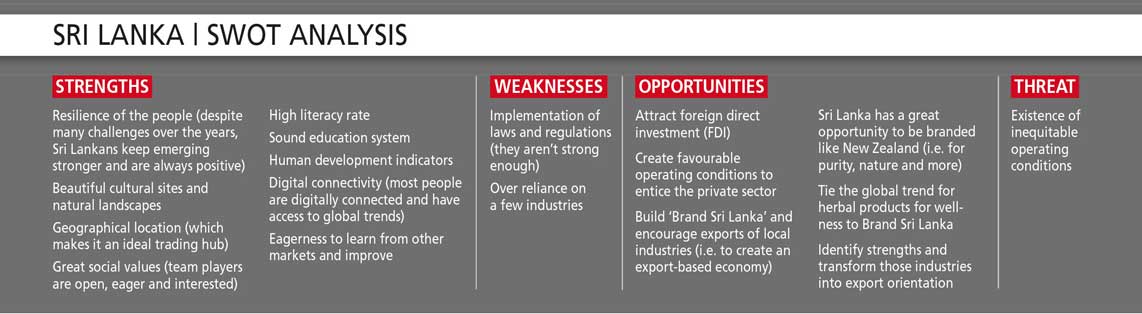

INDUSTRY OPPORTUNITIES Meijboom-van Wel explains: “Sri Lanka is globally known for industries such as tea, apparel, cinnamon, pepper and gems. I believe the move to expand the export portfolio and create a wider basket of industries is necessary while simultaneously developing technological infrastructure.”

“The Colombo International Financial City (CIFC a.k.a. Port City) will be an attractive economic and business hub, which can generate valuable employment for the country while improving forex earnings,” she adds.

Meijboom-van Wel is convinced that Sri Lanka can become another Singapore for the South Asian region and position itself strategically, “making Colombo and Hambantota great trading ports and investment hubs.”

On the issue of debt and depleting reserves, she posits: “We see this phenomenon in many countries impacted by COVID-19. A balance between supporting the coronavirus hit economy and an accelerated vaccination programme, as is being done here, is the best solution under the circumstances. For a developing country, ensuring financial sustainability is critical.”

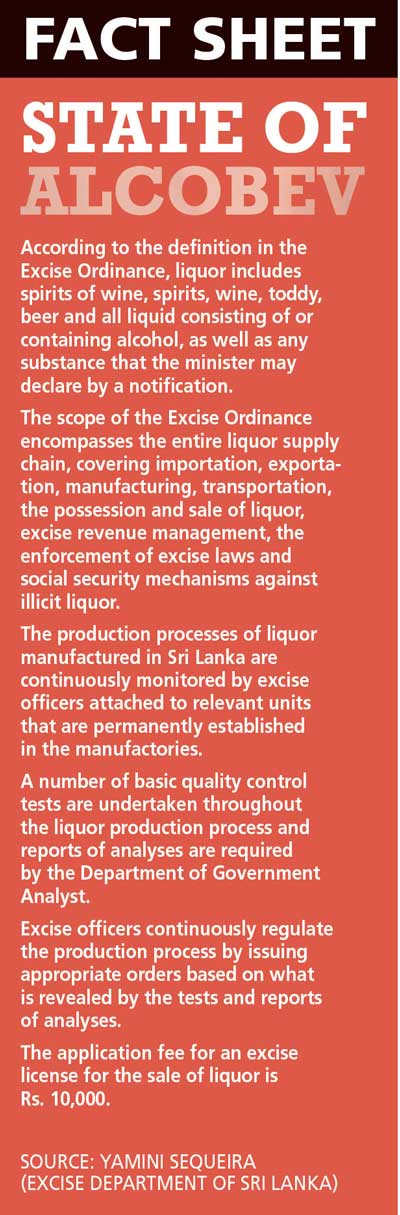

MISSED OPPORTUNITIES Operating in Sri Lanka’s alcoholic beverage or ‘alcobev’ sector, Meijboom-van Wel believes that there’s a missed opportunity: the rise in e-commerce and an increase in home consumption due to the pandemic is an ideal platform for the sector.

She elaborates: “I believe the home consumption trend is here to stay with people meeting in small groups and ordering in rather than visiting restaurants. It’s a great way to extend convenience for people. Given that the appropriate regulatory checks are in place, alcoholic beverages should also be allowed on e-commerce platforms so that consumers can purchase legal drinks such as beer in a safe and responsible manner from their homes.”

In her view, if alcohol can be distributed in more legal licensed outlets spread out over the island, easier access to legally manufactured alcohol will reduce illicit liquor consumption. Presently, legally produced alcohol, wine and beer are sold in limited licensed outlets; and as a result, people living far away can’t access legal alcohol.

In her view, if alcohol can be distributed in more legal licensed outlets spread out over the island, easier access to legally manufactured alcohol will reduce illicit liquor consumption. Presently, legally produced alcohol, wine and beer are sold in limited licensed outlets; and as a result, people living far away can’t access legal alcohol.

“So logically, by increasing the number of legal alcohol licences, illicit liquor consumption can be reduced and the state will be able to earn higher taxes,” she points out.

The ban on advertising alcohol is another restraint, Meijboom-van Wel maintains: “In other markets, we are able to convey our message of responsible consumption and explain why certain products match moderation better.”

She continues: “The alcobev sector should be permitted to conduct digital marketing because it helps to individually target people in a way that the messaging won’t reach anyone who shouldn’t be seeing it. A direct result of the present ban is that you miss an opportunity to educate people on how they can enjoy alcohol in a responsible way.”

Another trend that’s gaining focus globally is health and wellbeing with the adoption of healthy lifestyles having been amplified by the global pandemic. Moderation is key in this case as people streamline their lifestyles to boost their immunity.

Meijboom-van Wel explains: “While this trend can be seen in many Asia-Pacific markets, the opposite is true in Sri Lanka in the case of the alcobev sector.”

“People are opting for higher alcohol [content] products due to a quantity over quality mindset,” she notes, continuing: “Sri Lanka is one of the few countries where high alcohol containing beers are the norm. For some time now, most markets have been seeing a perceptible shift towards lower pulling beverages, milder refreshing beers or even zero percent alcohol beers.”

MODERATION In developed markets, zero percent alcohol beers can command over 10 percent of the sector. But in Asia, milder and more ‘sessionable’ beers with between four and five percent alcohol content are popular. They are the norm, accounting for over 80 percent of beer volumes.

Commenting on the alcobev sector, she adds: “Taxation on beer generally is very high in Sri Lanka (84% versus spirits), which makes it unaffordable. In developed countries, there is more consumption of beer and less of spirits, and that’s a good thing.”

She explains that “this shift has taken place because governments view beer as being better for one’s health and they can also eliminate the illicit alcohol sector, which doesn’t pay taxes. So increased access to legally manufactured beer and spirits will benefit Sri Lanka too.”

“Since strong beers with more alcohol content are popular, they cost more. Allowing and stimulating lower alcoholic beers to enter the market will make beer more affordable,” Meijboom-van Wel notes. Though the preferred sizes are large bottles, she believes smaller packs enable people to enjoy beer in a more moderate way.

“Since strong beers with more alcohol content are popular, they cost more. Allowing and stimulating lower alcoholic beers to enter the market will make beer more affordable,” Meijboom-van Wel notes. Though the preferred sizes are large bottles, she believes smaller packs enable people to enjoy beer in a more moderate way.

Meanwhile, she cites an interesting survey conducted on market development in relation to premiumisation and consumer needs by Kantar and Ipsos three years ago: “Markets and consumers move through different stages as the market develops – from the more basic need for quality and safe products in early stage developing markets to the need for status or showing off.”

“This is followed by experiences that are fit for the occasion in more developed markets all the way to the need for purposeful brands in very developed markets,” she adds.

Meijboom-van Wel avers: “As Sri Lanka is developing apace; you will see a quick shift in needs that consumers demand from brands.”