BANKING SECTOR

MONEY MATTERS

Compiled by Yamini Sequeira

FINANCIAL SHADOWBOXING

Nanda Fernando notes how the pandemic has highlighted challenges that lie ahead

The last financial year was challenging for a number of reasons. Firstly, the economy was on a low growth trajectory, which brought about difficulties in business expansion and performance. Next, the Easter Sunday attacks severely impacted civilian life and businesses alike. And there was a major election scheduled for mid November and uncertainty in the run up to it.

“These major events created very difficult conditions for all industries and sectors including banking. By March, we expected the worst to be over. Post the [then scheduled] April general election, we anticipated business confidence to improve. And this was expected to drive private sector credit demand and thereby the growth of the banking sector,” recounts Nanda Fernando.

LIMITED GROWTH He goes on to explain that the macroeconomic slowdown was the primary cause for increasing non-performing loans (NPLs) in the banking sector.

As economic conditions tightened, most sectors found it increasingly difficult to sustain profitable businesses. Credit periods were extended and nonpayments increased. There were limited expansion opportunities, and everyone was in a defensive ‘wait and see’ mode.

It follows that advances and profit growth of the sector slowed down, and NPLs and impairments increased.

Commenting on lessons learnt by the banking sector during the curfew – when people still had to access cash – Fernando asserts: “Mainly, it was that we live in a world that’s in a constant state of volatility – and to survive in such an environment, we need to stay agile and maintain constant awareness.”

“The next important lesson was to increase the rate of adoption of new digital technologies. What’s more, we were successful in bringing on board many customers to digital platforms during this period,” he adds.

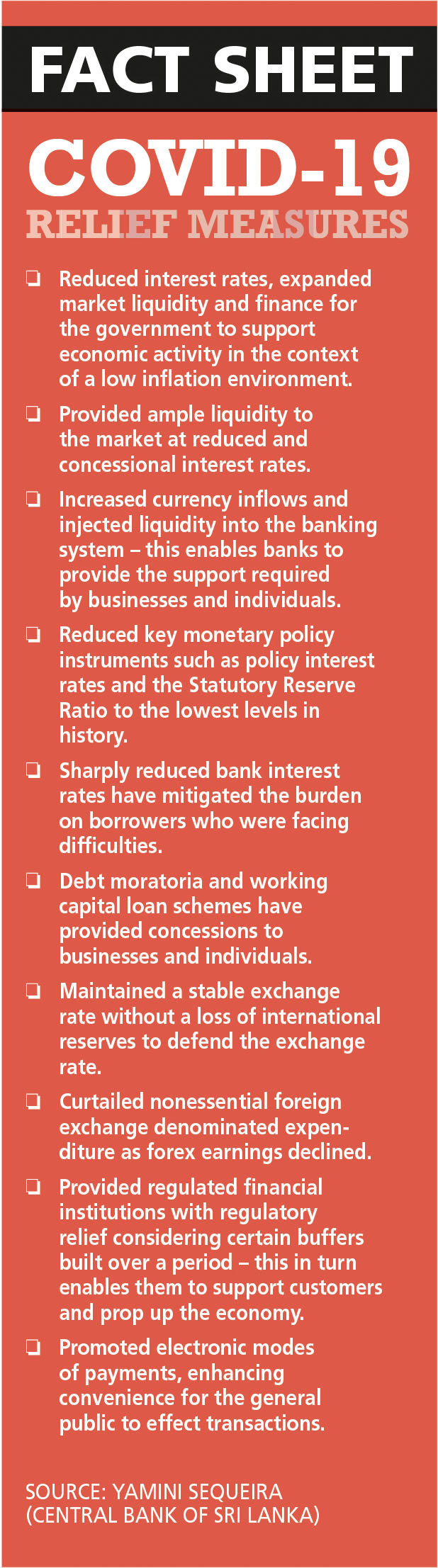

Although the government announced loan waivers and schemes to contain the economic impact of the coronavirus, Fernando feels that “the announced programmes will have a temporary and negative impact on sector profitability.”

“However, these programmes are essential for the revival of the economy. Banks can absorb losses due to built-up reserves and capital buffers of past years,” he assures.

PANDEMIC EFFECT While the economic fallout that resulted from last year’s Easter Sunday attacks was limited to Sri Lanka alone, the COVID-19 pandemic has had a major impact on the world at large. All economies – developed, developing and underdeveloped – have been affected by the global health crisis.

Job losses and pay cuts are becoming more commonplace across markets and industries, leading to lower consumer and business spending.

However, there is a glimmer of hope: a few countries have had some success of flattening the curve and are beginning to ease their lockdowns.

Businesses are reopening and welcoming their first waves of customers. Governments too are rolling out stimulus packages to drive economic activity and thereby create employment opportunities. As parts of the world attempt to return to normal, we need to be cautiously optimistic and not let our guard down.

CHANGING COURSE Delineating the new challenges he foresees for the short and medium terms due to the pandemic, Fernando believes the main challenge is the COVID-19 situation in Sri Lanka and the rest of the world. Until and unless the situation is brought under control both here and abroad, it’s very difficult to aspire for sustained growth, he opines.

Once this is brought under control, supporting affected industries and customers to get back on their feet, instilling confidence in consumers to start spending, repaying government debt accrued during the pandemic, reducing budget deficits and building up reserves to resume trade are the main challenges Fernando foresees for the short and medium terms.

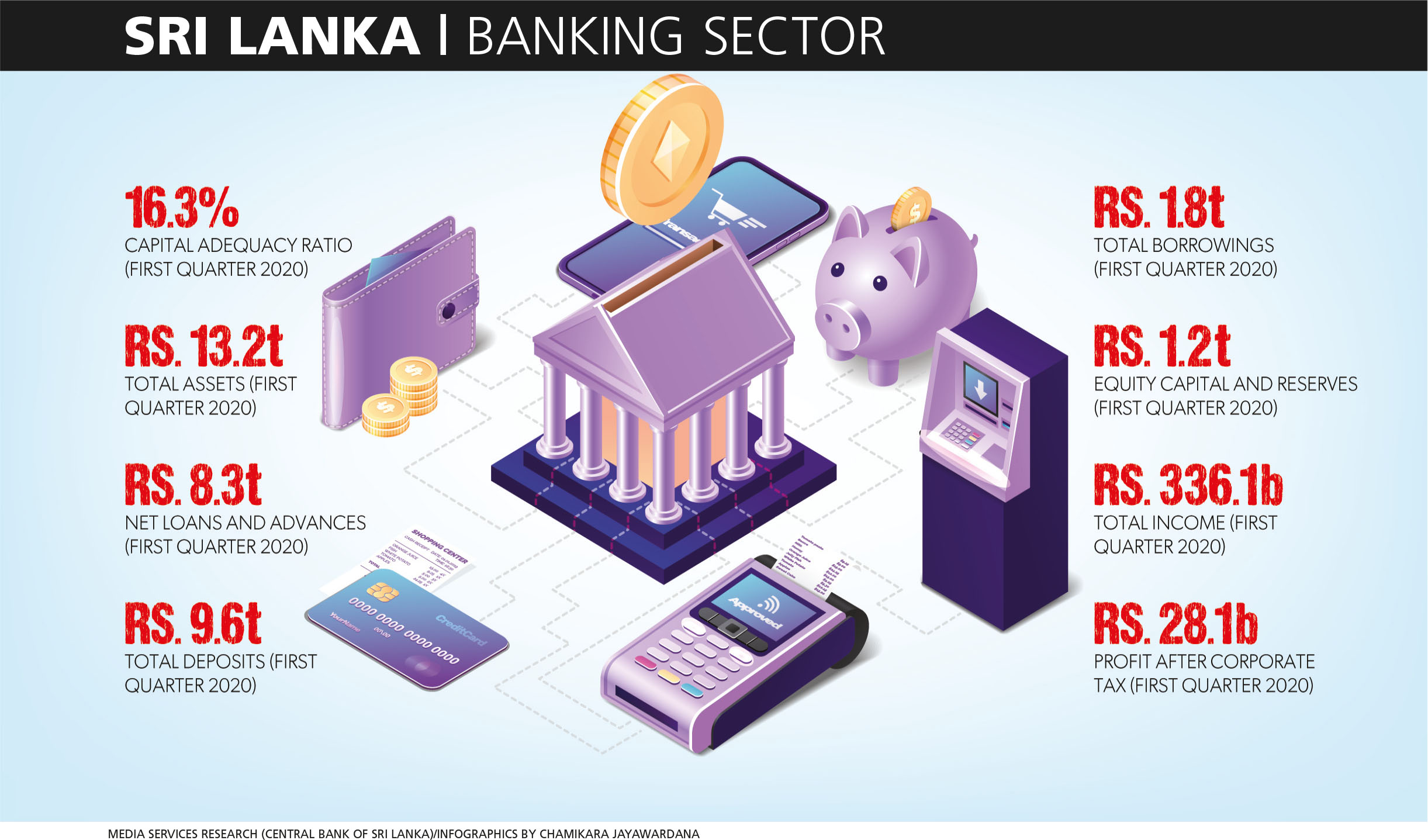

With the capital adequacy compliance regulation looming ahead in 2021, he insists that it is not a major challenge, adding: “Almost all banks were comfortably above the required capital levels at the end of the first quarter of 2020.”

“We don’t foresee a major issue by the end of the year as growth in the banking sector is expected to slow down, requiring less capital for growth on the one hand, and expected improvement in impairments due to moratoriums and other concessions granted to businesses on the other,” Fernando maintains.

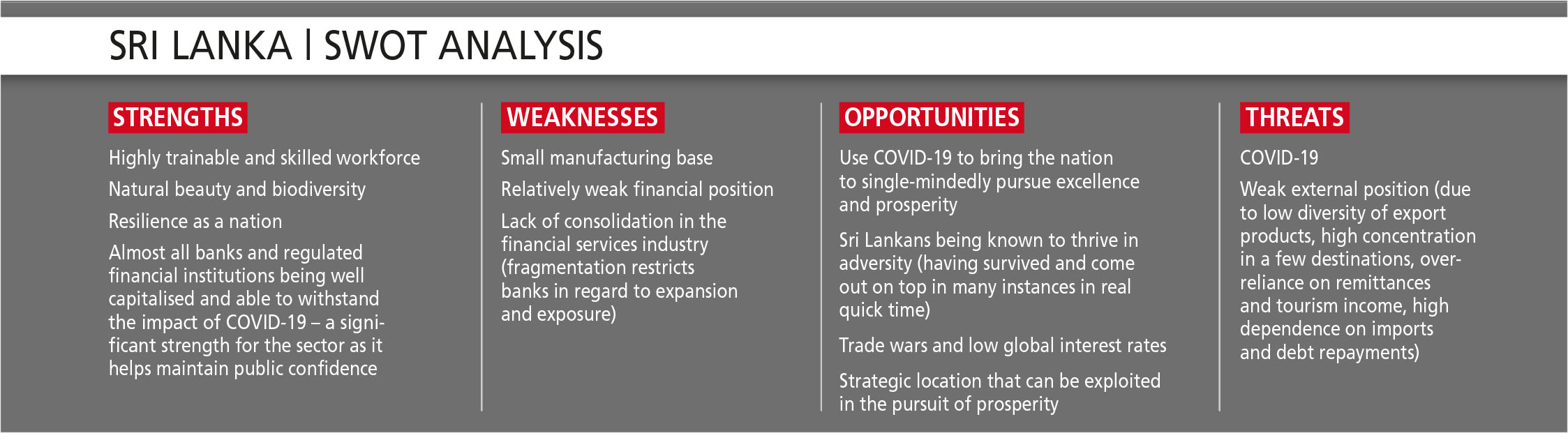

STATE OF PLAY He does not envisage further consolidation in the sector in the present climate, noting that as of now, almost all banks and regulated financial institutions are well capitalised and able to withstand the impact of COVID-19.

However, consolidation is a long-term need for Sri Lanka’s financial services industry as fragmentation restricts banks in terms of expansion and exposure, he adds.

Sharing his take on the state of play in microfinance and its future, considering the adverse impact on the sector in 2019 and 2020, Fernando states that “microfinance is by nature a high return high-risk business. It’s an essential and integral part of any financial system as it caters to nascent businesses and low income families.”

He continues: “Currently, due to the elevated risks, the sector is going through a challenging phase. However, the tide will turn and the need for microfinance will become even more important for economic growth when it does.”

FUTURE WISH LIST Topping the banker’s wish list is for the COVID-19 situation to be brought under control globally. Thereafter, if the government can create an enabling environment for businesses to flourish with greater security and political stability, there will be nothing more to wish for, he says.

And he assesses the relative strengths and weaknesses of the banking sector: “The banking sector was already transforming itself to survive in a digital era and COVID-19 acted as a catalyst in that process. Therefore, investments already made in digital technologies are a key strength of the sector.”

“Moreover, the banking sector is blessed with a committed, responsible and ethical workforce. This was proved beyond doubt during the COVID-19 lockdown,” he declares.

Fernando also remains hopeful that the weakened capacity for raising debt capital by Sri Lankan banks in overseas markets due to the economic impact of COVID-19 will become stronger as it limits local banks’ ability to lend in foreign currencies.