MACRO OUTLOOK

ATTACKS ON MANY FRONTS

Shiran Fernando raises concerns over the state of the nation’s fiscal affairs

The Easter Sunday terrorist attacks in Sri Lanka marked a sad and shocking event in the history of our country, which was only weeks away from celebrating a decade of peace. While we strive to pull through in the aftermath of the events that unfolded on 21 April and heal as a nation, the economic impacts will become more evident in the months ahead.

TOURISM IMPACT One area that will be affected is tourism earnings – this is based on the nature of the attacks as well as the historical impact of similar incidents on tourist destinations such as Bali. Rather than attempting to quantify the impact of the terror attacks, this column focusses on what it would mean in the context of maintaining macro stability in terms of the current account.

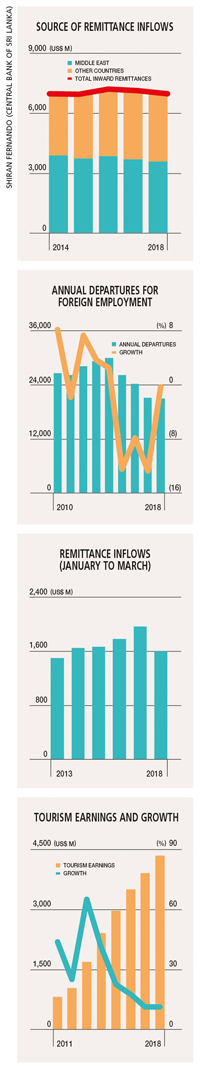

Between 2009 and 2018, tourism earnings increased at a compound annual growth rate (CAGR) of close to 30 percent. In both 2017 and 2018, earnings from tourism grew by 18 percent. A lower growth rate leading to a contraction would be of consequence to the current account given a decline in inward remittances, which is among the country’s largest sources of foreign exchange.

REGIONAL INFLOWS Remittance to Sri Lanka saturated in the five years up to 2018. While inflows to the country declined by two percent last year, they reached a record high in total for low and middle income countries.

According to the World Bank’s Migration and Development Brief, annual remittance flows to the above-mentioned regions grew by 9.6 percent year on year in 2018. Global remittances as a whole rose to US$ 689 billion from 633 billion dollars in 2017. Of greater relevance to Sri Lanka is the fact that remittance inflows to South Asia increased by 12 percent.

As for regional trends, inward remittances to South Asia accelerated by six percent in 2017 (Sri Lanka witnessed a decline of 1% in that year). Growth was driven by a pickup in oil prices, which boosted outward remittances from the Middle East. Remittances to India, Pakistan and Bangladesh grew by 14, seven and 15 percent respectively in 2018. In this context, Sri Lanka displays a divergence compared to the region.

LOWER DEPARTURES A key reason for the saturation in remittance inflows has been the decline in annual migration for foreign employment. In 2014, more than 300,000 people departed for foreign employment compared to 211,459 last year, which represents a fall over four consecutive years.

Partly at least, the reason for this decline is the emergence of better opportunities in the domestic market and impact of measures to discourage migration in certain categories of work. According to the Sri Lanka Bureau of Foreign Employment, there has been a consistent decline in absolute terms across all categories of human resources.

Another reason for the saturation is the fall in remittances from the Middle East. While Sri Lanka received US$ 3.9 billion in remittance inflows from the region in 2014, this had fallen to 3.6 billion dollars by 2018 with most other key sources of inflows having grown in this period. This is of some concern as the uptrend in oil prices isn’t resulting in an increase in remittances from Gulf countries.

INAUSPICIOUS START Remittances slumped in the first quarter of this year, declining by 18 percent and representing the lowest inflows for this period in absolute terms since 2013. This is a worrying sign for the current account in particular with the potential impact on tourism earnings set to cushion the deficit.

Remittances to the region are expected to rise in 2019, according to the forecasts compiled by the World Bank. It will be interesting to see whether Sri Lanka will enjoy any benefits from this increase.

CURRENT ACCOUNT In the first two months of this year, imports slumped by 22 percent, mirroring the impact of the slowdown in remittance inflows. And in February, the trade deficit recorded its lowest level in more than five years.

While this is good news overall vis-à-vis the current account deficit, a further slowdown in remittances could result in lower expenditure on imports. The reduction in imports may counterbalance the decline in inward remittances and cushion part of the slowdown of tourism related inflows following the terrorist attacks.

However, these expectations can only work in the short run and are dependent on many variables being in the country’s favour. Therefore, the economy requires a shift to a higher growth trajectory in these hard times.

As emphasised in the Central Bank of Sri Lanka Annual Report 2018, “the country can no longer afford to postpone such reforms if Sri Lanka is to progress along a high and sustainable growth trajectory over the medium term – and catch up with countries that were behind Sri Lanka several decades ago.”