COVER STORY

LMD EXCLUSIVE

TIME TO GO GLOBAL

Indira Malwatte charts a course to jumpstart the local export economy and leverage on global value chains

Four decades’ experience of serving the government both internationally and locally as a top export promotion officer facilitating exports has stood Indira Malwatte in good stead in her current role as Chairperson of the Export Development Board (EDB) of Sri Lanka.

The first female to helm the EDB, she also has extensive hands-on experience serving in the private sector – exporting a highly perishable product, and entering new and demanding markets where the company had the honour of being the first agricultural entity in Sri Lanka to be Global G.A.P. certified.

Her in-depth knowledge of multiple sectors spans industrial, agricultural and services expertise in supply chain management and international marketing.

Malwatte has participated in a number of World Bank, ITC, GIZ, CBI and JETRO export development projects. She has also served on government and private sector boards, and undertaken a number of product development and export oriented consultancies.

Having initially joined the EDB when it was only six months old, Malwatte notes that her later appointment as chairperson was “like coming back home.”

In this exclusive interview with LMD, she outlines plans to renew the EDB’s mission of facilitating the island’s exporters both large and small.

– LMD

Q How do you perceive Sri Lanka’s prospects as well as potential challenges in the context of global markets – i.e. for the economy in general and export sector?

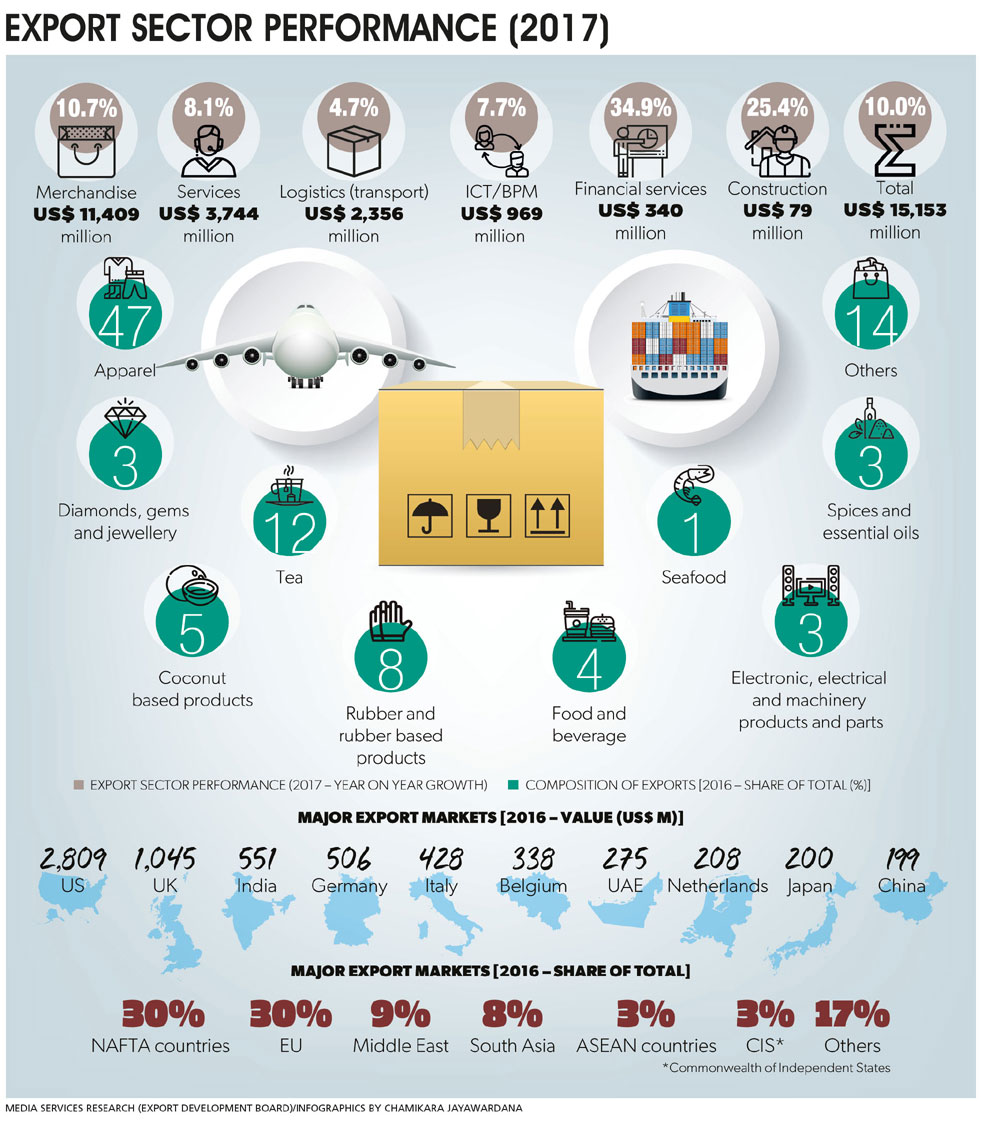

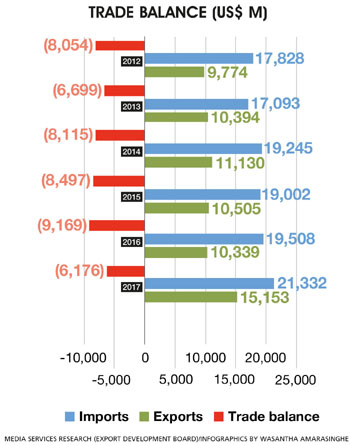

A Sri Lanka witnessed around seven percent growth for short spells especially in 2010 and 2012, following the end of the conflict. Exports too enjoyed high growth during this period although declining from 27 percent of GDP in 2000 to 13 percent of GDP in 2016.

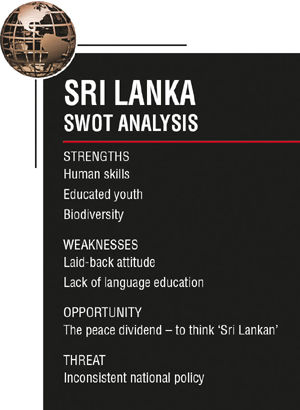

Post-conflict Sri Lanka had a significant level of optimism in terms of export growth, which was short-lived. Therefore, achieving sustained high growth is a serious challenge. Making the transition from debt financed public investment and import substitution, to private sector led exports and foreign direct investment (FDI) in manufacturing for an export based development strategy remains challenging. However, it is the only option for Sri Lanka.

Given a small market of 21 million people, the growth potential for Sri Lanka inevitably lies in global integration. Sri Lanka’s products and services will need to not only compete domestically but also in the highly competitive international market.

The international trading environment is also changing rapidly with the advent of global production networks and value chains.

Integration into global production networks (GPNs) is vital for Sri Lanka to switch to export oriented industrialisation where economies of scale could be reaped and lead to higher export earnings.

Sri Lanka has been identified as a ‘Market of the Future’ by Euromonitor and a key trade partner in Southeast Asia. It has to source new markets and carve out easy access to them. The FTAs with India, Pakistan and Singapore – and new FTAs or economic partnership agreements with Asian countries such as China, Thailand, Malaysia and Bangladesh – will create access to large markets.

The regaining of GSP+ is an opportunity for exporters who must make use of the facility to maximise benefits and enhance competitiveness. Seventy-five percent of the country’s GSP exports to the EU were concentrated on seven product categories. Therefore, product diversification in the export market is crucial.

Sri Lanka is moving towards an export oriented economy. Developing a national strategy for exports is a key component of Sri Lanka’s export drive. Globally competitive strategies have been developed under the National Export Strategy (NES). They are ready for implementation based on inclusive and extensive consultations with more than 600 public and private stakeholders focussing on a vision of ‘Sri Lanka – an export hub driven by innovation and investment.’

The NES vision is underlined by four national objectives, which provide the overall framework for the prioritisation of reforms, institutional alignments, market development, and selection of focus sectors and trade support functions. It provides the conditions for enabling diversification through strengthened emerging sectors such as boat building, processed food and beverages, electrical and electronic components, spices and concentrates, ICT/BPM and wellness tourism.

The NES vision is underlined by four national objectives, which provide the overall framework for the prioritisation of reforms, institutional alignments, market development, and selection of focus sectors and trade support functions. It provides the conditions for enabling diversification through strengthened emerging sectors such as boat building, processed food and beverages, electrical and electronic components, spices and concentrates, ICT/BPM and wellness tourism.

All export industries in Sri Lanka will benefit from the improved performance of key trade support functions including trade information and promotion, quality infrastructure, logistics, and innovation and entrepreneurship

Sri Lanka’s location on the international maritime map puts it at an advantage to be a major player in entrepot trade. Globally, the top three entrepots (excluding the US) are Hong Kong, Singapore and Dubai. Sri Lanka has the potential to be in a better position than these global giants. It must continue the economic reforms that have been implemented, invest in infrastructure and warehouse facilities, reduce taxes and duties, ensure quality and productive labour, streamline procedures and implement focussed policies to take advantage of its location.

The country witnessed monthly merchandise export earnings of US$ 1 billion for five months last year, and a total export value of 15 billion dollars in merchandise and services exports. The EDB expects 15 percent growth in merchandise and services exports, to reach foreign exchange earnings of US$ 22 billion in 2020. Furthermore, with EU GSP+ and the implementation of NES, and by making the overall business environment conducive, EDB has set an ambitious target to double the export value in six years by 2023.

Q In regard to promoting Sri Lankan exports, what should our medium to long-term strategies entail?

A The focus of the government’s liberal economic policies is to rebalance the economic growth model to become more outward oriented, private sector driven and knowledge intensive – one that is capable of adding more value to products that are highly competitive in the global market.

And the EDB’s vision is to position Sri Lanka as a prominent export hub for innovative products and services, which is aligned with the development vision of the government.

Sri Lanka’s startup landscape is dominated by digital entrepreneurs. Most of these startups are adapting proven business models to local circumstances and considering regional markets to scale up. Going forward, it will be important for Sri Lanka to nurture startups beyond digital, and enable those that are willing to take on both technology and market risk.

The Asia-Pacific region has accounted for nearly two-thirds of global growth in recent years. Developments in the region are therefore, central to the global economic outlook and for formulating policies around the world. Being placed strategically in the Asian region, Sri Lanka has a natural advantage to link up with GPNs.

There’s been a notable shift in GPN trade away from developed nations and towards developing countries. Participating in global value chains will require attracting joint ventures and anchor investors. For that to happen, Sri Lanka will need laws to streamline import procedures, and gradually reduce tariffs and para tariffs while improving trade logistics.

The NES represents the ambitions of public and private sector stakeholders for an empowered export sector, and takes into account the local challenges and opportunities.

Q Many traditional brands have to craft new strategies in emerging markets as old markets become saturated. How easy or difficult will it be to navigate this new reality?

A Once a brand is established in the mind of a consumer, it creates a positive impression. An established brand has no boundaries, and will spread across to emerging and new markets, from the old and traditional.

Brands are characterised by the aspirations of consumers, which is why some sections of the market are attracted to certain brands. However, brands have to evolve with the times, and consumer beliefs and aspirations, to continue to exist in the market. Brand values and aspirations will change from one segment to another. Therefore, it is vital that brands craft new strategies not only for emerging markets but also to sustain traditional markets.

New digital tools and platforms combined with powerful data analytics are enabling brands to directly engage with customers, improve the shopping experience and gain valuable data at every point along the path to purchase. It is time for established and emerging brands to take note, and evaluate the merits of going direct to consumers.

For established brands that have direct to consumer channels, digital platforms will not only complement the existing channel strategy but also broaden the markets beyond. And for emerging brands, it will enable them to grow their business quickly without incurring the costs associated with traditional channels.

Q What must be done to address declining export revenues in certain key manufacturing sectors?

A Exports are a key pillar of growth for any economy and today, Sri Lanka pays the price for not prioritising this in the last decade.

Sri Lanka’s outward looking skilled population is a major economic asset and competitive advantage. Human capital and a strategic location combined with a growing peace dividend give the island tremendous potential – as a regional and even global hub for trade.

However, tackling critical business climate bottlenecks that hurt competitiveness and productivity of exporters – including multiplicity documentation, burdensome and outdated domestic regulatory systems, and coordination between government agencies needs attention.

Sri Lanka’s transformation towards achieving upper middle income status essentially requires a transition from an economy that’s largely driven by commodity products and relatively inexpensive inputs for production, to a knowledge intensive economy focussed on developing and commercialising high value products and services.

It is knowledge that will take Sri Lanka to the next trajectory. There should be research with economic value. The private sector, government research bodies and universities need to work in collaboration; it is only then that research could be made use of.

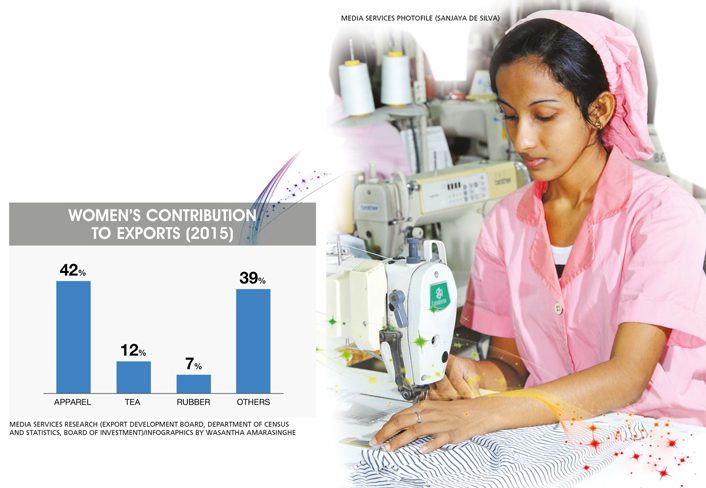

Our export base has remained the same for over 30 years; it relies on a narrow export base of apparel, tea, rubber, coconut, gems and jewellery. We cannot generate growth based on such limited exports.

We need to enter industries in manufacturing such as high value added apparel and related services, textiles, high value added rubber products, yacht and shipbuilding, and high value added food processing (agribusiness and marine), as well as IT enabled services, logistics and tourism.

Q What is your take on the prevailing labour and export regulations in Sri Lanka?

A Labour regulations have to be amended to suit current industry requirements – for example, by introducing flexitime and virtual offices (particularly for the IT industry), and offering manufacturing establishments the flexibility to decide what constitutes a working week. In terms of export regulations, we need to amend relevant older acts of parliament.

Q Do you believe there’s a need to bridge the gap between the public and private sectors?

A Yes. This is the reason why the EDB always encourages public-private partnerships. Furthermore, public sector emoluments aren’t compatible with those of the private sector. Particularly, officials of promotional organisations have to work closely with the private sector and international organisations (both private and government) – and therefore, they need to maintain high professional standards in every aspect. They need to be remunerated on an equal basis. This was so when the EDB was set up in 1979.

Public sector salaries cannot attract and motivate young professionals to join the state sector, and retain professional senior level staff. Therefore, this factor has to be addressed urgently.

Q What must Sri Lanka do to promote its SMEs in international markets?

A There’s tremendous potential to transform SME support industries in Sri Lanka. The Sri Lankan SME sector holds the key to an entirely new paradigm in export led growth for our country. The EDB has already identified several SMEs under the 2000 Export Entrepreneurship Development Programme with the potential to take products to international markets and compete effectively. However, there are others that need to be competitive by improving in scale and quality. This process has to take place organically and the EDB is confident that this will gather momentum with the numerous programmes it will implement under Budget 2018.

Many SMEs fail to secure orders from buyers due to their inability to invest in the requirements stipulated by compliance auditors because of financial constraints. Therefore, it is essential for SME exporters to upgrade their production facilities and obtain relevant international certifications to gain the confidence of and build long-term business relationships with buyers.

Q And how important do you think financial inclusion is in the context of SME expansion?

A SME exporters do not have the financial capacity to compete; the long lead time between delivering an export order and receiving payment is another obstacle for SME exporters seeking to enter international markets.

Adequate working capital availability at concessionary rates is very important to invest in modern technology and expand operations. Prevailing banking requirements for requesting collateral, debt to equity ratios and guarantees hinder SME expansion as many fall short on these requirements.

SMEs also lack skills in financial forecasting and preparing business plans particularly using IT based accounting packages. Therefore, lending institutions should focus on these issues and provide customer centric assistance.

Banks should look at SMEs from a development banking angle rather than from the perspective of a commercial bank. The lack of an Exim bank as in most countries or development banks such as what we had in the 1980s is felt badly.

Q Is there an adequate focus on innovation, and supporting and training local entrepreneurs in Sri Lanka?

A Innovation is important at all stages of development. In Sri Lanka, incremental innovation will be associated with the adoption of foreign technology, and social innovation can improve the effectiveness of business and public services. High-tech R&D based innovation matters at the later stages of development.

Innovation and entrepreneurship are thus becoming increasingly critical to Sri Lanka’s economic competitiveness in both domestic and global markets. Enabling export oriented SMEs and enhancing the performance of R&D would be the way to go. This transition will create relatively highly compensated jobs and additional wealth in Sri Lanka.

Sri Lanka’s policy and regulatory environment is generally not conducive to supporting the entry and scaling of growth oriented startups.

There is also a severe fragmentation of research institutions and an inadequate policy environment, and the R&D sector is mostly underfunded. Given these factors, R&D programmes are generally unable to conduct or deliver research that is impactful. It is increasingly difficult to attract and retain high quality research staff into these organisations, and brain drain has been a major concern.

In most developed economies, the private sector accounts for well over 50 percent of R&D funding. But in Sri Lanka, the public sector dominates R&D funding so steps need to be taken to foster greater private sector R&D investment.

There’s also a weak intellectual property (IP) regime. The national legislation does not currently exist to establish clear ownership in IP developed from public R&D funds. Moreover, there isn’t a clearly coordinated effort among relevant stakeholders in Sri Lanka’s innovation and entrepreneurship ecosystem.

Q Has Sri Lanka achieved reasonable progress with respect to certification and standardisation mechanisms?

A Sri Lanka has achieved reasonable progress with regard to system certification but product certification remains in the development stage. There’s also a need to prepare standards for potential import products entering the country under the new FTAs that the government plans to sign in the near future.

Furthermore, the national quality infrastructure (NQI) and its technical regulatory (TR) framework have yet to be developed to their full potential. NQI institutions should be able to provide an acceptable service to suppliers of products and services, and consumers, as well as the regulatory authorities. The apex policy-making body to implement NQI will be the National Quality Council, which is to be established in the near future.

The NES has also identified the development of quality infrastructure within the country as a priority. Based on a proposal submitted by the EDB for Budget 2018, financial allocations have been made to upgrade the structure and acquire instruments for government quality institutions in Sri Lanka.

Q How important is it for Sri Lanka to initiate FTAs – especially in the region?

A The trade agenda should be driven by opening and creating new pathways for agreements in addition to mutual opportunities. Protection does not help as businesses need to become globally competitive.

Sri Lanka has been classified by the World Bank as one of the most protected economies in the world over the past decade, a situation that the government is attempting to reverse.

The country is pursuing a more proactive FTA strategy to reduce trade barriers with major Asian economies. Through the FTA with Singapore, bilateral trade and investment can act as Sri Lanka’s point of entering into the diverse ASEAN market. Stronger relations with Singapore can help Sri Lanka’s standing in Southeast Asia and participation in global value chains.

Meanwhile, the FTA being negotiated with China has the potential to increase market access for Sri Lankan exports to China, and have a transformative impact on investment and technology in Sri Lanka.

It is critical however, that these agreements are properly sequenced to minimise the administrative burden on traders and increase opportunities to forge sustainable market linkages.

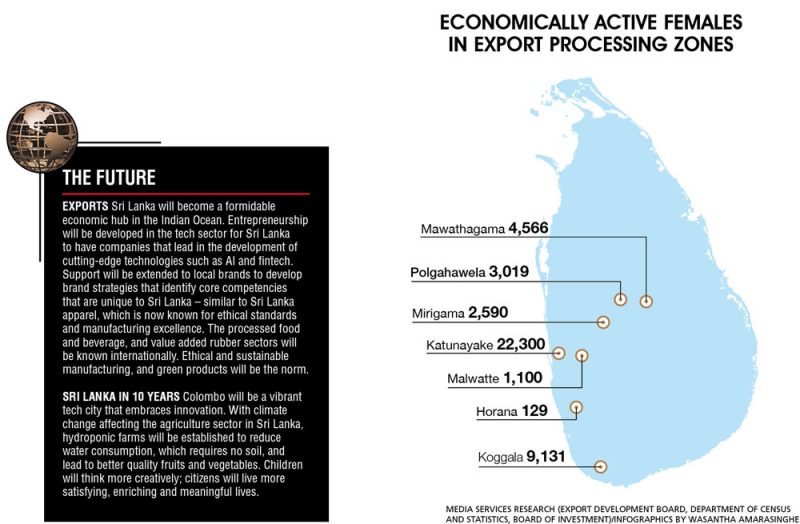

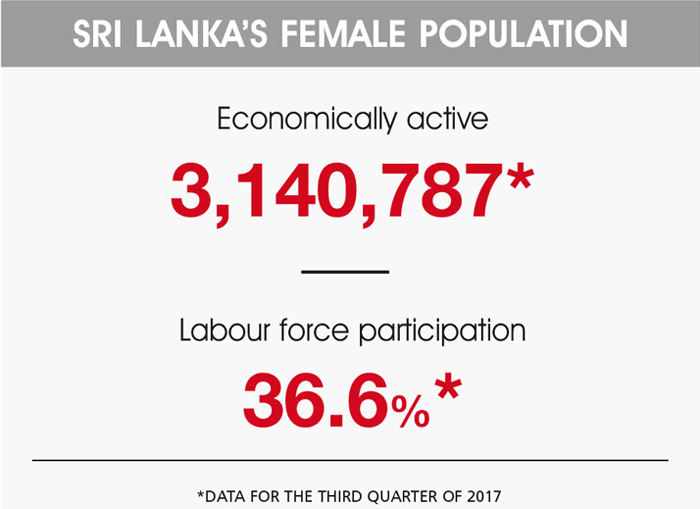

Q How would you characterise the contribution made by females to the national economy – and the export sector in particular?

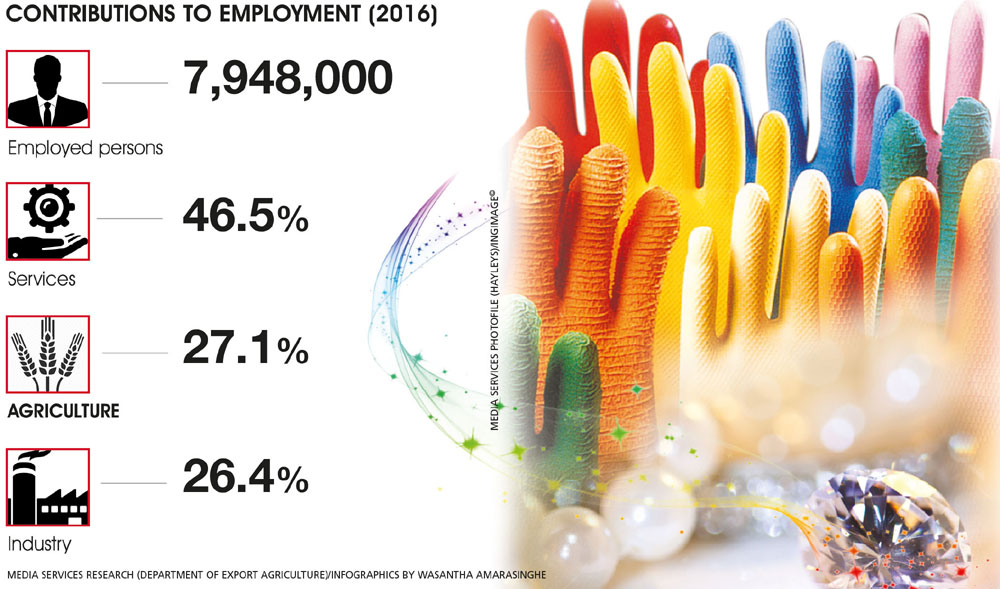

A Women’s contribution to the economy is enormous whether in business, on farms, as entrepreneurs or employees, or unpaid work at home. Investing in women’s economic empowerment sets a direct path towards gender equality, poverty eradication and inclusive economic growth.

With respect to the export sector, approximately 50 percent of those employed in the apparel industry are females, thereby empowering the business activities of women. This is also true of the tea and rubber industries.

Q And how do you view being the first woman to serve as Chairperson and Chief Executive of the Sri Lanka Export Development Board (EDB)?

A It affirms that if you’re professional, have a passion for what you do and pursue your goals, you can achieve your dreams. I feel that this has been the reason behind my success.

Q Last but not least, what are your thoughts regarding the work-life balance and the ‘work hard/smart, play hard’ motto?

A An employee needs to feel happy in the organisation. Regardless of the salary, if you feel recognised and have the opportunity to go up in life, that is what attracts people to an organisation – and this reflects well on the quality of work and image of the organisation.

– Interviewed by Zulfath Saheed

Leave a comment