THE ECONOMY

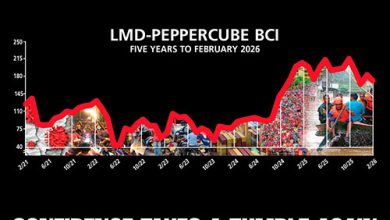

Businesses continue to wrestle with a sense of uncertainty as in the past few months; and this time around too, there’s a sense of unpredictability in the latest findings of the LMD-PEPPERCUBE Business Confidence Index (BCI) survey – although the underlying theme is one of a turnaround in economic sentiment.

TURNAROUND IN SENTIMENT

There’s a sudden turnaround in sentiment although the outlook remains gloomy

THE ECONOMY In March, more than a third (35%) of survey participants expressed optimism about the economy ‘improving’ over the next 12 months, marking a 12 point spike from February (23%).

Seventeen percent of respondents anticipate the economy will ‘stay the same,’ reflecting a slight difference in percentage points compared to the previous month (18%).

Notably however, nearly half (48%) expect the economy to ‘get worse,’ albeit that this represents a decrease of 11 percent from February’s 59 percent.

SALES VOLUMES There’s a growing sense of optimism regarding sales volumes ‘getting better’ over the next 12 months with 32 percent anticipating an uptick – that’s a five point rise compared to the preceding month.

Slightly over a fifth of survey participants (21%) expect their sales numbers to ‘stay the same,’ reflecting a drop from the previous month’s 25 percent. Additionally, the proportion anticipating sales volumes to ‘get worse’ has fallen by one percentage point to 47 percent.

Moreover, 29 percent of respondents report ‘increased’ sales volumes over the previous 12 months, which is a notable spike from February (25%).

Nineteen percent say their sales numbers ‘stayed the same’ – up three percentage points from the prior month. However, 52 percent – seven percent fewer than in February – disclose a ‘decrease’ in volumes.

As for the next three months, there’s a sense of optimism surrounding sales volumes ‘getting better’ with 32 percent expressing hope – a five percent increase from February.

In addition, less than a fifth (18%) anticipate sales volumes to ‘stay the same,’ marking a seven percent drop.

Despite these nuances however, the prevailing sentiment remains subdued as half (50%) of the survey participants anticipate their sales volumes to ‘get worse’ over the next three months (February – 48%).

INVESTMENT CLIMATE Optimism regarding the investment climate remains muted with only five percent of respondents polling ‘very good.’

And there’s a notable decline in the proportion of participants who perceive prospects as being ‘good,’ dropping to one in 10 from 17 percent a month ago.

Thirty-eight percent of respondents regard the climate as being ‘fair’ while a majority (47%) still view the outlook as ‘poor’ or ‘very poor’ – that’s a marginal improvement of one percentage point compared to February.

EMPLOYMENT PROSPECTS The March survey sees an ‘increase’ in job prospects with 31 percent indicating an intention to expand their workforce – up from 23 percent in February.

In the meantime, slightly over half (52%) plan to ‘maintain’ current staff levels while 17 percent anticipate downsizing over the next six months, marking a slight decrease from the previous month (18%).