TAX REGIMES

If there is one thing Americans despise, it’s taxes. The US was practically founded as a nation, in opposition to taxes. In the years running up to the Revolutionary War, the Boston Tea Party – which took place on 16 December 1773 – was sparked by duties on tea, which were levied by the British Government.

If there is one thing Americans despise, it’s taxes. The US was practically founded as a nation, in opposition to taxes. In the years running up to the Revolutionary War, the Boston Tea Party – which took place on 16 December 1773 – was sparked by duties on tea, which were levied by the British Government.

POWER PLAY

Aaron Fernando warns that when governments assume power in times of war civil liberties come under threat

Colonists found it unacceptable that they were being taxed, without having a voice in Parliament, and the continued elevation of the issue of taxation eventually reached a breaking point – and war broke out.

ANTI-TAX MINDSET Ironically, in Washington D.C., the licence plates now read ‘Taxation Without Representation,’ since federal taxes are levied in the capital. Yet, it lacks voting rights in Congress; because, technically, Washington D.C. isn’t a state.

In the US Constitution, there’s an inbuilt, tense balance between the rights of states and the federal government. However, over time, the federal government has gradually increased its powers, often during war and emergencies. Taxation is one of these powers, but other political powers have been extended in times of crisis.

Although tax rates in the United States are low, compared to many other developed countries, they have risen since the founding of the nation. According to a study conducted by the Pew Research Center last year, Americans fork out at least 10 percent of their income in taxes, on average, unlike in other OECD countries.

Yet, culturally, the people continue to oppose what is perceived as being a high tax regime. Another study by Pew also found 59 percent of the people surveyed agreeing that ‘there is so much wrong with the federal tax system that Congress should completely change it.’

WARTIME TAXES This is difficult to do when, dealing with a population that despises taxes. But of course, the federal government often raised taxes during times of war and emergencies.

In 1913, a constitutional amendment was required to make income tax legal in the US. There had been forms for income tax prior to this, but they were temporary, while one had been declared unconstitutional. In the first years of its modern form, income tax was nominal – only one percent of the population had to pay it, and their tax bill was nominal.

Over time, however, this tax grew. During World Wars I and II, tax rates rose rapidly, as they did during the Great Depression, as well as when the Korean and Vietnam Wars were in full swing. All of this is intuitive, since federal spending necessarily grows during a conflict. During the Depression, New Deal programmes were expensive, and the money had to come from somewhere.

However, once a crisis or conflict has passed, tax rates do not fall to pre-crisis levels. Although periods of relative prosperity, without major conflicts, are accompanied by lower tax rates, they have almost never dropped to pre-crisis levels. It was only after the Civil War – a decade after income tax was levied, to fund the war effort – that the tax was repealed. In all other cases, taxation never returned to where it had been.

POLITICAL POWER As expected, the state does not merely extend its powers economically, during times of war and emergencies. Its political power also increases. For instance, President Barack Obama has been criticised for using a law known as the Espionage Act, to prosecute whistle-blowers.

The Espionage Act was enacted in 1917, to be used against German saboteurs during World War I. The spirit of the law was to combat those aiding a foreign power. Yet, it has been used to target people who expose government wrongdoing.

Intelligence agencies such as the Central Intelligence Agency (CIA), National Security Agency (NSA) and National Reconnaissance Office (NRO) have also grown steadily, although their budgets and sizes are a secret. Documents leaked by Edward Snowden have shown that the budgets of these spy agencies consistently increased, during the ‘war on terror,’ in the past decade.

Thus, it is apparent that when policies are established to make way for an increase in the government’s power in wartime or periods of emergency, those policies tend to continue to remain – even when the crisis has passed. This mechanism, for any sovereign government to extend its own powers, often goes unnoticed.

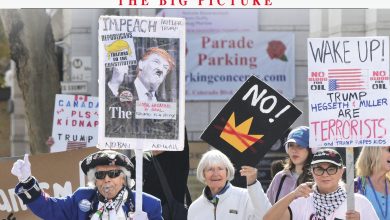

It is critical, therefore, to address this tendency. Over time, if the powers assumed during crises are not redressed afterwards, a sovereign government could inch its way towards tyranny. Beyond that, when a crisis is ongoing (such as the war on terror, Cold War, war on drugs and so on), powers will increase and remain in the hands of a sovereign government.

If unchecked, this poses a serious danger to civil liberties, and an individual’s or community’s ability to question and challenge national policies.