SWITZERLAND FAST- TRACKS FUNDING FOR SMALL BUSINESSES

Switzerland fast-tracks emergency aid for small businesses weathering COVID-19

- Switzerland offers fast access to credit and emergency loans.

- The International Monetary Fund says COVID-19 has already pushed the world into recession.

- The UK Federation of Small Businesses has called accessing support “nightmarish”.

Switzerland is fast-tracking small business aid to help stave off the economic effects of coronavirus – offering an example to other nations weathering the downturn.

Have you read?

While governments around the world are introducing financial support measures for their citizens, businesses in some countries are complaining they can’t access the funds quickly enough to stay afloat.

But Switzerland’s Federal Council is offering rapid access to credit facilities to bridge liquidity shortfalls. The country has distributed emergency loans to more than 76,000 small businesses, substantially more than other countries in Europe, according to the Financial Times.

The fast-action plan was the idea of Thomas Gottstein, the chief executive of Credit Suisse, the FT reports, who worked with finance minister Ueli Maurer and others to set up a task force.

“The key thing was for the process to be conducted in a rapid and straightforward manner, so that the money is transferred to the company’s account as quickly as possible,” Mr Gottstein says in the FT.

Switzerland is one of the countries hit hard by the COVID-19 outbreak. On 16 March, the Federal Council declared a national state of emergency, closing all shops, restaurants, bars, entertainment facilities and schools until 19 April, prohibiting public gatherings of five people or more and recommending all citizens stay home.

Other countries have also enacted strict lockdown measures to stave off the crisis. While this should help mitigate the human cost, the International Monetary Fund (IMF) says it has already pushed the world into a recession. In the US alone, in the last two weeks in March almost 10 million people applied for unemployment benefits.

“For 2020 it will be worse than the global financial crisis,” the IMF says. “The economic damage is mounting across all countries, tracking the sharp rise in new infections and containment measures put in place.”

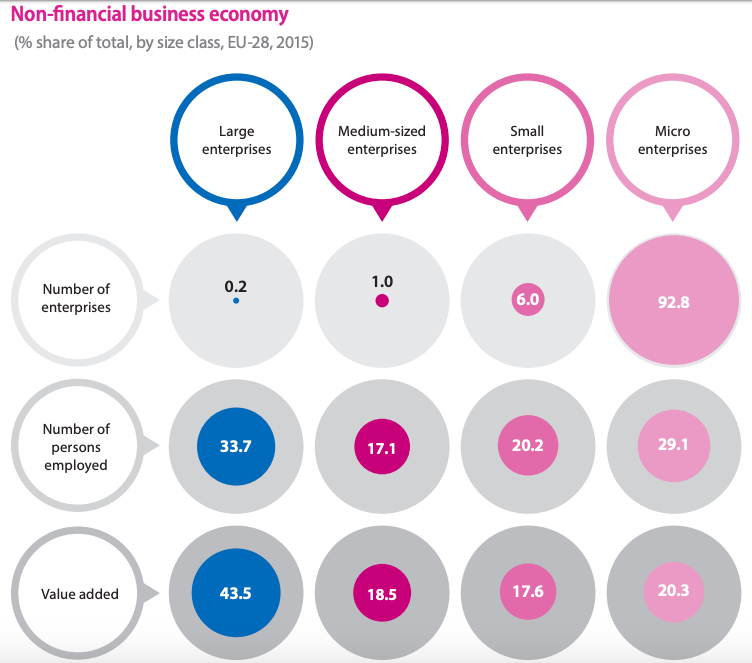

Small- and medium-sized businesses are the engine of the global economy – and are also among the worst hit by the pandemic. They play a major role in most economies, according to the World Bank, representing about 90% of businesses and more than 50% of employment worldwide.

To help support them, policymakers around the world are enacting different measures. In the US, the government is offering one-time tax rebates to individuals as well as $349 billion in forgivable Small Business Administration loans and guarantees to help small businesses that retain workers.

China’s administration has expanded its re-lending and re-discounting facilities to support micro-, small- and medium-sized firms, and taken steps to ensure liquidity remains for smaller businesses.

In the UK, the Coronavirus Business Interruption Loan Scheme (CBILS) has faced challenges, where business owners said they couldn’t access funding quickly enough. It’s now been significantly expanded, with some changes to features and eligibility criteria to widen its scope.

The Chancellor @RishiSunak has announced improvements to the #CBILS emergency loan scheme for small businesses. We’ll watch closely how the banks deliver this. https://t.co/0oiOEKIp98

— FSB (@fsb_policy) April 3, 2020

The FT reported that Germany’s emergency loan scheme has also “had patchy success”, with money taking too long to arrive.

In the UK, the Federation of Small Businesses welcomed the latest measures to improve access to the Coronavirus Business Interruption Loan Scheme.

“Time and again we’ve heard from members who’ve approached their bank seeking an emergency loan, only to be offered anything but,” says the FSB’s National Chairman, Mike Cherry. “They were promised interest-free, fee-free, government-backed support from banks but, until now, the process for securing it has proved nightmarish for many.”