WHAT PRICE POLICIES ON LIFE AND TAXES?

Wijith DeChickera files a return as the nation digs deeper into its pockets to fuel state coffers while major tax frauds of yore go scot free

The saying has it that two things are certain in life... death and taxes; and while it is true that since the pandemic strangled the economy and the economic crisis saw a bankrupt Sri Lanka send out an ‘international obituary’ of sorts, the killing fields of the last month or so of 2023 proved to be the tightening of that tax noose around islander livelihoods.

Hot on the heels of the IMF’s ‘death notice’ and the release of the second tranche of some US$ 337 million from its 2.9 billion dollar Extended Fund Facility (EFF) over 48 months – or bailout as it is popularly but perhaps wrongly labelled – came a state policy whereby the widening of the tax net under stringent conditions signalled that the International Monetary Fund at least is serious about the government meeting its revenue target shortfalls through the tax regime.

And the stringency of taxpaying conditionality – for example, that no one desirous of opening a current account at a bank, registering land or renewing a vehicular licence (from January onwards) – while no doubt welcome for Treasury coffers would raise a plethora of fresh issues for a polity already heavily burdened by corruption at all levels and cost of living adjustments for everyone but the elites who are known as ‘the one percent,’ inured from hardship.

But debate as one may, the (some might say) draconian new tax policy designed to bump up governmental revenues in the year ahead to keep the EFF on track and Sri Lanka’s debt restructuring programme on a sustainable path, the state’s modus operandi vis-à-vis policies per se begs a panoply of questions that defy ready answers.

For instance, are the island nation’s administrators capable of or committed to crafting, shaping and implementing meaningful policies (this time on tax) only at the behest of the international community – in this instance, the world’s trade, financial and currency police – when national fiscal policies fall short?

Sri Lanka fell some 15 percent short of its IMF stipulated revenue target of Rs. 3,268 billion for 2022/23. It raked in 2,778 billion rupees and sparked the tax revisions for 2023/24 onwards into the foreseeable future; which is to say, election time... that notorious season in which ‘things fall apart, the centre cannot hold’! As in 2019, when former president Gotabaya Rajapaksa’s regime reversed the erst-while and equally stringent tax regime of an erstwhile IMF programme.

For another, what about fiscal or financial policy tweaks to amend the sinkholes through which a gargantuan Rs. 800 billion or so was lost in tax revenues through the reduction of VAT (from 15% to 8%) and corporate taxes (from 28% to 24%), and the abolition of Pay As You Earn (PAYE) and Nation Building Tax (NBT), by dint of slashing the tax base by an estimated 33.5 percent – causing budget deficits to soar and necessitating printing of money?

More to the point, what punitive measures is the government planning to take (as a matter of national policy on waste, economic mismanagement and actions tantamount to corruption or incompetence – or both) against those whom the Supreme Court recently found culpable of causing the devastating economic crisis of 2002, which led to the island nation defaulting on its external sovereign debt for the first time; and later, declaring bankruptcy?

The island’s leading court found that a slew of defendants were guilty of triggering the country’s worst financial crisis by mishandling of or inaction on the economy; but short of such a declaration were not inclined to award public compensation bar legal costs for the petitioners who filed the fundamental rights (FR) case in the public interest alone.

It is up to that public now, whose FRs were right royally violated, to press the case – the root cause of which was centralising of power under an elitist-backed oligarchy that (by design or default) caused not only acute shortages of food, fuel, fertiliser, pharmaceuticals and other essential items but also drove the nation to file for bankruptcy, and saw popular sovereignty in action as never before to oust a sitting exec president – although the regime remains in situ in the legislature.

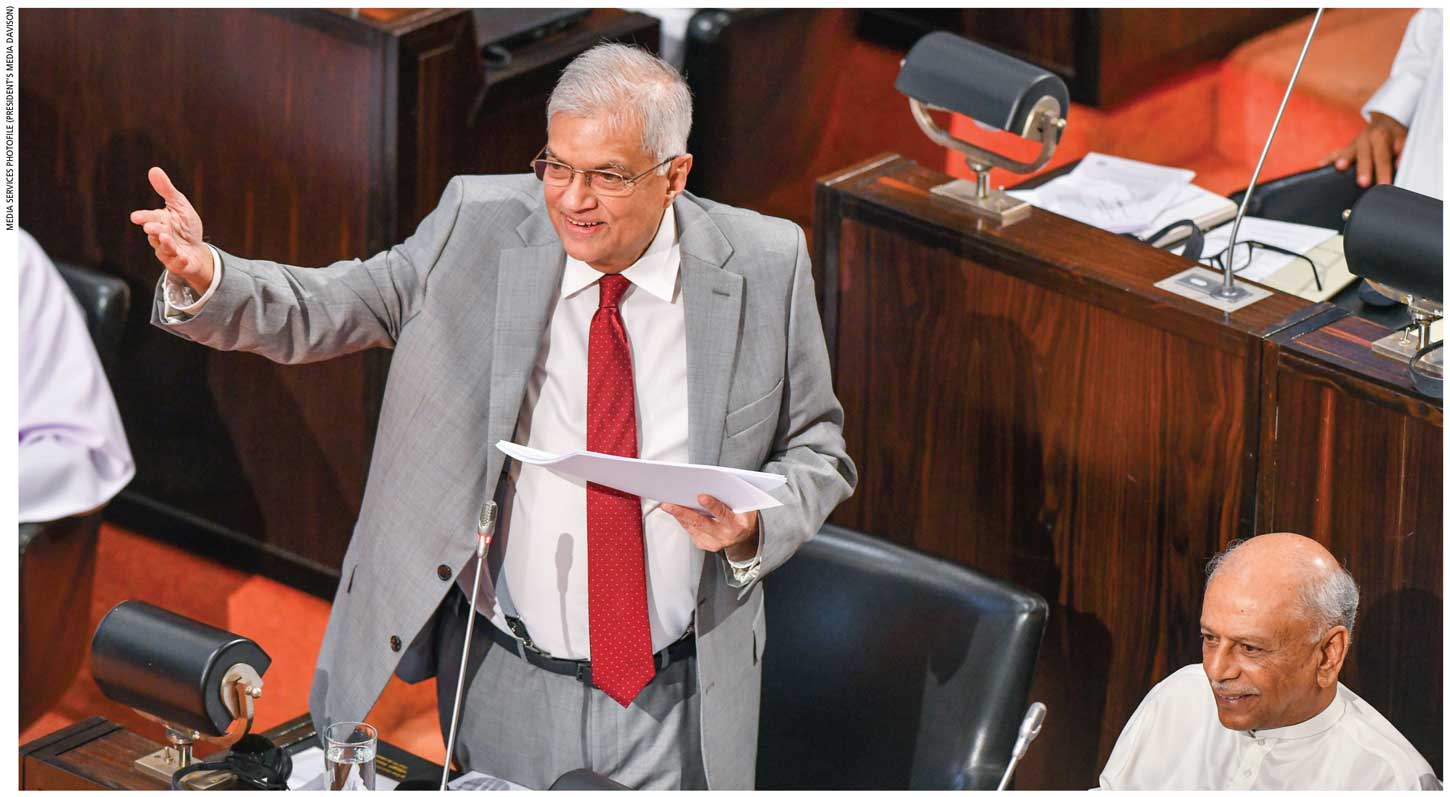

Of course, under the aegis of the IMF, the administration of President Ranil Wickremesinghe is taking remedial fiscal measures through Budget 2024, which has been described in the media as being “ambitious” by virtue of targeting an estimated 47 percent increase in tax revenues in the year ahead.

There are also IMF driven anticorruption measures now written into law to help stem if not reverse the tide.

These come in tandem with ostensibly populist measures to hike state sector workers’ pay to the tune of ten thousand smackers a packet and boost government pensions in an election year, as well as in a milieu where the bureaucracy is already bloated beyond the boundaries of efficient returns on investment – to say nothing of salutary service being rendered to the public who bear their tax burden.

Under the aegis of the IMF, the administration of President Ranil Wickremesinghe is taking remedial fiscal measures through Budget 2024, which has been described in the media as being “ambitious”

This content is available for subscribers only.