POST BALANCE SHEETS

PROFIT SQUEEZE AHEAD?

Fiscal measures look set to exert pressure on the island’s leading corporate entities in the months that lie ahead

The national economy grew by four percent year on year to Rs. 2.2 trillion in the second quarter of 2017, according to the Department of Census and Statistics. As in previous quarters, the highest contribution to GDP came from the services sector (56.5%), followed by industry (nearly 26%) and agriculture (slightly over 8%). As for the island’s external economy, the Central Bank of Sri Lanka reports that “Sri Lanka’s external sector showed a mixed performance in August,” adding that “although export earnings increased in August… higher growth in import expenditure resulted in an expansion of the trade deficit.”

The national economy grew by four percent year on year to Rs. 2.2 trillion in the second quarter of 2017, according to the Department of Census and Statistics. As in previous quarters, the highest contribution to GDP came from the services sector (56.5%), followed by industry (nearly 26%) and agriculture (slightly over 8%). As for the island’s external economy, the Central Bank of Sri Lanka reports that “Sri Lanka’s external sector showed a mixed performance in August,” adding that “although export earnings increased in August… higher growth in import expenditure resulted in an expansion of the trade deficit.”

The Central Bank notes that the financial account of the balance of payments was supported by the receipt of the second tranche of the foreign currency term financing facility to the government, along with continued foreign inflows to the Colombo Stock Exchange (CSE) and the government securities market in August.

During the first eight months of 2017, Sri Lanka’s balance of payments is estimated to have recorded a surplus of US$ 2,175 million compared to an excess of 211 million dollars in the corresponding period of 2016.

BUSINESS SENTIMENT By and large, the LMD-Nielsen Business Confidence Index (BCI) has remained volatile in calendar year 2017. After recording marginal gains in the two preceding months, the index shed 15 basis points (to 112) in March followed by another two months of slightly positive results. Thereafter, the confidence barometer fell in June only to record a gain in July, which was followed by an outright slump in both August and September.

Ahead of Budget 2018, the unique index recorded an increase of seven points (to 106) in October – although business leaders sought more on the ground and immediate action to rebuild lost confidence ahead of the 9 November pronouncements and local government elections scheduled for January 2018.

In a recent edition of LMD, Nielsen’s Managing Director Sharang Pant has cautioned that “large-scale concerns on the economy and business climate still persist.”

In an early indication of sentiment on the recently unveiled fiscal proposals, shares were weighed down by declines in telecom and banking stocks the day after Budget 2018 outlined plans to target both sectors to boost state revenue.

That said, the December edition of LMD notes that the latest BCI survey, which was conducted hot on the heels of the budget presentation, “presents a few revelations of its own – and its outlook is largely optimistic.”

The index climbed up to 119 in November from 106 in the previous month, edging ahead of its 12 month average (117) but lagging behind the all-time mean of 130. Pant attributes the recent uptick in biz confidence to the budget, which he says “was welcomed across stakeholders as a document that aims to strengthen long-term measures as well as work out policies aimed at [a] short-term recovery.”

CONSUMER CONFIDENCE Meanwhile, in November, which reflects a mere one point gain, Nielsen’s Consumer Confidence Index (CCI) stood at 53 from the prior month. After a few months of holding back on their spending, consumers appear to be feeling the pinch although a reduction in taxes on internet data has been welcomed. Inflation however, remains a concern among consumers.

BUDGET PROPOSALS Budget 2018 seeks to raise revenues through new levies that “could adversely impact industries that are also facing regulatory, investment and external challenges,” the Ceylon Chamber of Commerce asserts.

The chamber also recommends that the government progresses its “renewed commitment in state owned enterprise (SOE) reforms and capital market development through the divestment in holdings of non-strategic enterprises with a credible plan of action.”

In its analysis of the fiscal policy brief for 2018, Fitch Ratings remarks that “Sri Lanka’s budget for 2018 sticks broadly to the targets for fiscal deficit reduction … but high government debt and the large cost of debt servicing weigh heavily on Sri Lanka’s credit profile.”

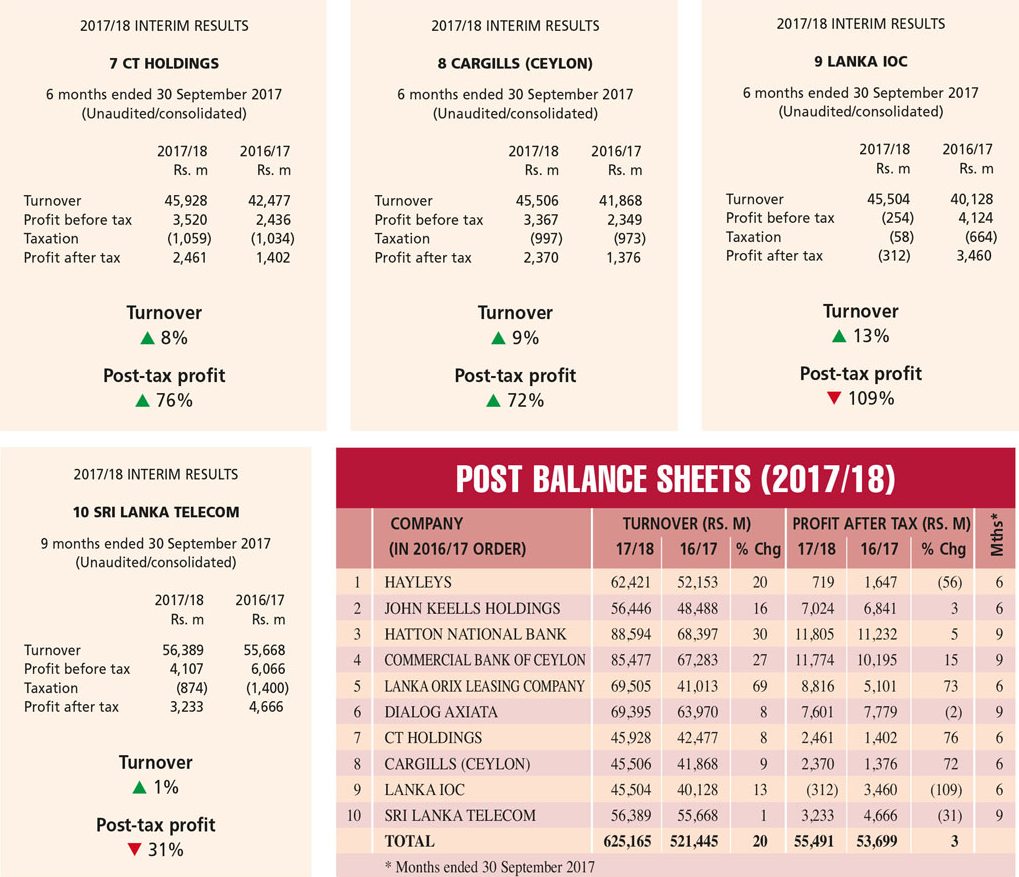

INTERIM RESULTS The latest interim results at 30 September 2017 of the LMD 100 Leaderboard indicate a healthy uptrend in revenue in financial year 2017/18 with aggregate turnover of the top 10 listed entities increasing by 20 percent year on year (to in excess of Rs. 625 billion) – which is far higher than the 13 percent hike in the LMD 100’s 2016/17 cumulative top line.

In contrast however, aggregate profit after tax of the top 10 reflects only a meagre increment of three percent (to slightly over 55 billion rupees) compared to the corresponding period of the previous year.

Much like the prior year’s LMD 100, nine of the top 10 companies are so far in the black in financial year 2017/18 – although three of the 10 LMD 100 leaders report that they’ve had to contend with a contraction of profits for the period ended 30 September 2017.

First placed Hayleys reports a 20 percent hike in turnover for the first half of 2017/18 to surpass Rs. 62 billion. However, its bottom line has more than halved year on year to 719 million rupees in the six months to 30 September 2017.

A statement issued by Hayleys reveals that “poor weather conditions hampered agricultural production, leading to reduced turnover and operating profits … Increased raw material prices also negatively affected the group’s hand protection and purification products segments.”

Commenting on Hayleys’ performance, Chairman and Chief Executive Mohan Pandithage notes: “We are confident that the acquisition of Singer (Sri Lanka) together with the recent major investments that the Hayleys group has made into leisure, and transport and logistics sectors, are anticipated to yield significantly improved results for the group.”

Indeed, Hayleys is expected to charge ahead in the LMD 100 rankings when it consolidates the results of Singer (Sri Lanka) going forward.

John Keells Holdings (JKH) witnessed a 16 percent expansion in its top line for the six months ended 30 September by surpassing 56 billion rupees. Meanwhile, its bottom line registered a three percent year on year upside with post-tax profits growing to Rs. 7 billion.

Chairman Susantha Ratnayake explains in a recent address to shareholders that the increase in profitability of JKH’s transportation business in the second quarter of financial year 2017/18 is mainly attributable to the group’s bunkering, and ports and shipping businesses.

According to JKH’s Chairman, in the group’s leisure sector, profitability of the Maldivian and Sri Lankan resorts segment was impacted by the partial closure of Cinnamon Dhonveli Maldives and Ellaidhoo Maldives by Cinnamon, and the closure of Bentota Beach by Cinnamon for reconstruction. Meanwhile, JKH’s city hotel sector witnessed lower occupancy and average rates primarily as a result of the increase in room inventory in Colombo.

The increase in profitability in its real estate segment “is mainly attributable to the higher rental income received from the property businesses,” Ratnayake discloses and he assures that “the construction of Cinnamon Life is progressing well.”

In the nine months ended 30 September 2017, Hatton National Bank’s (HNB) income grew by a robust 30 percent year on year to surpass Rs. 88 billion. Meanwhile, its tax-paid profits increased by a less impressive five percent from the prior year (to Rs. 11.8 billon). The bank notes that “all group companies contributed positively towards the group.”

“Interest income was complemented by fee and commission income, which grew by 20.4 percent year on year on a net basis, adding Rs. 6.1 billion to the bank’s top line. [The] credit card business, trade finance and guarantee commission continued to be key contributors towards this growth,” HNB adds.

Meanwhile, Commercial Bank (ComBank) reported a consolidated income of Rs. 85.5 billion (up 27% year on year) for the first nine months of calendar year 2017 while its bottom line appreciated by 15 percent year on year (to reach 11.8 billion rupees).

Commenting on Commercial Bank’s performance at the end of the third quarter of 2017, Chairman Dharma Dheerasinghe states: “We continue to improve the quality of our loan book leading to further reductions in our non-performing loan (NPL) ratios and [are] focussed on growing volumes in core business areas.”

ComBank’s Managing Director Jegan Durairatnam notes that the bank ended the nine months with capital ratios that were substantially higher than those required under Basel III, which came into effect in July. He discloses that the bank’s capital funds stood at over Rs. 90 billion and is therefore, above the 20 billion rupees specified under the minimum capital standards announced in a recent regulation for licensed banks in Sri Lanka.

Lanka ORIX Leasing Company’s turnover grew by a whopping 69 percent from a year back (to Rs. 69.5 billion) in the six months ended 30 September 2017. Profits also soared by as much as 73 percent year on year to register Rs. 8.8 billion.

Telecom giant Dialog Axiata saw its top line expand by eight percent for the period under review, to exceed Rs. 69 billion for the nine months to 30 September.

After-tax profits however, were down by two percent year on year (to Rs. 7.6 billion). While the group continued its growth momentum across mobile and fixed line businesses, Dialog says the erosion of profit after tax was impacted by an “increase in depreciation, net finance costs and non-cash translational forex losses.”

CT Holdings generated a consolidated turnover of Rs. 45.9 million (up 8% year on year) in the first half of financial year 2017/18 while its half-year post-tax profit skyrocketed to 2.5 billion rupees (from Rs. 1.4 billion rupees a year ago).

The group’s improved financials were driven by growth in the retail, fast-moving consumer goods (FMCG) and restaurant sectors.

Its operational review notes: “We expect the second half of the year to mirror the results of [the] first half with steady growth across sectors. The group will continue to aggressively expand its businesses across the country, improve productivity and range in its businesses, and deliver on our ethos of transforming regional economies.”

Group entity Cargills (Ceylon) also posted positive results in the interim period to 30 September 2017 with turnover rising by nine percent year on year (to Rs. 45.5 billion) and profit after tax reaching almost 2.4 billion rupees – versus a profit of 1.4 billion rupees in the corresponding period of 2016/17.

Top ranked energy company Lanka IOC returned to the red in the first half of financial year 2017/18, recording an after-tax loss of nearly Rs. 312 million (against a profit of 3.5 billion rupees in the corresponding period of the prior year). However, its turnover improved (by 13 % year on year) to 45.5 billion rupees.

And lastly on the 2017/18 LMD 100 Leaderboard, Sri Lanka Telecom (SLT) reported a turnover of Rs. 56.4 billion (up 1% year on year) for its first nine months in 2017 while the group’s after-tax profit plummeted by 31 percent year on year (to 3.2 billion rupees).

FUTURE OUTLOOK Corporates await greater clarity on Budget 2018 whereby the government imposed fresh taxes on certain classes of motor vehicles, telcos, banks and liquor in a bid to boost state revenue. They will also have to contend with the changes that are to take effect with the new Inland Revenue Act come 1 April 2018.

As for the LMD 100 podium next year, there’s every chance of a further shakeup among the front-runners with substantial growth in investments and a turn of top line fortunes in the offing. Based on the results declared so far, Hayleys we feel will lead the charge with JKH, the two leading private sector banks (HNB and ComBank) and LOLC also vying for honours.