LANDING IN HEAVY WEATHER

Corporates may well be tightening their seatbelts in the hope that the economic crash landing will be soft rather than hard

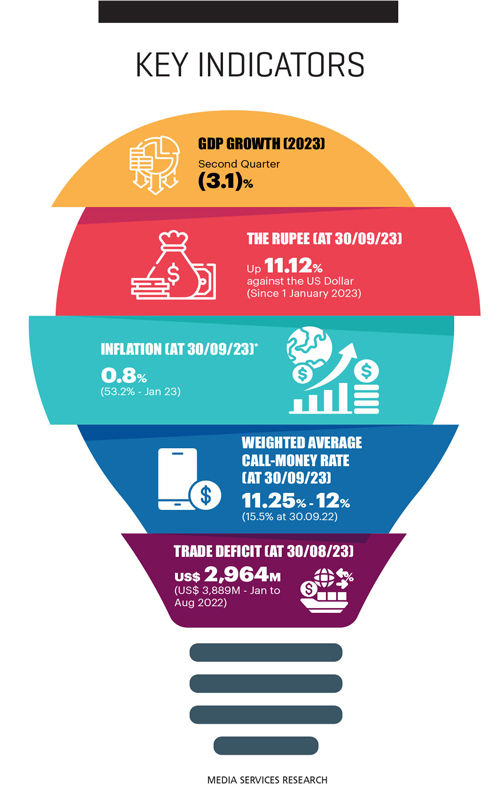

The Economic and Social Statistics 2023 report – compiled by the Central Bank of Sri Lanka – reveals that provisionally at the time of its release, year 2022 witnessed a GDP contraction of 7.8 percent in comparison to the 3.3 percent upside in 2021.

And it reported that unemployment stood at 4.7 percent of the labour force in 2022 – a slight decrease from 2021’s 5.1 percent.

The Central Bank commented on external sector performance too, saying that “import expenditure on merchandise increased by 7.8 percent year on year to US$ 1,388 million in July 2023 compared to 1,287 million dollars in July 2022.”

“However, the relaxation of import restrictions since June 2023 could gradually generate higher import expenditure in the period ahead, once demand conditions improve in the economy,” it added.

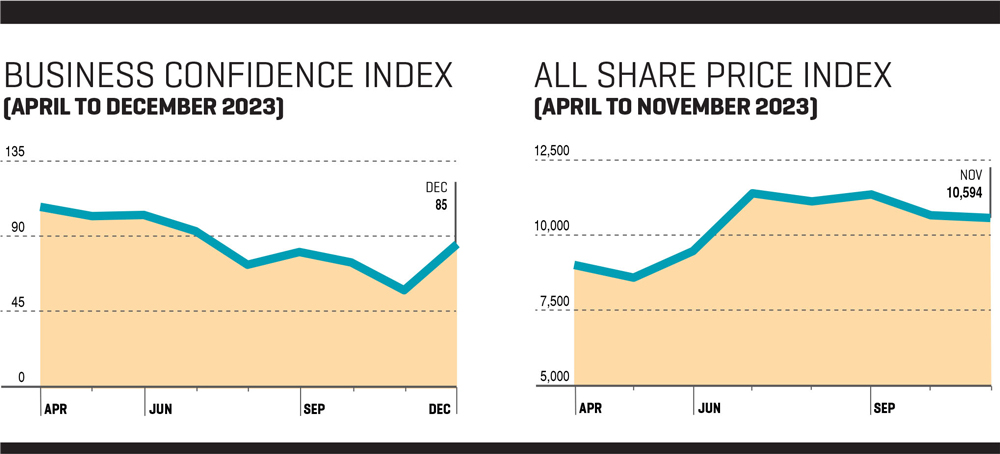

BUSINESS SENTIMENT The LMD-NielsenIQ Business Confidence Index – which is now the LMD-PEPPERCUBE Business Confidence Index (BCI) – fluctuated throughout financial year 2022/23.

Taking off on a positive note, the index reached a peak of 116 in April 2022, only to experience a downturn in June and July, hitting its lowest point of 49. This decline coincided with the onset of the uprising, political instability and subsequent rise in inflation, casting a shadow over business prospects.

Despite the challenges however, the BCI rebounded to 98 in November 2022 but further fluctuations in the ensuing months followed – and the index ultimately settled at 72 in March 2023 to conclude the financial year under review.

The latest BCI survey, which was conducted by PepperCube in the first week of December 2023, sees corporates expressing a sense of cautious optimism, following the BCI’s 15 month low of 58 in the preceding month.

In a holistic sense, this turnaround may be a reflection of how the business community views the 2024 budget proposals.

Be that as it may, it goes without saying that year 2024 will bring fresh challenges with the prospect of elections, a likely spike in the cost of living following the value added tax (VAT) hike and numerous external sensitivities.

BUDGET 2024 The national budget for 2024 – titled ‘A Prelude to a Bright Future’ – was presented in parliament on 13 November 2023 with an expression of hope by President Ranil Wickremesinghe who underscored its transformative bent, and described the proposals as a pivotal step towards shaping the country’s future and establishing a modern economic framework aligned with global trends.

The president expressed confidence that much like inflation was reduced to single digits, the country can be salvaged from high inflationary pressures. He noted that inflation, which skyrocketed to 70 percent in September 2022, had fallen to 1.5 percent in October 2023.

In contrast however, the cost of living and doing business remains high, which has led to shrinking disposable incomes and corporate profits.

Wickremesinghe maintained that the national economy is being healed because the right procedures and methodologies have been followed over the past year, claiming that essential commodities are available in abundance.

The president also noted that interest rates have fallen from 30 percent to 15 percent (and since his budget speech, they have fallen further – by one percentage point) while adding that during the first half of calendar year 2023, the government was able to record a primary surplus.

He claimed that at the height of the economic crisis, tax revenue was increased by 50 percent in the first six months of the year. And in addition, foreign reserves shored up to US$ 3.5 billion from zero and the confidence placed in Sri Lanka by foreign countries has been restored.

But he did acknowledge that there’s yet a long way to go…

Wickremesinghe also called on Sri Lankans to fast track the journey towards a production economy and proposed to restructure the organisational structure related to information technology in the public sector in order to facilitate a digital economy by 2030.

The need to create a ‘green economy’ was also touched on to face the future with strength.

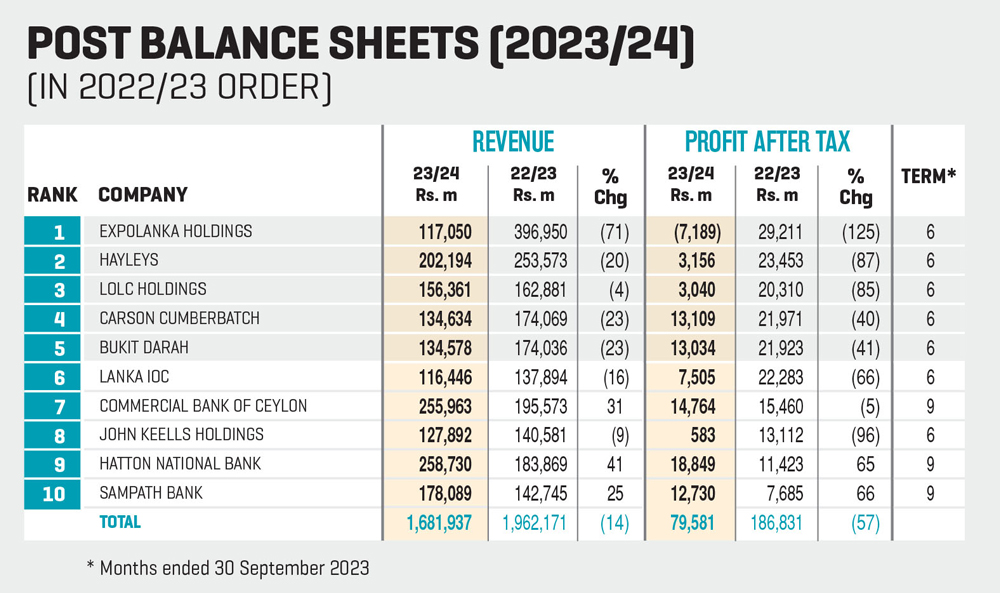

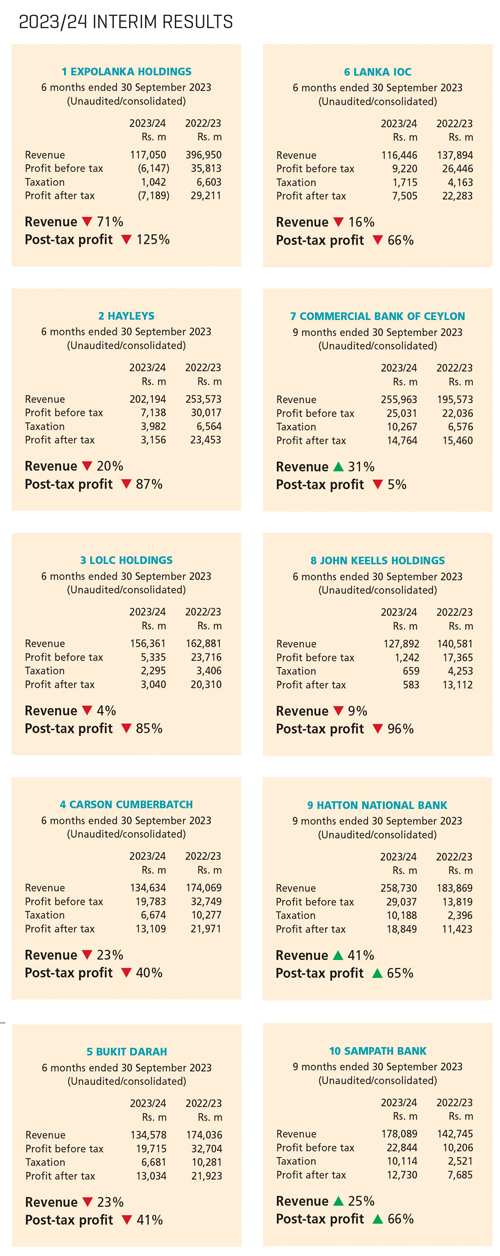

INTERIM RESULTS A review of the latest interim results of the LMD 100 Leaderboard for the period ended 30 September 2023 suggests that Sri Lanka’s leading listed entities are facing yet another tumultuous year with both top and bottom lines falling on a year on year basis.

The collective revenue (Rs. 1,682 billion) of the top 10 listed companies declined by 14 percent. For the sake of comparison, at the same point in financial year 2021/22, the 10 leading lights enjoyed a hike in turnover of a whopping 72 percent over the prior year.

As for the aggregate profit after tax (PAT) of the LMD 100 Leaderboard for the period ended 30 September 2023, the outcome is even worse: the cumulative PAT plummeted by 57 percent to marginally under 80 billion rupees, compared to a 44 percent hike at the prior reporting timeline.

In financial year 2023/24 to date, all but two of the 10 leading corporates have reported lower after-tax profits while in the context of turnover, seven of the LMD 100 Leaderboard companies also announced reduced top lines.

Expolanka Holdings, the champion of the Leaderboard, reported a substantial fall in its consolidated income by in excess of 70 percent (to Rs. 117 billion – compared to nearly 397 billion rupees at the same time in financial year 2022/23).

The logistics conglomerate’s PAT also took a hit, dropping by 125 percent to register a loss of slightly over Rs. 7 billion for the same period.

Executive Director and Group CEO Hanif Yusoof comments: “Throughout the year under review, our key focus was on consolidating performance in light of the challenging operating environment. We committed to strengthening the fundamentals of our business, which remained our primary focus.”

“In the current economic landscape, we find ourselves amidst market uncertainties in global trade and logistics. The last quarter of 2022 reflected negative growth while indicators for the first quarter of 2023 suggest stagnation in global trade. Inflation related concerns have raised fears and resulted in a drop in demand. This has had a notable impact on the purchasing behaviour of consumers, as indicated by various consumer confidence indexes, signalling a slowdown on a global scale,” he emphasises.

Yusoof continues: “Despite the current challenging macroeconomic factors, our commitment to core business fundamentals remains unwavering. As we move forward, we remain cognisant of the evolving market dynamics, and will continue to adapt and adjust our strategies accordingly.”

Hayleys – the diversified conglomerate led by Mohan Pandithage, which occupies the No. 2 slot in the 2022/23 LMD 100 – reported a reduction of 20 percent in its consolidated revenue for the first half of its 2023/24 financial year to settle at Rs. 202 billion. And its bottom line eroded by 87 percent to slightly over three billion rupees for the six months ended 30 September 2023.

The Hayleys Lifecode titled ‘Ambition to Action,’ set out in its 2022/23 annual report, states: “The successive challenges faced by Sri Lankan businesses over the past three years prompted the group to reposition and optimise its businesses with the aim of building resilience.”

Pandithage states with confidence: “I truly believe that this is a pivotal time for our country, offering a unique chance to reset our socioeconomic development model towards more resilient, equitable and sustainable growth. Recent policy interventions to restore macroeconomic stability have enabled the country to reach a working equilibrium, which together with the approval of Extended Fund Facility (EFF) by the IMF, has set the country’s economy on a path to recovery.”

Third placed LOLC Holdings recorded a four percent decline in its top line (to Rs. 156 billion) for the six months ended 30 September 2023. The group’s bottom line also took a hit with reported PAT falling to three billion rupees – compared to a whopping Rs. 20 billion at the same time in the preceding year.

Deputy Chairman Ishara Nanayakkara says of the conglomerate’s plans for the future: “From amongst a total of 25 countries where the group is present, it has financial services operations in 18 countries while poised to commence operations in two more countries. Not only is the group diversifying to new markets but it is also diversifying across sectors in these markets.”

Carson Cumberbatch reported a consolidated revenue of nearly Rs. 135 billion, reflecting a 23 percent shrinkage in the first half of its 2023/24financial year. The company’s half-year post-tax profit also declined to 13 billion rupees (40% lower than at the same time in 2022/23).

Group entity Bukit Darah remained profitable in the first half of its financial year 2023/24; it also reported a PAT of Rs. 13 billion although the company’s top line (134 billion rupees) fell by 23 percent compared to the same period in the previous year.

Meanwhile, Lanka IOC (LIOC) reported negative turnover growth (16%) in the first half of its financial year to reach Rs. 116 billion and a post-tax profit of seven billion rupees (a contraction of 66%) for the six months ended 30 September 2023.

For the first nine months of calendar year 2023, seventh placed Commercial Bank of Ceylon (ComBank) reported a consolidated income of almost Rs. 256 billion rupees, which reflects a notable increase of 31 percent. However, its bottom line contracted by five percent, to record nearly 14 billion rupees.

John Keells Holdings’ (JKH) top line of slightly under Rs. 128 billion for the first six months of its financial year 2023/24 reflects a nine percent contraction while the group’s PAT also declined (by as much as 96%) to just over 583 million rupees.

On the other hand, banking entity Hatton National Bank (HNB) recorded a consolidated top line in excess of Rs. 258 billion for the first nine months of calendar year 2023, marking a growth of 41 percent. And what's more, its bottom line grew by 65 with a PAT of nearly 19 billion rupees.

No. 10 on the LMD 100’s top 10 list is Sampath Bank. It enjoyed a 25 percent increase in consolidated income to over Rs. 178 billion while the bank’s bottom line demonstrated substantial growth with a 66 percent increase to in excess of 12 billion rupees after tax.

LMD100 OUTLOOK Based on the interim financial statements at 30 September 2023, there could well be a change at the top next year: the interim results for financial year 2023/24 suggest that Hayleys may be occupying the highest spot on the LMD 100 podium at this time next year.

And its challengers could come from within the ranks of the banking duo of HNB and ComBank, and LOLC.