MACROECONOMIC OUTLOOK

CAUTIOUS OPTIMISM AMID SHIFTING FISCAL TRENDS

Deshal de Mel takes stock of the positive trends in the Sri Lankan economy and likely implications for the foreign investment outlook

Sri Lanka’s economy appears to have turned a corner in the last couple of months, as sentiment shifts towards a more positive line. This has also been reflected in macroeconomic data. The indications are that we may have reached a peak in the current interest rate cycle, as a number of positive developments on the monetary and fiscal fronts are likely to permit rates to ease, after rising throughout the year.

Sri Lanka’s economy appears to have turned a corner in the last couple of months, as sentiment shifts towards a more positive line. This has also been reflected in macroeconomic data. The indications are that we may have reached a peak in the current interest rate cycle, as a number of positive developments on the monetary and fiscal fronts are likely to permit rates to ease, after rising throughout the year.

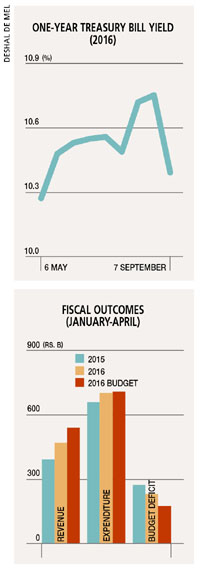

The Prime Lending Rate reached 12 percent in September, reflecting a rise of 450 basis points through the course of the year. The one-year Treasury Bill yield, however, showed signs of easing, following a spike with the July rate hike – it declined by 36 basis points, at the 7 September auction.

KEY DRIVERS Several factors have influenced this change of direction, on the monetary front. First, there has been a return of foreign investment inflows to Sri Lanka’s rupee-denominated government securities. Following several months of outflows through 2015 and the first quarter of this year, foreign money began returning to government bills and bonds, since March.

By the end of 2014, there was around Rs. 450 billion in foreign holdings of government securities, which plummeted to 220 billion rupees by March 2016. But as of early September, foreign holdings recovered to Rs. 300 billion. This has helped ease upward pressure on yields on benchmark Treasury Bills and Bonds, and led to a moderation of interest rates in the second quarter of the year.

A second factor has come in the form of raising offshore capital, since July. A US$ 1 billion 10-year sovereign bond at 6.85 percent and a five-and a-half year US$ 500 million bond at 5.57 percent, followed by a syndicated loan of 700 million dollars, has contributed to easing the immediate cash flow needs of the Government. In turn, this has eased the domestic borrowing requirements of the state – and thus, market liquidity as well.

FISCAL FOCUS An important third factor has been an improvement in the Government’s fiscal performance, in the first half of this year. With the spotlight falling on the government revenue shortfall, there was a reversal in the period from January to April, as noted in the mid-year fiscal position report published by the Ministry of Finance.

Revenue increased by 20 percent in four months ended 30 April, compared to the same period last year. Sixty-one percent of this growth came from import-based tax collections, 28 percent from domestic consumption taxes and 13 percent from higher income tax receipts.

For sustained growth in taxes, it is necessary to develop a better balance between direct taxes (such as income tax) and indirect taxes (e.g. domestic and imported consumption taxes). Excessive reliance on import-based taxes is not sustainable.

BUDGET FOCUS Revenue growth in January to April remained 13 percent below the rather ambitious 2016 budgeted revenue growth figures. Thus, the budget deficit, while improving compared to 2015, remained 34 percent above the budgeted level. This leaves room for further fiscal risks to emerge in the latter part of the year, particularly if revenue streams slow down, as imports contract under tighter macroeconomic conditions. The 2017 budget must take cognisance of this, and ensure a pragmatic fiscal programme with realistic revenue projections, and avoid expansionary recurrent expenditure.

GLOBAL IMPACT The other risks to this improved sentiment arise from the global economy. In spite of a likely US Federal Reserve (the Fed) rate hike before the end of this year, investor appetite for emerging market debt has been positive.

GLOBAL IMPACT The other risks to this improved sentiment arise from the global economy. In spite of a likely US Federal Reserve (the Fed) rate hike before the end of this year, investor appetite for emerging market debt has been positive.

A reversal of this trend – due to either the Fed signalling an accelerated rate hike outlook, or a major global risk event – would hinder the flow of capital into Sri Lanka, and create pressure for rates to increase again and the rupee to weaken.

FDI OUTLOOK In addition to the encouraging developments on the monetary and fiscal fronts, there has also been notable growth in Foreign Direct Investment (FDI) in the first half of this year. Post-war FDI has been disappointing, averaging between US$ 1 billion and US$ 1.5 billion a year.

However, following a slow first quarter this year, 46 new projects had been signed at the end of June, with an estimated value of 982 million dollars. Around half of this relates to 16 new condominium or mixed-development investment projects.

Meanwhile, US$ 296 million is estimated to have come from new manufacturing investments – including boat building, pharmaceuticals, organic fertiliser, soft toys, health devices and tiles. There are seven new hotel projects, with an estimated investment of 133 million dollars.

Other investments included renewable energy (US$ 25 million), trading houses (US$ 40 million) and IT office complexes (US$ 13 million). The increase in investments is a positive signal for future economic growth and job creation, which will filter into longer-term economic growth.

The outlook for further investment also remains positive, particularly with renewed efforts to position Sri Lanka as a location to establish operations that cater to markets in the Indian subcontinent and other Indian Ocean countries.

It is envisaged that such investments would drive the trade-investment nexus, and be able to leverage Sri Lanka’s locational and logistical advantages, along with the free trade agreements that Sri Lanka is negotiating with India, China and Singapore, together with the GSP+ concessions.