RIDING THE RECOVERY WAVE

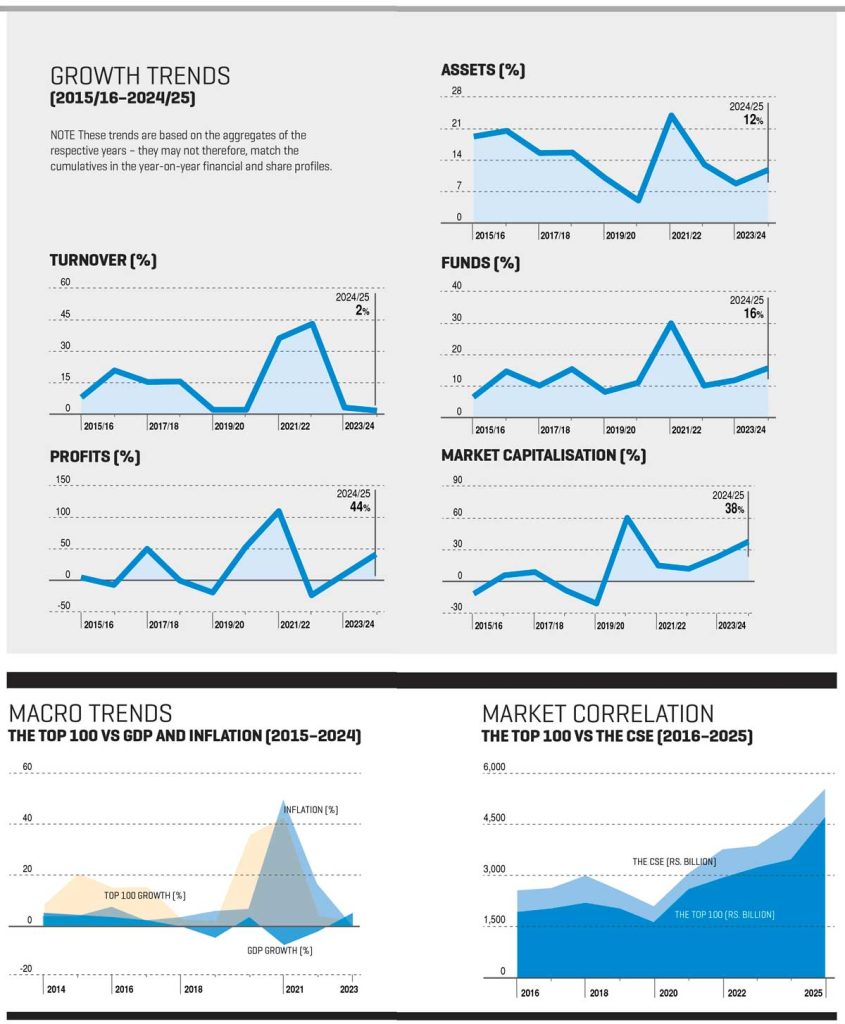

Financial year 2024/25 witnessed a marginal uptick in earnings coupled with a welcome spike in profitability

While notable signs of economic stability have emerged, cautious optimism continued to shape business sentiment throughout much of financial year 2024/25 with many corporate leaders proceeding prudently in their decision making.

Nevertheless, Sri Lanka has demonstrated remarkable resilience – as overall economic activity picked up, the nation continued to show progress in its path towards a recovery. Yet, for many businesses this recovery remains uneven and its benefits not fully visible across all sectors.

In November 2025, Sri Lanka was ranked the second most expensive country to live in within South Asia. According to the latest data from Numbeo, the monthly cost of living for an individual, excluding rent, stood at nearly Rs. 153,900.

This ranking underscores the growing financial pressures on individuals and families – particularly in urban centres such as Colombo, where expenditure remains among the highest in the region, intensifying cost of living concerns.

A key factor behind this heightened burden has been the wave of tax increases introduced as part of fiscal consolidation efforts following the economic crisis. While these measures were crucial to securing international assistance and reinstating macroeconomic discipline, they have simultaneously strained consumers, small enterprises and middle income households.

VAT hikes, the imposition of new levies on professional services, and revisions to electricity and water tariffs have collectively driven up everyday expenses, leaving many grappling with the persistent weight of rising living costs despite the broader narrative of an economic recovery.

Interim results from major listed companies suggest that the operating environment is gradually stabilising, pointing to the broader positive shift in Sri Lanka’s economy.

This edition of the LMD 100 provides an analysis of the performance of the nation’s leading listed companies, in a year defined by restoration and recovery as the country regained a sense of economic stability.

LEADERBOARD Hayleys, a leading multinational and diversified conglomerate, retains its dominance by securing the No. 1 position in the LMD 100 for financial year 2024/25 – marking a remarkable 10th year at the summit of the rankings.

This year’s Leaderboard showcases a diverse mix of sectors that form the backbone of the economy – viz. food, beverage and tobacco; capital goods; diversified financials; banks; energy; and food and staples retailing.

Meanwhile, LOLC Holdings, a key player in the diversified financial sector, climbs one spot to secure second place, advancing from its position in the previous financial year.

Carson and Cumberbatch – the food, beverage and tobacco giant – ascends three places to claim the third position in the 2024/25 LMD 100 rankings. Following closely is Bukit Darah (a fellow conglomerate in the same sector), which also moves up three notches to secure fourth place.

The capital goods conglomerate John Keells Holdings (JKH) maintains its standing at No. 5 in this year’s rankings.

Energy giant Lanka IOC (LIOC) makes an impressive leap from eighth position in the preceding financial year to sixth on the LMD 100 list for 2024/25.

Meanwhile, Commercial Bank of Ceylon (ComBank) slips five places from its previous year’s No. 2 ranking to secure seventh place.

In the retail space, CT Holdings and Cargills (Ceylon) – two stalwarts in food and staples retailing – take eighth and ninth positions respectively. Rounding off the top 10 is Hatton National Bank (HNB), which records a six place drop from its previous fourth position in financial year 2023/24.

REVENUE STREAMS The cumulative revenue of Sri Lanka’s 100 leading listed companies reached Rs. 7,276 billion in financial year 2024/25, marking a modest annual growth of two percent.

This performance signifies a marginal uptick over the previous financial year, during which the aggregate turnover of LMD 100 entities surpassed 7,144 billion rupees.

In financial year 2024/25, 65 companies within the rankings reported annual revenues exceeding Rs. 20 billion – a marginal decline from 67 in the prior financial year.

And the 21 highest ranked corporates – Hayleys, LOLC, Carsons, Bukit Darah, JKH, LIOC, ComBank, CT Holdings,Cargills (Ceylon),HNB, Sampath Bank, Dialog Axiata, Melstacorp, Ceylon Cold Stores, Ceylon Beverage Holdings, Lion Brewery (Ceylon), Vallibel One, Hemas Holdings, Sri Lanka Telecom (SLT), Brown and Company, and National Development Bank (NDB) – breached the 100 billion rupee turnover mark.

BOTTOM LINES Despite ongoing concerns surrounding the tax regime, post-tax profits recorded a notable surge from the previous financial year.

In 2024/25, the cumulative profit after tax (PAT) of the LMD 100 soared by 44 percent to in excess of Rs. 751 billion – up from 523 billion rupees in the preceding financial year.

Additionally, the number of loss making LMD 100 companies dropped to seven, marking an improvement from 12 in financial year 2023/24.

Ten quoted companies – led by ComBank with Rs. 55.6 billion – reported a PAT in excess of 20 billion rupees, which is two more than in 2023/24, signalling a stronger and more profitable corporate landscape despite the squeeze on earnings.

TAXATION In financial year 2024/25, companies featured in the LMD 100 paid out over Rs. 3.6 billion on average in taxes with an aggregate tax bill of nearly 365 billion rupees for the LMD 100 companies as a whole.

Hayleys accounted for over Rs. 12 billion in taxes – a 23 percent increase from the previous period while the largest taxpayer was ComBank with a contribution of 42.1 billion rupees.

Other major contributors include HNB (Rs. 39.2 billion), Sampath Bank (20.4 billion rupees), Ceylon Tobacco Company (CTC) – over Rs. 19 billion, Melstacorp (18 billion rupees and counting), Bukit Darah and Carsons (Rs. 17 billion), Distilleries Company of Sri Lanka (DCSL) with more than 11 billion rupees and NDB forking out Rs. 10 billion.

ASSET VALUES Two of Sri Lanka’s leading private sector commercial banks – ComBank and HNB – together with diversified financial powerhouse LOLC reported combined assets exceeding Rs. 6 trillion on their 2024/25 balance sheets.

ComBank’s assets surpassed 2.8 trillion rupees, HNB recorded over Rs. 2.2 trillion and LOLC’s total assets exceeded two trillion rupees.

In cumulative terms, the LMD 100’s total assets rose by a notable 12 percent to over Rs. 22 trillion in financial year 2024/25.

MOVERS AND SHAKERS Swisstek (Ceylon) makes a notable leap in the rankings, advancing from No. 97 to 75th place for the 2024/25 period, to claim the top position on the LMD 100’s most notable movers list.

Alumex alsoimproved its standing, rising from 93rd to 77th place while Access Engineering enjoyed notable progress, climbing from 66th to No. 52 in the latest edition of the LMD 100.

Overall, 57 leading listed corporates improved their rankings in the 2024/25 edition of the LMD 100.

SECTOR RANKINGS For the period under review, the capital goods sector maintains its dominance, securing the top position with a cumulative turnover exceeding Rs. 1,709 billion.

This represents over 23 percent of the combined revenue of the LMD 100, around 15 percent of total assets and approximately 23 percent of shareholders’ funds for financial year 2024/25.

Additionally, the capital goods sector contributed 14 percent to the LMD 100’s cumulative profit after tax during the same period.

Following closely, the food, beverage and tobacco sector emerges as the second largest contributor to the LMD 100, reporting an aggregate income exceeding 1,596 billion rupees. It accounted for slightly over a fifth of the cumulative revenue of the top 100 companies during the financial year under review.

Meanwhile, the banking sector secures third position among the 14 categories represented in the 2024/25 edition of the LMD 100. Notably, its aggregate post-tax profit amounted to nearly a quarter of total tax paid profits in the LMD 100.

INVESTOR YARDSTICKS JKH leads the pack in market capitalisation with a value of nearly Rs. 356 billion at 31 March 2025. LOLC Holdings follows in second place with a market cap surpassing 282 billion rupees while CTC secures third position with over Rs. 261 billion.

THE FUTURE In its Financial Stability Review for the Year 2025, the Central Bank of Sri Lanka notes that the financial sector’s resilience improved during the first half of 2025 compared to the previous year.

This stability was underpinned by favourable domestic macroeconomic developments despite persistent global uncertainty and the lingering aftereffects of the economic crisis experienced in the recent past.

It adds that credit extended by financial institutions – particularly to the private sector –increased during the period under review. This growth was supported by easing pressure on household and corporate balance sheets, buoyed by expanding economic output and subdued inflationary conditions.

According to the Central Bank, the banking sector demonstrated improved resilience across key indicators such as profitability, capital adequacy, efficiency, asset quality and market risk exposure.

And it adds that with the economy on a recovery path – characterised by low inflation, declining interest rates and ongoing fiscal consolidation – credit growth is expected to persist, especially through continued private sector lending.

Meanwhile, the October Sri Lanka Development Update released by World Bank acknowledges that the nation’s recent economic performance has been strong, though the recovery remains incomplete.

The World Bank says economic growth has yet to return to pre-crisis levels and poverty remains notably elevated.

It emphasises that sustaining the recovery will require continued macroeconomic stability, urgent structural reforms, and more efficient and better targeted public spending.

The global lender expects Sri Lanka’s economy to expand by 4.6 percent in 2025 – driven by a modest rebound in the industry sector and steady growth in services – before moderating to 3.5 percent in 2026.

However, it warns that this outlook remains subject to heightened risks due to global volatility, elevated uncertainty and uneven recovery momentum.

While inflation remains low and external inflows are strong, food prices continue to exert pressure and the accumulation of reserves has slowed. The World Bank also notes that the country’s economic output still lags below 2018 levels.

From a broader perspective, the IMF’s World Economic Outlook (WEO) published in October 2025 (titled Global Economy in Flux, Prospects Remain Dim) underscores that although near-term forecasts have improved modestly, global growth remains subdued as economies adjust to new policy environments.

While some trade tensions have eased following recent policy resets, the overall global economy remains acute.

The WEO says: “The global economy is adjusting to a landscape reshaped by new policy measures. Some extremes of higher tariffs were tempered, thanks to subsequent deals and resets. But the overall environment remains volatile and temporary factors that supported activity in the first half of 2025 such as frontloading are fading.”

It explains that inflation in Asian economies was subdued while it remained steady in the US. This apparent resilience however, seems to be largely attributable to temporary factors including frontloading of trade, and investment and inventory management strategies, rather than fundamental strength.

“Globally, inflation is expected to continue easing though trends differ by region, remaining above target in the United States with upside risks and relatively subdued across much of Asia,” the WEO observes.

Growth is expected to hold steady at 3.2 percent in 2025 and 3.1 percent in 2026 with advanced economies growing around 1.5 percent, and emerging market and developing economies just above four percent.