LMD APRIL 2025 – COVER STORY

Driving Capital Change

The market appears well-positioned to warrant a strong performance backed by solid fundamentals

Vindhya Jayasekera

The Colombo Stock Exchange (CSE) stands at a pivotal moment, navigating volatility while positioning itself for growth. With a market capitalisation exceeding Rs. 5.6 trillion, the CSE has seen resilience despite fluctuations, backed by a surge in investor confidence and promising earnings outlook.

As Sri Lanka’s financial landscape evolves, the exchange is poised for a transformation – one that demands strategic leadership and a bold vision.

Enter Chief Executive Officer – Designate Vindhya Jayasekera…

With over two decades of experience in capital markets, she has excelled in both investment banking and asset management. Prior to joining the CSE, she served as the Chief Investment Officer of NDB Wealth Management, and oversaw Rs. 380 billion in assets across equity and fixed income.

She was a key team member in the two largest IPOs on the CSE during her tenure at NDB Investment Bank.

Jayasekera has also gained global exposure at Lehman Brothers in the US as a Fulbright-Lehman Scholar back in 2007. A CFA Charterholder and Financial Risk Manager (FRM), Jayasekera also contributes to academia by lecturing at leading institutions on financial markets.

Holding a First Class BSc in Civil Engineering from the University of Moratuwa and an MSc in Finance from the University of Illinois – where she earned a medal for academic excellence – Jayasekera embodies expertise, leadership and innovation in the country’s financial services industry.

With her leadership, the CSE is poised to drive growth, enhance investor confidence and navigate the evolving landscape of Sri Lanka’s capital markets. This marks a significant step forward for the exchange.

– Compiled by Tamara Rebeira

“The market began to rally and gain momentum in the lead up to the presidential election from early September last year”

Q: The Colombo Stock Exchange (CSE) enjoyed a strong start to the year but has witnessed volatility since then. How would you assess the current state of the market with the next three to six months in mind?

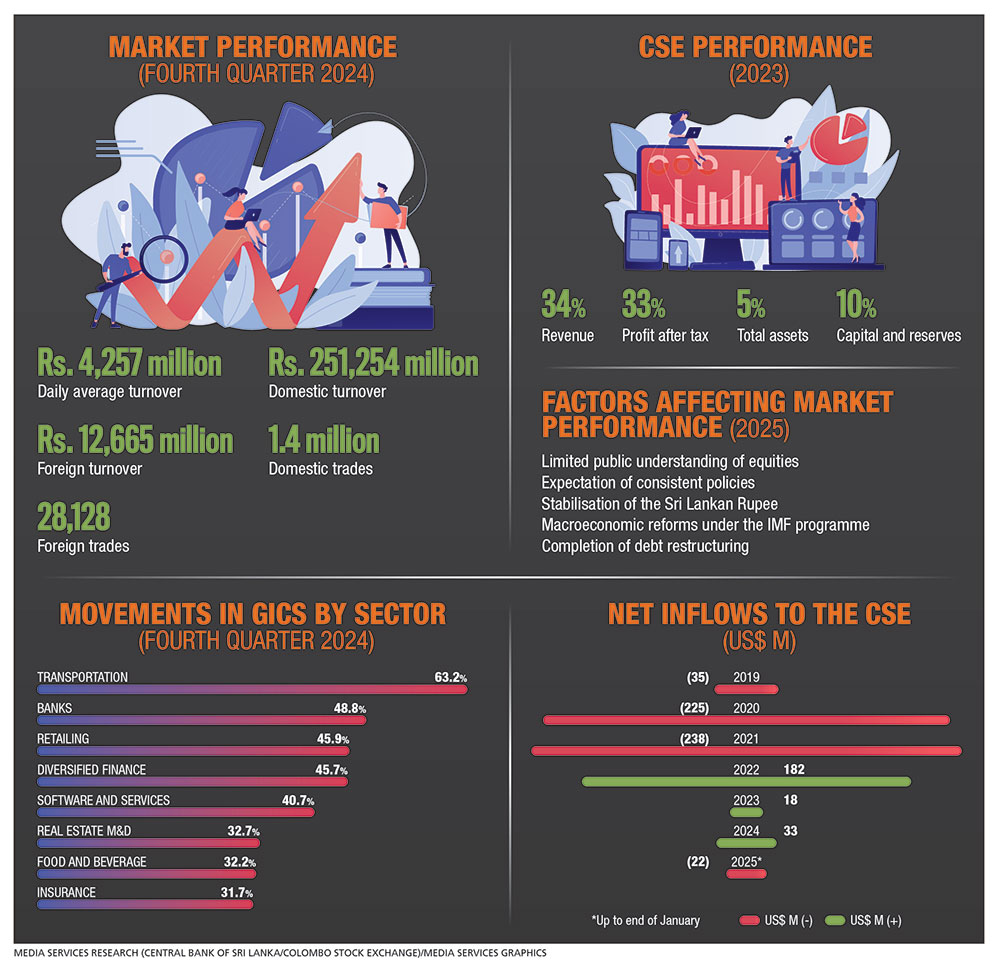

A: The market began to rally and gain momentum in the lead up to the presidential election from early September last year. From that point, it gained a little over 50 percent for the remainder of the year.

Although the All Share Price Index (ASPI) recorded a 49.7 percent gain for 2024, this growth was entirely driven by its performance in the last four months of the year.

The surge was fuelled by several positive developments, including the new government receiving a strong people’s mandate. This implied political stability – and the conclusion of the debt restructuring process provided a boost to market sentiment.

So far this year, things have somewhat settled. The market has entered a consolidation phase with investors opting to cash in on the profits they earned. This is not unusual in equity markets – or any market for that matter – as it’s a usual practice of market trading for existing investors to realise profits while new investors emerge.

Looking at the bigger picture, the country’s macroeconomic fundamentals remain solid. Political stability continues, interest rates are at very low levels and we are starting to witness a pickup in credit growth.

Additionally, last year’s earnings cycle was impressive with trailing 12 month profits rising by over 25 percent even after excluding extraordinary and one-off items. Robust earnings growth is expected to continue moving forward, supported by a favourable interest rate environment, which helps businesses manage costs and further drive credit expansion.

Overall, the outlook for the year remains promising. The market appears well-positioned to warrant a strong performance backed by solid fundamentals. And both foreign and local investors can take advantage of this cooling off period to establish positions in the market.

Q: Last year, the CSE was recognised as the second-best performing in the region. How does Sri Lanka compare with other regional markets today?

A: The ASPI returns of over 49 percent last year contributed to putting Sri Lanka on the map as the second-best performing market in the region in 2024.

This was supported by strong macroeconomic fundamentals against a backdrop of a stable political outlook, the conclusion of debt restructuring and improvements in the country’s credit rating outlook as mentioned earlier.

At present, Sri Lanka doesn’t rank among the highest bracket compared to the performance of other regional markets, as we’re witnessing some volatility with certain investors opting to realise profits.

However, looking ahead at the rest of 2025, the fundamentals remain strong – if not even better than last year. Interest rates remain low, currently standing at around eight percent after declining from their peak of 30 percent in 2022.

Inflation is well under control. After having reached a high of 50 percent in September 2022, the country experienced a deflationary environment. Additionally, the exchange rate – which peaked at around Rs. 363 against the US Dollar – appreciated by over 22 percent throughout 2023 and 2024.

Real GDP growth reached five percent in 2024 and credit growth has been steadily improving. On the fiscal side, we are witnessing positive developments with improved tax collections and rising profitability contributing to steady growth in tax revenue and a primary balance surplus.

In contrast, some regional markets are still recovering and navigating through their own economic challenges. Comparatively, Sri Lanka has managed to stabilise its economy with the reform agenda being implemented – albeit gradually.

The government also has reaffirmed its commitment to the IMF process. While challenges remain, the strong foundations being laid for future stability should be reflected in the market’s long-term performance.

Q: In your assessment, how have recent developments – including the 2025 budget, a 15 percent tax on service exports and completion of the third review under the International Monetary Fund’s Extended Fund Facility (EFF) – influenced the stock market and investor sentiment?

A: Budget 2025 is broadly positive for the market with an emphasis on fiscal consolidation, debt management and fostering an environment that’s conducive to long-term economic growth.

Some proposals aimed at revitalising sectors such as agriculture, tourism and technology could support market growth by encouraging investment in these areas.

Moreover, the proposed government spending on key areas such as infrastructure and social welfare could drive growth in construction, real estate and consumer focussed industries. Overall, investor’s value policy consistency and the budget appears to have delivered on that front – an important factor, especially following an election cycle.

However, it’s true that the introduction of a 15 percent tax on service exports has raised concerns among export oriented businesses, particularly in the IT and business process outsourcing (BPO) sectors. This move presents both positives and negatives.

On the one hand, the tax can be justified on the grounds of equity and that it would help Sri Lanka improve its fiscal health, ultimately creating a more stable economic environment in the long run.

But on the other hand, if Sri Lanka aims to position itself as an IT hub and attract long-term investment, strategic national policies may be necessary to support industries that are of critical importance.

While there aren’t many listed IT-BPO companies directly impacted by this tax, several divisions and profit centres within listed companies may experience an impact. In the long term, if the government effectively manages broader economic recovery, growth in other sectors could offset the effects on export driven services.

Ultimately, the key will be how well the government balances tax reforms with the need to maintain a business-friendly environment while ensuring stability and growth. Investors will closely monitor how the government and affected industries respond to the tax, and whether it hampers their growth prospects.

The successful completion of the IMF review has likely improved Sri Lanka’s standing among foreign institutional investors. It should reassure global investors that the government is committed to sound economic policies and long-term growth, which could translate into increased foreign direct investments (FDI) and capital market inflows in the medium to long term.

“Additionally, the exchange rate – which peaked at around Rs. 363 against the US Dollar – appreciated by over 22 percent throughout 2023 and 2024”

Q: Sri Lanka’s reform agenda under the IMF programme aims to restore economic stability. What role do you see capital markets playing in this recovery – and how can the CSE contribute to long-term economic growth?

A: Sri Lanka’s reform agenda under the IMF programme is focussed on stabilising the economy and getting it back on track. Capital markets, particularly the Colombo Stock Exchange, have a crucial role to play in this recovery.

A: Sri Lanka’s reform agenda under the IMF programme is focussed on stabilising the economy and getting it back on track. Capital markets, particularly the Colombo Stock Exchange, have a crucial role to play in this recovery.

It is often said that economies grow when capital markets expand. A report published by the International Finance Corporation (IFC) in March titled ‘Financing Firm Growth: The Role of Capital Markets in Low and Middle-Income Countries’ provides definitive evidence supporting this claim.

The findings are both fascinating and eye-opening, as the research tangibly shows evidence that GDP growth goes hand in hand with the development of a country’s capital markets. In fact, nearly half of the difference in the money raised through capital markets can be attributed to a nation’s economic growth.

Additionally, funds raised through capital markets are directly linked to increases in a country’s total stock of physical capital and more importantly, employment levels. Essentially, when companies raise capital by issuing stocks or bonds, they utilise these funds to invest in areas such as new factories, equipment or technology.

These investments not only drive company growth but also contribute to a nation’s overall physical capital – essentially its infrastructure and productive assets. A higher level of physical capital leads to improved infrastructure, increased production capacity, job creation and overall economic expansion.

Over the 22 year period covered in the study, capital market financing resulted in a 22 percent increase in physical capital and a 20 percent rise in employment in middle income countries.

Furthermore, raising capital through the CSE can boost FDIs by attracting foreign investors seeking opportunities in Sri Lankan companies. This inflow of capital not only brings financial resources but also new technology and expertise, which can help improve industries including manufacturing and infrastructure.

As a lower middle income country, Sri Lanka has immense potential to drive economic growth and job creation by leveraging our capital markets. The CSE stands ready to welcome new issuers seeking to raise capital through equity or debt.

At the same time, we are engaging with potential new issuers and assisting them in understanding the value of listing. We’re also continuously updating regulations to enhance the potential product portfolio of issuers to raise capital as we believe that the CSE has a strong role to play in this process.

“Sri Lanka has managed to stabilise its economy with the reform agenda being implemented – albeit gradually”

Q: From a governance and regulatory perspective, how well is Sri Lanka positioned in terms of stock market oversight and stability?

A: I believe the Securities and Exchange Commission of Sri Lanka (SEC) and the CSE have made commendable progress in strengthening stock market governance and regulatory oversight.

While there will always be areas for further improvement, the current system is proving to be quite robust in terms of investor protection and transparency. As a stock exchange, we take investor protection very seriously, and governance and compliance are integral to this process.

The SEC is the primary regulator of Sri Lanka’s stock market; it is responsible for enforcing rules and regulations that ensure transparency, fairness and efficiency in the market. To this end, the SEC has taken notable steps to align Sri Lanka’s regulatory framework with international best practices particularly in corporate governance, disclosure requirements and insider trading regulations.

Additionally, the SEC has been vigilant in conducting investigations and prosecutions have taken place in the recent past. From a perceptions standpoint, there has been a fundamental shift in the market with clear improvements in regulatory enforcement.

Corporate governance has been a key focus area of both the CSE and SEC, and numerous corporate governance rules have been introduced to enhance accountability and transparency among listed companies.

Key regulations require listed companies to maintain independent boards, disclose financial information in a timely manner and uphold the rights of minority shareholders. These measures align with global standards and foster trust in Sri Lanka’s capital market.

Furthermore, the CSE requires corporates to adhere to international financial reporting and disclosure standards, which further instils confidence among domestic and foreign investors. The adoption of International Financial Reporting Standards (IFRS) has also improved the transparency and credibility of financial statements.

Furthermore, the CSE requires corporates to adhere to international financial reporting and disclosure standards, which further instils confidence among domestic and foreign investors. The adoption of International Financial Reporting Standards (IFRS) has also improved the transparency and credibility of financial statements.

Strengthening the enforcement of existing laws and holding wrongdoers accountable is critical to ensuring long-term market stability. Despite having a strong regulatory framework, instances of insider trading, market manipulation and corporate noncompliance occasionally occur, and they can undermine investor confidence.

However, we have witnessed a marked reduction in such activities. Although there is always room for further improvement, it is a continuous and evolving process. No market in the world is entirely immune to these issues. There will always be a few unscrupulous investors or market participants who attempt to exploit loopholes.

The key is to consistently identify and address these gaps, and this has been taking place progressively over the past few years.

At the same time, overregulation can hinder free market movement and limit profit potential for investors. It’s important to strike the right balance and that remains a continuous learning process.

We are on the right track and in collaboration with the SEC, we’ll continue to refine corporate governance practices and strengthen other key regulatory areas, to enhance the overall stability and attractiveness of Sri Lanka’s stock market.

“Investor’s value policy consistency and the budget appears to have delivered on that front – an important factor, especially following an election cycle”

Q: What do you view as the most meaningful opportunities and risks for investors in the stock market in the months ahead?

A: When discussing the most meaningful opportunities in the Colombo Stock Exchange, I would rank continued progress under the IMF programme and fiscal reforms as the top priorities since both contribute to a stable environment for the country’s economic growth.

Last year, we witnessed a spike in investor confidence driven by the reform agenda; and if we remain on track, this positive sentiment is expected to continue. A stable economic outlook could lead to a rebound in key areas such as manufacturing, exports and services.

When analysing price to earnings ratios, the CSE presents a cost-effective opportunity for foreign investors compared to peer markets. Given Sri Lanka’s recent economic challenges, many listed companies remain undervalued relative to their regional counterparts.

As the economy recovers, value investors are likely to find attractive opportunities in blue chip and growth stocks that currently trade at lower valuations but have strong long-term return potential.

Foreign investor participation in the CSE is currently below 10 percent – down from its highs of 40 percent several years ago. However, as Sri Lanka’s credit ratings improve and the country starts to witness consistent economic stability, we can expect renewed interest from foreign investors, which would improve market liquidity.

Additionally, the prevailing low interest rate environment presents a compelling opportunity for local investors to generate returns through capital gains and dividends. However, there are areas that one should keep an eye out for.

One of the biggest concerns is the increasing geopolitical tensions and its impact on Sri Lanka. These tensions are leading to global economic uncertainty that could affect investor sentiment and market performance.

Both local and foreign investors will also be closely monitoring any deviations from the reform agenda. Sudden shifts in taxation or regulatory policies could likely swing investor sentiment as the country, despite its rapid recovery and resilience, still remains in a fragile state.

Q: What new initiatives are in the pipeline to encourage more companies including SMEs and startups to list on the CSE? And how can the stock exchange play a role in expanding Sri Lanka’s capital markets?

A: The CSE not only establishes rules and provides the infrastructure for companies to list but also actively engages with potential issuers to educate them on the benefits of listing.

We have a dedicated team focussed on issuer engagement and education, which has engaged with over 300 potential issuers through collaboration with trade associations, workshops and other awareness sessions.

A significant challenge in Sri Lanka is the lack of awareness and misconceptions surrounding stock exchange listings. Our goal is to correct these misunderstandings and build greater awareness.

Sri Lanka has a robust banking sector that has traditionally served as an easy avenue for companies seeking to raise funds for expansion or new projects. Larger companies often secure preferential rates, which discourages them from exploring alternative capital raising options.

However, the Central Bank of Sri Lanka has issued a directive requiring banks to gradually reduce their maximum single borrower exposure to 25 percent of their Tier 1 capital by December 2028, beginning in January 2026. As a result, companies will need to explore alternative avenues of financing and the CSE will be one viable option that can be evaluated.

In this context, we have been continuously engaging with potential issuers to educate and help them become market ready.

On the SME front, the CSE launched the Empower Board in 2018 to facilitate the listing of SMEs with a stated capital between Rs. 25 million and 200 million rupees at the time of listing.

We agree that SMEs are the backbone of Sri Lanka’s economy. According to research, they account for over 75 percent of all businesses, provide 45 percent of national employment and contribute 52 percent to GDP.

The Empower Board enables SMEs to raise capital under more relaxed conditions compared to the Main Board or Diri Savi Board. However, convincing and educating these companies, and preparing them to be market ready, is a gradual process.

Our team proactively conducts regional educational programmes to support this effort. Although the pick up has been slow, the responses have been promising and we believe that continuous engagement will yield results in the medium to long term.

Other initiatives by the CSE include expanding our product portfolio with the introduction of green bonds, infrastructure bonds and other sustainable financial instruments that can help attract global investors.

We are also enhancing digital platforms and tools to improve market accessibility for investors, and broadening our presence across Sri Lanka to ensure that businesses and investors in all regions can access capital markets effectively.

“The key will be how well the government balances tax reforms with the need to maintain a business-friendly environment while ensuring stability and growth”

Q: How has the evolving political landscape, following the installation of the new administration, influenced investor sentiment and the strategic direction of the CSE, in your opinion?

Q: How has the evolving political landscape, following the installation of the new administration, influenced investor sentiment and the strategic direction of the CSE, in your opinion?

A: By looking at the returns of the CSE in 2024, we see the impact that the installation of the new administration has had on investor sentiment. As mentioned earlier, nearly all the approximately 50 percent growth in 2024 can be attributed to the last three to four months of the year, coinciding with the run-up to the election.

Several factors may have contributed to this shift in investor sentiment. With a two-thirds parliamentary majority, there is general acceptance that the administration will be able to implement reforms more effectively.

Additionally, the government’s focus on fiscal discipline, anticorruption measures and adherence to the IMF reform programme has reassured both local and foreign investors. This has likely led to increased market activity and sustained positive investor sentiment. I believe that a sense of cautious optimism among investors still prevails.

However, I am confident that the CSE’s strategic direction will remain unchanged regardless of the administration or market sentiment. Even during periods of the worst market confidence such as the economic crisis, the CSE continued to introduce regulations to facilitate new products including green and blue bonds, infrastructure bonds, Shariah compliant bonds etc.

We’re only now beginning to witness the results of the foundation that was laid sometime back and we will continue along this trajectory.

There are many new products in the pipeline such as exchange traded funds (ETFs), derivatives etc. The CSE will continue to introduce the infrastructure to facilitate trading in these instruments while continuing our efforts to educate investors on these products and opportunities.

“It is often said that economies grow when capital markets expand”

Q: And how is the CSE adapting to emerging trends in foreign direct investment (FDI)? What strategies are in place to attract more foreign investors to the local stock market?

A: The CSE has identified several emerging trends in FDI that are specific to the market; and we are taking measures to cater to these trends and attract more FDIs into the country.

There is increased traction in sustainable, and environmental, social and corporate governance (ESG) investments globally, in foreign fund managers’ decision-making processes. Investors are increasingly prioritising companies that adhere to sustainable practices and demonstrate strong corporate governance.

The CSE is catering to this shift in multiple ways. We have introduced a sustainable bond framework, which enables corporates to attract foreign investment by issuing green, blue or other sustainable bonds.

Additionally, as noted earlier, the CSE has made ESG disclosure a mandatory component of annual reporting. We are exploring the possibility of introducing an ESG based index to highlight corporate commitments to sustainability and governance, further increasing visibility among local and foreign investors.

Enhanced digital platforms and trading systems make it easier for international investors to access the market, and ensure transparency and efficiency. We are in the process of implementing the central counterparty clearing (CCP) system this year.

And we’re evaluating the introduction of omnibus accounts with phase one open to foreign investors, which will make way for managing trades of more than one person and facilitating more efficient transactions. Alongside these initiatives, we are upgrading key systems that will enable us to adopt current international market practices.

Another key focus area is diversifying the product range by introducing investment instruments that are gaining popularity among foreign investors such as ETFs and derivatives. These products are expected to enhance market efficiency and liquidity while providing foreign investors with alternative ways to gain exposure to Sri Lanka’s capital markets beyond direct equity investments.

Furthermore, foreign investors are increasingly prioritising corporate governance and transparency when making investment decisions. In this regard, the CSE has been strengthening its corporate governance standards and regulatory framework, to ensure greater transparency and accountability among listed companies.

With these initiatives in place, the CSE has been laying the groundwork to take advantage of Sri Lanka’s recent improvement in credit ratings and ongoing fiscal reforms that have boosted investor confidence to position it as an attractive destination for foreign investments.

We continue to actively engage with foreign investors, keeping them informed of new developments and showcasing Sri Lanka as a compelling investment destination through platforms such as Invest Sri Lanka, which brings together policy makers, regulators and industry leaders to discuss investment opportunities on a broader global stage.

Q: What can we expect in relation to stock market performance in the medium term? And what would help drive the market?

A: Market performance in the medium to long term will be shaped by a combination of opportunities and challenges. Ongoing reforms under the IMF programme and improving economic fundamentals will contribute to a positive market outlook.

In particular, the low interest rate environment and improving credit growth are expected to enhance corporate profitability. Additionally, improved credit ratings and fiscal discipline could attract more foreign investors, and boost market liquidity and valuations.

Ultimately, the takeaway is that if you believe in Sri Lanka’s growth story, the market will reflect it. While it may not happen immediately, long-term returns should align with the country’s expected growth trajectory. Over the past five years, the market has delivered an effective return of 20 percent annually.

Before joining the stock exchange, I worked as a fund manager for nearly 15 years and one recommendation we gave investors was to look at long-term returns – to pick and choose good companies to invest in.

If you choose companies with strong fundamentals, the short-term returns don’t matter as the value of the company will be reflected in its pricing in the long term. This will help you sleep soundly at night, knowing that you’ve made a good investment even if short-term volatility exists.

Key market drivers will include the successful implementation of reforms, increased FDI inflows and an improved business environment. If Sri Lanka continues to prioritise economic stability, sustainable growth sectors and market friendly reforms, the CSE has the potential to experience strong performance and enhanced investor confidence in the years ahead.

Q: The external investor environment hangs in the balance with the advent of trade wars, suspension of aid programmes and prospect of a recession in the US. How will the emerging world order impact developing nations such as Sri Lanka?

A: This evolving global landscape presents both challenges and opportunities for developing countries such as Sri Lanka. Escalating trade tensions could disrupt global supply chains, impact export driven sectors such as apparel and tea, and strain foreign exchange earnings.

If aid programmes are suspended, Sri Lanka may face difficulties in securing external financial support for development projects and potentially slowdown economic recovery. A potential recession in the US or other major economies could dampen global demand, and affect Sri Lanka’s exports, tourism and remittances.

To overcome these challenges, Sri Lanka must focus on strengthening ties with South Asian and ASEAN countries, which could open new trade and investment opportunities while reducing our reliance on Western markets. We should also seriously look at diversifying our export base and exploring untapped markets.

Furthermore, the rise of digital trade and remote work presents an opportunity to position Sri Lanka as an IT hub – an area the country has been exploring and should prioritise more strategically.

Ultimately, Sri Lanka’s ability to adapt to these shifts, maintain its reform agenda and foster a business friendly environment for foreign investors will be critical to our ability to thrive despite the external challenges.

Our success will depend on the strategic partnerships we cultivate, our capacity for innovation and how effectively we position ourselves in the global economy amid an evolving landscape.

Leave a comment