LMD 100 Q&A

Q: What is your assessment of Sri Lanka’s economic path, given the multiple crises the nation has faced recently?

A: Sri Lanka remained resilient and made notable progress in implementing difficult but much needed economic and structural reforms. In response, domestic macroeconomic conditions recorded an encouraging recovery.

Inflation reduced from its peak of 70 percent to below one percent as at September 2023 with reserves recording a US$ 2.6 billion increase for this year as at June.

Given significant headway made on fiscal consolidation – including completion of the local currency part of the domestic debt optimisation plan and advanced discussions with external creditors – the country made progress to meet requirements for debt sustainability.

However, it is vital that these measures are sustained over time – including considering the non-populist nature of such reforms.

Good governance, credibility and transparency will be pivotal in improving consumer and business confidence, whilst fostering an environment of economic security. These will be central in securing public support.

Emphasis should be placed on reviving economic growth. Though consumer and business confidence improved recently, growth remains subdued with the economy contracting – albeit at a slower pace – on a quarterly basis.

Revival of the tourism industry will continue to be instrumental, and concerted efforts are needed to devise and implement a sustained campaign, to drive arrivals and improve tourist experiences at key points in their journey.

The focus should also be on building external reserves, and strengthening tax and social safety net measures, as well as optimising the energy sector among others.

Q: What are the burning issues facing the country as it heads into 2024?

A: Political stability is critical in creating a conducive environment for meaningful economic growth – as are clear, transparent and unambiguous regulations, policy continuity and consistency, regardless of changes in governments.

It is critical for Sri Lanka to work towards its revenue mobilisation measures through efficient tax administration reforms and widening the tax net.

Challenging macroeconomic conditions coupled with the rising cost of living over the past few years have contributed to increased migration. The consequence of this brain drain will be acutely felt in the ensuing years, and measures to attract and retain talent are vital.

While the path of fiscal consolidation needs to continue, a renewed focus on driving growth through greater tax policy continuity and consistency, as well as ensuring transparency and governance, will be vital.

Together with ensuring the necessary safety nets for vulnerable segments of the population, this will also help alleviate some social issues and concerns, through wider and broader participation in the recovery process.

Q: What measures have been taken to sustain and grow the group?

A: John Keells Holdings (JKH) has been investing substantially in multiple areas of business with the aim of building capacity and capabilities, as well as expanding its portfolio.

The Cinnamon Life Integrated Resort, which is expected to commence operations at end 2024, is expected to transform the landscape of Colombo, establishing the city as a tourism hub – given its iconic design and multi-use facilities ranging from hotel, conferencing, restaurants, residential and office spaces to gaming.

The group entered into an MOU with a leading international gaming operator, which consists of the framework for investing in and operating a casino at the Cinnamon Life Integrated Resort, as well as the commercial agreement between the parties.

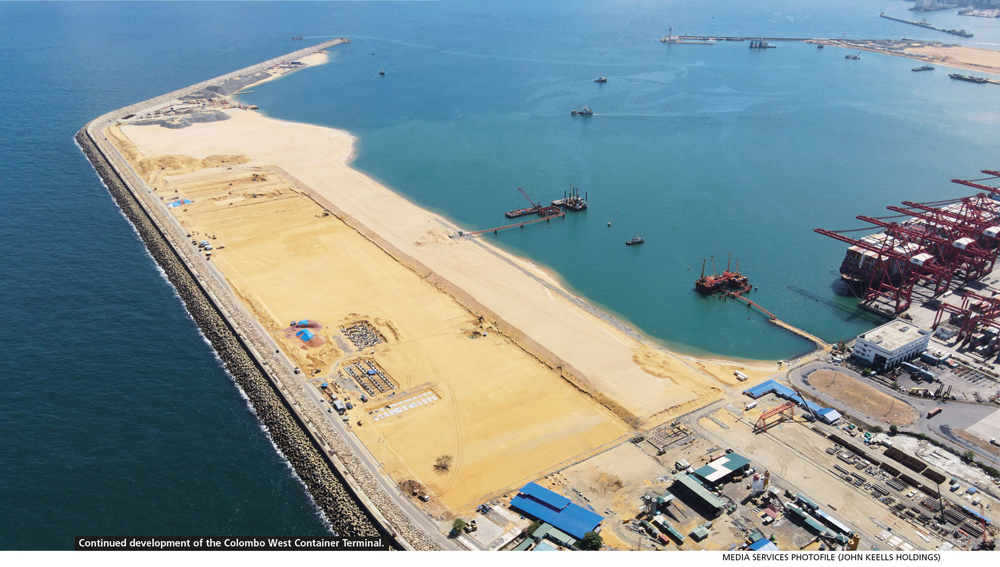

The West Container Terminal (WCT-1) in the Port of Colombo is also envisaged to be a key contributor to the group’s next phase of growth.

This investment – with an annual handling capacity of 3.2 million twenty-foot equivalent units (TEUs) – is envisaged to enhance the group’s ports and shipping business, by augmenting the port’s strategic proposition and addressing capacity constraints.

Q: What major projects has the group undertaken in terms of environmental, social and governance (ESG) considerations?

A: Emphasis on ESG enables a sustainable business model delivering value to all stakeholders. In this dynamic and evolving journey, we are currently reformulating the group’s ESG framework, setting revised group wide ESG ambitions and translating them into related targets.

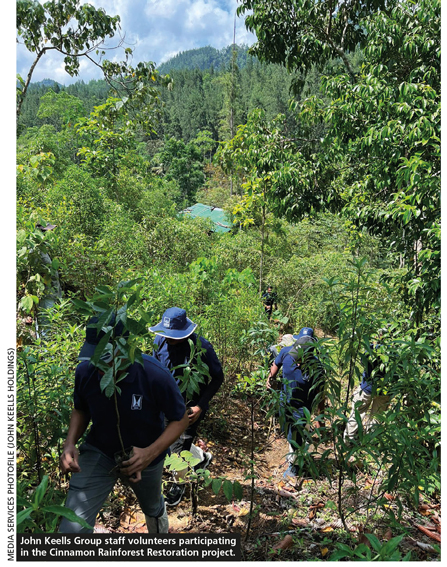

The Cinnamon Rainforest Restoration Project represents a five year commitment to restoring 59 acres of forest in Suduwelipotha by removing invasive plants and replacing them with 25,000 native trees by 2024. By 2045, this effort is expected to absorb 600,000 kilogrammes of carbon annually, and produce over 12 million litres of oxygen every hour.

Various projects are in place across the group such as the development of best practices for meaningful coexistence in mitigating the growing human-elephant conflict in Sri Lanka; and ‘Project Leopard’ in Yala, which aims to support the livelihoods of cattle farmers and protect the leopard population.

JKH also initiated a three-pronged Crisis Response Initiative, addressing issues surrounding health and nutrition, education and livelihood development.

One of our key projects is the School Meal Programme, implemented in partnership with the Ministry of Education. It is designed to provide nutritious meals to children on school days, and its sustainability in the long run is ensured through the building of school kitchens.

Additionally, a donation of Rs. 100 million was made to the Suwa Seriya Foundation to help sustain its fleet of ambulances.

The group’s corporate governance framework is the cornerstone of all decision making and serves as a vital element in reducing corruption, ensuring corporate fair-mindedness and creating sustainable value.

We will continue to stay abreast of internationally accepted best practices, and continuously challenge the status quo in our journey of being transparent and ethical.

JKH was ranked first in the Transparency in Corporate Reporting (TRAC) Assessment 2022 by Transparency International Sri Lanka (TISL) for the third consecutive year with a 100 percent score for transparency in disclosure practices.

This ranking is testimony to the group’s regularly reviewed and updated governance framework, which aims to reflect global best practices, evolving regulations and dynamic stakeholder needs.

Telephone: 2306000 | Email: jkh@keells.com | Website: www.keells.com