Compiled by Yamini Sequeira

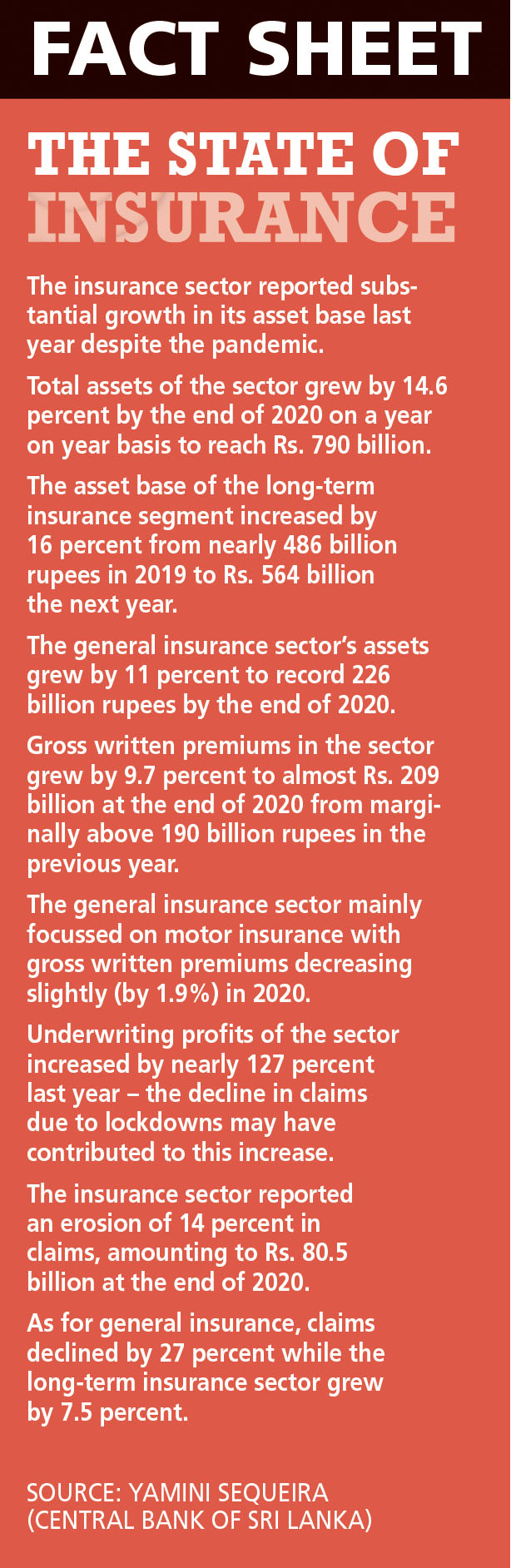

The outbreak of COVID-19 in Sri Lanka has impacted just about every industry. Reflecting on the year gone by, Shehan Feisal notes: “Financial year 2020/21 was perhaps the most challenging ever experienced by the insurance sector. While 2019 was comparatively reasonable, the sector was significantly impacted by last year’s developments.”

COVID-19 RESISTANCE

STEADFAST UNDER PRESSURE

Shehan Feisal says the insurance sector has been resilient during the pandemic

“Since our market is relatively strong, it finds a way to manoeuvre around obstacles and always looks ahead. The present situation has spurred companies to reevaluate their product portfolios to see if they are aligned to people’s real needs,” he elaborates.

“Since our market is relatively strong, it finds a way to manoeuvre around obstacles and always looks ahead. The present situation has spurred companies to reevaluate their product portfolios to see if they are aligned to people’s real needs,” he elaborates.

The veteran insurer avers that the effects of the global pandemic have accelerated demand for life and health insurance: “A pandemic is generally excluded from life policies and a majority of policies here didn’t include it. Yet, the sector rallied around and offered to pay COVID-19 related costs to policyholders up to certain limits despite not being liable to do so.”

“I believe this approach has enhanced confidence in the insurance sector,” he asserts. These days, COVID-19 hospitalisation and death cover is becoming the norm. And undoubtedly, the sector has evolved during the year to meet the expectations of policyholders.”

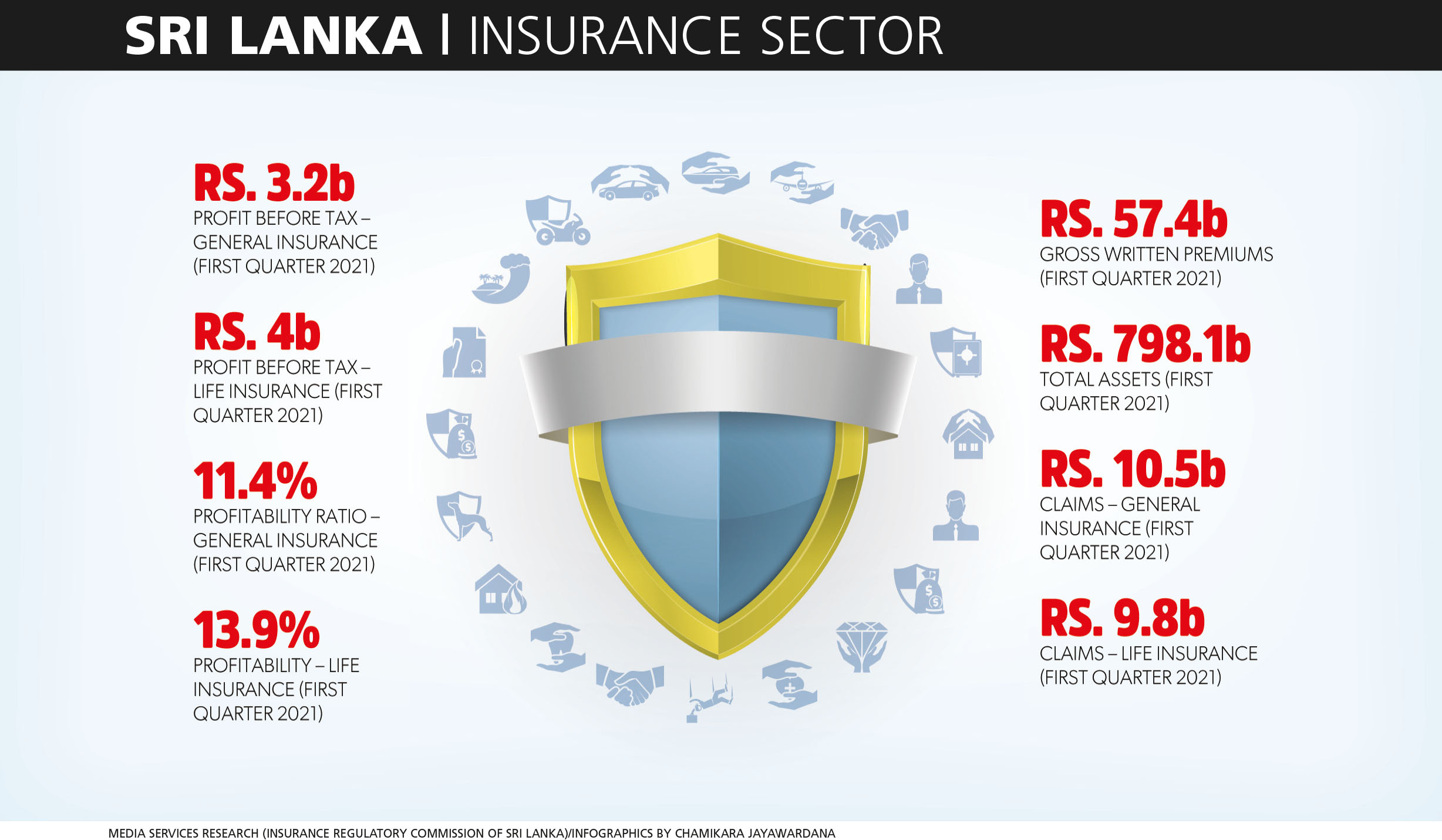

Feisal reveals that although the sector was looking at 2021 for an improved operating environment to revive its goals – which was the case in the first quarter of the year – the third wave that began at the end of April gave way to lockdowns and the accompanying constraints once again.

“As a result, with disposable incomes declining, insurance doesn’t remain a priority. In any case, insurance is not a top priority for Sri Lankans and this has led to many policies lapsing. It was indeed a tough year and insurance companies had to adapt to all of that,” he muses.

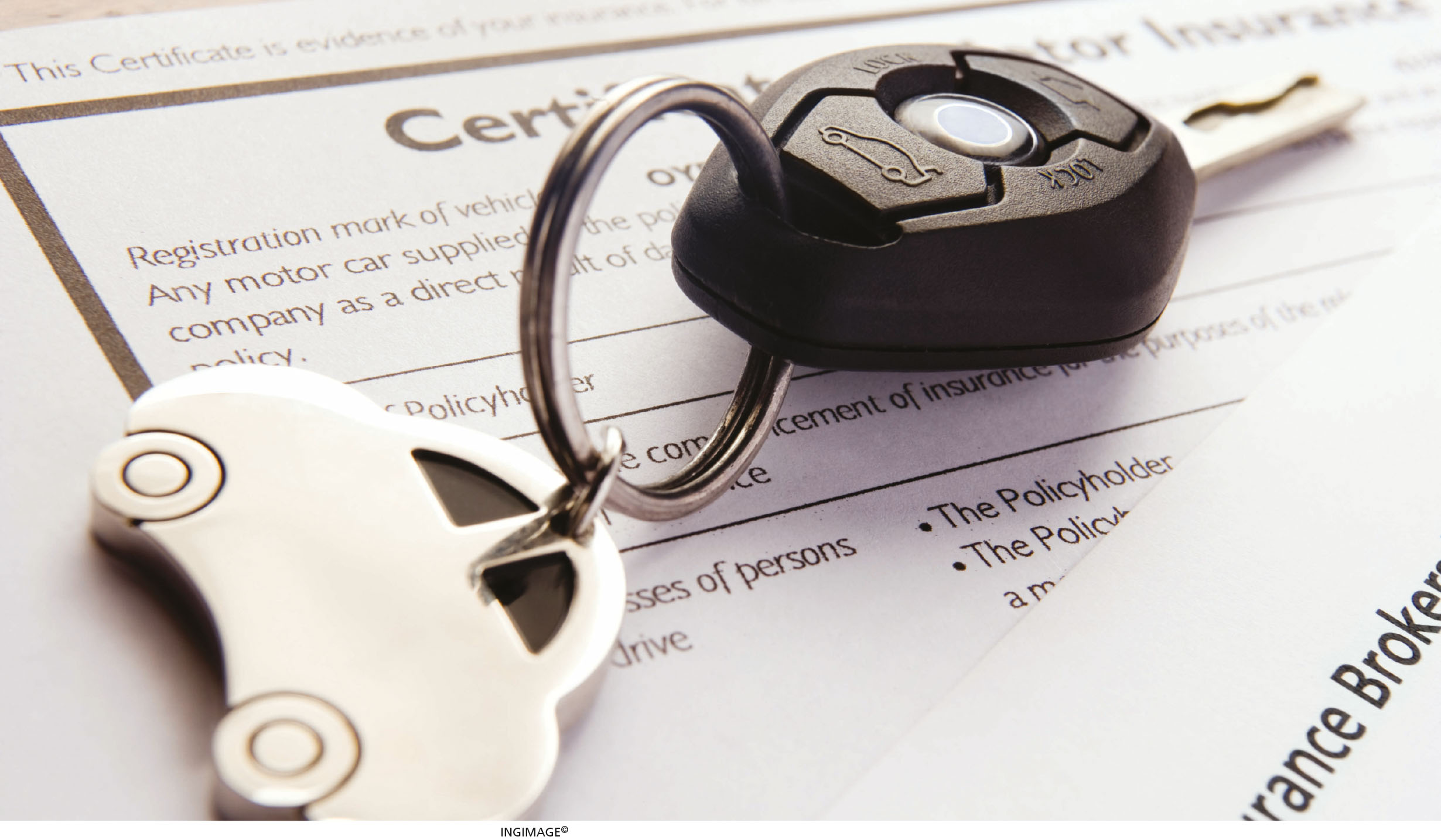

Feisal points to the devastating impact on tourism and related businesses, and vehicle importers and dealers that have been affected by the import ban, as well as people who wanted to buy three wheelers or light trucks for commercial activities.

All these groups have to contend with unprecedented challenges.

“Overall, both the general and life insurance sectors were affected in different ways. The Rs. 100 billion general insurance sector – of which motor insurance comprises over 60 percent – saw a decline of two percent compared to the percent annual growth ranging between 10 and 15 percent, which it generally averages under normal circumstances,” he notes.

Feisal adds that life insurance was affected due to the lack of continuity of policies once policyholders’ incomes were impacted. Mobility restrictions also prevented people from paying premiums while companies too couldn’t send their officers to collect dues. He concedes that beyond the Western Province, the penetration of policies declined as many people hold third party insurance cover for vehicles in line with lower income levels. However, he is hopeful that “as the next generation is more educated, the youth will realise the benefits of having insurance.”

Feisal adds that life insurance was affected due to the lack of continuity of policies once policyholders’ incomes were impacted. Mobility restrictions also prevented people from paying premiums while companies too couldn’t send their officers to collect dues. He concedes that beyond the Western Province, the penetration of policies declined as many people hold third party insurance cover for vehicles in line with lower income levels. However, he is hopeful that “as the next generation is more educated, the youth will realise the benefits of having insurance.”

The fact remains that despite the enormous potential in the market to grow life and general insurance, progress has been at a snail’s pace.

The fact remains that despite the enormous potential in the market to grow life and general insurance, progress has been at a snail’s pace.

Feisal cites the case of India where the government has subsidised policies for farmers. In this scenario, it pays half of the premium while the farmer accounts for the balance for agriculture or crop insurance policies.

“Perhaps Sri Lanka too could devise a similar arrangement but it will need consultation with all private sector operators,” he states, adding: “The Sri Lankan government’s Suraksha insurance product that covers children’s medical and educational needs is a step in the right direction to include more people under the protection of insurance.”

Unlike the more popular banking and marketing professions, knowledge about chartered insurers is low. Feisal observes that “most people who qualify as chartered insurers do so only after they’ve gained experience in the sector – meaning, worked in it for a while. This is unlike students who actively seek chartered marketing or accountancy qualifications.”

Unlike the more popular banking and marketing professions, knowledge about chartered insurers is low. Feisal observes that “most people who qualify as chartered insurers do so only after they’ve gained experience in the sector – meaning, worked in it for a while. This is unlike students who actively seek chartered marketing or accountancy qualifications.”

He explains: “Today, insurance companies are encouraging employees to enhance their technical qualifications through the Sri Lanka Insurance Institute (SLII), which is affiliated to the Chartered Insurance Institute (CII) in the UK. Some companies even link remuneration and promotions to this.”

“I believe that we will face a dearth of qualified insurers unless this qualification is proactively marketed to the younger generations,” he cautions.

While commending the sector for its resilience, Feisal reflects that it has shifted from being tariff-based to more price-conscious over the decades, which has skewed the playing field.

He feels there have been many missed opportunities when it comes to driving penetration especially within the life insurance segment.

On the other hand, he has faith in the adaptability of insurance companies to build the sector’s strength: “Even during the tsunami, insurance companies were able to adapt and upscale to provide relevant protection for the victims even though it wasn’t included in their cover. Subsequently, insurance companies paid out during the floods too.”

To this end, Feisal explains that Sri Lanka’s insurance companies are there for their customers, no matter the catastrophe. This is a great attribute, he declares.

“If you aren’t there for the people, people will not be there with you. In the aftermath of the tsunami, insurance companies took a hit because they paid out billions of rupees to policyholders although the policies had not factored in losses attributable to tsunamis. These instances have gone a long way in building public confidence in the insurance sector,” he maintains.

And Feisal points out that “the future prospects of any sector are now pegged to the state of the economy and how it will be revived during the year.” Decades of untapped potential continues to weigh on the sector and experts are of the opinion that perhaps digitalised insurance solutions could be the magic wand to encourage greater adoption.

Either way, the sector needs an injection of innovation and maturity, and a level playing field, for it to evolve to the next stage.

The interviewee is the Chief Executive Officer of Amana Takaful

This content is available for subscribers only.