HAYLEYS

RANK 1

“Sri Lanka’s competitiveness will depend on a robust national digital identity system and large-scale industrial zones with private and foreign participation”

Q: As Sri Lanka continues to pursue economic and political stability, how is the corporate sector driving growth while overcoming challenges that persist on many fronts?

A: With Sri Lanka’s economy showing signs of recovery and major rating agencies upgrading the country’s outlook, there is renewed optimism across the corporate sector.

Hayleys has long stood as a barometer of growth in Sri Lanka, demonstrating remarkable resilience and continuing to expand in challenging periods.

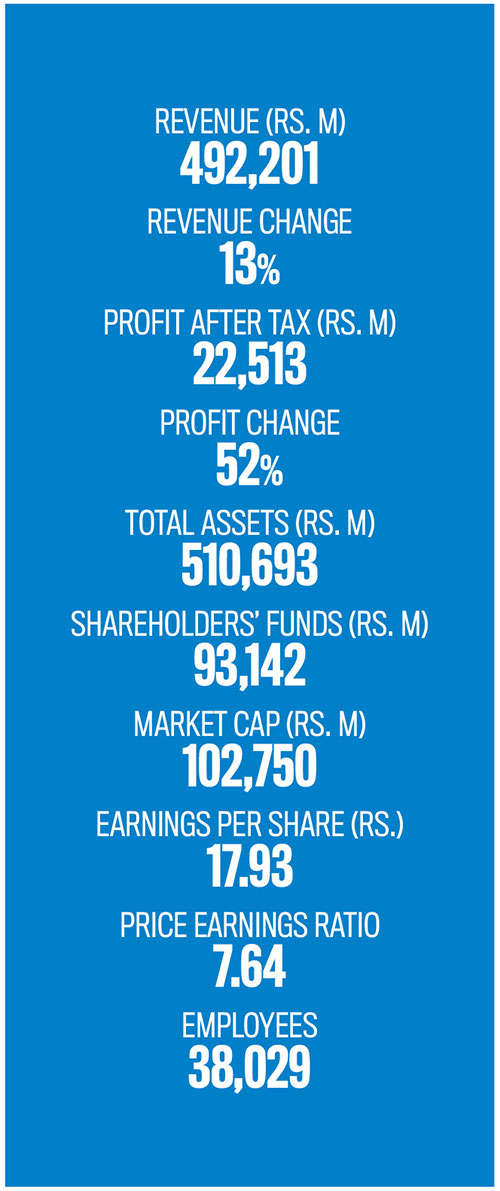

Over the past decade, the group delivered a 10 year US dollar denominated compound annual growth rate (CAGR) of nine percent, placing it well above the trajectory of the national economy. This has been possible due to our strong international footprint driven primarily by exports with over half of our revenue generated in Sri Lanka for global markets.

The remaining 48 percent of our earnings are generated locally, and are directly influenced by domestic political stability and GDP performance. Many of our businesses move in tandem with broad economic activity and local economic growth consistently drives stronger consumer demand including in categories such as consumer durables.

And the balance between international and local revenue streams has enabled the group to maintain steady and resilient growth. Beyond financial performance, the group remains committed to inclusive development, supporting over 38,000 livelihoods directly and thousands more through extended value chains.

Above all, we adapt continuously to changing environments through proactive management, digital transformation and a strong focus on environmental, social and corporate governance (ESG) principles, ensuring that we remain agile and aligned with global standards and expectations.

Q: Could you outline your group’s plans – especially regarding expansion?

A: Our expansion agenda remains anchored to national priorities and global shifts. In renewable energy, our project pipeline comprising wind and solar developments is aligned with Sri Lanka’s national energy policy targets for 2030.

We are also deepening our presence in mobility, which has now emerged as a separate and significant vertical for the group. Our aim is to broaden offerings and expand our product range meaningfully as this sector evolves. In the retail space, we continue to explore strategic formats while assessing the most suitable long-term approach.

These priorities are complemented by geographical diversification initiatives focussed on strengthening our presence across markets.

Q: What are your group’s goals and objectives for financial year 2025/26?

A: During the first half of the year, Hayleys surpassed internal budgets and maintained strong momentum. We expect this to continue into the second half, supported by sustained organic growth.

In Sri Lanka, we will channel increased investments into high growth sectors such as consumer, retail and renewable energy. These investments will lay the foundation for future returns with the benefits reflected progressively in subsequent years.

Across the group, we remain focussed on international expansion, strengthening our regional presence and moving closer to customers in key markets. We continue to strive towards our aspiration of becoming a US$ 2 billion revenue company.

ESG commitments remain central to our direction, guided by the Hayleys Lifecode 2.0 framework.

Q: What are the challenges facing the industries and sectors that your organisation is part of?

A: As a diversified conglomerate operating across multiple verticals, our businesses face varied conditions. Some sectors benefit from favourable market environments while others contend with changing consumer behaviour and affordability constraints under prevailing tariff structures.

Climate variability continues to affect agriculture linked businesses while global supply chain movements – including geopolitical disruptions – influence logistics and trading.

A critical challenge ahead is the change in the definition of single borrower limits (SBL), which will cap exposure at 25 percent of Tier 1 capital from next year. This will restrict access to capital for large-scale corporates.

While external capital markets remain expensive for investors, Sri Lanka’s domestic capital markets are yet to mature sufficiently to meet the corresponding funding requirements.

Export focussed businesses are also facing the effects of the removal of the simplified value added tax (SVAT) mechanism, which is creating a cash flow disadvantage for suppliers and making local sourcing less attractive.

Navigating this landscape requires continuous agility and strong risk management.

Q: How can Sri Lanka improve its ease of doing business and competitiveness on the international stage?

A: Sri Lanka must prioritise an agenda to improve its global standing. A digitally enabled trade ecosystem – including the rapid roll out of the customs single window, and digitalisation of import and export processes – is essential.

Fast tracking national infrastructure will strengthen the country’s regional position while a digital investment facilitation agencywould accelerate approvals and improve coordination across government institutions.

Tax reforms must focus on widening the base through digital compliance rather than increasing rates for already compliant taxpayers.

Sri Lanka’s competitiveness will depend on a robust national digital identity system and large-scale industrial zones with private and foreign participation.

Q: How is your company embracing ESG standards?

A: Hayleys has been at the forefront of addressing global ESG challenges by adopting goals to reduce greenhouse gas (GHG) emissions; transition to renewable energy; promote circularity; and preserve biodiversity through initiatives such as mangrove restoration and reforestation.

Inclusive development remains a central pillar of our approach. We continue to link smallholder farmers, rural entrepreneurs and local suppliers to international markets while supporting education, livelihoods and community development.

As a listed company, governance excellence is institutionalised through well-defined ESG oversight structures, robust risk management systems and transparent reporting practices aligned with international standards.

Telephone 2627000 | Email info@cau.hayleys.com | Website www.hayleys.com