FISCAL OUTLOOK

Sri Lanka’s fiscal performance through the first half of this year tells a story of discipline and strain. On the one hand, revenue mobilisation has outpaced expectations, the primary balance is continuing to deliver beyond targets and headline indicators of debt sustainability are holding steady.

IS A DURABLE RECOVERY ON THE CARDS?

Shiran Fernando analyses the state’s financial health during the first six months of 2025

On the other hand, the country is spending far less than it had planned on public investment, raising questions about growth momentum at a time when the economy needs renewed dynamism.

This duality set the stage for November’s 2026 budget speech, which will outline the trajectory of revenue and also clarify whether the government can translate fiscal consolidation into sustainable growth.

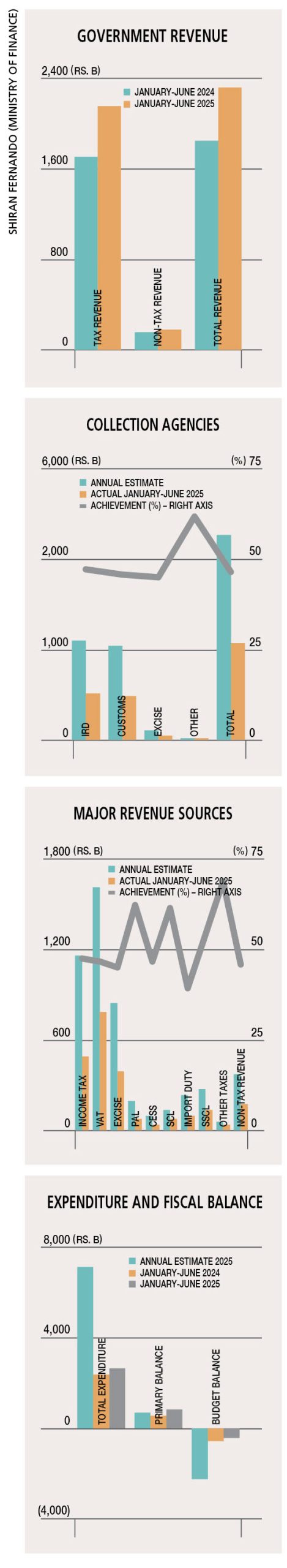

REVENUE EXPANSION The numbers underline a clear improvement in fiscal discipline. Total government revenue in the first half of this year expanded by 25 percent compared to 2024, driven by the revival of motor vehicle imports, which was a long awaited policy reversal.

The resumption of vehicle imports alone contributed to an acceleration in customs and excise collections. This eased pressure on other tax lines and boosted confidence in the revenue trajectory.

This improvement has placed Sri Lanka firmly on track to meet and potentially exceed its ambitious revenue-to-GDP targets. Importantly, revenue mobilisation has been broad-based and not only dependent on indirect taxes – signalling that administrative reforms and tightened compliance are beginning to yield results.

In a country long plagued by weak revenue performances, this surge represents a structural shift rather than simply a cyclical bounce.

PRIMARY BALANCE More striking is the continued over-performance of the primary balance, which is the fiscal metric most closely watched by international creditors and the IMF.

By excluding interest payments, the primary balance reflects whether a government can cover its current obligations without adding to its debt stock. Sri Lanka’s consistent out-performance here is the clearest indicator yet that debt sustainability targets aren’t only being met but exceeded too.

LOW INVESTMENT But if revenue tells a story of progress, expenditure tells one of restraint and perhaps missed opportunity.

Despite a budgeted capital expenditure of Rs. 1.3 trillion for 2025, actual spending on public investment in the first half was only 17 percent and below 2024 levels.

This matters because public investment in particular projects earmarked for education, healthcare and connectivity are the engines that power growth in the medium term.

Under-spending in public investment risks weakening demand, stalling productivity gains and slowing the very structural transformation the government has committed to. While tight controls on recurrent expenditure are understandable, the inability to roll out the investment pipeline reflects both fiscal caution and possible implementation bottlenecks.

RISING PRESSURE Meanwhile, recurrent expenditure continues to climb. The twin drivers here are interest costs and increasing public sector wages. Interest payments have consumed a growing share of government outlays, leaving less room for discretionary spending.

At the same time, salary adjustments for public servants – though politically unavoidable – have further lifted the recurrent bill.

This shift in the composition of expenditure underlines a structural challenge. Without faster growth and greater investment, a rising share of resources will be locked into servicing debt and sustaining salaries, leaving little room for future priorities such as infrastructure, education and climate adaptation.

BUDGET SPEECH The fiscal outturn at mid-year is setting the stage for the November budget, which will be closely scrutinised for two reasons.

First, it will provide the clearest sense of the revenue trajectory for 2026 – especially whether the extraordinary boost from vehicle imports can be sustained and whether tax compliance gains are durable.

Second, it will have to address the imbalance between revenue mobilisation and capital spending. The credibility of the fiscal consolidation effort depends not only on improving balances but also on ensuring that growth doesn’t falter in the process.

Policy makers will need to articulate how Sri Lanka plans to accelerate the disbursement of its ambitious investment allocation. This will require not only fiscal space but also stronger public financial management systems, greater capacity within line ministries and leveraging private capital through public-private partnerships (PPPs).

BALANCING ACT The first half of 2025 confirms that Sri Lanka has made real progress in putting its fiscal house in order. Yet, the country risks achieving fiscal consolidation while capital spending continues to lag resulting in a drag on growth.

Therefore, the forthcoming budget speech will be more than an accounting exercise; it will be a test of whether the government can translate fiscal discipline into inclusive job creating and investment led growth.

Fiscal consolidation has bought Sri Lanka credibility and stability but without investment, the economy risks stagnation.

To sustain confidence at home and abroad, the government must continue to deliver on its revenue targets, maintain the primary balance advantage and urgently unlock the growth potential embedded in its capital budget. Only then will the gains of fiscal prudence translate into a durable recovery.