Emerging Trends in Real Estate®: The global outlook for 2019

Managing expectations

The political and economic uncertainty of the past year will likely persist in key markets throughout 2019, yet real estate continues to attract capital and demonstrate its enduring appeal as an investment asset class.

The acquisition of income-producing commercial real estate increased by 3 percent to $963.7 billion in 2018, the third highest annual total on record, after 2007 and 2015.

Granted, there was an ebb and flow of capital around the regions, but the fact that overall global deal volume increased at all is testimony to the strength of demand for the income real estate offers, given the turbulent geo-political and economic conditions for investment in 2018. If anything, however, 2019 is likely to present a greater test of the industry’s collective nerve.

The industry leaders canvassed for Global Emerging Trends all take comfort from the fact that there is lower leverage in the system and lower levels of supply in all regions than in previous cycles. But in light of the worsening economic backdrop to investment, pricing of core real estate – a long-running concern in all three of our regional reports – becomes more of an issue than ever.

One global player believes the market is at a “transition point” as a result of current pricing and changes to monetary policy. A correction is coming, sooner or later. And as all three regional reports show, investors and fund managers are revising their strategies according to their own appetite for risk, albeit stopping short of moving into secondary locations as they did in the previous cycle.

Top cities for real estate investment in 2019

| Canada | Europe | Asia Pacific | United States |

| Toronto | Lisbon | Melbourne | Dallas/Fort Worth |

| Vancouver | Berlin | Singapore | New York-Brooklyn |

| Montreal | Dublin | Sydney | Raleigh/Durham |

| Madrid | Tokyo | Orlando | |

| Frankfurt | Osaka | Nashville | |

| Amsterdam | Shanghai | Austin | |

| Hamburg | Ho Chi Minh City | Boston | |

| Helsinki | Shenzhen | Denver | |

| Vienna | Seoul | Charlotte | |

| Munich | Guangzhou | Tampa/St Petersburg |

Operating in a new world

The regional Emerging Trends in Real Estate reports, published towards the end of 2018, all show that obsolescence is a growing concern for asset owners across the globe, against the backdrop of rapid changes in technology, demography and social norms.

Technology, particularly mobile technology, has put much more power in the hands of the consumer, which is driving change across all sectors. And as new generations become workers and consumers, different social values and choices are influencing where and how people work and shop – and underpinning the rise of the shared economy.

Assets will need to be adapted to meet the needs of the people using them more effectively, or converted to entirely new uses. Real estate owners will need to become operational businesses, and learn very different skills than they required even five years ago. At the heart of this will be understanding what the person using a building wants and delivering it seamlessly.

The challenges do vary, according to sector, but all are affected by the possibility of accelerated obsolescence. Retail and hospitality have been in the eye of the storm for some time; offices are closer to the beginning of the revolution. The residential and industrial sectors seem to be more insulated from change because of the positive balance between supply and demand. Industrial is perhaps storing up problems for the future around the design of buildings in sectors where the technology of the occupier is advancing rapidly.

What is a valuable asset today?

That question has become much more complex than it once was, across all sectors.

It’s clear that to avoid obsolescence and remain relevant in the modern world, real estate will need to provide that amenity and experience that the ultimate end users require – be they office workers, shoppers or residents.

Technology will be key in measuring feedback from people – both in terms of what they say they like about a building as well as how they actually use it in practice – and in creating a clearer link between new uses and value.

Owners will need to forge closer ties with occupiers, to collaborate and analyse what’s working for the people using buildings, day in and day out. The owners who can assess how people want to feel about a building and fulfil that intangible demand will be the most likely to avoid their assets becoming obsolete.

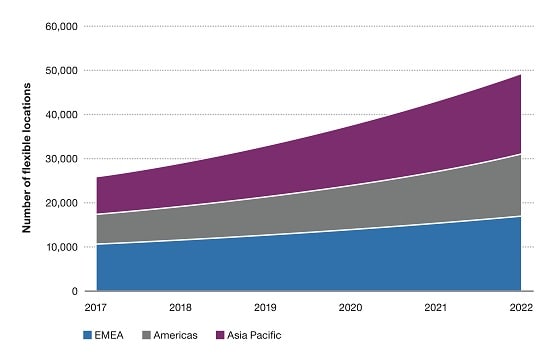

But how do you put a value on space that no one is directly paying for and how will a future buyer value it? Some sectors, like flexible offices or co-living, are so new that the real estate industry, in particular investors and valuers, have not yet reached consensus about how to value them. “You have all of these business models that have never been seen before, and the capital market has not evolved yet to work out how to value these assets,” one investor told us.