ECONOMIC OUTLOOK

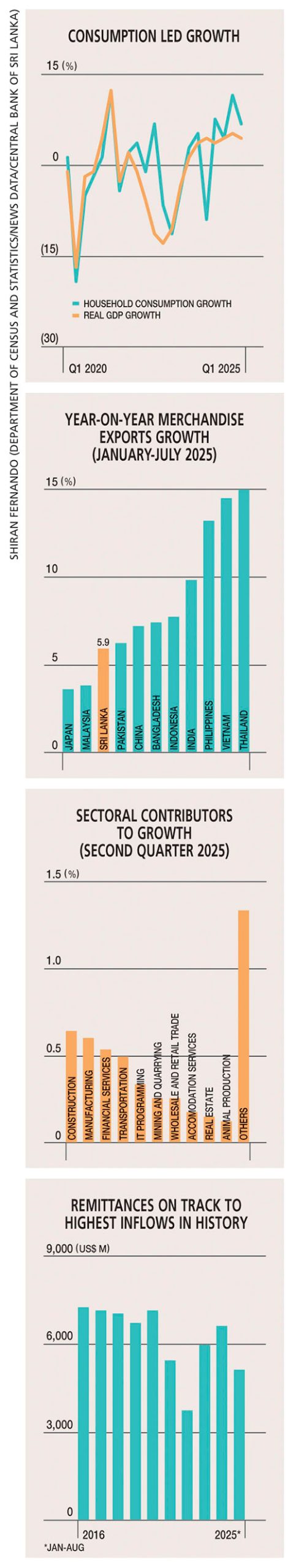

Sri Lanka’s economy is once again showing signs of resilience. In the second quarter of 2025, GDP expanded by 4.9 percent year on year and marked the eighth consecutive quarter of growth.

GROWTH MOMENTUM CONTINUES

Such consistency hadn’t been seen since the 2016/17 period, underscoring a shift from mere stabilisation to a more decisive recovery.

The question now is whether this momentum can be transformed into a period of sustained and accelerated growth – and as such, it’s necessary to examine the latest GDP numbers and consider what they tell us about the country’s economic trajectory.

STRONGER PULSE Following two quarters of contraction, the agriculture sector recorded growth in the April-June period with output rising by two percent, compared to a contraction of 0.7 percent in the first three months of the year and 2.2 percent in the last quarter of 2024.

Agriculture provided much of the lift, supported by strong harvests in rice, fruits and animal husbandry. However, weaknesses remained in spices and fishing.

Following an extended run, the industry sector cooled modestly – manufacturing contracted slightly as businesses grappled with tariff and trade uncertainties. Yet, this was countered by renewed activity in mining and construction, which signalled investment and infrastructure related work regaining traction.

The Purchasing Managers’ Index for Construction continues to remain positive and with the resumption of retail construction, this subsector has room to grow further and recover to pre-pandemic levels.

Services, which form the bedrock of Sri Lanka’s economy, accelerated at its fastest pace since the last quarter of 2021. Tourism, which mirrored 2018 pre-crisis levels, powered growth in transport, warehousing and hospitality.

In the meantime, the rebound in construction boosted real estate and related services, while even public administration and defence showed renewed activity after earlier contractions. Wholesale and retail trade improved but still lag behind their long-term average.

The other aspect of GDP is to consider it in the context of expenditure, where it’s evident that household consumption averages 60-70 percent of gross domestic product. Weak spending by consumers is a drag on economic growth.

However, since last year’s second quarter, household consumption has been consistently positive and one and half to twice the GDP growth witnessed in previous quarters. This signals that consumers are recovering from the crisis and looking to spend more than they did in the past.

EXTERNAL DRIVERS Exports, tourism and worker remittances continue to anchor the recovery. Exports of goods were up six percent in the first half of this year, remittances have averaged US$ 650 million a month (which is well above pre-pandemic levels) and tourist arrivals rival the country’s best ever year of 2018.

Even lagging sectors such as construction, private investment and credit markets are showing signs of revival with private sector credit growing 20 percent year on year in July. Much of this credit is towards the import of vehicles but the real estate sector is also borrowing heavily.

The most encouraging yardstick is the inflow of worker remittances, which rose almost 20 percent during first eight months of 2025 and is on track to achieve its highest level ever. Recent skilled migration and demand from nontraditional high paying markets are key drivers of this growth.

US tariffs have also underscored this resilience. Initially imposed with a punishing 44 percent reciprocal tariff in April, Sri Lanka saw a 90 day pause before the United States imposed a 20 percent tariff in August.

Crucially, this rate is largely aligned with competitors such as Bangladesh, Vietnam, Malaysia, Indonesia, Thailand and Pakistan. As a result, Sri Lanka’s relative export competitiveness remains intact.

However, Sri Lanka can’t afford to rest on its laurels with the 5.9 percent growth it has seen in exports. While much of this could be due to inventory buildup in countries such as the US, nations such as Thailand, Vietnam and the Philippines saw their exports grow between 13 and 15 percent in the first half of 2025.

This highlights both the lack of market and product diversification of Sri Lanka’s export basket relative to a country such as Thailand, which is seeing more demand for EV components and processed food.

WHAT LIES AHEAD Though manufacturing is vulnerable to external shocks, agriculture is uneven across subsectors and domestic demand still lags in some areas, the persistence of growth is an encouraging sign.

With exports, worker remittances and tourism performing strongly, and construction and credit showing renewed energy, the economy is moving towards a more balanced footing.

The forthcoming Budget 2026 should help promote more growth and sustain Sri Lanka’s reform path, by unlocking barriers to land, labour and capital. Spurring investment led export growth through private sector investment zones and digital led productivity incentives are also avenues for expansion.

If policies remains consistent and the investment climate improves alongside ongoing structural reforms, Sri Lanka may well sustain this momentum beyond 2025.

In an era of global uncertainty, that would be no small achievement.