CONSTRUCTION LANDSCAPE

Compiled by Yamini Sequeira

TIME TO BUILD BACK BETTER

Hasith Prematillake surveys the evolving landscape of a critical industry

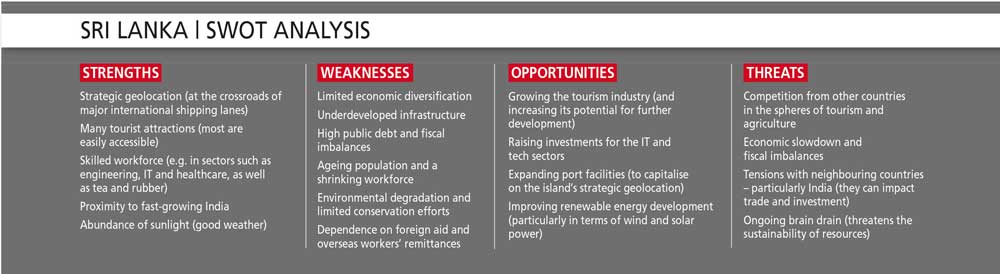

Sri Lanka’s construction industry and engineering sector continue to reel from the impact of the COVID-19 pandemic and subsequent economic crisis after contracting by more than 30 percent.

Currency depreciation, high raw material prices, downwardly adjusted sovereign country ratings and other unfavourable factors have stymied further investment and expansion.

Hasith Prematillake says: “Although the manufacturing industry witnessed a measure of expansion soon after the pandemic eased, recessionary conditions in Europe and the US have limited further growth opportunities.”

“Some businesses had to shutter factories due to the higher taxes that came into effect this year. Investors started moving away from Sri Lanka and businesses were focussed on overseas expansion. Meanwhile, the construction industry has witnessed muted growth month on month so far,” he laments.

A drop in public spending on infrastructure projects was seen due to Sri Lanka’s rising external debt burden. Some key donor funded public infrastructure projects continued however, albeit at a slower pace.

SILVER LINING Prematillake asserts: “The expansion of the Bandaranaike International Airport (BIA) is critical to support larger numbers of tourist arrivals.”

He continues: “Although the project was suspended for a few years, the Japan International Cooperation Agency (JICA) has once again taken on the project and hopefully, the construction of a world-class airport will commence in 2024.”

“The expansion of the Colombo Port with the East Container Terminal and West Container Terminal projects is ongoing, while other major hotel and residency projects are also on track; they give confidence to both investors and buyers,” he affirms.

And Prematillake points out that since private apartment projects were mostly constructed at pre-economic crisis prices, “they will likely earn better margins selling at today’s rates.”

In fact, the exchange rate of the Sri Lankan Rupee against the US Dollar makes property investments an attractive proposition. During the first half of this year, the Colombo District’s Land Valuation Index (LVI) spiked by 15 percent from a year earlier, according to the Central Bank of Sri Lanka.

Residential land values increased 17.2 percent, commercial property appreciated by 15.1 percent and industrial allotments rose by 13.5 percent, according to the LVI.

“Another area that’s needed to bolster the construction industry is energy security. The 500 MW wind power projects in Pooneryn and Mannar, and the upgrading of transmission lines across the country, are critical to avoiding major power crises in the future,” he emphasises.

RENEWABLE ENERGY Prematillake elaborates: “The dire situation has forced more businesses to consider renewable energy; and this is an area in which our organisation is driving innovation with shared investment models and so on.”

He adds: “Private companies and policy makers should work together to design more energy saving technology solutions in the construction industry and related sectors.”

“As a result of price stabilisation for global materials and capacity expansion, the cost of solar panels is dropping. This will help accelerate the adoption of solar power in Sri Lanka,” he predicts.

On average, the world is adopting renewable energy at the rate of 13-15 percent. Prematillake observes: “Sri Lanka is lagging way behind as China targets a total capacity of 450 GW by year end while India is at around 70 GW. And developed countries such as France and the Netherlands are recording around 15 GW.”

Conserving water resources is another topic that’s close to Prematillake’s heart.

“Having attended several environmental, social and governance (ESG) related learning interventions – including water conservation programmes to see how we can reduce consumption in our operations – it is important to know there are many ways to optimise water usage in residential and commercial spaces. Proper water audits need to be conducted at regular intervals to identify water leakage,” he recommends.

RETAINING TALENT Sustainability of resources is becoming a key priority for corporations and nations.

Prematillake opines: “As in the apparel industry, which is seeing the adoption of net zero targets, the construction industry too has to gear up to adopt green construction and ESG principles. A serious transformation of the renewable and nonrenewable energy infrastructure is needed to ensure energy security in the future.”

Although the price of raw materials for construction remains high in rupee terms, the prevailing lower interest rate regime should boost demand for commercial and residential spaces.

“There was an oversupply of luxury apartments a few years ago; but since no new projects have commenced in the past couple of years, demand and supply equilibrium will take place,” Prematillake surmises.

He lauds construction and engineering businesses for establishing their footprints in new locations. Prematillake explains: “Saudi Arabia is attractive for local enterprises as the desert kingdom has announced a target of US$ 2 trillion worth of construction projects.”

“Other Middle Eastern countries such as Oman and the UAE are also exhibiting demand in the construction industry. The major challenge that Sri Lankan enterprises face is a lack of exposure to high value projects in the global market. On all other fronts, Sri Lankan entities can compete strongly with competing organisations,” he avers.

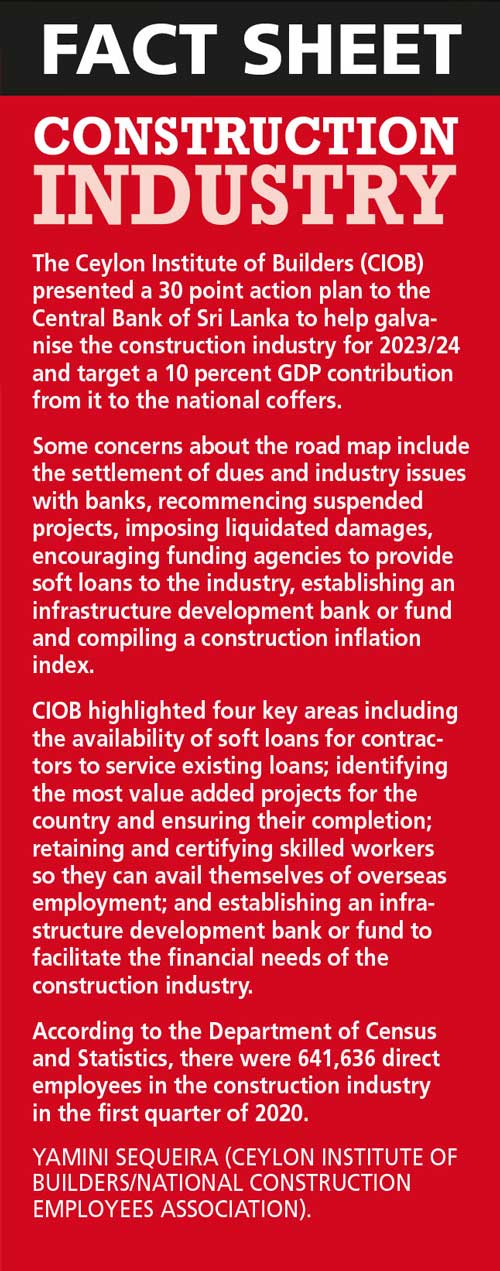

However, Prematillake points out that “the construction industry is witnessing the migration of skilled talent, which could become a challenge if the field sees rapid growth in the future.”

“Already, a shortage is being felt in terms of skilled workers such as quantity surveyors, engineers, business development executives and so on. That could lead to a need to import labour if this trend isn’t reversed,” he explains.

The National Construction Employees Association (NCEA) has revealed that over 600,000 direct employees and more than one million indirect workers in the construction industry lost their jobs by mid-2023, due to the suspension of projects and a lack of new ventures.

As a critical industry that is the backbone and a barometer of a thriving economy, construction needs good news by way of large contracts through foreign direct investments (FDIs). To this end, the recently relaxed import regime coupled with lower interest rates bode well for investors.

There also needs to be a concerted effort to educate and improve the skills of the workforce by means of a formula that’s relevant to all industries and sectors.

The interviewee is the Managing Director of Hayleys Fentons.

This content is available for subscribers only.