CENTRAL BANK POLICY

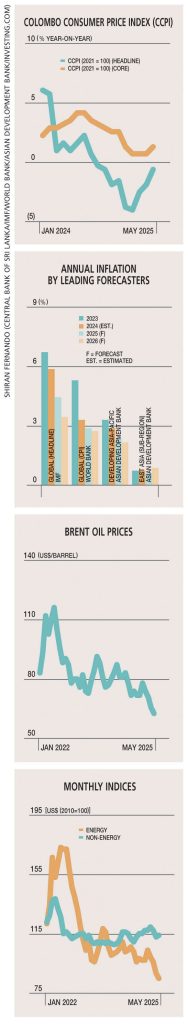

Sri Lanka’s inflation trajectory has remained subdued following the sharp surge in 2022. Headline inflation, as measured by the Colombo Consumer Price Index (CCPI), has been in deflationary territory (year-on-year below zero percent) for nine consecutive months since September 2024.

ECONOMIC UPS AND DOWNS

Shiran Fernando reviews the Central Bank of Sri Lanka’s forward strategy

However, inflation is expected to turn positive after June, partly due to the recent electricity tariff hike. Nevertheless, core inflation – which excludes volatile items – has remained positive, though occasionally below one percent, indicating that aggregate demand hasn’t weakened too much.

So let’s explore the future trajectory of inflation – and evaluate the impact that global inflation will also have for the remaining months of this year.

THE OFFICIAL VIEW According to the Central Bank of Sri Lanka, deflationary pressures have eased since March. It projects inflation to rise more gradually than previously expected and turn positive by early in the third quarter of 2025, before moving towards the target of five percent.

Core inflation is also set to pick up slowly from current low levels. Despite this expectation, the bank cut policy interest rates further in May, citing the need to ensure that inflation rises towards the desired target.

Another reason for the Central Bank to consider reducing interest rates is from a GDP growth perspective.

Growth eased to 4.8 percent in the first quarter of 2025, from five percent in the last three months of 2024. Some of the base effects and impacts from the initial round of reforms are also wearing off. Therefore, lower interest rates will stimulate consumption and investment, and facilitate higher credit growth.

An interesting data point to measure demand is to review the consumption of electricity by industry. According to the bank, consumption by the industry sector recovered to only 4,626 GWh last year, which was higher than 2022 and 2023 but lower than 4,822 GWh in 2021.

This is a proxy indicator that shows whether an economic recovery is still underway; and apparently, aggregate demand from the industry sector is yet to hog the limelight.

With this forecast for inflation, the Central Bank has considered the potential risks.

Upside risks to this outlook include adverse weather affecting agriculture and stronger than expected demand amid rising credit growth. Downside risks stem from a potential global demand slowdown, which could reduce energy prices.

GLOBAL INFLATION This is gradually cooling but remains above pre-pandemic norms, and reflects persistent pressures in services, labour markets and trade. According to the IMF’s April 2025 World Economic Outlook, global headline inflation is projected to decline to 4.5 percent this year, after reaching 6.8 percent in 2023.

In its June 2025 Global Economic Prospects, the World Bank projects a slightly lower figure of 2.9 percent for 2025, noting that elevated tariff levels by the US and tight labour markets continue to exert upward pressure on prices – especially in advanced economies.

While monetary policy tightening in most regions has helped reduce inflation from its peaks, central banks across the world remain cautious, particularly in economies where services inflation is proving to be sticky.

Regionally, developing Asia and the Pacific are seeing a much sharper disinflationary trend. In its Asian Development Outlook (ADO) of April 2025, the Asian Development Bank (ADB) forecasts inflation in the region to average 2.3 percent this year with some sub-regions such as East Asia experiencing inflation as low as 0.6 percent.

This moderation is largely driven by declining food and energy prices, more stable exchange rates and relatively subdued domestic demand in certain economies.

While this provides monetary space for regional central banks, the ADB also highlights downside risks from geopolitical tensions and trade protectionism – particularly due to the spillover effects of US tariffs on Chinese goods, which could change the path of inflation in the second half of 2025.

LOW OIL SHOCK Since the first half of 2022 when Brent crude prices surged above US$ 100 a barrel, oil prices have remained relatively stable despite multiple global shocks, including heightened geopolitical tensions in the Middle East, rising protectionism and uncertainty stemming from the global tariff war.

This relative stability can be attributed to several factors.

Firstly, market participants appear to be taking a more long-term view of oil fundamentals and discounting short-term volatility.

Secondly, persistent concerns around slowing global demand driven by weaker economic momentum in advanced and emerging markets have moderated expectations of sustained price increases.

Moreover, the perception that any supply disruptions can be offset by alternative producers particularly in the Middle East and the US shale sector has added a layer of resilience to the market. This is a welcome development for Sri Lanka, as it eases external sector pressures and contributes to more stable import costs.

However, there remains the risk of a black swan event such as geopolitical turmoil or a disruption to the supply chain. Such a scenario underscores the importance of vigilant monitoring of global energy market developments.