BUSINESS STARTUPS

THE SCIENCE OF VALUATIONS

Taamara de Silva offers insights into how startup valuations are compiled

Are you a smart and daring Sri Lankan, brimming with passion and ready to embark on an ambitious venture? And are you prepared to stake your claim by disrupting the manner in which products and services are offered today?

If the answer is ‘yes,’ your enthusiasm would have seen you cash in your savings to build an amazing product prototype – the minimum viable product! But it is then that the problem arises. How do you launch it?

Obviously, you need money – for which investors would have to enter the picture. But before approaching them, you need to figure out the investment required. In other words, how much is your product worth? Not knowing the answer to this would be the worst part.

It’s commonly said that business valuation is more art than science. If this is true, valuing a startup is squarely in the domain of the artist. However, it’s possible to master the art and assign a value, which makes sense to you and is aligned with the expectations of potential investors.

The real issues in startup funding are the two variables used to come up with a valuation: cash (economics), which encompasses how much an investor pays for shares; and equity (control) or how many shares are issued to investors.

Of course, the entrepreneur’s supply curve and investor’s demand curve intersect in a zone where both can reach mutual agreement. This is the sweet spot. Yet, transactions often close on the basis of the bargaining power of the parties concerned.

So the best way to approach this issue is to put yourself in the shoes of an investor… and ask yourself a few questions.

Is the startup in a hot sector or do you have an experienced and proven management team? For instance, a serial entrepreneur can command a higher valuation. Do you have a functioning product (this may be more applicable to companies in the early stages)? Do you have traction? In other words, do customers see value in your product?

Business valuation of any kind is never cut and dry. For startups with little or no revenue and an uncertain future, assigning a valuation is especially tricky. However, for mature businesses that are publicly listed and have a steady revenue, specific facts and figures are used to determine a value.

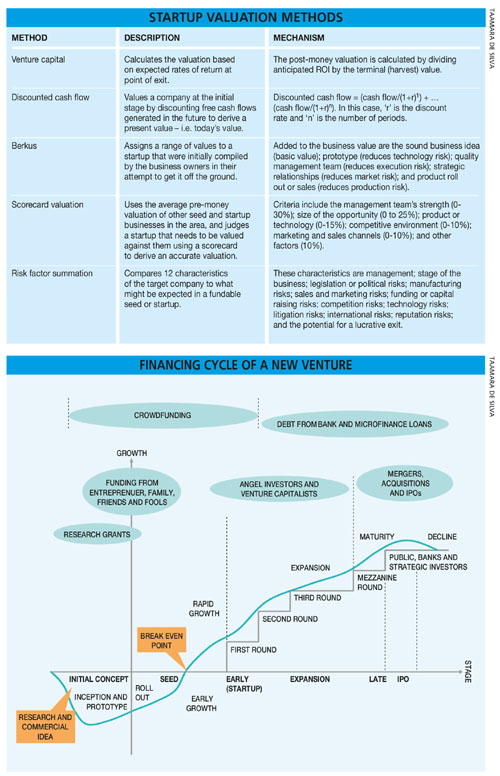

New venture financing begins with an initial concept that is self-funded or through generous contributions from friends or family until it breaks even. Seed funding options are also available at this point including crowdfunding, which can be explored as an alternative.

However, rapid growth can be achieved when venture capital or angel investors, or a combination of both, invest through funding rounds. The initial round of funding is typically used to establish a product in the market and take the business from the growth stage to the next phase of expansion.

Subsequent funding rounds would be required when the company is relatively established and needs to expand by hiring more staff, penetrate new markets or even consider acquisitions. These rounds will take the company from the expansion to maturity stage in the business life cycle.

The mezzanine round is in fact an intermediate round and is recognised as bridge financing shortly before a company goes public. Having reached its maturity stage, it can consider mergers, acquisitions and listing on a stock exchange through an IPO.

This may also signal the exit stage for venture capitalists who intend to capitalise on their investment gains and repatriate profits back to their fund’s investors. In essence, the startup investment journey for early stage investors would have completed its full circle by then.

There are a few models that could be considered to value a startup but businesses shouldn’t stop at one approach. Sophisticated angels and entrepreneurs will want to use several methods because no single method is useful every time.

Multiple methods also help in the negotiation process because an average can be determined between them!

Leave a comment