BUSINESS SENTIMENT

A LESS MERCURIAL BAROMETER

A rise once more in the exclusive business barometer raises hope of better times

The implications of Budget 2023 – and a reassessment of cash flows, assets and liabilities – will occupy the minds of corporates as the new tax rates and policies kick in. But there’s been a sense of optimism in recent times even as people acknowledge and realise that difficult times lie ahead for everyone, if the national economy is to recover and stabilise.

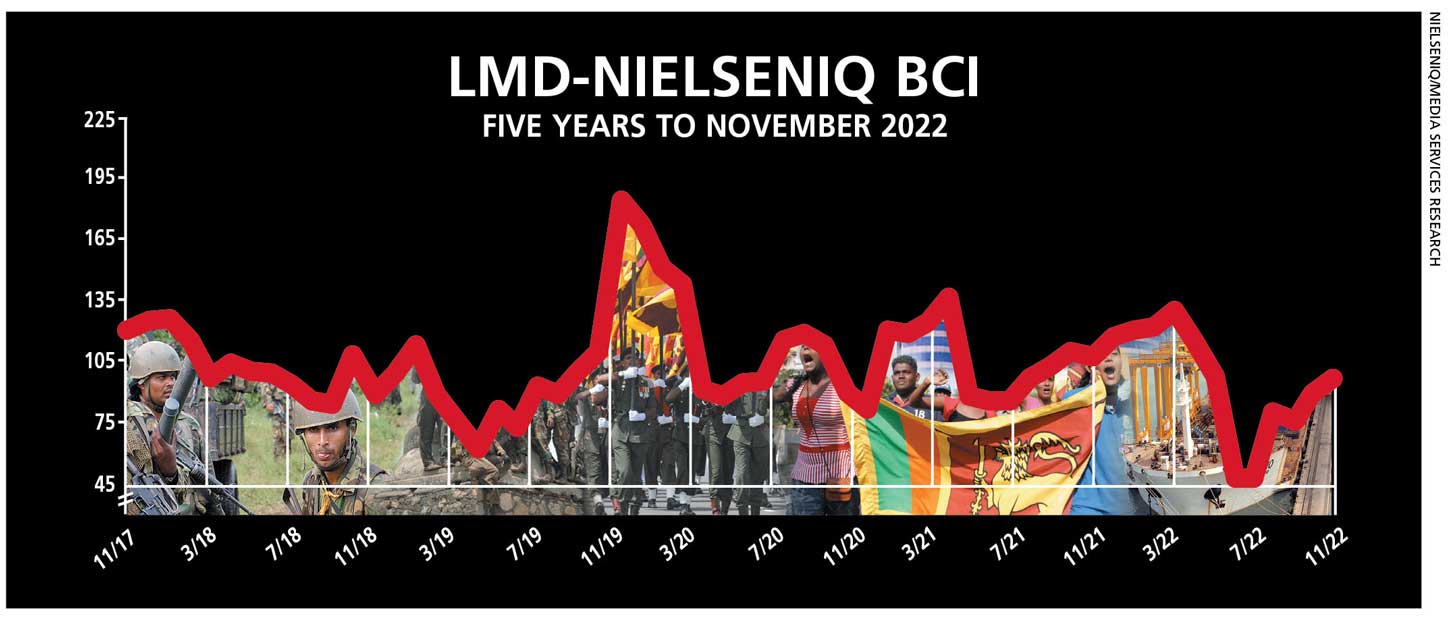

THE INDEX It is a relief to note that once again, the LMD-NielsenIQ Business Confidence Index (BCI) has climbed another nine basis points – from 89 in October to 98 a month later.

So the barometer of business sentiment is now only 11 basis points shy of where it stood a year ago (109); and it is hoped the new year will see this cautious optimism intact. That said, the index is still well below March’s 132, the highest so far this year despite the advent of fuel shortages, power outages and the rupee’s demise.

NielsenIQ’s Director – Consumer Insights Therica Miyanadeniya asserts: “As we approach the end of 2022, which was a turbulent year, expectations of better things to come in 2023 are high on the radar.”

SENSITIVITIES To a stranger’s eye and if the traffic on the streets is anything to go by, it may seem as if Sri Lanka is over the worst of its economic worries. In fact, the uncertainty in the air over recent months appears to have been replaced by a sense of cautious optimism.

But the truth is that many nations – First World countries included – are facing the reality of hard times to come. And here at home, inflation remains high on the list of concerns, followed by the level of forex reserves, the new tax regime and the value of the rupee.

PROJECTIONS The question on everyone’s lips is whether or not the measures and reforms announced in Budget 2023 will suffice not only to secure the IMF’s Extended Fund Facility (EFF) of US$ 2.9 billion but also kick-start an economic revival.

Indeed, the jury is out on the pros and cons of the budget presented on 14 November, and we will know the verdict when next month’s survey gets underway in the first week of December – and we report on its outcome in next year’s first edition of LMD.

Beyond the fiscal landscape, there are external risks such as the ongoing war in Ukraine and the prospect of a world recession in particular.

Internally, the sensitivities include the outcome of ongoing debt restructuring talks, coupled with renewed calls for an election by opposition forces and other radical elements on the periphery, which could put political instability back on the table in the new year.

On the other side of the table so to speak, is the prospect of tapering inflation – which would relieve both businesses and the people of the extreme hardships they’re facing – and to this end, what the Governor of the Central Bank of Sri Lanka Dr. Nandalal Weerasinghe said at a parliamentary advisory committee meeting on 17 November bodes well, albeit that it is against the backdrop of a sky high base: “With present monetary policies, inflation would be controlled at four to five percent by the end of next year.”

Whether we should work and live in hope therefore, is a matter of conjecture.