BUSINESS SENTIMENT

BUSINESS CONFIDENCE CRASHES

The perilous state of the nation sends the sentiment index into a tailspin

The new Inland Revenue Bill was passed in parliament in early September with a view to streamline the system of taxation, broaden the tax base and grow government revenue as outlined by the International Monetary Fund (IMF) when it approved a three year loan facility for US$ 1.5 billion.

Speaking to reporters recently, Vice President – Sovereign Risk Group of Moody’s Investors Service William Foster noted: “The reforms of the Inland Revenue Act offer prospects of higher revenues. The implementation of revenue reforms that foster long-term fiscal consolidation will be critical to shoring up Sri Lanka’s credit profile, which is weighed down by the country’s large debt burden and relatively weak debt affordability.”

Meanwhile, investors await greater clarity on the new tax law to gauge its real impact. And it could well be that any related apprehensions may have filtered down to the corporate level as reflected by the bombshell that came with the latest update of the unique LMD-Nielsen Business Confidence Index (BCI).

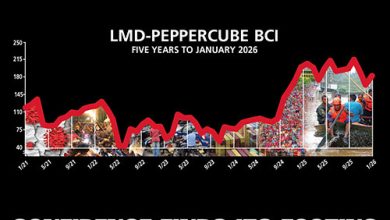

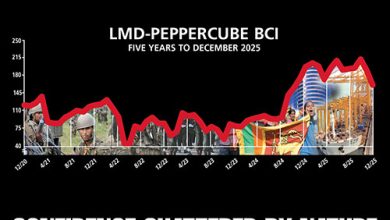

THE INDEX In September, the BCI plummeted to below the psychologically important mark of 100 basis points – at a lowly 99, the index shed a massive 22 basis points from the previous month and now lies at a 64-month low.

So this is the first time since June 2012 – when Sri Lanka was grappling with the iron fist of the United Nations Human Rights Council (UNHRC), following its damning resolution in March that year alleging war abuses – that the index has fallen to double digits.

Ironically, the last occasion on which the BCI fell by more than 20 points was in the aftermath of last year’s budget presentation – the hope therefore, is that there will not be a repetition of that post next month’s Budget 2018 proposals.

Nielsen’s Managing Director Sharang Pant explains that “the volatility of the last few months – where the index has seen wild swings from 115 to 134, then down to 121 and now 99 – is due to knee jerk reactions to both positive and negative news.”

He continues: “So while the index was largely governed by trends in inflation, taxes and interest rates, in the latter half of 2016 and early part of 2017, the ups and downs of the last four months are related to positive and negative news in the country.”

“Despite favourable changes on the inflation front, the passing of the new Inland Revenue Bill and tax on data being reduced, businesses and consumers are seeking transparency and corruption free governance to tide over such shocks.”

THE ECONOMY The outlook on the economy has also suffered as less than one in 10 respondents now feel it will ‘improve’ in the coming 12 months. This figure stood at around one in five (21%) in the previous month and nearly a third six months ago.

Speaking to the pollsters, a corporate executive laments: “There does not seem to be any systematic implementation within the government to take the economy forward and nor is there a solution for this.”

A slightly more optimistic respondent notes that “the economy at present is at a standstill; however, there’s potential for growth especially in the tourism industry and real estate sector.”

BIZ PROSPECTS Sentiment on business performance too has taken a beating with only 22 percent and 19 percent of those surveyed foreseeing better prospects for their businesses in the long and short terms respectively – the corresponding scales of optimism in the preceding month were 48 percent and 29 percent respectively.

INVESTMENT The investment climate continues to be viewed as being unattractive with 87 percent of BCI survey participants deeming it to be only ‘fair’ or worse. With regard to prevailing conditions, a member of the biz community opines that “compared to last year, we can see a downturn in the investment climate.”

“The finance sector has been greatly impacted owing to constant policy changes by the government,” observes another businessperson who says that “people are reluctant to invest” because of this.

This view is echoed by another survey respondent: “With the constant changes in government policy, many businesses are reluctant to invest in Sri Lanka.”

WORKFORCE Seventy-seven percent (versus 82% in the prior month) of corporates say they plan to maintain their workforce at existing levels in the coming six months.

In the meantime, the share of those looking to increase their staff numbers has grown to 17 percent in September from 15 percent in August, which is an encouraging sign.

SENSITIVITIES Business leaders appear to be calling out inconsistency in economic policy making and the lack of a skilled workforce as reasons for deferring their investment plans.

Moreover, they assert that “the public doesn’t have sufficient disposable income and there seems to be an increase in corruption in the government.”

Another businessperson also remarks that “many of the country’s resources are being underutilised. Import revenue as well as the exchange rate are in a very bad state…”

PROJECTIONS In last month’s edition, we felt that while Nielsen’s September survey of businesspeople was likely to be an eye-opener on many counts, it was “unlikely that a major shift in the BCI’s fortunes (or indeed, misfortunes) would eventuate in the near term” – such was the state of the nation at that juncture.

As it turns out, we were wrong. The latest BCI survey results will surely come as a rude shock to even the most pessimistic forecasters.

It follows that the next few months will be closely watched as businesspeople react to the new Inland Revenue Act and unfolding tax regime, and inflation, as well as the forthcoming budget proposals. And there’s now a risk that political hara kiri could return to plague a nation that is already reeling from the ill effects of widespread corruption in the past and at present.

It would seem that at this point, one can only hope for the best – and that could well be that the index doesn’t continue to slide.