BUSINESS SENTIMENT

Having endured a challenging period, Sri Lanka formalised an agreement with its bilateral creditors led by Japan and India to the tune of US$ 5.8 billion recently.

INDEX DIPS AS CHALLENGES PERSIST

Business confidence trends down following four successive months of moderate progress

Sri Lanka also closed a US$ 12.5 billion International Sovereign Bond (ISB) restructuring arrangement with the parties reportedly agreeing on the financial terms.

And in early June, the IMF concluded the second review of Sri Lanka’s bailout programme under its Extended Fund Facility (EFF), making way for the release of US$ 336 million in funds.

Despite emerging signs of a recovery however, the global lender of last resort warned that the economy remains vulnerable.

The International Monetary Fund emphasised the critical need for Sri Lanka to restore fiscal and debt sustainability to overcome the economic crisis – achieving sustainability is essential not only for the economy to recover from its current crisis but also to prevent a recurrence of the severe economic conditions experienced in 2022, it explained.

Additionally, President Ranil Wickremesinghe announced that Sri Lanka is now free to pursue a new economic direction. The necessary legal framework has been submitted to parliament to build an export-oriented economy, he added.

Meanwhile, the World Bank’s latest Global Economic Prospects report projects that Sri Lanka’s economy will expand by 2.2 percent this year. This represents a 0.5 percentage point upward revision from January, supported by modest recoveries in remittances and tourism.

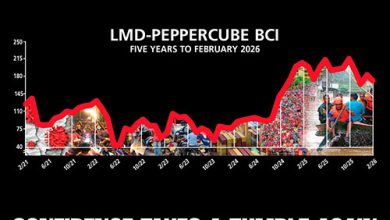

THE INDEX Following its gradual rise for four consecutive months, the LMD-PEPPERCUBE Business Confidence Index (BCI) registered a decline in July, dropping to 96 after surpassing the 100-point threshold in the prior month. This rise above 100 – which was the first in over a year – was short-lived, likely due to the uncertainty that stems from the impending presidential election.

What’s more, the index remains well below its all-time average of 122.

PepperCube Consultants notes that July’s findings reflect a mix of optimism and pessimism in business circles. It adds that while the economy continues to be the most pressing national issue, the cost of living and upcoming poll remain critical concerns.

SENSITIVITIES The business community continues to contend with the effects of political interference, which ranks as the foremost concern among survey participants, followed by high taxes and political instability.

Critical indicators such as inflation, despite being in single digits, and the brain drain continue to cast doubts about the country’s growth prospects.

PROJECTIONS The political unrest and instability that come with an election are likely to undermine any sense of recovery in the commercial and economic sectors.

While there is much to celebrate for having achieved our debt restructuring goals, the outcome of the presidential election – in all probability in October – will certainly have an impact on both business and investor confidence.

Against this backdrop, we expect the BCI to come under pressure in the near term.