BP TAKES HIT OF UP TO US$ 17.5 BILLION

BP faces hit of up to $17.5bn as it forecasts lower oil prices

BP has forecast lower oil prices for decades to come as governments speed up plans to cut carbon emissions in the wake of the coronavirus pandemic.

It has cut price forecasts by about 30%, and expects Brent crude to average $55 a barrel from now until 2050.

As a result, the oil giant says it will revise down the value of its assets by between $13bn and $17.5bn (£13.8bn).

BP said it would have to become a “leaner, faster-moving and lower cost organisation”.

Last week, the firm announced plans to cut 10,000 jobs following a global slump in demand for oil.

Countries across the globe have ordered people to stay indoors and not travel as a result of the coronavirus pandemic, which has caused a slump in demand for oil.

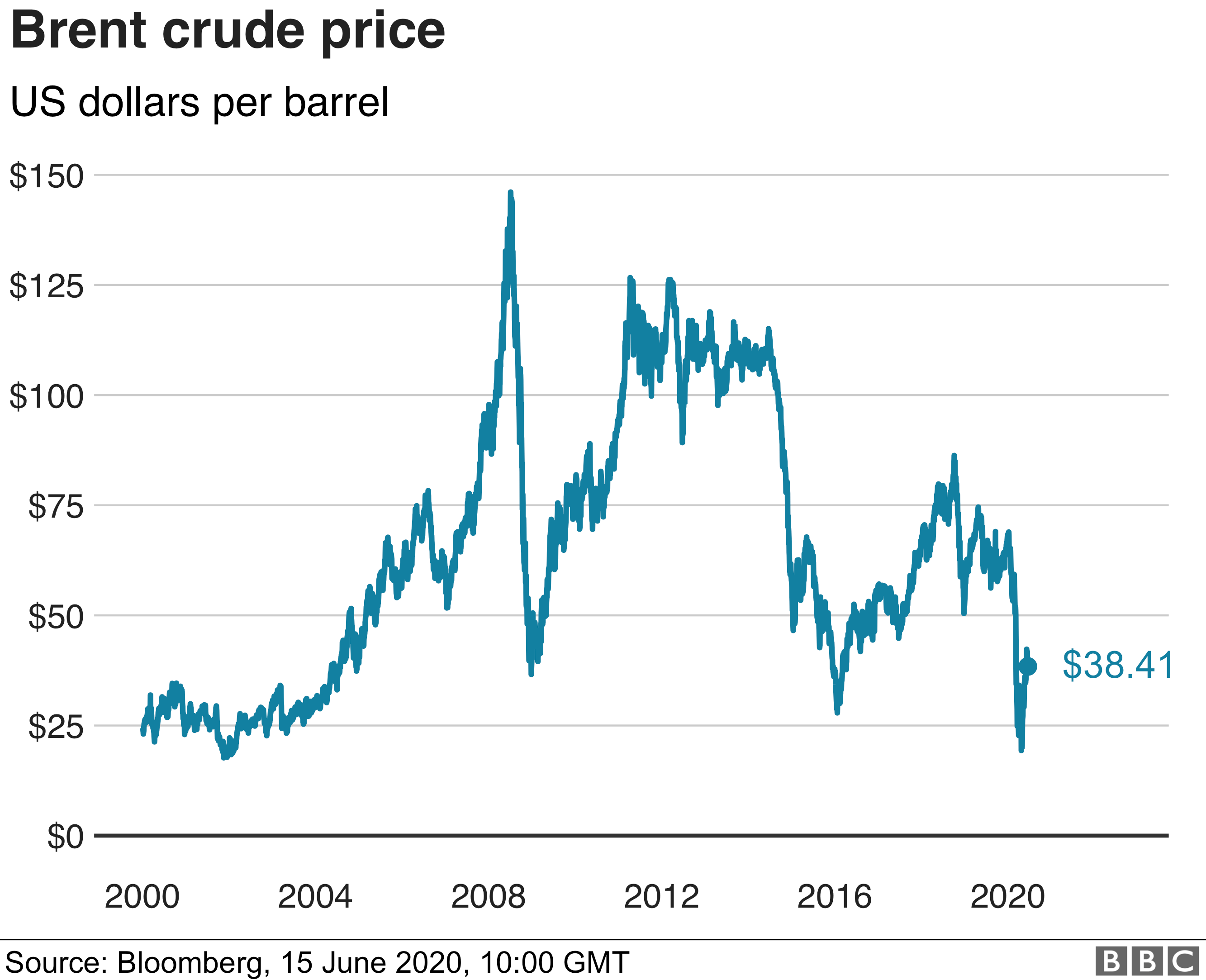

As a result, the cost of oil fell to less than $20 a barrel at the peak of the crisis, less than a third of the $66 it cost at the start of the year.

‘Lower carbon economy’

For a brief period buyers were actually paid to take delivery of crude oil amid a shortage of storage.

The price has since partly recovered to around $37 a barrel.

BP says it has “a growing expectation that the aftermath of the pandemic will accelerate the pace of transition to a lower carbon economy and energy system, as countries seek to ‘build back better’ so that their economies will be more resilient in the future”.

The BBC’s environment analyst, Roger Harrabin, said: “The North Sea is difficult and expensive to exploit, so this is clearly a business-based decision by BP.

“But the ramifications for the climate are potentially very significant. Experts have been warning for years that firms have already discovered far more oil than we can afford to burn if we want to protect the climate.

“This, in part, is a reflection of that new reality. We’ll see how other firms respond.”

When Bernard Looney took over as BP chief executive in February, there was much talk that he, finally, would reshape the company in line with the need to combat climate change.

His predecessors – going right back to John (now Lord) Browne had often spoken of it, but “Beyond Petroleum”, Lord Browne’s phrase for a new-look BP, had often been held back by financial imperatives – not least of which the tens of billions of pounds spent in compensation and clean-up payments after the tragic Gulf of Mexico blow out in 2010.

The coronavirus has now rather forced Mr Looney’s hand.

He has already announced that 10,000 jobs will go worldwide in response to lower demand for oil, and this morning’s statement is the first step in confronting what Mr Looney believes will be a harsh new reality for big oil.

Not only will prices be lower for longer, but government efforts to rebuild the economy will mean a faster-than-expected shift to low-carbon sources of energy.

That means that the value of the oil in the ground that BP plans to develop is lower than forecast, and that some fields might never be developed.

This is a powerful echo – although it does not come from the same argument – of environmental campaigners’ “stranded assets” thesis.

This says that oil companies will have oil fields that will not be able to be developed at all if we are to keep climate-change induced temperature increases in check.

The question now is whether other big oil companies, in particular the US giant Exxon, which has been resistant to climate-change arguments, will follow suit.