AMANA BANK

Amãna Bank Geared To Grow SMEs

Realizing the significance of the Sri Lankan SME Industry, Amãna Bank, the country’s one and only licensed commercial bank to fully disengage from interest based transactions, has over the years nurtured the entrepreneurial effort by offering a host of business friendly financing solutions.

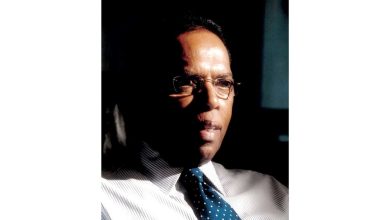

With a focus of being an SME Bank, Amãna Bank aspires to be a driving force in propelling the SMEs to go to the next level. Explaining this strategic focus, the Bank’s Senior Vice President Corporate & SME Banking M.M.S. Quvylidh said “We are dedicated to provide and improve access to suitable financial services to the SME sector and nurture their entrepreneurship, whereby we support them in achieving their true potential and at the same time become a major contributor to the growth of the national economy. We want to see the SMEs banking with us progressing in the sectorial ladder and go up the value chain, where today’s micro, small and medium entrepreneurs will be one day successful in transforming themselves to macro level corporate organizations.”

Further adding Quvylidh said “Our unique financing model facilitates us to do this, as we mainly operate on a partnership basis, where we are geared to face the risk and rewards of the business together with our customers as true partners in progress and stand to benefit only through its success.”

“Our financial solutions are designed to be accessible to all, which includes Working Capital Financing, Short Term Financing, Capital Expenditure Financing as well as Leasing Facilities. We have also recently setup a dedicated SME and Commercial Leasing unit to facilitate the opportunity for customers to benefit from the higher financing to value ratio imposed by the Central Bank” said Quvylidh.

Explaining how the Bank met the various financing needs of its customers Quvylidh stated “Many of our customers were used to the array of financial services available at conventional Banks, whereas we were unable to finance certain requirements due to not having a suitable non-interest based alternative. To cater to such requirements, overtime we introduced many alternative products such as overdraft facilities, project financing as well as financing for cultivation.”

“The Bank has had good exposure across the key economic sectors. In the agricultural sector we have been supporting rice milling and storing as well as fresh produce cultivation with the introduction of an alternative solution. Further we have also supported SMEs who are dealing with traditional crops such as Tea, Rubber and Coconut, while also supporting the animal husbandry business by financing shrimp farming, dairy, poultry, leather, fisheries and many others” added the Senior VP.

Showcasing the Bank’s focus towards those SMEs in the Industry sector, Quvylidh further said “We have extended our people friendly solutions to the garment industry where we support those SMEs who are into manufacturing, factory modernization and handloom, while also building a strong presence in the Confectionary, Timber and Plastic Industries.”

“The service sector continues to be one of the key focus sectors of the Bank” Quvylidh added further saying “The economic value addition by the service sector continues to grow, and over the years our products have been well accepted by those in IT, Tourism, Healthcare, Education, Transport, Energy, Wholesale and Retail Trade as well as the booming Real Estate market.”

The Bank has also had a strong presence in Project Financing. In recognition of the Bank’s efforts to finance projects of SMEs, the Bank was bestowed with the ‘Islamic Finance Deal of the Year’ accolade conferred at the Sri Lanka Islamic Banking and Finance Industry Awards for many consecutive years. Such accolades were bestowed on projects such as setting up a mini hydro power plant, financing of a domestic airline, establishing the country’s first sustainable oceanic fish farm in the open sea 2 kms off the Trincomalee coast, commissioning of Sri Lanka’s largest and most modern livestock feed mill as well as financing the manufacturing of multiday fishing vessels.

The Bank’s SMEs clients are not only limited to financing solutions but are also benefited from an array of Trade Services. “To facilitate the smooth operations of our customer’s import and export business we offer comprehensive, convenient and speedy Trade Services as a one stop solution such as LCs, Shipping Guarantees, General Guarantees, Custom Bonds and many more” said Quvylidh.

As a part of its unique banking model, the Bank extends its services in developing fiscal strategies that suits the SMEs by partnering in all stages of its growth, making sure it caters to a competitive business landscape. “This is a key difference in our Banking model” explains Quvylidh mentioning “With a thorough understanding of their limited access to markets, skills and capital, we offer a service proposition that will augment their business to the next level. Through the assistance of a dedicated relationship manager for each and every customer, such additional services include helping customer identify their financing needs, identifying their income sources and cash flows, structuring their facilities according to the business flow as well as advising and guiding on the preparation of financials and establishing the necessary management structures and processes.”

Sharing his concluding remarks the Bank’s Senior VP said “With the digitalization of Banking, SME customers are seeking for more conveniences in their day to day Banking. For this purpose, we have facilitated our customers with Online Banking, Real Time External Fund Transfers, SMS Alerts, Cash Deposit Machines as well as E-statements. These conveniences together with our wide range of financing solutions have made us ready and geared to grow SMEs and we look forward to becoming a catalyst in their journey towards success.”

With a mission of Enabling Growth and Enriching Lives, Amãna Bank reaches out to its customers through a network of 28 branches, 4000+ ATM access points, Internet & Mobile Banking, Debit Card with SMS alerts, Online Account Opening, 365 Day Banking, Saturday Banking, Extended Banking Hours, 24×7 Cash Deposit Machines and Banking Units Exclusively for Ladies.

The Bank was recognized as the Best ‘Up-and-Comer’ Islamic Bank of the World by ‘Global Finance Magazine’ at the 18th Annual World’s Best Banks Award Ceremony held in Washington DC, USA. The Bank was also bestowed the coveted title ‘Islamic Finance Entity of the Year’ at the inaugural Islamic Finance Forum of South Asia Awards Ceremony.

Amãna Bank PLC is a stand-alone institution licensed by the Central Bank of Sri Lanka and listed on the Colombo Stock Exchange with Jeddah based IDB Group being the principal shareholder having a 29.97% stake of the Bank. The IDB Group is a ‘AAA’ rated multilateral development financial institution with an authorized capital of over USD 150 Billion which has a membership of 57 countries. Fitch Ratings, in October 2017, affirmed Amãna Bank’s National Long Term Rating of BB(lka) with a Stable Outlook. Amãna Bank does not have any subsidiaries, associates or affiliated institutions representing the Bank.