FISCAL OUTLOOK

Following Sri Lanka’s difficult but successful macroeconomic stabilisation, the World Bank’s Public Finance Review serves as a guide to the next phase, detailing how to transform the country’s huge fiscal adjustment into a durable, pro-growth and fair economic foundation.

SRI LANKA’S PATH FROM CRUNCH TO CLIMB

Prashanthi Cooray examines the World Bank report on Sri Lanka’s, recovery measures and strategies for growth

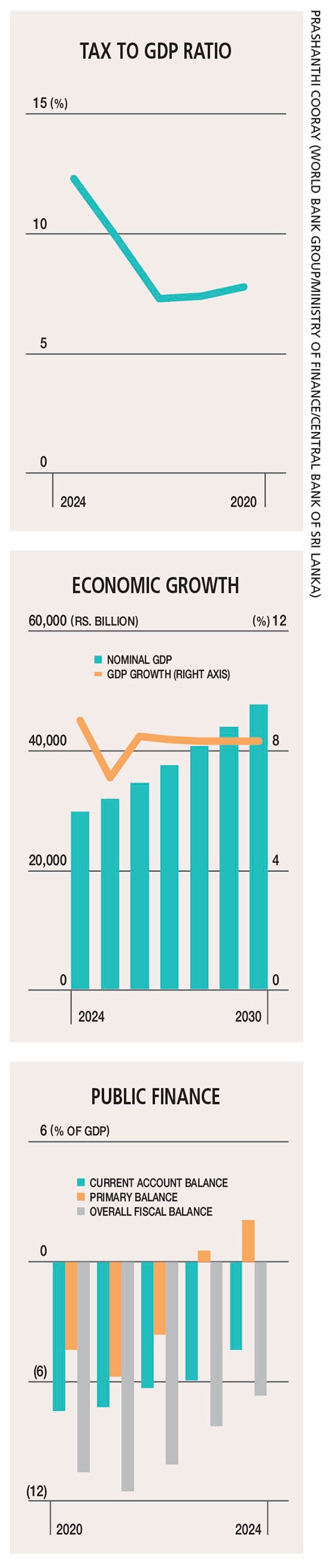

Sri Lanka’s stabilisation process has needed a historically and internationally large fiscal adjustment, amounting to nearly eight percent of GDP since 2021. The primary balance, which is a key indicator of fiscal health, improved by a striking 7.9 percent of GDP between 2021 and 2024.

However, this turnaround was heavily reliant on indirect taxation.

More than 75 percent of the increase in revenue stemmed from these regressive taxes, which disproportionately affect low income earners. While the tax to GDP ratio increased to 12.3 percent in 2024, future revenue mobilisation must be structured to avoid further harming equity and growth.

Under the government’s current medium-term fiscal framework (MTFF), revenues are expected to increase from 13.6 percent of Gross Domestic Product in 2024 to 15.1 percent by the end of this year, climbing to 15.3 percent by 2028. This path requires raising an additional 1.5 to two percent of GDP in revenue by 2029 through targeted reforms.

With further spending cuts being unfeasible, the report suggests boosting revenue and improving the efficiency of existing expenditures. Between 2017 and 2023, government spending averaged 19.5 percent of GDP, which is not large by international standards, placing the focus squarely on quality and not quantity.

The recommended path for revenue mobilisation involves a three pronged approach targeting tax policy, administration and morale.

On the policy side, this includes introducing a minimum corporate income tax at an effective rate of 15 percent and adopting a comprehensive framework for tax incentives, alongside publishing their costs and benefits.

In terms of administration, the priority revolves around digitising the Inland Revenue Department (IRD) and adopting risk based enforcement methods.

And finally, to strengthen taxpayer morale, measures such as simplifying processes including electronic filing, ensuring stability in tax policy (with no changes during a year) and guaranteeing prompt tax refunds are emphasised to build public trust.

Reforming how money is spent is crucial, particularly since capital expenditure fell to 3.4 percent of GDP in 2023 – a decline from the 2017–2022 average of 4.4 percent. Investments should be reprioritised towards addressing major infrastructure gaps and increasing allocations for routine maintenance.

Sri Lanka’s wage bill reached five percent of Gross Domestic Product in 2023 and the report calls for easing this burden by gradually reducing staff through attrition, ensuring frontline services remain intact, and establishing a pay commission to bring greater fairness and consistency to public sector wages.

Transfers and subsidies – which averaged only 1.6 percent of GDP between 2017 and 2023 – should be restructured by phasing out universal subsidies for the likes of fertiliser and water, replacing them with highly targeted transfers to ensure support reaches the most vulnerable people.

While Sri Lanka has navigated its way out of an immediate crisis, the recovery is far from over. After experiencing a cumulative economic contraction of 9.6 percent in 2022 and 2023, the economy is estimated to have rebounded by around five percent in 2024.

However, the full effect of the crisis means the country is only projected to regain its 2018 real GDP level next year.

The restoration of macroeconomic stability is evident in the external sector, where usable official reserves climbed to US$ 4.7 billion at the end of 2024 – that’s a marked turnaround from net foreign assets that were 6.4 billion dollars in the red in 2022.

To sustain positive momentum, the government anticipates a medium-term growth rate of five percent, which would help make fiscal adjustment more manageable if achieved.

While progress has been made in restoring stability, sustaining the recovery will require deep structural reforms focussed on stronger revenue mobilisation and measures to ensure that fiscal adjustment does not disproportionately affect people’s daily lives.