BLOCKCHAIN TECHNOLOGY

DIGITAL FINANCE PROSPECTS

Samantha Amerasinghe highlights the impact of blockchain on emerging markets

Blockchain is often referred to as a ‘radical innovation’ or general-purpose technology not unlike the steam engine or electric motor – in other words, it is a technology that can create ‘subsequent innovation and productivity gains across multiple industries’ similar to the internet before it.

Most of the attention surrounding blockchain has taken place in developed economies but its greatest potential lies in emerging markets. Advocates for blockchain technology have called it a pillar of the Fourth Industrial Revolution while sceptics dismiss it as an ‘overhyped combination of existing technologies.’

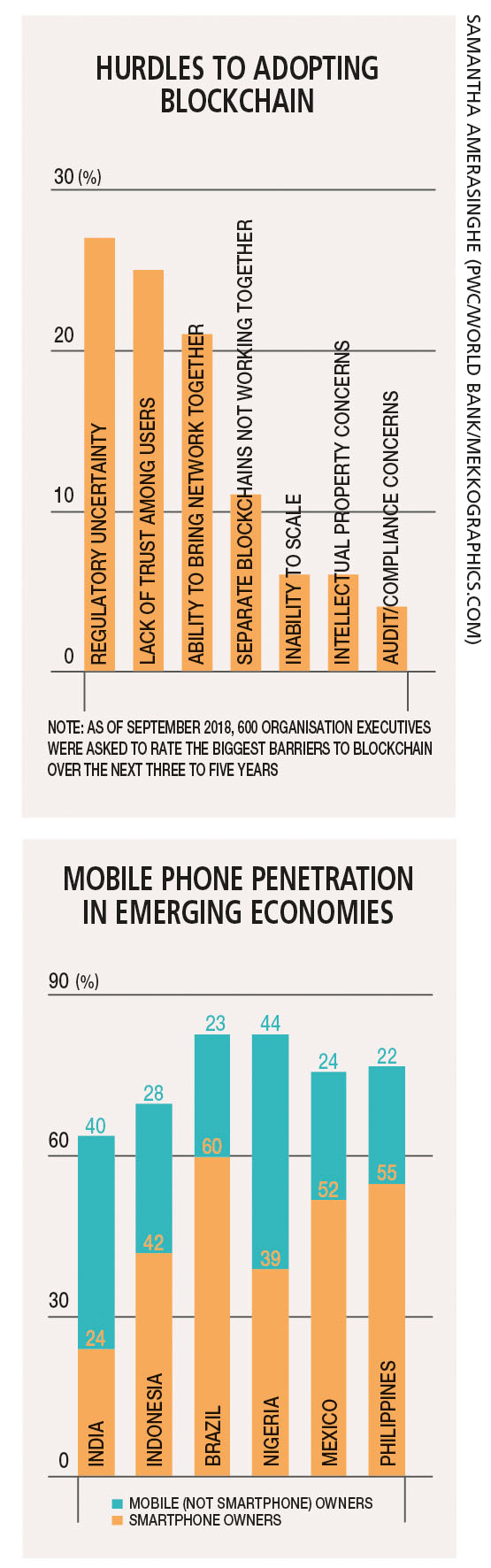

Despite the enormous potential that blockchain technology presents, there is no shortage of challenges to its adoption and efficient implementation. Interestingly, the COVID-19 pandemic has helped push through some of the obstacles to blockchain adoption.

Blockchain remains in its early stages of development but may prove valuable to emerging countries – they are ideal for the adoption of blockchain based financial solutions due to their underserved populations, lower bank penetration and legacy systems, and greater presence of digital financing.

The convergence of these factors could result in a technological leapfrog that boosts financial inclusion and growth. This happened with mobile technology in many emerging market regions particularly Sub-Saharan Africa.

In many cases, emerging economies have a relative lack of incumbents in financial services with significant market power to block new entrants. Existing infrastructure is weak in almost all low income countries. This also means there’s likely to be less organisational resistance to the new technology and lower transition costs of moving to a fresh system.

Many emerging countries have large populations that remain underserved in terms of financial and banking services due to the high cost of customer acquisition. Additionally, the extensive use of mobile based services particularly in Africa and Asia makes it easier to extend blockchain based services.

Mobile penetration is extremely high even in lower income countries – 83 percent among the working age population. Blockchain has the potential to generate up to US$ 380 billion in additional revenues if it achieves the longstanding goal of financial inclusion by serving previously unprofitable customers and SMEs.

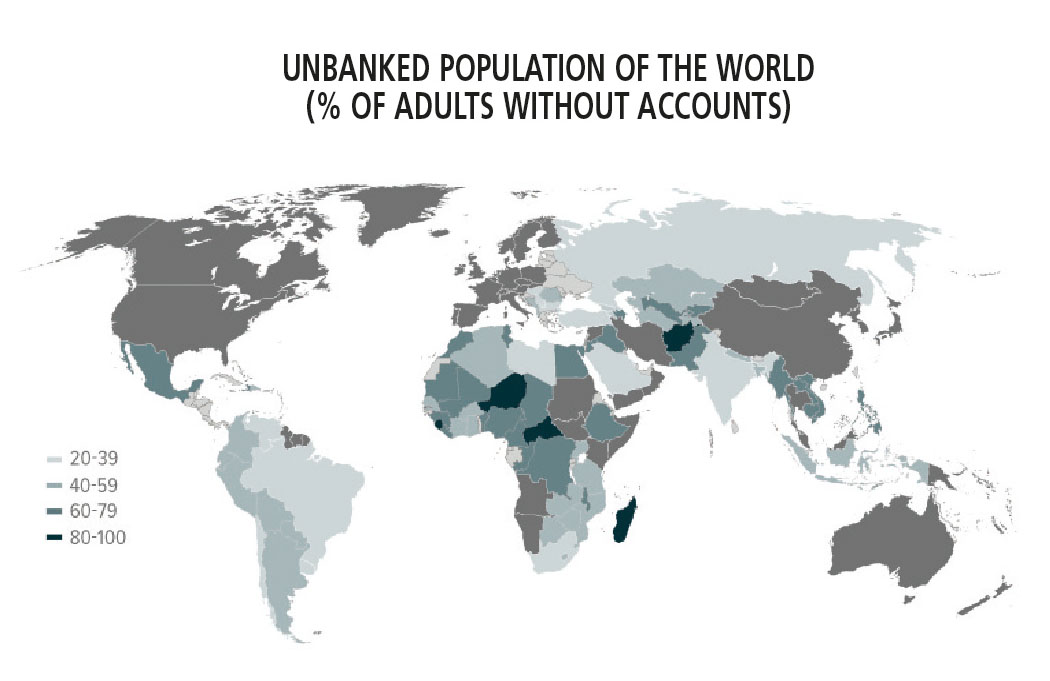

Globally, about 1.7 billion adults remain unbanked – they are without an account in a financial institution or through a mobile money provider.

Account ownership is nearly universal in high income countries and therefore, virtually all unbanked adults live in the developing world. Nearly half live in seven developing economies – viz. Bangladesh, China, India, Indonesia, Mexico, Nigeria and Pakistan.

It is imperative that there’s strong support from local governments and financial institutions in these countries to leverage the potential of blockchain.

Many emerging markets experienced a reduction of available financial services in recent years as banks and other institutions undertook de-risking in the wake of the financial crisis. Blockchain can help reverse this trend through its ability to reduce regulatory costs and increase transparency.

Other benefits of blockchain include facilitating remittances and reducing the cost of trade finance, both of which boost growth and improve standards in poor countries. This in turn helps individuals establish a digital identity at a lower cost, which is necessary to gain access to financial systems. It also has the ability to complement rapidly growing mobile platforms in the developing world.

The US (representing 54% of the blockchain innovation space) and Europe continue to lead the world in blockchain adoption and innovation. However, their dominance is being challenged by Asia – and China in particular. Blockchain based applications and services are also springing up across Africa and Latin America.

Many emerging market governments are aware of blockchain’s substantial potential benefits but they’re wary of the risks. Operational risks include system outages, security, resiliency and capacity, while blockchain’s limitations in confidentiality, privacy and scalability should also be considered.

Some countries are becoming major financial supporters of blockchain technology with the hope of providing their economies with a technological advantage and boost to growth. For example, China has explicitly made blockchain a pillar of its economic development strategy.

Asia is becoming a global leader for venture capital investment and testing of blockchain solutions but there are stark differences across the region. China, Hong Kong and Singapore lead the way.

Blockchain technology’s adoption in the region has been facilitated by the digitalisation of payment solutions particularly in China. Asia has become a champion of blockchain development due to strong government and regulatory support, and sustained access to venture capital.

China’s government is piloting a sovereign blockchain digital currency, led by the central bank – the People’s Bank of China. Its appetite for blockchain is anchored in its enormous demand for financial inclusion.

COVID-19 has revealed weaknesses in global supply chains, countries’ inability to deploy resources where they are most needed, and difficulties in capturing and sharing the data needed to make rapid decisions. Blockchain solutions such as the open data hub MiPasa (which have been under development for years) have been repurposed to address these challenges.

However, blockchain technology will need to overcome serious technical, organisational and regulatory challenges before it gains widespread adoption. Companies and regulators in emerging markets will have to strike a balance between allowing sufficient space for innovation to flourish while also effectively managing the associated risks and costs.