US MONETARY POLICY

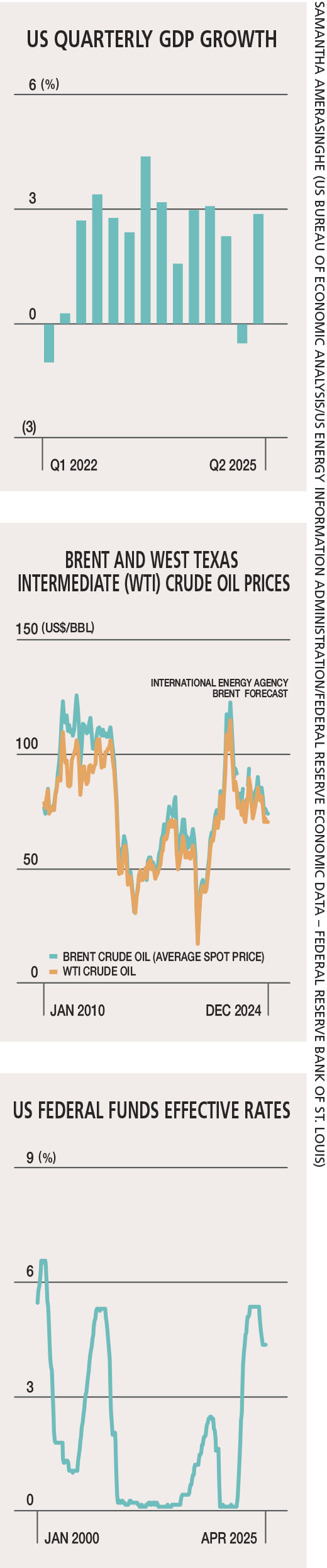

US Federal Reserve policy makers are divided on whether to reduce interest rates this year, amid fears that tariff turbulence could cause a fresh surge in inflation while also cooling economic growth. The Fed held interest rates steady for the fourth consecutive meeting this year, despite President Donald Trump’s tariffs bringing risks of higher inflation.

Its conundrum centres on whether to keep borrowing costs higher because of expectations that Trump’s tariffs will raise prices or cut rates to offset any softening of economic growth. In addition, the US economy faces the prospect of inflation reigniting due to oil prices surging on the back of tensions in the Middle East.

CAUTION TAKES CENTRE STAGE

Samantha Amerasinghe reports on how the US Fed is viewing monetary policy

The US Fed has been on pause mode for six months, fearing a big shock to inflation from Trump’s tariffs. But any serious tariff impact hasn’t materialised yet; and it’s too early to speculate about an economic impact as a result of it.

Perhaps more importantly, it’s still not totally clear what the Fed should do.

Its obligation is to keep longer-term inflation expectations well anchored. Inflation remains above the Fed’s target of two percent. Rates at 4.25-4.5 percent are considered to be above the so-called ‘neutral level,’ which neither accelerates nor slows down the economy.

In June, officials cut their forecasts for economic growth while boosting their outlook on inflation. Late June projections showed growth at 1.4 percent for 2025 – which is substantially weaker than last year with unemployment rising from its current level of 4.2 percent to 4.5 percent, and personal consumption expenditure inflation increasing to three percent from 2.1 percent in April.

Economic data supports lowering rates in the near term, despite the threat of higher inflation.

Before considering any changes to its policy stance, the Fed is also monitoring tensions in the Middle East. Oil prices are likely to surge on the back of rising tension between Israel and Iran, and fuel higher inflation.

Ultimately, the direction that oil prices in the US will take would depend on whether Iran decides to block the Strait of Hormuz, which is a key trade route that accounts for about 20 percent of the world’s crude oil. However, its closure could result in a sustained supply shock and will do more damage to other economies as well.

China buys a third of all the oil that comes from the Persian Gulf while the United States buys less than three percent because its economy is far less dependent on foreign oil than it was back in the 1970s when there were a series of very large shocks.

Fracking has turned the US into a major oil exporter, so the situation is very different from the oil crises of the past.

Therefore, it seems that any major spikes in oil prices resulting from higher inflation won’t be sustained. Nonetheless, expensive oil amplifies the Fed’s biggest worry of stagflation, which will force it to choose between supporting growth and fighting inflation.

Tensions between Trump and Federal Reserve Chair Jerome Powell have resurfaced following the Fed’s recent decision to hold interest rates steady. Trump stated again that he might consider firing Powell, which he had previously ruled out.

With unemployment still low and output not yet showing signs of contraction, the Fed has judged that its current policy stance is appropriate. However, Trump prefers lower interest rates, which could counteract his policy on tariffs in the short run.

However, while lower than its peak, inflation remains above target and leaves little room for interest rate cuts without risking renewed price pressures. Moreover, Trump’s push for lower interest rates creates both macroeconomic and institutional problems.

In the face of still stubborn inflation, if the Fed lowers interest rates, it risks undoing the fragile progress since the post-pandemic surge in prices.

Although lower rates could offer some short-term relief from the economic drag caused by trade tensions and the recent spike in tariffs, they would do so at the risk of future inflationary pressure.

Easing monetary policy against a backdrop of persistent inflation is more likely to produce stagflation than sustainable growth. Furthermore, institutional problems are arguably more problematic and damaging in the long run, as political interference in monetary policy compromises the independence and credibility of the central bank.

For the time being, Powell insists that the Fed is “well-positioned to hold off on rate cuts” as the economy is still solid. The Federal Reserve will continue to remain in wait and see mode as it gains more clarity on Trump’s tariffs in the months ahead, before deciding on moving forward.

There is no indication from the Fed that it is preparing to imminently reduce interest rates at its next meeting scheduled for 29-30 July. It seems that the Federal Reserve has only one option for the time being, which is to watch inflation expectations and hold.