US ECONOMY

Economists have been dissecting Federal Reserve Chair Jerome Powell’s speech at the central bank’s annual conference in Jackson Hole for signals on where interest rates are heading. They are also assessing the outlook for oil prices, following US President Donald Trump’s threats to slap Russia with additional sanctions and tariffs unless it agrees to a ceasefire with Ukraine.

Despite tariffs putting upward pressure on inflation, Powell’s speech indicated a greater willingness to cut interest rates. He cited three factors that support lowering rates.

WATCHING THE FED’S MOVES

Samantha Amerasinghe presents the likely scenarios for US interest rates

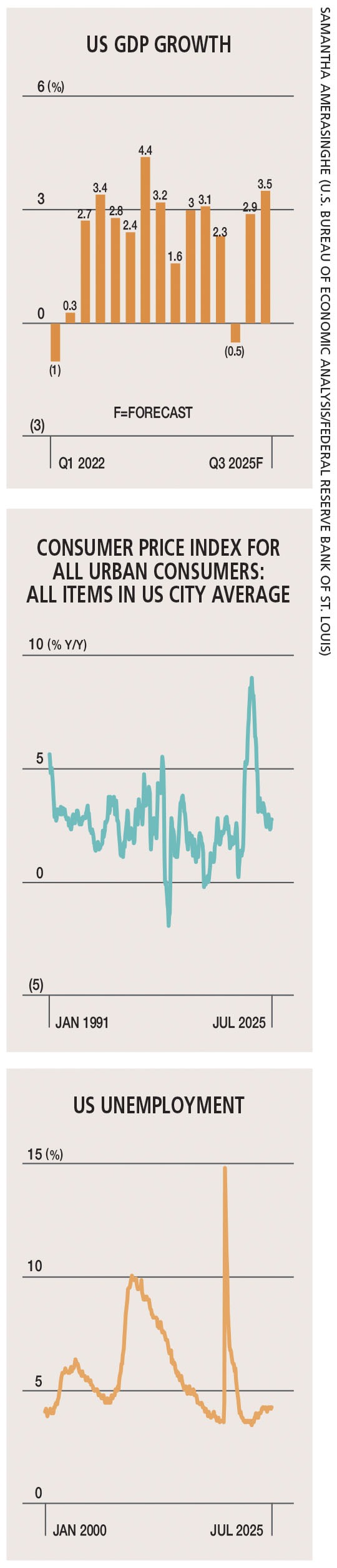

Firstly, inflation has moved closer to the Fed’s two percent target and come down substantially over the previous two years.

Secondly, the labour market has cooled and finally, any upside risks to inflation have diminished. A softening labor market has resulted in a slowdown in economic activity, and reduced the likelihood of substantial increases in inflation. Clearly, the balance of risks appears to have shifted toward a weakening economy.

In addition, GDP growth has slowed notably in the first half of this year to 1.2 percent – that’s roughly half the 2.5 percent rate of acceleration in 2024. The decline in growth has largely reflected a reduction in consumer spending.

As with the labour market, some of the slowing down of GDP likely reflects lower growth of supply or potential output. However, upward risks to inflation due to tariffs continue to weigh heavily on policy makers’ minds.

Regarding the impact of tariffs on consumer prices, Powell seems to be leaning more towards the belief that the levies may only cause a onetime bump to prices and not result in ongoing inflation.

Nonetheless, inflationary tariffs are still one of the potential risks that could prevent rates from moving lower over time.

The Fed’s interest rate stance also plays a role in the oil market and provides a signal to pinpoint where prices are headed.

Hopes of an imminent cut would generally weaken the US Dollar and make oil cheaper for foreign buyers while boosting demand. However, though it seems that rate cuts are imminent, it’s still too early to tell.

Oil markets are currently caught between conflicting forces. Trump’s aggressive trade and energy policies have created fresh uncertainty, and bullish supply risks, demand uncertainties, OPEC+ decisions and a strong dollar have been offsetting forces.

If the US enforces strict sanctions on Iran and Russia, and tariffs disrupt North American supply chains, the price of oil could easily breach the US$ 80 mark again. But if OPEC+ increases production or economic concerns weigh on demand, prices may remain range bound in the 70-85 dollar per barrel corridor, which many analysts expect.

There are also lingering concerns about China’s economy, which has shown signs of slowing with factory activity, investment and retail sales falling in recent months.

As the world’s largest oil importer, any sustained weakness in Chinese demand could cap oil price gains. US sanctions and tariffs may push prices higher in the short term, but demand side risks could limit any long-term upside.

In August, the US and China extended a pre-existing tariff pause, and avoided an all-out trade war for 90 days. With this extension, the imposition of higher US tariffs on China was suspended until 10 November, providing some respite for China’s economy.

US political parties are pushing for a bill titled ‘Sanctioning Russia Act of 2025,’ which would target any country that buys Russian oil and natural gas. This would give Trump the authority to impose 500 percent tariffs against nations such as India and China that are perceived to be helping Russia.

Recently, the administration mounted pressure on India to stop importing Russian oil by imposing a total 50 percent tariff on Indian goods.

However, Trump hasn’t initiated punitive actions against China. As the largest purchaser of Russian oil, China imported a record 109 million tonnes of the product last year, representing nearly 20 percent of its total energy imports.

By contrast, India imported only 88 million tonnes of Russian oil in 2024.

Trump’s leniency towards China is surprising. This is because he’s keen to avoid a tariff spike given that US retailers would want to stock up on inventories of Chinese goods ahead of the Christmas season.

The US has also acceded to China’s demands and eased some of its export restrictions on advanced semiconductors. Some experts believe Trump is buying time to allow negotiations on a broad trade deal that would include rare earth minerals. China has long dominated the mining and processing of these minerals.

Powell’s rate cut signalling was stronger than expected at Jackson Hole but a move in the near future is clearly not guaranteed.

In the interim, potential policy developments from the Trump administration on the trade front coupled with another month’s data could impact the Federal Reserve’s next move and where oil prices are headed. With more uncertainty ahead, we will just have to wait and see.