THE ECONOMY

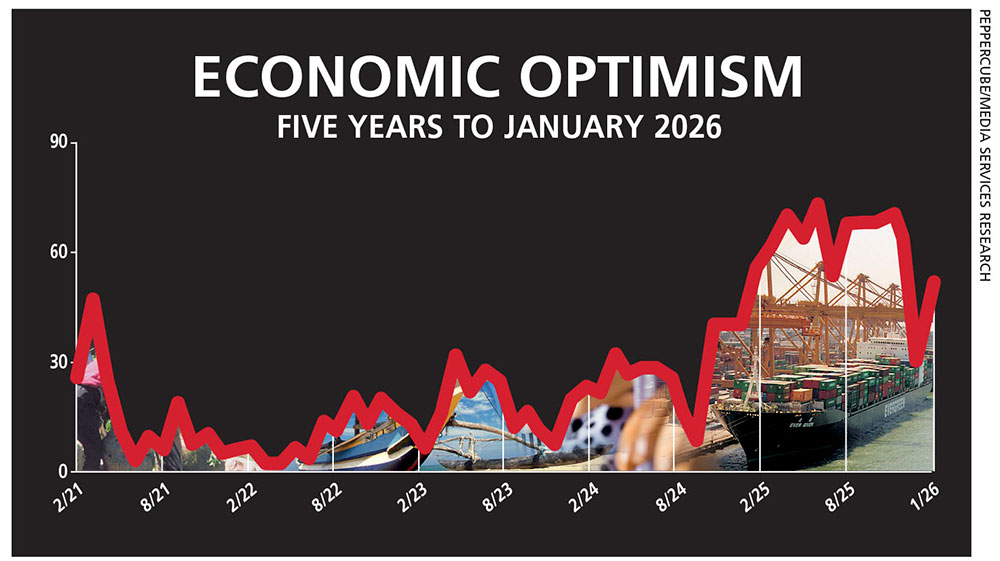

Economic sentiment improved notably in January, although certain indicators continue to point to a mixed outlook in the eyes of the corporate community. The easing weather conditions, which weighed on business activity not long ago, appears to have lifted sentiment with businesspeople viewing the economic outlook more positively in January.

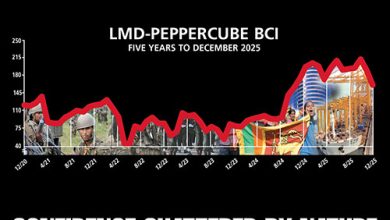

THE ECONOMY The latest LMD-PEPPERCUBE Business Confidence Index (BCI) survey, conducted in the first week of January, registered an uptick in economic optimism, reversing the dramatic decline recorded in the previous month.

NEW YEAR BRINGS NEW HOPE

Economic confidence shows signs of improvement as Ditwah’s impact eases

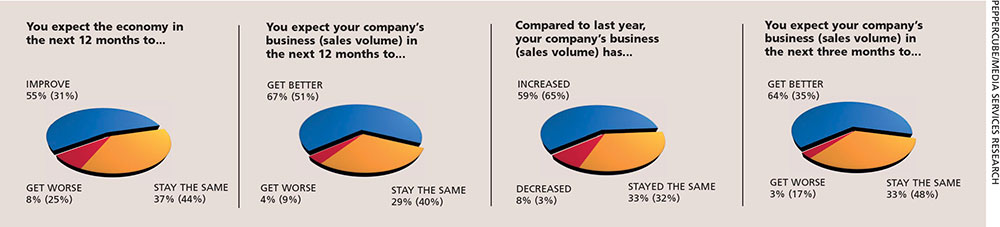

More than half (55%) of respondents now believe the economy will ‘improve’ over the next 12 months, representing a sharp 24 point increase from December. And 37 percent expect conditions to ‘stay the same’ – this marks a seven point decline from the month prior.

In the meantime, only eight percent anticipate that the economy will ‘get worse’ (a notable 17% drop from December).

SALES VOLUMES Expectations regarding sales volumes improved considerably with a clear majority (67%) expecting an improvement over the next 12 months. This outcome reflects a 16 point increase from December.

Meanwhile, 29 percent of executives expect their sales volumes to ‘stay the same,’ recording an 11 point decline from the previous month. Only four of the 100 respondents surveyed believe their sales volumes will ‘get worse’ – down five percentage points from the preceding month.

Fifty-nine percent of poll participants report an ‘increase’ in sales volumes – a six point decline from the previous month.

Additionally, a third (33%) say their sales volumes ‘stayed the same’ (edging up one point from December’s 32%). Only eight percent report a decline, marking a five point increase from the three percent recorded a month earlier.

Looking ahead to the next three months, expectations of higher sales volumes gained notable momentum: nearly two thirds (64%) of respondents project an increase – a substantial 29 point jump from December’s 35 percent.

And a third (33%) of the sample population believe their sales volumes will ‘stay the same’ (reflecting a 15% decline from the previous month) while only three percent expect their numbers to ‘get worse’ over the next three months – a 14 percentage point drop from the month prior.

INVESTMENT CLIMATE Confidence in the investment climate remained broadly unchanged with 14 percent viewing the outlook as ‘very good.’

Those who say the future looks ‘good’ increased by nine percentage points to 34 percent while 39 percent view the investment outlook as ‘fair’ – a modest three percentage point decline from the previous month.

Meanwhile, nine percent perceive the investment climate as being ‘poor’ or ‘very poor’ – that’s a decline of nine points from the preceding month.

EMPLOYMENT PROSPECTS Only 37 percent of respondents say they intend to ‘increase’ their staff numbers, which is a three point decline from December.

Meanwhile, 58 percent plan to maintain the status quo (down 3%) while only five percent expect to downsize in the next six months – unchanged for the third consecutive month.