THE ECONOMY

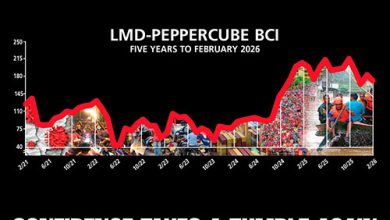

Corporates are grappling with myriad challenges as they navigate the prevailing uncertainties. The latest findings from the LMD-PEPPERCUBE Business Confidence Index (BCI) poll continue to underscore widespread apprehension about the economic landscape.

MIXED ECONOMIC SENTIMENTS

Businesses are navigating challenges and opportunities amid the turbulence

THE ECONOMY In June, 30 percent of survey respondents expressed optimism about the economy ‘improving’ over the next 12 months, which aligns with the May outcome.

And more than one in four executives (26%) anticipate the economy will ‘stay the same,’ which is also consistent with the previous month.

And likewise, 44 percent believe that the economy will ‘get worse,’ once again mirroring the sentiments reported in May.

SALES VOLUMES Salespeople continue to navigate with a sense of unease amid a somewhat improved outlook that sales volumes will ‘get better’ over the next 12 months. Thirty-four percent foresee an uptick, indicating a three point increase from May’s projections.

A quarter (25%) of survey participants expect their sales numbers to ‘stay the same,’ reflecting a slight dip from May’s 28 percent. Meanwhile, 41 percent expect their sales volumes to ‘get worse’ – this outcome has remained stagnant over the past three months.

Thirty-three percent of poll participants report an ‘increase’ in sales volumes over the past 12 months, marking a five point rise from May’s 28 percent.

Furthermore, 23 percent say their sales numbers ‘stayed the same,’ reflecting a three point fall from the previous month. And 44 percent report low volumes – down slightly from 46 percent in May.

Looking ahead, expectations for higher sales volumes in the next three months have improved with nearly a third (32%) expressing optimism about their numbers ‘getting better,’ which reflects a five percent uptick from the previous month.

Nearly a quarter (24%) of respondents expect their sales numbers to ‘stay the same,’ reflecting a five percent decrease.

On the downside, a substantial proportion (44%) of survey respondents expect their sales volumes to ‘get worse’ over the next three months – a sentiment that remains unchanged from May.

INVESTMENT CLIMATE There’s a notable change for the better with eight percent rating our investment prospects as ‘very good,’ compared to only two percent in May. This is the highest level of optimism this year.

Countering the above to some extent, the proportion of participants that view the outlook as ‘good’ slid by two points (to 21%).

Meanwhile, 33 percent perceive the investment climate as ‘fair’ (May – 42%) while nearly four in 10 (38%) consider the outlook to be ‘poor’ or ‘very poor,’ reflecting a decrease of five percentage points compared to May.

EMPLOYMENT PROSPECTS The June survey underscores a growing trend among businesses planning to ‘increase’ their workforce with 29 percent aiming to do so. This marks an eight percentage point rise from the prior month.

But a majority (61%) intend to maintain current staff levels (May – 73%).

Additionally, 10 percent anticipate downsizing over the next six months, compared to six percent in the previous month.