LMD 100 Q&A

Q: What is your assessment of Sri Lanka’s economic status?

A: It is emerging from major setbacks over the past several years at a gratifyingly fast pace. It’s encouraging to see macroeconomic stability being regained with inflation under control, interest rates moderated and exchange rates relatively stabilised – demonstrating the effectiveness of fiscal reforms and decisive monetary policy actions.

Tourism and remittance performances together with controlled imports have helped increase gross official reserves. With the domestic debt optimisation (DDO) finalised and envisaged finalisation of international debt restructuring, there’ll be greater confidence in our economy and external profile.

We still have our work cut out to bring the country back on a sustainable growth path. And we have to power through long delayed structural – particularly, state-owned enterprises (SOE) – reforms, as well as to land and labour laws, which are keys to attracting foreign direct investment (FDI) and unlocking our true growth potential.

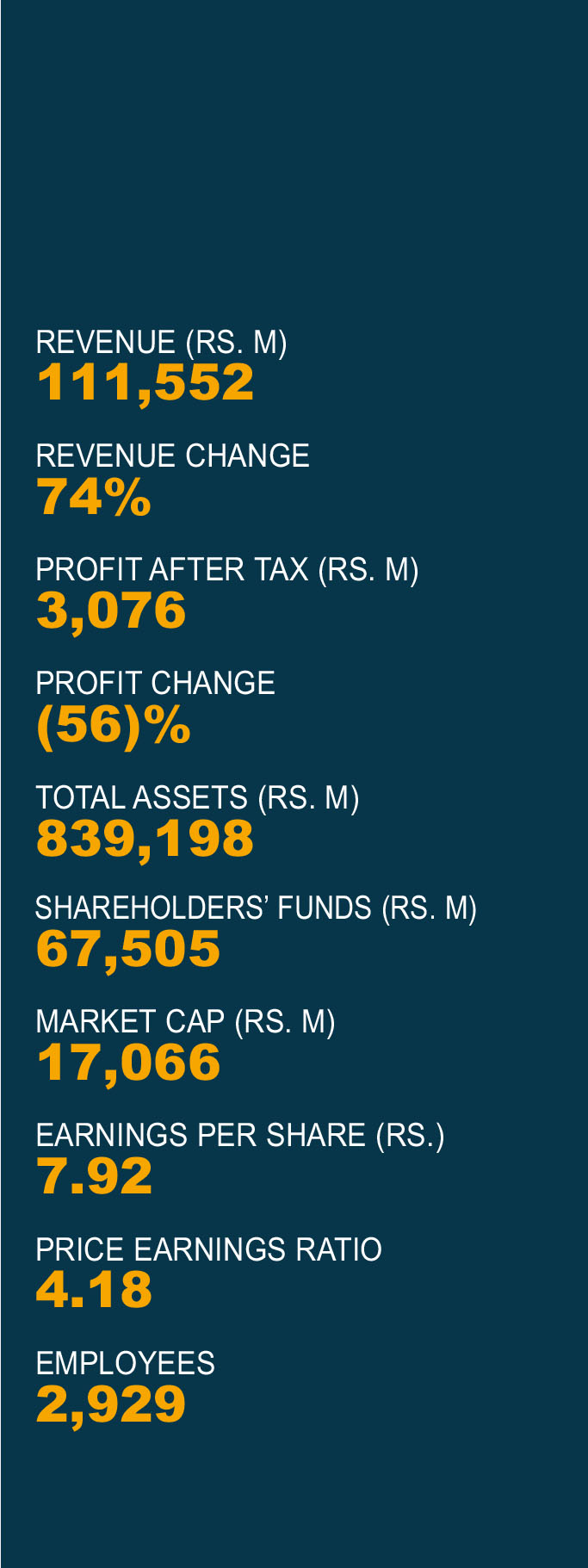

Q: How is the bank faring under existing macroeconomic conditions?

A: We’ve been prompt in responding to emerging challenges. The agility of our team and versatility of our strategy enabled us to deploy tactical workarounds to safeguard the interests of our shareholders, customers, employees and other stakeholders.

Our strategy revolves predominantly around efficient balance sheet utilisation in preserving capital and returns.

Propelling economic revival is the key, and we’ll be driving transactional and digital banking to support and stimulate economic activity. We’re also focussing on internal efficiencies that would deliver considerable upside potential such as enhancing our net interest margins (NIM) and improving asset quality.

We strive to achieve a healthy equilibrium in our performance by investing in driving our digital strategy, product innovation and so on with a deep commitment to customer-centricity.

Q: How can Sri Lanka improve its ease of doing business and competitiveness internationally?

A: Macroeconomic stability – including low and stable inflation, a market driven exchange rate and healthy interest rate levels – are prerequisites in attracting quality investments.

Rectifying rigidities in the labour market is attributable to a mismatch of skill sets, increasing labour costs, unionisation and high compensation stemming from labour laws.

Consistent government policies – particularly around economics and foreign investments, and strong efforts to curtail corruption – are also important. A simple tax structure and consistent policy will augur well for long-term planning, thereby stimulating investments.

Enhancing trade openness – by eliminating complexities of the tariff structure and non-tariff barriers, and enhancing border clearance efficiency – are imperative to Sri Lanka as the country ranks low in this aspect. These will augment Sri Lanka’s connectivity to global supply chain networks and help leverage our strategic location advantage.

Sri Lanka needs to work on its power and energy sectors, ICT adoption, expediting legal processes and strengthening infrastructure – including good road networks and other modern transport solutions. The efforts of all parties are required to push the needle in the right direction.

Q: How should businesses align organisational performance with environmental sustainability?

A: It begins by assessing the impact created on the environment through operations. Banks and financial institutions are considered the largest contributors to the climate crisis depending on where they channel their money, and are coming under increasing pressure to cut funds to industries that lead to environmental and social degradation.

All our lending processes are governed by a board approved environment and social risk management framework (ESRM), developed based on globally accepted principles prescribed by the IFC. We have a strong governance structure, a dedicated team and all relevant staff aligned to ensure that our lending is responsible.

Our strong digital drive in conducting customer transactions and internal processes has led to considerable savings on paper and emissions from commuting.

In addition to this, our dynamic work modes comprising working from home (WFH) options lead to lower emissions and energy consumption.

NDB has been a pioneer in financing renewable energy generation; and in terms of funding, we account for approximately 30 percent of the country’s renewable energy generation capacity.

Telephone: 2448888 | Email: contact@ndbbank.com | Website: www.ndbbank.com