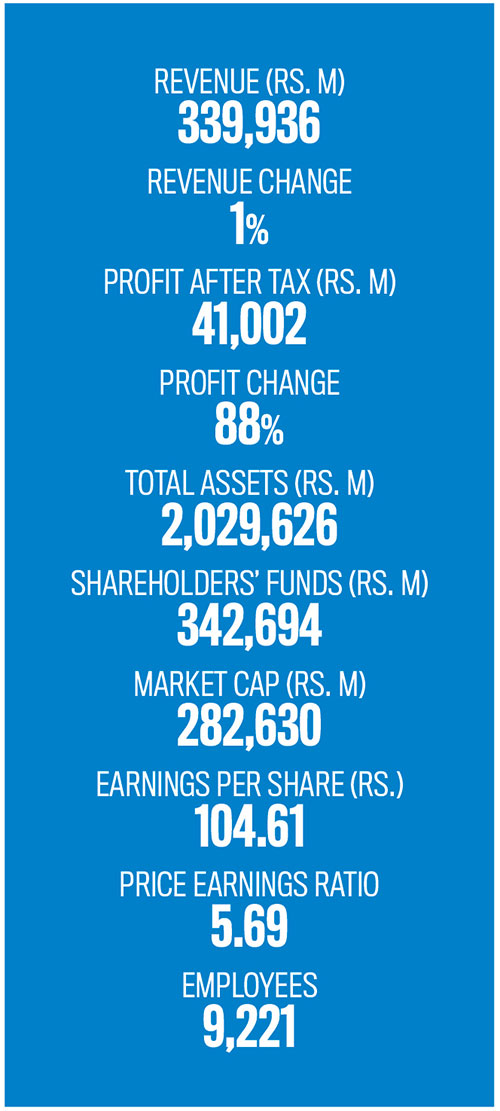

LOLC HOLDINGS

RANK 2

“Financial services have remained the cornerstone of the group’s profitability – with robust risk management practices”

Q: What are the key achievements of your company?

A: LOLC Holdings is a diversified multinational conglomerate operating in over 27 countries. It is also recognised as Sri Lanka’s most internationally diversified corporate group.

Spanning operations across financial services, agriculture and plantations, manufacturing and trading, leisure, research and innovation, digital empowerment, construction, automotive and strategic investments, the group continues to grow through disciplined financial management and strategic expansion.

As its footprint expands across South and Southeast Asia, Central Asia and Africa, LOLC Holdings is guided by its commitment to shared prosperity, coupled with priorities focussed on digital transformation, capacity building, global expansion and continuous innovation.

The group’s global diversification and stability is reflected in its financial strength with 50 percent of the top-line income originating from foreign operations and 58 percent of its asset base spread across its international operations.

Financial services have remained the cornerstone of the group’s profitability – with robust risk management practices entrenched, ensuring sustainability of the globally diversified operation.

Our global footprint has deepened its financial inclusion expanding our digital footprint and maintaining strong asset quality. We remain committed to further advancing financial inclusion across all geographies we operate in while empowering micro and small enterprises.

A major highlight of 2025 was the group’s expansion in the global tea industry, marked by the acquisition of Lipton’s plantations in Kenya, Rwanda and Tanzania following the purchase of Finlays’ Kenyan operations in 2023, whereby the group has now become the largest manufacturer of tea globally.

Domestically, the group strengthened vertical integration through full ownership of Pussellawa Plantations and a controlling stake in Tea Smallholder Factories, alongside investments in cinnamon and the Sun Yield processing facility.

These investments underscore the group’s intent to build a dominant, export driven agricultural portfolio capable of capturing rising global demand for Ceylon origin products. Integration further supports greater value addition, productivity gains and sustainability practices across plantations.

The group has consistently demonstrated resilience across its trading and manufacturing businesses with market leadership in key verticals.

With booming inbound travel, LOLC’s hospitality assets in Sri Lanka, the Maldives and Mauritius are well positioned for further growth in the coming year as the hospitality business has rebounded strongly with improved margins supported by robust pricing and rising tourist arrivals.

Flagship properties under Browns Hotels & Resorts delivered strong operating profits. The launch of the Nasandhura property and Barceló Whale Lagoon Resort in the Maldives further strengthened the group’s leisure portfolio while construction of the Port City Colombo Marina is underway, expanding future capacity and enhancing the overall hospitality offering.

We continue to pursue a differentiated hospitality strategy focussed on premium experiences, operational excellence and destination led tourism development.

Another notable development was entry into the affordable new energy vehicle (NEV) segment, aimed at enhancing mobility for middle income families in Sri Lanka. In partnership with Wuling and BAW, the group introduced NEVs and expanded electric vehicle (EV) charging infrastructure, reinforcing its commitment to sustainable and accessible transportation solutions.

This initiative also supports the global push toward reduced carbon emissions and more efficient mobility ecosystems.

Q: What trends do you observe in your sector and what have you done as a business to optimise some of them?

A: LOLC continues to adapt its strategic direction in response to evolving industry dynamics, positioning the group to capture opportunities across its diversified sectors.

In financial services, the group has strengthened digital delivery and fintech driven solutions to deepen financial inclusion, particularly for SMEs and underserved communities across the geographies it operates in.

In the agriculture and plantations sectors, rising global demand for high quality produce has prompted investments in sustainable farming, modern processing and post-harvest management.

Across manufacturing, trading and mobility, the group is integrating sustainability into operations by improving energy efficiency and expanding into the affordable NEV segment, alongside the development of supporting EV infrastructure.

Our tourism portfolio is poised for stronger contributions, driven by natural appeal and increasing regional travel demand in Sri Lanka, the Maldives and Mauritius.

Sustainability remains central to our strategy, reflected in ongoing investments in the environment, communities, humanitarian efforts and meaningful stakeholder engagement.

Q: As Sri Lanka continues to pursue economic and political stability, how is the corporate sector driving growth while overcoming challenges that persist on many fronts?

A: As the nation works towards economic and political stability, the corporate sector is driving growth by strengthening governance, accelerating digital transformation and improving operational efficiency. Businesses are adapting to challenges through diversification, stronger risk management and regional expansion.

LOLC Holdings continues to support national growth through its diversified portfolio as strategic investments, acquisitions and technology adoption strengthen operations, expand global linkages and create sustainable value.

Adopting a strong focus on inclusive growth, the group is advancing green financing, women’s economic participation and financial inclusion, reinforcing its role as a key driver of economic revitalisation.

LOLC Holdings continues to build capacity in emerging sectors while contributing to productivity improvements that support broader economic recovery.

Leveraging its geographic and sectoral diversification, the group continues to demonstrate resilience and drive sustainable growth.

Its diversified model, innovation driven approach and financial discipline remain vital even as the group expands across South and Southeast Asia, Central Asia and Africa, guided by its values, people and commitment to shared prosperity.

Q: How is your group embracing environmental, social and corporate governance (ESG) standards?

A: At LOLC, we remain deeply committed to ESG principles as sustainability is embedded in the core of our operations – from climate smart agriculture and renewable energy to responsible lending and community upliftment.

Each business line is now aligned to ESG metrics in keeping with United Nations Global Compact (UNGC) principles, further integrated into strategy and board level oversight.

Our corporate governance structure continues to evolve with best in class practices, combining fairness, responsibility, independence, transparency and accountability.

Moreover, board committees have been strengthened to oversee risk, compliance, sustainability and stakeholder engagement. Data security, regulatory compliance and ethical conduct are deeply embedded across our businesses.

Telephone 7880880 | Email info@lolc.com | Website www.lolc.com