YEAR OF RESURGENCE?

A recovery may define financial year 2025/26 if the interim results of the LMD 100 Leaderboard are anything to go by – subject to factoring in the impact of Cyclone Ditwah

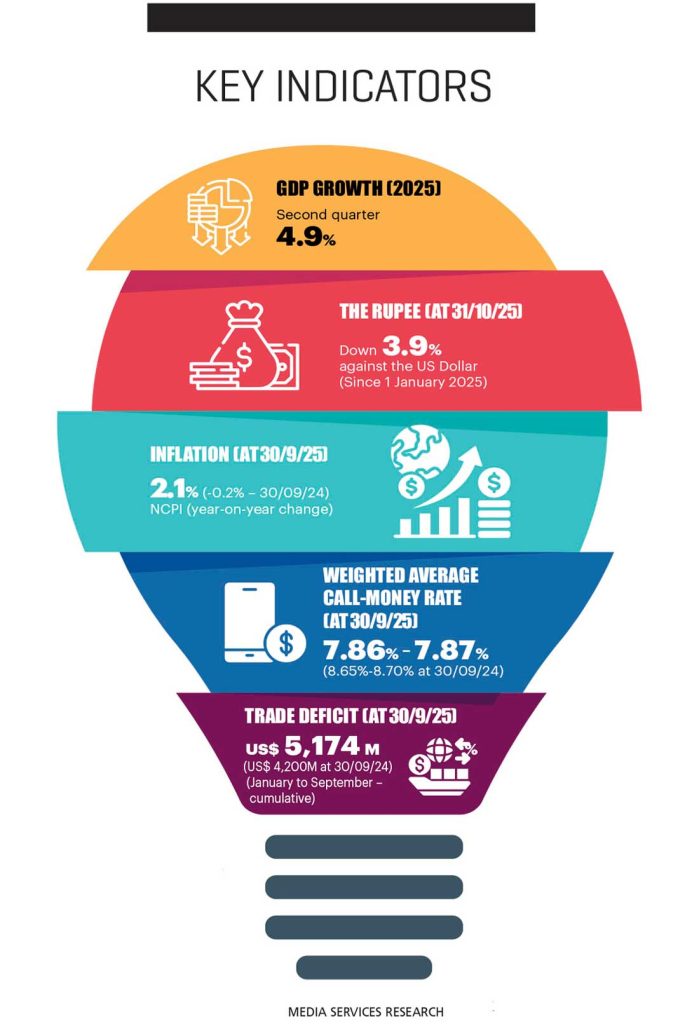

The Central Bank of Sri Lanka’s Financial Stability Review for 2025 highlights a notable strengthening of the country’s financial sector during the first half of the year, compared to the same period in 2024. This improvement was supported by favourable domestic macroeconomic conditions, despite heightened global uncertainty and the lingering effects of the recent economic crisis.

With the macro financial environment stabilising to a certain degree, credit extended by financial institutions – particularly to the private sector – rose during the review period. And this expansion was aided by easing pressures on household and corporate balance sheets, as economic output improved and prices remained somewhat subdued.

Meanwhile, the economy rebounded with five percent growth in 2024, reversing the declines seen over the preceding two years.

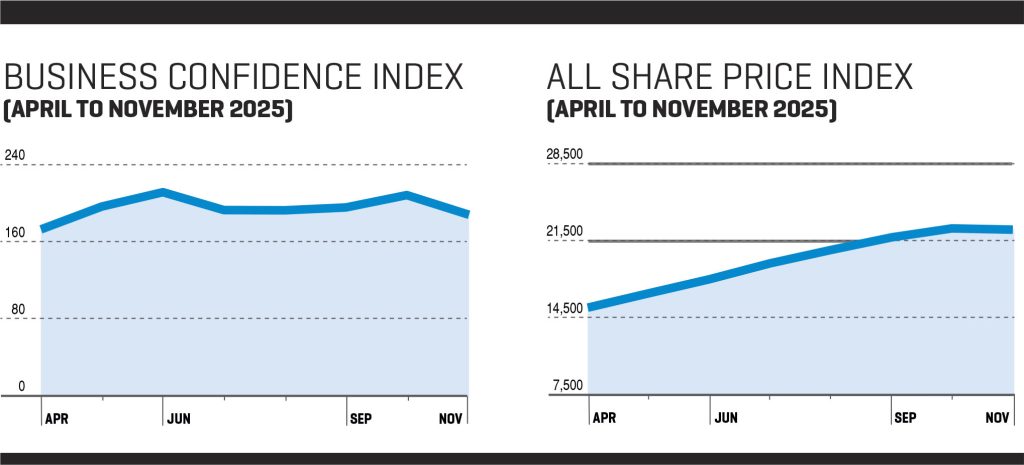

BUSINESS OUTLOOK The gradual strengthening of the financial sector coincided with a period of volatility in business sentiment. The LMD-PEPPERCUBE Business Confidence Index (BCI) fluctuated incessantly during the 2024/25 financial year – the index even recorded an all-time high in October 2025.

After falling to its lowest level (63) in February 2023, the BCI rebounded sharply, hitting a historic high of 212. Despite this surge, sentiment remained reactive to economic developments, ending the calendar year on a fluctuating note and reflecting cautious optimism in corporate circles about business prospects.

Biz sentiment recovered to 197 in March 2025, closing the financial year on a strong note. This improvement likely mirrored the business community’s cautious optimism as it awaited the newly appointed government’s interim budget presentation at the time.

Since then, the index has continued to strengthen with intermittent ups and downs in the lead-up to the budget for fiscal year 2026, signalling tentative but growing confidence across the private sector.

BUDGET 2026 In presenting Budget 2026, President Anura Kumara Dissanayake announced that Sri Lanka is close to completing its debt restructuring process and poised to regain the economic output lost during the economic crisis.

He asserted that the economy has stabilised and investor confidence is gradually being restored. And the president highlighted a noteworthy reduction in the country’s debt to GDP ratio – from around 114 percent previously to an expected 96 percent at the end of 2025… and with a target of reducing it further to 87 percent by 2030.

The government also outlined its medium-term vision of achieving seven percent economic growth, underpinned by fiscal consolidation measures aligned with the US$ 2.9 billion IMF programme.

These targets include a primary surplus of 2.5 percent of GDP, government revenue to the tune of 15.4 percent of gross domestic product and a budget deficit of 5.1 percent of GDP for the year.

REFORM MOMENTUM The International Monetary Fund recently announced that performance remains strong, supported by solid fiscal revenue outcomes and improvements in external resilience.

However, it stressed that maintaining the reform momentum will be crucial to safeguarding macroeconomic stability, especially given risks arising from global geopolitical tensions and persistent trade policy uncertainty.

The global lender of last resort underscored the importance of accelerating bilateral debt agreements with the remaining official and commercial creditors, to restore debt sustainability and build investor confidence. The fund also noted that monetary policy should remain data driven with central bank independence rigorously upheld – including the avoidance of monetary financing of the budget.

Additionally, the IMF called for measures to resolve nonperforming loans, improve governance in state owned banks, and strengthen insolvency and resolution frameworks, in order to support credit growth and ensure financial sector stability.

Echoing several of these concerns, Fitch Ratings reaffirmed Sri Lanka’s Long-Term Foreign Currency Issuer Default Rating (IDR) at CCC+.

The agency noted that despite progress on reforms and the completion of sovereign debt restructuring in 2024, the country’s elevated general government debt and high interest to revenue ratio continue to constrain its rating.

Fitch acknowledged that Sri Lanka’s ongoing reform commitments have supported a solid economic recovery, low inflation, fiscal consolidation and improvements in the external financing position.

However, it highlighted that restoring investor confidence and strengthening the investment climate – particularly around foreign direct investments (FDI) – will be critical to sustaining medium-term growth, even though improvements are likely to be gradual.

Fitch points to an emerging divergence between the resilience of leading corporates and the sovereign’s fragile external position. While the government’s credit metrics remain weak, the country’s leading commercial banks and well managed conglomerates continue to maintain stable national ratings.

So 2026 appears to be shaping up to be a pivotal year, particularly as the regulatory landscape continues to evolve in areas such as taxation and debt restructuring. Expectations remain high that the cost of living will ease – not only in statistical terms but day-to-day realities as well – amid ongoing external pressures.

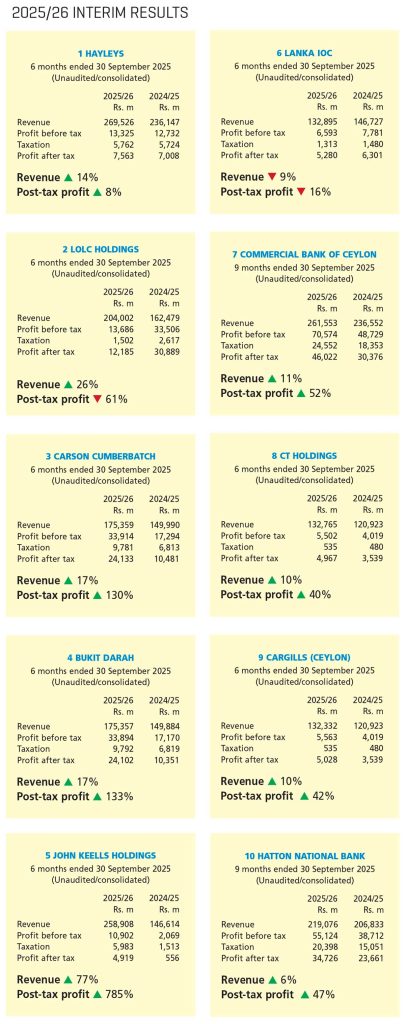

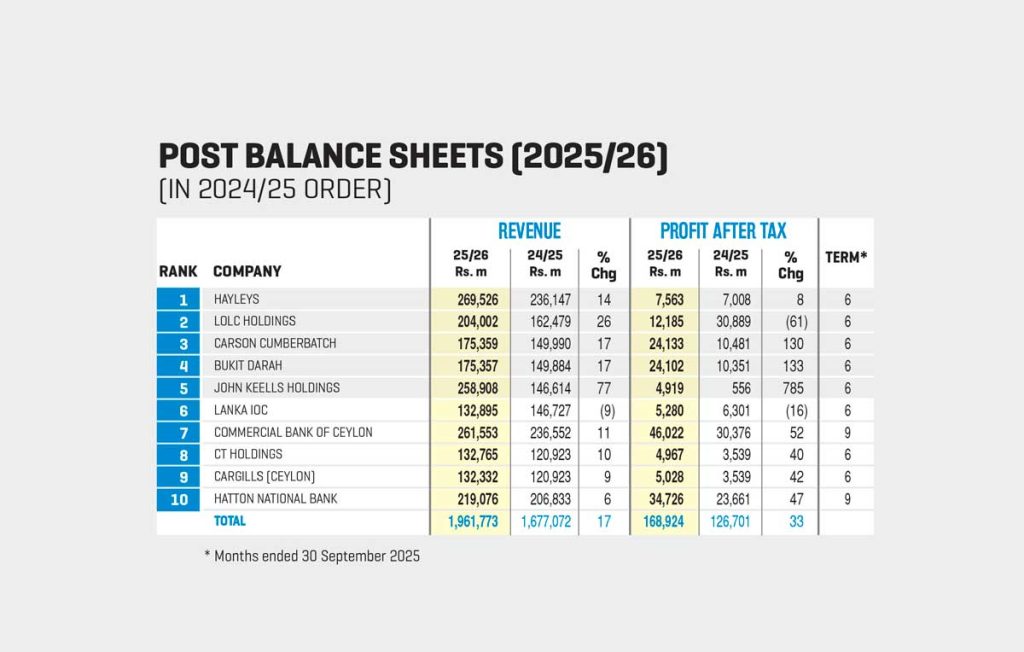

INTERIM RESULTS A review of the latest interim results of the LMD 100 Leaderboard for the period ended 30 September 2025 paints a rosier picture than we have seen in the last two years with both the top and bottom lines of the nation’s leading listed companies by and large trending upwards.

The collective turnover of the top 10 listed companies (nearly Rs. 1,962 billion) reflects an acceleration of over 17 percent year-on-year. For context, at the same time in financial year 2024/25, the 10 leading LMD 100 companies reported a collective increase in revenue of only three percent over the prior year.

As for the aggregate profit after tax (PAT) of the LMD 100 Leaderboard for the period ended 30 September 2025, the collective bottom line improved markedly with cumulative PAT rising by 33 percent to almost 169 million rupees, compared to slightly under Rs. 127 million at the same time in the preceding comparative period.

However, two of the top 10 leading corporates reported softer earnings in after-tax profits. And in terms of turnover, one company from the LMD 100 Leaderboard posted a contraction of its top line.

Hayleys, the reigning LMD 100 Leaderboard champion and diversified conglomerate, recorded a 14 percent improvement in consolidated income, surpassing 269 billion rupees – compared to Rs. 236 billion for the same period in financial year 2024/25. And its PAT rose by eight percent from the previous year, recording in excess of 7.5 billion rupees for the period.

Chairman and Chief Executive Officer Mohan Pandithage comments: “The global environment is shaped more than ever by unpredictability and volatility is now the backdrop to our world. The operating landscape in 2024 was increasingly fractured across political, economic, environmental and social spheres, with an escalation of geopolitical and geo-economic tensions, increased frequency of extreme weather events and widespread societal and political polarisation.”

“Once considered the very barometer of the local economy, the group has grown beyond its bounds, outpacing national benchmarks as our strategic international expansion has redefined impact and scale. The group’s revenue growth of 13 percent during the year significantly outperformed the national GDP growth of five percent,” Pandithage states.

He continues: “Amidst a turbulent global climate, Sri Lanka’s gradual return to stability offered a hopeful turning point following years of prolonged challenges.”

LOLC Holdings, ranked No. 2 in the 2024/25 LMD 100, reported a consolidated income of slightly over Rs. 204 billion for the first six months of its 2025/26 financial year – a robust 26 percent improvement.

However, the diversified conglomerate’s bottom line saw a notable decline, falling by 61 percent to 12 billion rupees for the six months ended 30 September 2025 – compared to Rs. 30 billion in the corresponding period of the previous year.

The 2024/25 LOLC annual report states: “Amidst macroeconomic stabilisation, currency appreciation and easing inflationary pressures, LOLC Holdings demonstrated one of the most exceptional financial performances in our history.”

Executive Chairman Ishara Nanayakkara says: “LOLC’s vision is underpinned by our commitment to inclusive growth, global relevance and sustainability. As we step into the next phase of our journey, we will continue to consolidate and expand our inclusive finance model, as well as strengthen our presence in real economy sectors – agriculture and plantations, manufacturing and trading, leisure, research and innovation and new energy vehicles (NEV).”

Third placed Carson Cumberbatch delivered a strong top line performance with revenue surpassing 175 billion rupees for the six months ended 30 September 2025 – an improvement of 17 percent. The group’s bottom line also surged with profit after tax climbing to over Rs. 24 billion – a leap of 130 percent from 10 billion rupees during the same period in the preceding year.

Chairman Ravi Dias says of the group’s plans for the future: “Our focus will centre on optimising operational performance, enhancing customer experience and driving innovation across all business segments. With our strong organisational foundation and dedicated team, we are well positioned to navigate market challenges whilst pursuing sustainable long-term growth that benefits all our stakeholders.”

Bukit Darah reported a consolidated income exceeding Rs. 175 billion, reflecting a 17 percent growth for the six months ended 30 September 2025. Its six month post-tax profit rose sharply to more than 24 billion rupees (a 133% increase compared to the same period in 2024).

Diversified conglomerate John Keells Holdings (JKH) remained profitable in the first half of its 2025/26 financial year, reporting a PAT of Rs. 4.9 million – a remarkable 785 percent increase. Meanwhile, the group’s top line also accelerated, expanding by 77 percent to over 258 billion rupees compared to the same period in the previous year.

Meanwhile, energy giant Lanka IOC absorbed a nine percent contraction in turnover for the first half of its financial year, posting Rs. 132 billion. Moreover, the company’s post-tax profit for the six months ended 30 September 2025 declined by 16 percent, settling at five billion rupees.

For the first nine months of calendar year 2025, seventh ranked Commercial Bank of Ceylon (ComBank) reported consolidated income surpassing Rs. 261 billion, reflecting an 11 percent spike. Its bottom line was even stronger with PAT jumping by 52 percent to slightly over 46 billion rupees – compared to Rs. 30 billion in the previous year.

CT Holdings posted a notable 10 percent increase in its top line, reaching nearly 133 billion rupees for the first six months of financial year 2025/26. Along with this spike in revenue, the company’s PAT rose by 40 percent to almost five billion rupees.

Food and staples retailer Cargills (Ceylon) reported a nine percent rise in its consolidated top line with income totalling over Rs. 132 billion for the first six months of financial year 2025/26. In line with this increase, its bottom line advanced by 42 percent, surpassing five billion rupees.

Hatton National Bank (HNB), ranked 10th on the LMD 100 Leaderboard, recorded a six percent top line improvement with aggregate income reaching

Rs. 219 billion. In addition, the bank’s bottom line also strengthened with PAT growing by 47 percent to exceed 34 billion rupees.

LMD100 OUTLOOK Based on the interim financial results for the period ended 30 September 2025, the top tier of the LMD 100 Leaderboard for 2025/26 is beginning to take shape. The numbers suggest that the race to the finishing line may well see a photo finish between Hayleys and JKH with the former with its nose in front at the halfway stage.