LMD FEBRUARY 2026 COVER STORY

BUILDING A FUTURE READY SRI LANKA

Sri Lanka’s global image reflects a mix of challenges and promise

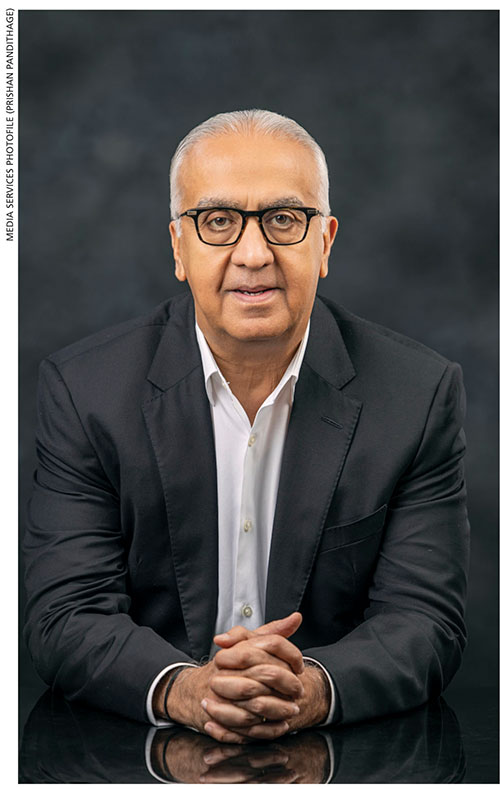

Bob Kundanmal

Bob Kundanmal is among Sri Lanka’s most quietly influential business leaders – an entrepreneur whose career reflects foresight, adaptability and an instinctive understanding of how global markets evolve over time.

As the founder and guiding force behind the Sino Lanka Group, he has built a diversified, private and equity driven enterprise with a strong regional footprint, anchored not in short-term cycles but long-term value creation.

His entrepreneurial journey began in the early 1990s with a modest apparel manufacturing and trading venture. What followed was rapid expansion into international apparel production, supplying globally recognised brands and establishing overseas manufacturing operations – early signals of a global outlook and willingness to scale beyond domestic boundaries.

A defining point came in 2008 when Kundanmal made the deliberate decision to exit the apparel industry. Anticipating shifts in global dynamics and buyer behaviour, he repositioned Sino Lanka into a diversified investment group spanning hospitality, education, healthcare, renewable energy, electric mobility, property development, financial services and information technology.

The move reflected a broader philosophy: that resilience lies in adaptability and longevity in the ability to evolve ahead of disruption.

Beyond Sri Lanka, Kundanmal has played a pivotal role in shaping Bangladesh’s private sector through the STS Group. Under his leadership, it has emerged as a benchmark institution in healthcare, education and finance – most notably through partnerships with global investors such as Blackstone and TPG that led to the establishment of Evercare Hospitals, which is Bangladesh’s largest private healthcare network today.

Bob Kundanmal’s career is defined less by individual ventures than by a sustained effort to create credible future ready platforms that strengthen cross border investment and contribute to long-term economic progress across South Asia.

– Compiled by Tamara Rebeira

The effectiveness of the Rebuild Sri Lanka initiative will depend on how well this private sector momentum is aligned with a coordinated national recovery effort

Q: How much faith do you place on the Rebuild Sri Lanka initiative, following the destruction caused by Cyclone Ditwah in late November? And how much weight will the private sector carry in minimising the economic fallout from the crisis?

A: The Rebuild Sri Lanka initiative represents a timely and necessary response to the widespread destruction caused by Cyclone Ditwah and it warrants measured optimism. In the aftermath of the disaster, the need to mobilise resources, coordinate relief efforts and outline a coherent national recovery framework is both urgent and complex.

Given the country’s current economic realities – including fiscal constraints, debt pressure and capacity limitations – these tasks present notable challenges for the government.

In this context, the Rebuild Sri Lanka initiative is a vital step towards restoring direction and confidence with its success hinging on coordination, clear priorities and broad-based support.

However, these challenges were partly mitigated by the swift and spontaneous response from the private sector and civil society. Even during the cyclone and its immediate aftermath, businesses, industry groups, NGOs and individuals stepped in to provide emergency relief, logistics support, medical assistance, food supplies and temporary shelter.

Large Sri Lankan corporates quickly repurposed supply chains, mobilised funds and deployed teams on the ground, often responding faster than formal mechanisms. This swift action highlighted the depth of social capital, agility and operational capability within the private sector.

Looking ahead, the effectiveness of the Rebuild Sri Lanka initiative will depend on how well this private sector momentum is aligned with a coordinated national recovery effort. The private sector can contribute not only through funding and relief but also by rebuilding infrastructure, restoring supply chains, supporting SMEs and generating employment.

Public-private partnerships (PPPs), transparency and clear accountability will be vital in rebuilding Sri Lanka – and the private sector is likely to play a notable role in minimising the broader economic impact of Cyclone Ditwah.

Q: How would you describe Sri Lanka’s image on the world stage – and what factors such as economic, political or social will mostly shape international perceptions going forward?

A: Any country is viewed internationally through a lens shaped by its economic, political and social developments. Sri Lanka’s global image reflects a mix of challenges and promise.

While economic and political fragilities are evident, the country’s social cohesion, strategic importance and capacity for innovation demonstrate resilience and potential. Sri Lanka remains a nation capable of overcoming setbacks, and rebuilding its social and economic fabric.

Its strategic location along key maritime trade routes positions the country as a vital hub for regional trade, shipping and logistics. The tourism industry, which is consistently ranked among the world’s top destinations, has shown strong growth, showcasing the island’s rich heritage, biodiversity and cultural appeal – even as natural disasters such as Cyclone Ditwah have temporarily disrupted activity.

Communities, businesses and civil society have repeatedly mobilised during crises by providing relief, restoring essential services and supporting recovery to reflect remarkable social resilience.

Traditionally, Sri Lanka has been renowned for its high quality Ceylon Tea, Ceylon Cinnamon and other commodities, as well as its status as a premium quality apparel manufacturer.

These industries continue to enhance the country’s international reputation and provide a strong foundation for trade, brand recognition and engagement with global markets.

High public debt, fiscal constraints, inflation and foreign exchange pressure have affected investor confidence, and perceptions of economic stability. In terms of politics, frequent leadership transitions, policy inconsistencies and episodes of public protest highlight the need for transparent governance and consistent policy-making.

International collaboration with financial institutions, trade partners and healthcare organisations has strengthened Sri Lanka’s credibility and capacity to manage crises, through technical expertise, funding and strategic support.

Overall, though economic and political challenges remain, Sri Lanka’s strategic advantages, social resilience and capacity for innovation offer a strong foundation for recovery – and gradual progress towards stability.

The long-standing brain drain has weakened the island’s talent base

Q: In your assessment, what are the most common misconceptions foreign investors have about Sri Lanka? And how can the private sector contribute to reshaping and strengthening this narrative?

A: One common misconception is that Sri Lanka lacks scale. Since the domestic market is relatively small, investors often underestimate the country’s ability to function as a regional platform by leveraging its strategic location, trade access and skilled workforce, to serve South Asia, the Middle East and beyond.

There is also a tendency to view Sri Lanka solely through the lens of recent economic distress.

Although the past few years have been challenging, many sectors continue to operate efficiently and competitively. Some investors underestimate the sophistication of Sri Lanka’s private sector, particularly in manufacturing, services, technology and ethical business practices.

Similarly, doubts are often raised about workforce capabilities, despite the country having a highly literate English speaking talent pool, strong middle management depth, advanced manufacturing capacity, and proven expertise in sectors such as premium apparel, IT services, education, healthcare and renewable energy.

The private sector has a critical role to play in correcting these perceptions. By showcasing successful, scalable business models and export oriented operations, companies can demonstrate Sri Lanka’s ability to operate well beyond the limits of its domestic market.

Internationally successful Sri Lankan businesses can serve as ambassadors by consistently showcasing credible success stories. This is what Sino Lanka has done over the past decade by expanding into Bangladesh across sectors such as healthcare, education and finance through the STS Group.

Private enterprises can further engage international investors through partnerships, joint ventures and participation in global forums, sharing real world outcomes rather than relying on macro level narratives. Investments in innovation, skills development and sustainability reinforce Sri Lanka’s positioning as a modern, competitive business destination.

Importantly, while political and economic volatility exist, it does not define the business environment as a whole. Public-private collaboration can support clearer policy dialogue, reform advocacy and trust building to help address investor concerns.

Q: In an increasingly competitive region, how can Sri Lanka position itself more compellingly against destinations such as Vietnam, Bangladesh and Indonesia, to attract investment, talent and opportunity? And how can we leverage or capitalise on our neighbouring regional power India’s sprawling market?

A: Operating in the global apparel industry for over three decades with direct experience across Sri Lanka, Vietnam and Bangladesh has provided clear insights into how competitive dynamics evolve across locations.

A recurring theme throughout this journey has been the need to adapt to political and economic volatility, which has often dictated shifts in operational bases.

For instance, restrictive economic conditions in Sri Lanka during the 1980s and ’90s led to a strategic move to Bangladesh. Later, periods of political and social instability in Bangladesh prompted diversification to Vietnam to manage risk and maintain continuity.

These shifts weren’t driven solely by domestic instability; they were equally shaped by constant buyer pressure for the lowest possible sourcing costs.

Global apparel buyers relentlessly seek marginal cost advantages, forcing manufacturers to move between production hubs. Businesses that survived were those that embraced globalisation, flexibility and market driven adaptation, rather than rigid single country strategies.

However, it is now evident that attempting to compete directly with the scale and low-cost manufacturing models of Vietnam or Bangladesh is not a sustainable path for Sri Lanka. Their vast labour pools and deeply entrenched supply chains make price based competition a race to the bottom, which Sri Lanka can’t and shouldn’t pursue.

Therefore, its competitive advantage must be redefined around value addition.

Traditionally, Sri Lanka has been renowned for its high quality Ceylon Tea, Ceylon Cinnamon and other commodities, as well as its status as a premium quality apparel manufacturer

The future of the apparel industry lies in moving up the value chain into areas that require skill, precision and sophistication. This includes high-performance sportswear, niche luxury apparel, technical textiles and specialised uniforms. Rather than confronting larger neighbours head-on, Sri Lanka should focus on industries that complement the scale driven growth of countries such as India.

This principle of strategic complementarity should extend beyond garments. Given the strengths of regional economies such as India, Vietnam, Indonesia, Thailand and Malaysia in electronics, machinery and industrial equipment, Sri Lanka can position itself as a supplier of high precision components, specialised parts and value-added assembly.

Leveraging existing capabilities, its strategic location and FTAs such as the Indo-Sri Lanka Free Trade Agreement (ISFTA), Pakistan-Sri Lanka Free Trade Agreement (PSFTA), South Asian Free Trade Area (SAFTA), and Asia-Pacific Trade Agreement (APTA) can accelerate this transition.

Workforce strategy is also critical. The long-standing brain drain has weakened the island’s talent base. Reversing this requires focussed efforts to retain skilled professionals through better opportunities and attract global talent by creating an open, innovation driven ecosystem.

Emulating successful models such as Singapore and Dubai can help Sri Lanka become a hub for R&D, entrepreneurship and next generation industries.

While political and economic volatility exist, it does not define the business environment as a whole

Q: Looking ahead, which sectors do you believe will be the primary engines of Sri Lanka’s next phase of growth – and where do you see the most promising opportunities emerging for both local and foreign investors?

A: Sri Lanka is a nation characterised by profound aspirations and unwavering determination, actively focussed on the continuous development of its human capital. The overarching goal is to equip the workforce to not only meet but exceed regional and international standards for talent and productivity.

This focus on nurturing its people has already yielded substantial success with the country fostering globally significant companies. These enterprises thrive in advanced sectors such as IT and sophisticated textile manufacturing. Beyond these high value industrial sectors, Sri Lanka remains a crucial global exporter of key primary resources – most notably world-renowned Ceylon Tea, coconut based products and natural rubber.

To achieve the next phase of robust and sustainable economic growth, Sri Lanka must pivot its strategic focus towards the services sector. The ambition is clear: to transition from a traditional trade balance to becoming a net exporter of services.

Crucially, this strategy involves establishing the nation as a premier financial and business services hub, for the entire South Asian and Indian Ocean region.

A core tactical component of this strategy is the meticulous analysis of the nation’s existing high performing companies within the services sector. By deconstructing the operational, technological and market entry formulas of these successful enterprises, government and industry leaders can establish a replicable blueprint.

This proven formula can then be systematically applied to foster and scale numerous new service exporting businesses, creating an exponential effect on the services economy.

Sri Lanka must strategically and assertively market itself to attract major global business services and technology operations. This includes actively courting business process outsourcing (BPO) firms, encouraging the establishment of large-scale data centres and attracting IT companies that are seeking a reliable and cost-effective presence within the Asian time zone.

The country possesses a compelling and distinct set of competitive advantages that make it an exceptionally attractive location for FDI. These include the provision of strategic fiscal incentives such as targeted tax benefits and holidays for priority industries, alongside a commitment to maintaining low and competitive industrial energy costs.

In addition, the country benefits from a highly educated English proficient and adaptable workforce – one that is capable of meeting the complex demands of global IT and services sectors. Its strategic geo location strengthens its appeal with seamless operations across key international markets by effectively linking Europe, the Middle East and East Asia.

The final pillar of the economic transformation plan is to leverage the country’s unparalleled location in the Indian Ocean as it straddles the world’s busiest East-West shipping lanes.

Sri Lanka must proactively consolidate its role as a major regional maritime and aviation logistics hub. This requires sustained investment in the development of world-class transshipment capabilities for both sea and air freight. The strategic development and capacity expansion of the Port of Colombo – already a key transshipment point – and the Port of Hambantota (with its deep draft capabilities) are essential.

This ambitious move will not only modernise logistics infrastructure but also attract the world’s largest logistics companies to establish regional distribution centres. Furthermore, it will encourage major global shipping lines to establish a central stable regional home port and operational base in Sri Lanka.

This consolidation will cement Sri Lanka’s position as the primary logistics gateway for South Asia.

Q: What structural reforms or policy changes do you consider most urgent to rebuild investor confidence, enhance policy stability and unlock sustainable private sector expansion?

A: Rebuilding investor confidence in Sri Lanka requires a decisive shift from policy volatility to a predictable rules based economic framework. The most urgent reforms span several interconnected areas, which together can restore credibility and unlock sustainable private sector expansion.

Policy consistency and institutional credibility must be established as a foundation. Investors need clear assurance that tax regimes, trade rules and regulatory frameworks won’t change arbitrarily. This calls for a medium-term fiscal and tax policy framework, which is anchored in law, transparent consultation before policy changes and firm limits on retrospective taxation.

Strengthening the independence and technical capacity of institutions such as the Central Bank of Sri Lanka, regulatory commissions, revenue authorities and the Treasury – while insulating them from political interference – will greatly reduce uncertainty and signal long-term commitment.

Improving the ease of doing business is equally important. Streamlining approvals, digitising licencing, customs and tax administration, and reducing discretionary decision making will directly lower transaction costs.

A systematic review and removal of outdated or overlapping regulations will particularly benefit SMEs and first-time investors while signalling that the state sees the private sector as a partner rather than an obstacle.

Fiscal reform remains critical to restoring macroeconomic stability.

Sustainability aligned with a green blueprint should sit at the core of an organisation’s long-term strategy

A simplified and predictable tax system with a broader base and fewer ad hoc exemptions is essential. Medium-term fiscal frameworks, credible expenditure discipline and stronger public financial management would help anchor expectations, and reduce risk premiums.

Lower fiscal risk also requires better governance of state-owned enterprises (SOEs) through professional boards, clear performance targets, audited financial disclosure, and a clear separation between commercial and policy objectives.

SOE reform warrants focussed attention. Large state-owned enterprises continue to drain public finances, crowd out private investment and distort markets. Enforcing hard budget constraints, professionalising boards, publishing timely audited accounts and pursuing strategic divestments or PPPs in non-strategic sectors – such as energy distribution, transport and logistics – will ease the fiscal burden while opening space for private capital and innovation.

Legal and judicial reforms are essential to protect investor rights.

Faster contract enforcement, specialised commercial courts, predictable dispute resolution mechanisms, clear land title systems, and the consistent enforcement of competition and procurement rules will strengthen the investment climate.

Sustainable private sector growth depends on a credible export and productivity led strategy. Stable trade policies, trade facilitation, targeted support for high value sectors such as renewable energy, logistics, IT-BPM, advanced manufacturing and agribusiness, together with labour market and skills reforms that align with private sector demand, are key to rebuilding long-term confidence and growth.

Excessive taxation risks capital flight, reduced investment and slower economic growth

Q: If Sri Lanka could implement one transformational change today, what do you believe would have the greatest positive impact on the country’s international image over the next five years?

A: One truly transformational change would be to entrench policy credibility and institutional independence through law and consistent practice.

A visible and sustained commitment to predictable, rules based governance will have the greatest positive impact on the country’s international image more than any single infrastructure project or incentive scheme.

International investors, development partners and rating agencies are less concerned about short-term growth numbers; they’re more interested in whether policies are stable, contracts are honoured and institutions function independently of political cycles.

Embedding medium-term fiscal and tax frameworks in law, protecting the operational independence of the Central Bank and key regulators, and ensuring transparent consultation before major policy changes will send a powerful signal that Sri Lanka has decisively moved away from ad hoc decision making.

Such a shift will quickly change perceptions. It would position Sri Lanka as a country that learns from crises, respects institutions and offers a predictable environment for long-term investment.

Over time, this credibility will reduce risk premiums, attract higher quality foreign investments, strengthen trade relationships and improve access to global capital markets.

Ultimately, a reputation for consistency and integrity in policy-making will do more to rebuild Sri Lanka’s international standing than any single reform headline. It will signal that the country is not simply recovering but also maturing as a stable and reliable economic partner as well.

The future of the apparel industry lies in moving up the value chain into areas that require skill, precision and sophistication

Q: As a business leader, what core principles guide your decision making as you navigate both domestic challenges and international expectations in an increasingly complex socioeconomic environment?

A: Though I once relied solely on gut instinct and intuition in decision making, the current landscape demands a data driven, empirical approach.

Given the multitude of investment opportunities and myriad options, deep research and analysis are essential. This enables a clearer understanding of the business outlook, accurate risk assessment and mitigation strategies, often requiring a cautious view on equity and project financing.

However, as international complexity and uncertainty escalate, our reliance on planning and figures often prove effective only in the short term. In such moments, I inevitably revert to intuition and experience.

Central to navigating this uncertainty is having a capable and competent team, and leadership that can anticipate risk, manage uncertainty, think strategically and out of the box – and make the necessary tough decisions to move forward.

This is why I strongly believe in empowering my CEOs to make bold decisions promptly. Hesitation over whether an idea is right will ultimately cost us more than moving forward, learning and resolving issues as we go.

Sri Lanka must proactively consolidate its role as a major regional maritime and aviation logistics hub

Q: How has Sino Lanka evolved its business strategy to meet the expectations of a more globally connected market? And what have been the key drivers of that shift?

A: Sino Lanka is deeply committed to being a global pacesetter, driven by an unwavering dedication to innovation, technological sophistication and continuous global attunement.

This philosophy is the cornerstone of our operations, positioning us not merely as participants but leaders in the industries we serve.

We pride ourselves on being an exceptionally agile organisation that’s structured to thrive amid rapid technological change. Our operational model emphasises swift and incisive decision making, and is supported by a culture of rigorous data driven testing.

This rapid cycle approach enables the immediate and seamless adoption of cutting-edge global technologies across our entire ecosystem, by encompassing products, services and diverse group companies.

We view this capacity for swift integration as a critical competitive advantage. Our strategic investment in future forward technology is both comprehensive and deep, and targets transformative sectors to ensure long-term value creation.

In healthcare, we are revolutionising patient care and diagnostics through the integration of advanced robotics for minimally invasive procedures and high precision imaging systems, whichdramatically improve diagnostic accuracy and early detection capabilities at Evercare Hospitals in Dhaka and Chattogram.

Through our joint venture Evolution Auto, we have introduced cutting-edge electric vehicle (EV) technologies to the country by aligning with the global EV transition. Our portfolio includes leading international brands such as AVATR, XPENG, IM, RIDDARA, KYC, King Long, Mahindra Last Mile Mobility, Revolt and Ather. Evolution Auto operates the largest EV brand portfolio in Sri Lanka.

Led by our renewable energy arm Synogen, our commitment to sustainability is reinforced by investments in advanced battery storage solutions that stabilise the grid, optimise renewable energy utilisation and ensure reliable clean power delivery. This is strengthened by our homegrown RadiantIQ platform, which delivers AI powered solar optimisation.

Across service oriented sectors such as hospitality and education, we are leveraging the power of artificial intelligence and machine learning (ML).

In hospitality, this translates into hyper personalised guest experiences and optimised operations.

And in education, these technologies accelerate and streamline onboarding and recruitment processes that are currently deployed across our ventures – including Universal College Lanka (UCL), Universal College Bangladesh (UCBD), International School Dhaka and Glenrich International School in Bangladesh.

This quick adaptation to external technological shifts, combined with an internal commitment to inspire, train and empower every member of our workforce, is fundamental to our sustained success and market resilience.

Crucially, the ultimate efficacy and impact of this ambitious technological strategy rely on the complete and enthusiastic buy in from every employee across the Sino Lanka Group. Each individual isn’t simply an implementer but an active agent of change – challenging the status quo, championing new processes and embodying our innovative spirit.

Our long-term success is driven by collective intellectual agility – the ability to stay ahead of rapid technological change by identifying meaningful long-term trends over short-lived distractions. This focus ensures Sino Lanka’s sustainability, market leadership and continued value creation for stakeholders.

Q: What is your long-term vision for Sino Lanka over the next decade or so?

A: Our primary strategic focus encompasses two key areas – i.e. continuous improvement and expansion within our existing industrial sectors.

This commitment goes beyond maintaining the status quo; it necessitates consistently elevating performance standards and achieving excellence in our core competencies.

Furthermore, we also intend to enhance our regional influence. Our objective is to establish a substantial and enduring presence not only within Sri Lanka but also across the wider region. This will be achieved through the consistent delivery of superior quality work and cultivation of strategic partnerships.

Crucially, we aim to solidify our reputation as an industry leader through perpetual innovation. The overarching goal is to be recognised as a pioneering innovator and a reliable, high quality developer, thereby creating a legacy of tangible development and positive outcomes in every undertaking.

Rebuilding investor confidence in Sri Lanka requires a decisive shift from policy volatility to a predictable rules based economic framework

Q: If you were to convey a message to the international community about Sri Lanka – vis-à-vis its potential, resilience and future – what would you choose to highlight?

A: Sri Lanka represents a genuinely outstanding location, offering great potential for its residents and those seeking successful careers.

The primary catalyst for this is our citizenry: they’re intelligent, diligent and ambitious; and they possess a distinctly global perspective. They constitute the powerhouse driving all growth and innovation.

In addition to the exceptional populace, the country is inherently beautiful, featuring pristine beaches, misty mountains and ancient heritage sites. This natural splendour attracts millions of tourists annually and has confirmed Sri Lanka’s status as a premier travel destination.

We urge our citizens, partners and friends to maintain unwavering faith in and support for our nation. While challenges exist – as they do in every dynamic, growing country, we wish to state unequivocally that we’re firmly committed not merely to confronting these issues but decisively overcoming them too. We are dedicated to continuous improvement and the creation of a truly progressive environment.

Throughout our history, Sri Lanka has consistently been a nation that champions meaningful, positive change, embracing reform and renewal. That legacy fuels our current resolve and we remain dedicated to sustaining this essential pursuit of a prosperous future.

This is more than a geographical location; it is home to all of us for profound personal reasons – family, culture, history or future aspirations; and we are collectively engaged in its protection and advancement.