Leveraging its profound expertise, John Keells Properties (JKP) has emerged as an innovator in transforming the real estate landscape in Sri Lanka. The organisation has continuously set new standards in the real estate sector, whether it’s for luxury apartments, sophisticated office spaces or vibrant retail complexes.

Leveraging its profound expertise, John Keells Properties (JKP) has emerged as an innovator in transforming the real estate landscape in Sri Lanka. The organisation has continuously set new standards in the real estate sector, whether it’s for luxury apartments, sophisticated office spaces or vibrant retail complexes.

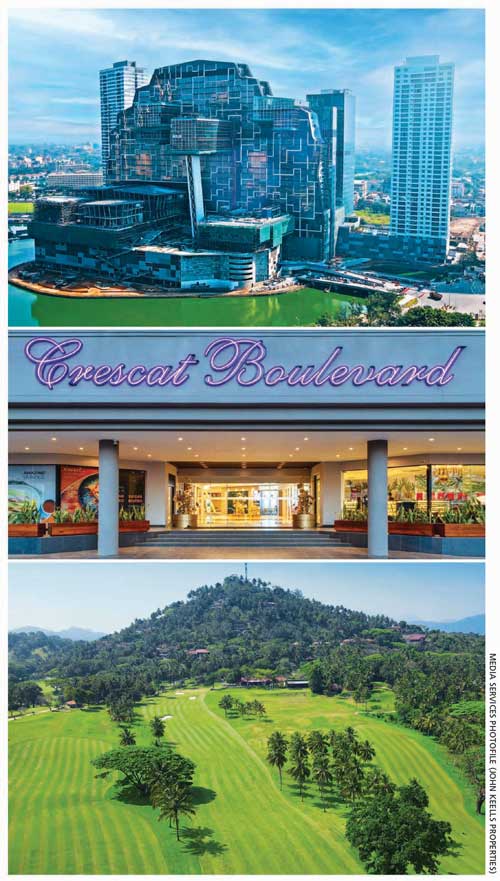

With a wide portfolio of residential, commercial and mixed-use developments that respond to its customers’ different requirements, the company’s developments are distinguished by high quality, attention to detail and the use of sustainable design concepts.

JKP places significant importance on understanding and meeting its customers’ changing demands. Its developments are designed to match the needs and aspirations of discerning homeowners and investors, with careful market research and a customer focussed approach.

Q: Sri Lanka has gone through a challenging period. Could you describe your experiences during these challenging times – and what are the opportunities you see for the future?

A: The most important lesson for us from the recent challenges is that we have the ability within us to face extremely trying circumstances, and emerge from those challenges stronger, wiser and better equipped to face the future. Undoubtedly, the last few years have been challenging; however, I firmly believe in the long-term potential of Sri Lanka and the ability to achieve this potential.

Now that we are gradually emerging from the crisis and policy measures are being proposed for the country to move forward in a sustainable manner, there are multiple avenues opening for growth. The reduction in interest rates that we are witnessing will bring about positive changes for the real estate sector.

Firstly, borrowing costs will witness a reduction, resulting in mortgages becoming affordable and thereby creating the ability amongst homebuyers to finance the purchase of new housing units through bank borrowings.

Secondly, investors will now seek alternative options to fixed income instruments for their investments, resulting in increased funds flowing to property given its relatively low risk, strong capital appreciation potential and the ability to generate a steady rental yield.

With the country largely returning to normalcy through better availability of fuel, uninterrupted electricity and the gradual removal of import restrictions, the patronising of malls by shoppers is increasing. This is a positive development for our tenants and we believe that this trend will be augmented by the improvement in tourist arrivals.

These factors will also have a positive impact on the operations of our golf resort, where we are seeing a trend of increased occupancy driven by both local and foreign guests.

Given these positive market signals and with the economy gradually improving, I feel the future has multiple opportunities that we are well placed to benefit from.

Q: What is your view on real estate as an asset class for investment?

A: Real estate is an asset class that gives investors the opportunity to generate attractive returns at a relatively low risk. It offers exposure to the residential market, as well as the service sector through properties in the office, hospitality and retail markets. Accordingly, I believe that real estate is an important asset class that enables investors to build a diversified portfolio.

Q: Where do you see the real estate sector in Sri Lanka over the next few years?

Q: Where do you see the real estate sector in Sri Lanka over the next few years?

A: The Sri Lankan real estate sector has been through one of the most trying periods in its history. However, I believe that a change of fortunes for the sector is imminent.

As mentioned earlier, the reduction in interest rates will have a positive impact on the sector through higher demand for housing units. This should result in the launch of new projects in the sector, contrary to the track record of the last few years during which we did not see the launch of any new projects of scale.

We feel that a larger part of this growth will be in the condominium market both in the city as well as the suburbs. Colombo, in comparison to its regional peers, has a very low prevalence of apartment living, and this is bound to change with people increasingly seeking convenience and better connectivity.

The finite supply of land and scarcity of land with good connectivity options will channel housing demand towards condominiums in the city and the suburbs of the city that have good connectivity to Colombo.

Although questions were raised regarding the viability of the commercial office market due to the pandemic induced shift to working from home, we are now seeing that trend gradually shifting to the traditional office setting.

Agile working will still be a part of the new way that people work. However, the requirement for office space will remain. In this respect, I believe that purpose-built office buildings in close proximity to public transport will see healthy demand over the next few years.

Businesses will focus on the efficiency of space and in this regard, the trend of converting old houses to offices should gradually diminish in favour of office buildings that offer operational efficiency.

Q: In your assessment, what is the reason for John Keells Properties’ success in a highly competitive market environment?

A: One of the reasons for the success of JKP is its relentless focus on innovation. At JKP, we are constantly looking out for new and innovative ways of operating, innovative business models and innovative products. This is evident from the game changing developments that we have undertaken from projects such as Cinnamon Life, On320 and TRI-ZEN to those that are currently on the drawing board.

The skill and dedication of the team at JKP is the other key reason for its success. Be it projects such as Cinnamon Life, which will transform Colombo, or challenges such as the pandemic and economic crisis, the team has been a driving force in ensuring that projects are delivered on time and at the highest standard of quality.

– Compiled by Allaam Ousman

INTERVIEWEE DETAILS

Rusiru Abeyasinghe

Head of Asset Management – Property Group

Vice President – John Keells Holdings

COMPANY DETAILS

Telephone:0702 294294 | Email:info@jkproperties.lk | Website:www.johnkeellsproperties.com