THE MARKET

Hatton National Bank (HNB) has positioned itself as Sri Lanka’s foremost trusted financial partner serving every major customer segment from youth and microfinance, to SMEs, emerging corporates and large businesses. HNB’s strategy of banking beyond transactions focusses on deep relationships while allowing digital systems to handle routine processes. This customer centric approach, supported by a highly rated mobile app and solution driven digital innovation, has accelerated adoption to over 1.1 million users.

With a strong capital base, liquidity and focus on sustainable, consistent growth reinforces its stability in a competitive market. Investments in cybersecurity and risk management ensure customer safety, cementing its position as an innovative and dependable financial partner.

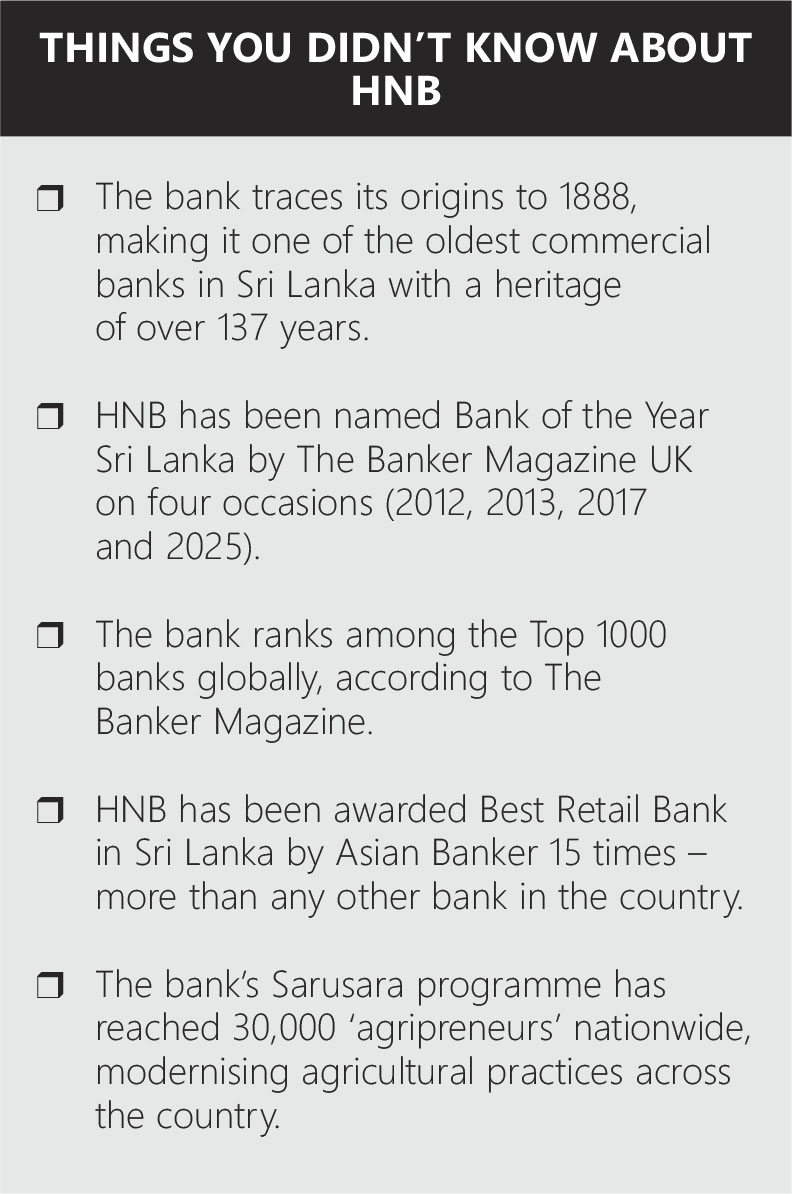

ACHIEVEMENTS

The bank has marked a defining journey of growth, innovation and national impact, emerging as one of Sri Lanka’s most diversified financial conglomerates. Over the past 25 years, the bank has expanded its footprint across the full spectrum of financial services by launching HNB Assurance in 2001, and establishing both life and general insurance arms.

It later entered investment banking through a joint venture – now fully owned as HNB Investment Bank – demonstrating foresight in strengthening capital markets and offering customers a wider range of financial instruments. HNB has also deepened its grassroots presence with the acquisition of Prime Grameen (now HNB Finance), extending financial inclusion to entrepreneurs and microbusinesses across the island. Its network of over 200 barefoot bankers underscores this unique reach.

HNB’s excellence has been consistently recognised through prestigious accolades: Best Corporate Citizen (2025), Business Today Top 40 No. 1, Best Bank in Sri Lanka and Best SME Bank by Euromoney, Best Bank for Large Corporates and recognition as the Strongest Bank in Sri Lanka by Asian Banker.

For 15 consecutive years, HNB has been named the Best Retail Bank in Sri Lanka. In addition, HNB has been recognised as Sri Lanka’s Best Bank for 2025 by The Banker Magazine UK, strengthening its position as one of the country’s most resilient and future focussed financial institutions.

HISTORY

HNB traces its origins to 1888 in Hatton, where it was established to serve the plantation sector at a time when managing salaries, remittances and trade flows posed notable challenges for both British investors and estate workers. Rooted in

the agricultural heart of the country, HNB spent its early decades supporting the plantation economy before gradually identifying opportunities for expansion.

In the 1920s, the bank acquired Indian bank branches in Sri Lanka, marking its first major phase of growth. A second transformative milestone came after independence, when Brown & Company took stewardship in the late 1950s and early ’60s. This period saw the acquisition of National Grindlays Bank, completed in 1970, after which Hatton Bank became Hatton National Bank and was listed on the Colombo Stock Exchange (CSE) – a listing it has maintained for 55 years, making it one of the longest standing financial services institutions on the exchange.

From the 1970s, HNB strengthened its dual focus on individuals and institutions. It became deeply involved in grassroots development through partnerships with donor agencies, the Central Bank of Sri Lanka and community programmes.

This later evolved into the renowned Gami Pubuduwa movement, which has supported over 244,000 customers and created a network of 200 barefoot bankers who work directly within rural communities. HNB’s commitment to social impact continued following national crises in 1983 and 1988/89, when it introduced youth livelihood programmes such as Gami Pubuduwa (Village Awakening), helping to stabilise communities and create sustainable incomes.

Over time, the bank consistently adapted to industry shifts – from early digital adoption to modern innovations such as non-face-to-face onboarding, face recognition and solution driven mobile banking. This ability to evolve while taking customers along the journey has enabled HNB to partner multiple generations of Sri Lankans, and remain one of the country’s most trusted and enduring financial services institutions.

THE PRODUCT

The bank’s product philosophy is built on a unified brand experience rather than individual offerings. The bank positions HNB itself – rather than standalone product names – as the solution customers turn to, regardless of their financial needs.

This monolithic brand structure allows all customers – from micro entrepreneurs in rural communities to SMEs, emerging corporates and multinational companies – to access relevant, customised solutions under one trusted umbrella.

A key differentiator is HNB’s commitment to banking beyond transactions, reinforced by systems designed around customer convenience. The bank was among the first in the sector to establish a dedicated innovation vertical and appoint a Chief Innovation Officer, ensuring continuous rethinking of processes, reduction of steps and introduction of customer centric digital solutions.

HNB’s digital ecosystem reflects this approach. The HNB Digital App offers individuals a seamless platform for everyday banking while businesses access the bank’s advanced transaction banking suite, which supports multi-tier approval structures, payroll processing, tax payments, supplier settlements and secure integration with enterprise systems.

By tailoring digital experiences to each segment’s needs, without overcomplicating them, HNB has embedded banking into customers’ lifestyles and business operations.

RECENT DEVELOPMENTS

HNB has introduced several key initiatives in response to evolving market dynamics, rising economic activity, and the growing needs of both premium customers and SMEs.

Recognising the expanding premium segment, the bank launched Sri Lanka’s first Metal Mastercard, catering to high net worth clients who seek exclusive experiences and global access. This strengthened HNB’s position as the country’s leading private banking provider.

At the same time, HNB has accelerated digital transformation with innovative payment solutions. The bank became the first in the world to launch HNB Accept in partnership with Visa – technology that turns any smartphone into a POS device, enabling seamless card payments without hardware. Complementing this is the introduction of mini POS devices to support small businesses and the digitisation of the expressway toll gates, where HNB holds a five year exclusive contract.

HNB has also advanced its sustainability agenda through a planned Rs. 10 billion sustainable bond issuance, participation in a US$ 1 billion sustainable financing transaction in Singapore, and increased support for renewable energy projects that reduce emissions and import dependency.

Further strengthening financial inclusion, the bank launched the HNB Women Banking Proposition, addressing the unique needs of women entrepreneurs and households – particularly meaningful as 30 percent of HNB’s microfinance clientele are women.

PROMOTION

The bank’s approach to brand promotion is rooted in a unified strategy that positions it as an integral part of customers’ everyday lives. Rather than relying on multiple sub-brands, HNB builds its identity around a single trusted banner – this philosophy drives the bank’s involvement in cultural, social and religious events across the country, enabling it to remain close to communities and embed banking within customers’ lifestyles.

Customer centric engagement is at the heart of HNB’s promotional strategy: the bank has strengthened its service model by appointing a customer experience officer and establishing a fully integrated omni channel contact centre – HNB Connect – offering 24/7 support via phone, email, chat and digital channels. Moreover, a dedicated digital engagement centre ensures that customers receive immediate assistance with digital banking, reinforcing trust and confidence.

HNB also positions itself as an enabler for SMEs and entrepreneurs – empowering them with solutions that make for convenience and business continuity. This has created a strong advocacy effect with customers introducing new clients to the bank organically.

Enhancements to branch layouts, queue management systems and the promotion of digital channels reflect HNB’s commitment to making banking convenient and enjoyable. Combined with its presence at major cultural events, HNB’s promotions reinforce its role as a community partner and customer first brand.

BRAND VALUES

The company’s brand values are anchored in integrity and trust, the foundations of its identity for over a century. As customers place their confidence – and wealth – in the bank’s care, HNB’s foremost commitment is to uphold the highest standards of ethical conduct, transparency and responsibility. This unwavering emphasis on integrity continues to define the relationship between the bank and the millions of individuals and businesses it serves.

Over time, HNB has evolved from being perceived as a traditional, authoritative archetype to an enabler – a partner that empowers customers at every stage of their financial journey. Curiosity and innovation are now central to the bank’s character, which is reflected in its willingness to challenge convention, embrace new ideas and design solutions that make banking simpler, faster and more meaningful.

HNB’s values also emphasise convenience, empowerment and progress, ensuring every initiative – from digital innovation to grassroots development – serves a real customer need. By positioning itself as a pillar of strength while enabling individuals, SMEs and communities to thrive, HNB has built a brand that is both trusted and forward-thinking.

These values form the cultural backbone of HNB, shaping the bank’s operations and strengthening its ability to remain relevant, dependable and deeply connected to the people it serves.